BNZ CEO Dan Huggins says the bank has confidence in the New Zealand economy, despite global volatility, to the extent its half-year financial results feature an impairment write-back rather than a charge.

BNZ says its unaudited net profit after tax for the six months to March rose $33 million, or 4%, to $795 million from $762 million in the same period of its previous financial year.

The bank booked a credit impairment write-back of $28 million versus an impairment of $71 million in its first-half last year. A write-back reverses, or eliminates, previously recognised impairment losses on loans.

"Looking beyond the current global volatility, we have confidence in the New Zealand economy and have delivered an impairment write-back to reflect this," Huggins says.

"The economy appears to be at a turning point, and while uncertainty remains, BNZ is well positioned to support its customers," says Huggins.

BNZ's unaudited total allowance for expected credit losses - loan provisions - as of March 31 was $975 million. That compares to an unaudited figure of $971 million a year earlier, or an audited figure of $1.024 billion. The new unaudited figure versus the old audited one represents a $49 million drop, reflecting the $28 million write-back and $24 million of write-offs, partially offset by $3 million in recoveries, BNZ says.

As of March 31, BNZ's impaired assets stood at $288 million up from $255 million a year earlier, with assets at least 90 days past due but not impaired at $258 million, down from $361 million.

Lending and deposit growth

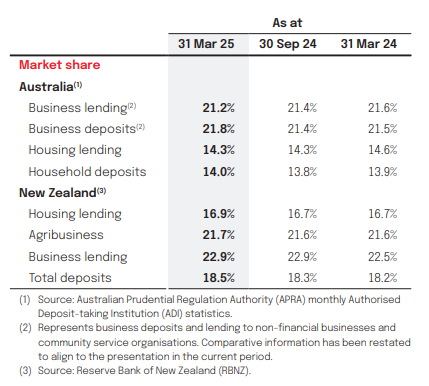

BNZ’s total net lending rose $4.3 billion, or 4.1%, year-on-year to $108.5 billion. Housing lending increased 5.6% to $62.1 billion, and business lending rose 2% to $43 billion. BNZ's deposits grew $5.4 billion, or 6.8%, to $87.6 billion, with Huggins saying term deposits continued to be the most popular choice.

Andrew Irvine, CEO of BNZ's parent, National Australia Bank (NAB), notes BNZ is now ranked first among NZ's big five banks for consumer Net Promoter Score (NPS). NPS measures customer loyalty and the likelihood of customers recommending a company or product to others.

"The improvements in customer experience are also reflected in BNZ's recent above system [market] growth in both household deposits and home lending. This is a great performance by Dan and his team," Irvine says.

Meanwhile BNZ's total operating income fell $23 million, or 1%, to $1.747 billion despite a 3% rise in net interest income to $1.5 billion. Gains less losses on financial instruments such as hedging fell to $82 million from $144 million.

Operating expenses increased $31 million, or 5%, to $672 million.

BNZ's net interest margin rose three basis points to 2.40%, its cost-to-income ratio rose 230 basis points to 38.5%, and its return on equity dropped 40 basis points to 11.9%.

'Watching developments closely'

Huggins says lower interest rates and strong conditions in the primary sector have helped the NZ economy.

"However, trade tensions have created significant volatility and heightened uncertainty in global markets."

"We are watching these developments closely to gauge how this uncertainty impacts global growth and New Zealand’s economic recovery. However, we remain optimistic about the country’s long-term outlook and are committed to supporting New Zealand’s growth aspirations," says Huggins.

BNZ reduced its interim dividend by $183 million to $496 million from $679 million last year. On Monday rival Westpac NZ increased its interim dividend by $14 million to $328 million.

NAB also reported interim financial results on Wednesday. The table below comes from NAB.

BNZ's press release is here.

NAB's investor presentation is here and its announcement is here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.