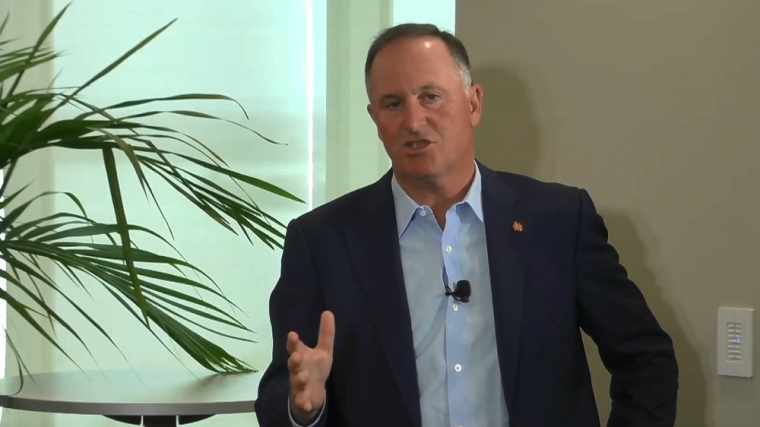

Former Prime Minister John Key is stepping down from the boards of New Zealand's biggest bank ANZ NZ, and its Australian parent, the ANZ Banking Group, effective March 14.

Having quit as PM in December 2016, Key was appointed Chairman of ANZ NZ in January 2018, joining the ANZ Group board in February 2018.

He'll be succeeded in both roles by Scott St John, who has been on the ANZ NZ board since 2021. St John is the ex-CEO of First NZ Capital, now investment banking and wealth management firm Jarden.

Key's tenure as ANZ NZ Chairman was marked by the shock departure of the bank's long serving CEO David Hisco in 2019. At the time Key said Hisco's departure was by mutual agreement, after Hisco's expensing to the bank of chauffeur driven cars for personal use and wine storage dating back nine years came to light.

ANZ Banking Group Chairman Paul O’Sullivan said Key had; "made an enormous contribution to ANZ with his unparalleled international business and political experience playing a critical role in our ongoing success. As a Board we will miss his wise counsel, global insights and good humour and we wish him and his family the very best for the future."

Of St John, O'Sullivan said his "deep business experience, particularly in financial markets," makes him an ideal replacement for Key as Chairman of ANZ NZ.

"He [St John] has served admirably on the ANZ New Zealand Board since 2021 and we look forward to welcoming him to the Group Board next month [March 25],” Mr O’Sullivan said.

Key was quoted in ANZ's press release saying it's the right time to step back from his commitments.

St John also chairs Mercury NZ Ltd and Fisher and Paykel Healthcare and is on the Fonterra and NEXT Foundation boards. He was Chancellor of the University of Auckland from 2017 to June 2021.

76 Comments

..time to sell your shares.

Aussie bank stocks are perennial favorites with Aussie boomers because of franking credits and the impenetrable property ponzi meaning that their profits are more or less guaranteed. Safest banks in the world apparently.

The top 10 stocks on the ASX comprise bank stocks, retail, and miners. What's more, they're approx 50% of total market cap. You could talk about concentrated, but the sheeple don't care. As long as the divs are there.

ANZ stock is up almost 10% YTD and 15% over the past 12 months. So you can argue it's par with inflation.

ANZ shares have been a terrible performer on a combined return basis over the long period I've owned them. Only recently have they started to show a bit more promise.

Even with franking credits? Seem to be a no brainer for most people. I don't own any individual bank stocks, just exposure through ETFs.

Kiwi owners of Aussie shares get franking (imputation) credits only on the comparatively minor NZ sourced portion of Aussie banks earnings. So not a major consideration.

Key sold a chunk of his holdings in Palo Alto just before it crashed by 20 % a few days ago. Did he have ANZ shares too and sell them recently ? May be he knows something the investors don't ? Usually they announce such parting several months before, to keep the markets calmed.

The cat is now out of the bag.

Article headline in Interest.co.nz now :

'Profit at New Zealand's biggest bank fell 22% in the December quarter as non-performing loans rose above $1 billion'.

The rumor going around Jellicoe St is that he was caught in the lunch room one night pulling a cleaners ponytail.

Ah, the old "Clarke Gayford" rumor mill has found a new target?

What's that expression about rats and ships?

This could be more telling about the stability of the banks than any OCR figures tomorrow.

He is getting the hell out of Dodge before the banking industry SHTF.

WATCH THE NEXT ANZ REPORT ON THE (AND OTHERS) RATCHETING UP OF THEIR MASSIVE PREVISIONS FOR BAD RESI PROPERTY LOANS.......THEN CRE LOANS, WHICH WILL BE THE NEXT CLUSTER TO DROP!.

Banks are great at covering up and Airbrushing financial cliff edges out of everyone's view.........until at the last second, they shout "warning, warning, pull up, pull up".....BANG!

Key knows when to exit a ONCE winning position........

Has he shorted ANZ by untracable proxies?

This would be my thoughts as well. Smells like the CEO and the Chair bailing from Telecom when Chorus split was announced. Lets see what the next 6-12 months brings for the ANZ fortunes.

A family friend was Chair at a NZ listed company. Resigned when they saw big issues coming. Directors don't want the potential liability exposure or potential protracted litigation.

There for the fees, not responsibilities.

Yes. Professional director is a vocation. Many need the pay check to pay their bills.

Who called it the other day? Te Kooti?

Yes, someone was. Good call

No wasn't me.

I struggle to warm to him, but he's had a pretty stellar career. A decent guy, not so sure - but what does that count for in 2024 anyway?

15 Feb 2024 ... by gnx | 15th Feb 24, 9:15pm 1707984958. I get a gut feeling sometimes. I was wondering if John Keywill resign shortly. More time etc

Worrying is the short notice! He is stepping down in just over 2 weeks. Not what one should call a gradual handover of the responsibilities.

Indeed, this is a very good point. I suspect there is something in the water, but it could be political as much as economic.

Seems to be a habit with him.

'Quit when Ahead'.. a great Maxim to live by and flourish. Key personifies that ?

One does have cause to wonder each time, though.

Smart ....very smart... knows when to hold and when to fold....

Sick of Sharon’s nonsense interest rate hike predictions lol

Maybe he wanted her to spin things more. She may be wrong a hell of a lot of the time, but she’s at least a fairly straight shooter…

doesn't want to get caught up in a "Jenny Shipley- mainzeal like" mess. agree short notice departure is a big red flag,

DIY......you nailed it.

Learn from others mistakes, legal own goals, and get the hell out of the Tsunami debris zone!

He did warn about the possibility of much "higher mortgage/borrowing costs and the possibility of 10% mortgage rates"

Perhaps this could be utilised in any future court hearings? Told you soo! The defence is ready!

Rats deserting the stinking shit perhaps - asking for a friend of course.

Legacy…

Black swan event

Who in their right mind would be holding Banking shares currently?

Liken it to holding fresh tickets for the entire family on the Titanic!

Who in their right mind would be holding Banking shares currently?

Liken it to holding fresh tickets for the entire family on the Titanic!

Why? Cards are stacked in their favor. Easiest business in town. Banks cannot fail if the ruling elite decides they shouldn't.

Yep. 2008. If banks tip over nowhere is safe.

"If banks tip over nowhere is safe. "

People forget about the critical importance of Financial Stability until there is panic and loss of confidence. Banks rely on the confidence of their creditors.

Some recent examples include Silicon Valley Bank, First Republic Bank, and Credit Suisse.

"Banks cannot fail if the ruling elite decides they shouldn't. "

Banks may need to be recapitalised if they need equity due to inadequate capital from loan losses.

One scenario is that the existing shareholders are unwilling or unable to recapitalise the bank and the government invests new capital and existing share holders are significantly diluted. Numerous examples of bank restructurings around the world.

Remember the recapitalisation of BNZ in the early 1990's?

Yep, dilution when re-capitalisation is required is always a risk of shares in any enterprise. Banks are no different; you estimate risk, pays yer money and takes yer chances. Despite ANZs indifferent track record at growing its equity, as the biggest bank they remain a pedestrian long term diversification investment proxy for the wider economy.

They are TBTF. Governments back them at times of crises. Safe bet for dividends, but one must cash out the profits often. Better still, take out your own investment and let the rest play on.

Oh shite. My house deposit is locked up in their Term PIEs.

#unsecuredcreditor

Watch the canopy... https://www.youtube.com/watch?v=d3ZrWUqhoBU

Don't worry, sh'el be right......

Safe as houses mate!

Property never goes backwards!

Well untill 2021........

We are all unsecured, so spread it like thin butter amoung the biggest banks and other asset classes.

Once they finally Implement the deposit guarantee scheme... ...which decade? .....your 100k Max will be Gummit guaranteed.

Tiĺl then, hold all bets and keep hardhats ready!

Once they finally Implement the deposit guarantee scheme... ...which decade? .....your 100k Max will be Gummit guaranteed.

Robbo never got around to guaranteeing the 'savings' of the great unwashed (bank creditors who naively think that banks custody their money for them and prudently lend it for mortgages).

Spreading it thin among 'other asset classes' won't save you if the big banks toes curl up.

Used ANZ's share trading platform (Aussie) after they bought it from ETrade then sold it to CMC last year. The linked cash accounts are with ANZ.

Dude knows when to jump ship... 'see ya later captain!'

Just freeing commitments to lead up some of the short, sharp, surgical and lucrative reviews the government is undertaking. Banking sector’s about to get ugly.

My pick, he heads up a large fund/PE firm to take State assets private.

Very lucrative work... ANZ pay is little league by comparison.

Pay rate irrelevant for a guy who can afford to buy and run his own helicopter.

You are so wrong.

On an international scale he's a pauper. What sort of heli is he running? It's not that big a stretch tbh, probably running it through expenses as well so we are paying for 40% of it.

Try running a 50m yacht with 10 full time crew and then get back to me - that is entry level wealth.

Wouldn't be invited to Nick Mowbray's parties. Max might. But not because of his wealth.

From distant memory he was said by pundits to be worth approx $50m when he ascended the throne. That was bound to be well understated and has probably at least doubled since then. True, by top end international standards that's a relatively modest fortune but still enough to afford a decent yacht. Entry level wealth ! OK.

A friend previously worked for a rich lister.

The compilers of the rich lists only see one side in their calculations - assets.

There is little transparency on the other side of the balance sheet and this may not be captured.

Tomorrows announcement is getting juicy

Where next? Bank of China perhaps?

Reserve Bank of NZ?

Key is too smart to join RBNZ. He may take up a position at RBA if offered though.

No idea why he is still working, time to retire and enjoy things, the guy must be worth 20x what my net worth is and I quit work several years ago now.

Power

Yep, will be some of that but if he enjoys the cut and thrust why not keep going.

The idea of enjoying your work must be foreign concept to you guys.

I simply quit the full time day job of having to deal with dick head bosses and turned my hobby into a part time self employment working from home. Pretty sure everyone who has ever worked in this country can understand that concept.

Head up Heartlands entry in AUS?

Some people are happy in life, others write sarcastic and cynical posts about every situation and every person, in a desperate attempt to make themselves feel better.

You can be both happy in life and enjoy engaging in a little sarcasm.

You don't sound like the happy type.

Projection.

Didn't he introduce legislation where a bank can have access of your account with over $100,000 in exchange for bank shares, should they need any cash to cover a possible bank default?

ANZ shares up 0.5% at the moment for the day (as at 2.27pm).

Oh oh, NZ banking sector is about to experience significant headwinds, if nothing else John Key has great timing.

Maybe National will call him back into service like the Tories did with Cameron to solve the middle eastern crisis. To be fair, we could probably do with an experienced international operator.

It's amazing how far a smile will get you.

The cat is now out of the bag.

Article headline in Interest.co.nz now :

'Profit at New Zealand's biggest bank fell 22% in the December quarter as non-performing loans rose above $1 billion'.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.