In a carefully-worded press release, the Reserve Bank (RBNZ) is "proposing" to ask Finance Minister Nicola Willis to designate HVCS, the clearing system through which high-value transactions such as house payments pass.

HVCS (High Value Clearing System) is one of three systems that clear funds, the final leg of the payments process before settlement. Designating it would allow the RBNZ to regulate and supervise the HVCS.

Every month, the RBNZ explained, more than $420 billion of transactions are cleared using HVCS, "which is more than New Zealand’s GDP."

It can't easily be substituted by another system, and disruption to its activities could damage New Zealand’s financial system, says RBNZ Director of Specialist Supervision Scott McKinnon.

“Designating HVCS will allow us to make sure that HVCS is operating soundly and efficiently. It would also allow us to look closely at the governance, access and crisis management of HVCS, while giving us powers that can help avoid significant damage to the financial system if there were problems with HVCS.”

HVCS is administered by bank-owned Payments NZ, which also administers the other two clearing systems - BECS (Bulk Electronic Clearing System), dealing with most retail payments, and CECS (Consumer Electronic Clearing System), dealing with the processing of ATM and EFTPOS payments.

Payments NZ is owned by ANZ, Westpac, BNZ, ASB, Kiwibank, TSB, HSBC and Citibank. The RBNZ says it shared its systemic importance assessment with Payments NZ in October 2023. Payments NZ responded via letter in December 2023, acknowledging the importance of the HVCS to the financial system, but "put forward several arguments related to our assessment," the RBNZ says.

"We considered their arguments and remain of the view that the HVCS is systemically important."

The RBNZ's interest in HVCS is due to its sheer size - its role is to make sure large payments, such as house purchases, are cleared and able to be settled.

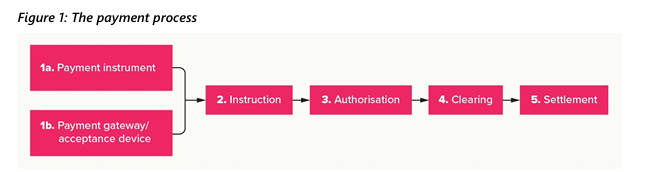

Each clearing system sets out the rules, standards and procedures for exchanging payment information and for defining settlement obligations for relevant payments types.

Clearing systems are not technology infrastructures, but are a standardised set of requirements that participants must follow to exchange and settle payments, the RBNZ explains in its primer on New Zealand's payments landscape.

Clearing is part of the "back-end" of the payments system, taking over once a customer's payment instruction has been authorised by their bank.

Clearing systems serve two functions.

The first is to calculate the settlement obligations between two participants in the system - typically, the payer's bank, and the payee's.

Secondly they format and exchange payment information between them.

HVCS sends payments messages between members of the AVP (Assured Value Payment) group. To use HVCS you have to be an AVP member.

Payments NZ decides who has access to HVCS. The RBNZ owns and operates the AVP and decides who can be an member.

The RBNZ requires only that AVP participants meet its requirements for access to ESAS (Exchange Settlement Account System), the final leg of the payments journey where all interbank transactions in New Zealand are settled.

ESAS membership has until now been bank-only.

But the RBNZ in March extended potential eligibility to NBDTs (non-bank deposit takers) and anyone else who meets its revised criteria.

It has received expressions of interest from six licensed NBDT's, but no actual applications.

The RBNZ's HVCS designation proposal is, for now, just a proposal, open to consultation by 30 September.

*This article was first published in our email for paying subscribers early on Monday morning. See here for more details and how to subscribe.

7 Comments

How do other countries do this?

Bitcoin’s market cap is around NZD 4 trillion and saw roughly NZD 3.5 trillion in transactions last month on its base settlement layer (on-chain, per Clark Moody) - plus an unknown but likely significant amount on its payment layer (Lightning). Actual economic turnover is unknown, since some on-chain activity is simply users moving funds between their own wallets or exchanges reorganizing storage.

New Zealand’s broad money supply is about NZD 433 billion, with the High-Value Clearing System processing roughly NZD 420 billion per month.

Bitcoin is about ten times larger than the NZD - yet both see monthly volumes on their high-value settlement layers that approach the size of their total supply.

We sell a lot of stuff overseas and buy a lot from overseas.

And like the NZD or any fiat currency, Bitcoin is only worth the faith people have in it. Should people lose faith in it, and sell off, then it too will lose faith, sorry I mean value.

That’s a great question and a common misunderstanding. The whole point of Bitcoin is to remove the “trust” requirement that fiat currencies depend on. As Satoshi put it in 2009:

“The root problem with conventional currency is all the trust that’s required… The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

Bitcoin is open source, so you don’t have to trust anyone - you can verify the math yourself. There is only one bitcoin, just like there’s only one Earth, and it cannot be expanded. That one bitcoin is divided into fixed units, such as 21 million BTC or 2100 trillion sats, just like land can be measured in hectares or square metres.

Every unit in circulation was unlocked and earned through proof-of-work (real energy and cost) unlike fiat, which can be created out of nothing. Fiat currencies fail when political interests expand the money supply, debasing the currency and causing inflation. Bitcoin is different: it’s the only asset in the world with true, verifiable scarcity, and it doesn’t rely on politicians to keep their promises.

Bitcoin is different: it’s the only asset in the world with true, verifiable scarcity, and it doesn’t rely on politicians to keep their promises.

It's not even an asset, it's a token. Scarcity doesn't guarantee value because it has no utility. Like every other token, its value depends on human faith.

Calling Bitcoin a “token with no utility” ignores the very real and unique functions it already performs.

-

Protection from inflation theft – Bitcoin’s fixed supply means your savings can’t be silently diluted by money printing. That’s a direct utility to anyone wanting to preserve purchasing power over decades.

-

True digital cash – Unlike online payments with fiat (which are just bank IOUs), Bitcoin is final settlement. Once paid, it can’t be reversed by a third party, which eliminates chargeback fraud — a multi-billion-dollar problem for merchants every year.

-

Micropayments – On Bitcoin’s Lightning Network, you can send fractions of a cent instantly to anyone in the world. This simply isn’t possible with Visa, Mastercard, or banking rails.

It’s not “faith” - it’s math, engineering, and real-world function.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.