The Reserve Bank (RBNZ) is proposing changes to banks' regulatory capital settings, citing a "higher risk appetite" to explain lower settings than set at the end of its last capital review in 2019.

However, on a media conference call RBNZ officials played down any expectation changes would trigger any immediate or substantial downward effect in lending and deposit interest rates.

"While we recognise the influence our capital rules can have on economic output and competition, we want to be clear that even material changes to capital settings, such as those covered in this Consultation Paper, are not expected to translate into significant changes for the economy," the RBNZ says, citing "other, more influential drivers."

The RBNZ didn't refer to the recommendation, issued by Parliament's Finance and Expenditure Select Committee on Friday, that increases in bank's capital built into the RBNZ's current capital review programme be cancelled "immediately."

The proposed softening of bank capital requirements follows a period of pressure on the RBNZ to make changes to its conservative settings, begun by the Commerce Commission's market study on personal banking services last year, and ramped up, with an added political factor, via the parliamentary select committee banking inquiry.

Finance Minister Nicola Willis welcomed the RBNZ consultation.

"Since 2019 concerns have been raised that the Reserve Bank’s capital settings may be undermining competition and efficiency in our banking industry, increasing the cost of lending to New Zealanders, imposing excessive restriction on lending to important sectors such as agriculture and community housing, and creating headwinds for economic growth," Willis says.

"Last year I issued a new Financial Policy Remit to the Reserve Bank outlining the Government’s expectation that in promoting financial stability, the Reserve Bank should ensure prudential regulation does not impede competition."

"My letter of expectations asked the Bank to consider a number of matters that could enhance competition, including a review of standardised risk weights, minimum capital thresholds for new entrants and access to the Exchange Settlement Account System," adds Willis.

The RBNZ, meanwhile, concedes current capital rules, set on an ascending track in a 2019 review, now looked "one of the highest among comparator countries." An Oliver Wyman report, commissioned by the bank to inform its current review, found the capital rules "have multiple areas of conservatism versus Basel III international standards."

RBNZ Chairman Neil Quigley says the options are calibrated to "a higher risk appetite than in our last review in 2019."

“Under the Deposit Takers Act, we will have stronger tools for supervision and crisis management, as well as additional capacity and capability as a regulator. That means we can responsibly ease capital requirements, while still protecting financial stability."

Governor Christian Hawkesby said capital settings "are one of the most important tools we have to protect and promote the stability of the financial system."

“However, it’s essential we strike the right balance – protecting depositors and the wider economy, while supporting competition and economic efficiency."

Two options

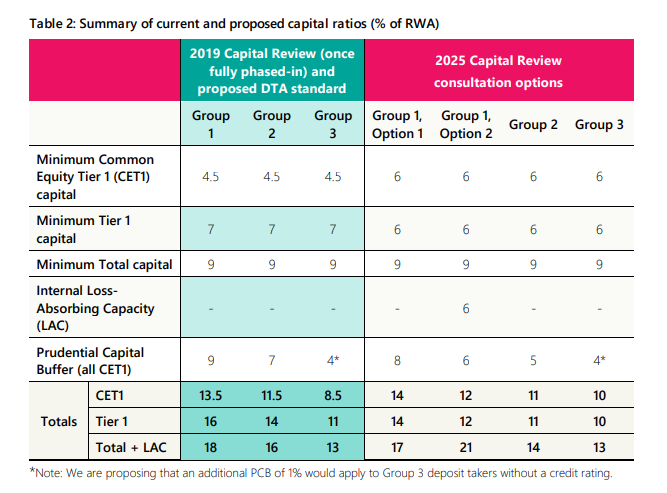

The bank is proposing two options, shown in the table below, for changes to banks' capital ratios - the amount of capital a bank is required to hold to provide a financial buffer to absorb unexpected losses.

On a media conference call, Angus McGregor, Assistant Governor for Financial Stability, said both "mostly" reduced the requirements set in the 2019 review.

The bank said it was moving from a "1-in-X-year event" basis for assessing risk appetite (1-in-200 at the time of the 2019 review), to benchmarking against a range of comparator countries.

It's proposed to remove the category of AT1 (Additional Tier 1) capital altogether.

The minimum capital requirement for deposit takers (banks) reduces from $30 million to $5 million, a move aimed at reducing barriers to entry which will be welcomed by fintechs.

McGregor said capital rules had only a small effect on lending rates.

"Small changes to equity have minimal effect on the cost of funding. The OCR (Official Cash Rate) and wholesale markets have a much bigger effect."

RBNZ Director of Prudential Policy Jess Rowe said the options in a sense presented different philosophies. Option 1 was "more like the current philosophy, [focused on] preventing crisis from happening."

Options 2 allows banks to "rely more on your ability to respond in a crisis."

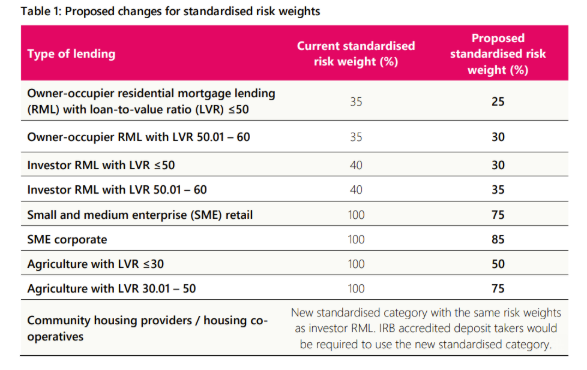

The RBNZ is also seeking feedback on proposed changes to risk weightings - essentially, the amount of lending a bank can do against each dollar of capital.

Officials said risk weightings changes didn't have a large effect on banks' lending allocation decisions, although they had a greater effect on lending interest rates than ratios.

"We don't expect this to set the world on fire. This is not the thing that's driving economic growth" Rowe said.

Submissions on the consultation paper are due by 3 October.

6 Comments

Officials said risk weightings changes didn't have a large effect on banks' lending allocation decisions, although they had a greater effect on lending interest rates than ratios.

Well if we want to attract the marginal buyer for the Ponzi, perhaps we need to look at Aussie. This probably eases banks' decisions on lending allocation.

From Oct 1, Australia’s federal government will allow first-home buyers to purchase a property with a 5% deposit, with no income cap, under an expanded Home Guarantee Scheme. The govt acts as a guarantor for the remaining 15% of the deposit.

- Eligible buyers avoid lenders mortgage insurance

- The program now has no income limits and will have unlimited places (previous years had caps).

- Buyers need to live in the property (amazing this has to be stipulated)

- Higher property price caps apply from October, making more expensive homes eligible under the scheme

So everyone escaping NZ because of the ponzi are just jumping from the frying pan to the fire eh 😂😂

Come on NZ, follow Oz, cut rates and cut restrictions…get that ponzi galloping again!

Poke and Prod the skinny, fading and CRASHING NZ Housing Ponzi back to Life???

Nar maaaaate, NZ has had enough of those stupid, pass the housing parcel games!

How about using our imaginations and doing some real business???

Way too hard…real business, productivity…and then paying tax on those earnings…f*^k that…let’s just get a heap of immigrants in, slash lending, burn restrictions and get that rockstar back 😉

More theatre

Big mistake she is a coming

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.