By Christian Hawkesby*

Over the past week, two key NZ inflation expectation surveys were released. Both compound the RBNZ’s headache over persistently low inflation.

On balance, in our view, these help keep the door open for further cuts in the Official Cash Rate (OCR), as soon the next March meeting.

Back in January, headline annual NZ CPI inflation for 2015 Q4 came in lower than expected at just +0.1%, well below the bottom of the RBNZ’s target range.

In the face of stubbornly low headline inflation, the RBNZ have been at pains to emphasise that core inflation measures (that strip out volatile items) and inflation expectations remain well anchored.

This helps justify their decision to look through the current low headline CPI inflation numbers, and instead focus on achieving future inflation outcomes.

As if to underline this point in bold print, in a recent speech the Governor took aim at critics of the RBNZ that take “a mechanistic approach” that leads to “an inappropriate fixation on headline inflation”.

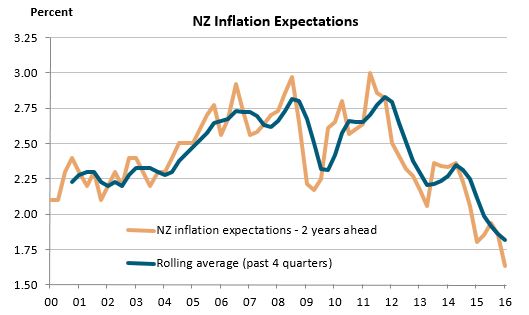

For many years, the RBNZ’s favoured measure of the NZ CPI inflation expectations was its own survey of expectations 2 years ahead. For much of Alan Bollard’s tenure as Governor this averaged around 2.5%, which in part motivated the inclusion of a new phrase in the Policy Targets Agreement (PTA) to “focus on keeping future average inflation near the 2% target midpoint”.

Source: RBNZ survey

As the RBNZ’s 2 year inflation expectations survey measure fell towards 2% in 2013, it was initially seen as a great triumph for the new regime. However, the story has become much more complicated since then, with this measure of inflation expectations continuing to trend lower. This creates both an analytical and communication challenge for the RBNZ.

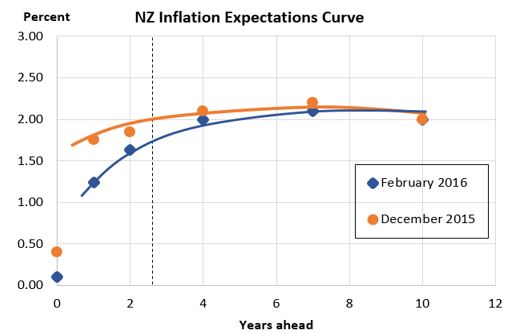

In search of a more comprehensive measure of NZ inflation expectations, last year the RBNZ introduced the concept of an inflation expectations curve. Instead of relying on a single number, they created a scatter plot of the results from a range of different survey measures. By fitting a curve through these observations, they create a richer picture, with the 2-to-3-year part of this curve being an important summary measure of the level of inflation expectations.

In the December Monetary Policy Statement, this approach had inflation expectations sitting around 2%. That reinforced the RBNZ’s confidence that inflation expectations remain well anchored, with little spillover from low current headline inflation numbers. However, the latest inflation expectations data released by AON and the RBNZ in February change this picture noticeably. The chart below is our own back of the envelope attempt to produce a new inflation expectations curve, updated to February 2016. With the 1 and 2 year ahead inflation surveys sharply lower, the 2-to-3-year part of this curve has been dragged down to around 1.75%. As such, it becomes harder to conclude inflation expectations are well anchored.

Source: RBNZ and AON surveys.

Notes: The 1 year ahead measure is an average of RBNZ and AON. 2 year ahead is RBNZ. 4 year and 7 year ahead is AON.

This leaves the RBNZ with an awkward policy judgment to make.

They could take a Bundesbank-type approach. That is, take no action and instead rely on their past inflation-targeting credibility for inflation expectations to eventually rise back to the mid-point on their own accord.

Alternatively, they could take an ECB-type of approach. That is, be very clear they are willing to “do whatever it takes” in order to generate inflation pressures that would lift inflation expectations back to the mid-point of the target, to avoid persistently low inflation. The ECB-type approach would involve taking action now.

Of course no single piece of economic data or survey will dictate the RBNZ’s approach. Some areas of the New Zealand economy are still performing strongly, particularly tourism and migration.

The Auckland housing market also remains a financial stability concern.

However, when added to a persistently elevated NZ dollar, falling dairy prices, a fragile global backdrop, and rising bank funding cost, in our view falling NZ inflation expectations help keep the door open for further cuts in the Official Cash Rate (OCR), as soon the next March meeting.

For investors, this all reinforces the theme of lower interest rates for longer, with continued demand for income generating assets.

------------------------------------------------------------

Christian Hawkesby is a director of Harbour Asset Management and head of their fixed interest division. You can contact him here »

25 Comments

The RBNZ does not necessarily have sole authority over its decisions.

They have a number of global organisations that they comply with.

NZ has been deemed a "commodity-based, high interest rate, new banking technology guinea pig" player in the global order.

Hence, the NZ economy is continually hamstrung by higher than necessary interest rates.

We will be in the Second Great Depression and then the decline to a lifestyle around the 1800s by the look of it.

It surprises me that NO economists talk about levels of credit growth when they argue about inflation targeting ....???

"The second section says that in pursuing the objective of a stable general level of prices, the Bank shall monitor prices, including asset prices, as measured by a range of price indices."

http://rbnz.govt.nz/monetary-policy/what-is-the-policy-targets-agreement

People who think lower and lower interest rates are the answer to our problems... are a little ignorant ,... in my view.

My generation has been conditioned... to borrow..to borrow ..to borrow...

Just look at the farming sector.... It is a microcosm of NZs' mass psychology... $8 billion in debt in 1995 to almost $60 billion in debt today...

The whole Modus operandi of Central Banks is that interest rates are used to influence the demand for credit... lower interest rates = more credit growth..

the big issue is that the economic Titans of the world had a GFC and were compelled to take extraordinary Monetary action... eg... QE and -ve interest rates..

NZ has not had a GFC.... The interest rate "cushion" our Reserve Bank has is the ONLY bullets left in the gun , in terms of lifting NZ out of a recession.... ( this is the normal business/credit cycle).

In the normal business cycle it is often the central Bank that takes us into recession because it raises interest rates due to "inflationary pressures"..

NZ is not in a recession.... the cost of mortgages is already incredibly low... Asset prices are already pretty high... Wages are rising ...employment levels are ok...

Just because we have really low inflation .... is not a problem , in-itself...???

( AND... Is it the Reserve Banks role to support exporters..??? to manage our exchange rate..?? )

(ALSO ... Is it a valid argument to say that if interest rates inEurope, China, Japan and USA are much lower than in NZ...then NZ MUST lower its rates..?? )

When we take the context of the Global economic climate ( deleveraging).... NZs' low inflation has NOTHING to do with deflationary forces within NZ.... within the context of credit growth.... NZ is not confronted with deflation.... ( the credit life blood is flowing...Banks are lending... Banks have been.."risk on" ie.. in a good lending mood)

The only reason I could see Wheeler lowering the OCR might be to save the Farming sector... which would not really be "saving" them... but probably turning the marginal, highly indebted ones into kinda "zombie " entities...??

(It sounds counterintuitive...but there really is a place for allowing land prices to fall... to allow bankruptcy... lenders taking a haircut.... cleansing...renewing ..etc... Out of that comes a fresh start...new blood etc.. )

ALSO ... Is it a valid argument to say that if interest rates inEurope, China, Japan and USA are much lower than in NZ...then NZ MUST lower its rates..?? )

Public reaction is negative as the interest rates in Japan.

The Wall Street Journal reported yesterday that Bank of Japan Governor Haruhiko Kuroda “has run out of ammunition”, receiving in part hostile reception from the Japanese parliament coupled with decidedly negative public reaction. From this, as always, the central banker was stunned that people might not like to be directly taxed for not spending as central planners desire. It didn’t help that the yen only measured in the “right” direction for the briefest of moments, leaving Kuroda like a duck hit on the head (to borrow, appropriately I think, Lincoln’s phrase). Read more

Yes, it is a valid proposition that NZ have similar monetary settings as most other developed world, especially in the absence of rational valid arguments.

Placing property prices onto the responsibility of the RB is futile. While NZ runs large immigration policies, huge international student policies, loose policy settings on overseas property buyers, the RB can never suppress property prices via interest rates.

Is policy to be implemented or gamed. It can be difficult when you're got players that just seem to do their own thing on the field.

http://m.smh.com.au/business/comment-and-analysis/our-banks-are-beyond-…

Not true, but some consider that credit growth doesnt matter when in the zero bound trap. Your view may well be that I and others are ignorant yet you display no understanding of several branches of economics such as Keynes and Minsky. The rest of your post is meandering nonsense IMHO so since I am ignorant its obviously a waste of time commenting further.

.

After Peak oil the world will be looking over it into territory the human species has never encountered before on a grand scale. That view is less and less energy from now til 2050 whenl we are back living on the annual sun output, if with CC there is anybody around that is. Hence wht the RBNZ is so utterly clueless its asking 2 years yet doesnt factor this loss of and cost of this energy.

When will peak oil occur? Not so long ago you kept claiming peak oil and then they started producing crap loads more. One day oil will peak but I can't see any compelling evidence that it will be any time soon as there are lots more possibilities with fracking. By the time it peaks we will be using much more renewables anyway.

If you understood some simple mathematics, and unfortunately it appears you don't, the evidence is already quite visible. The critical point isn't the peak, but the inflection point on the curve when plotted that signals the change in growth rate from positive to negative.

And if you understand simple economics, if the supply was indeed falling then the price should be going up instead of down.

It seems that you don't understand simple economics either, which predicts other outcomes when interest is involved. But don't feel bad, most economists don't understand the nature of interest, or compounding debt. (M.V)+i=P.Q is my modification of the quantity theory of money, put some numbers through that and see the outcome.

However I wasn't talking about theory, which all economics is, I was talking about real world outcomes. Real world constraints will trump mans theory every time and "Peak EROI" was more than 50 years ago for anyone that cares to look.

What do you think $148USD a barrel indicated in July 2008?

The World's economy has never recovered from that and never will.

a) Peak oil is a term referring to conventional oil's peak production which is in the 2005~2018 time frame, though 2005 or maybe 2010 seem arguable winners. Interesting charts showing that here http://peaksurfer.blogspot.co.nz/2016/02/foiled-by-oil.html

b) The thing about conventional oil is the EROEI is greater than 8 to 1, renewables will never do this so cant support our present industrial based global economy.

c) Fracking will be interesting to watch actually I'll admit. many of the possibilities are a) wrong geology b) politically a no go c) lack water to do so.

So the USA is currently producing about 4~4.8mbpd of shale oil however that sells at a discount as its not goof refinery feed stock. The Q will be how much indeed can be fracked around the world, but its not likely to be huge and a game changer just buy time which like US shale we will waste. Which brings us to,

d) The low oil price is causing projects to be cut, that bodes ill for future output, http://peakoil.com/production/selfish-oil-firms-relish-new-production-d….

The thing to appreciate is the timescale so when you find you run out of oil today, well tough it takes years to catch up. Ponder how well the world's economy will do during that wait.

In terms of when it will occur the financial occurrence was July 2008 when oil briefly hit $148USD, the world's economy never recovered from it and never will.

So we hit peak oil in 2008 and yet oil is now $30 a barrel due to oversupply?

I still believe that electricity is the future of energy, if we were to hit peak oil (unaffordable oil), countries like the states would build more nuclear plants. We just need better ways to cheaply store electricity, I don't think it is far away.

So to start with you didnt read "a)" ? "yet" has nothing to do with peak as such, all it means is that demand is lower than the supply which with economics 101 means the price collapses.

Oil at $30 is explained by 2 things i) collapse in demand, ii) new supply being committed to be brought onto the market from shale oil which isnt conventional oil of about 4~5mbpd, result, glut. The interesting things is shale oil isnt conventional oil so refiners who get less output from it will only take it if its cheaper, canadian tar sands is I think similar, this stuffs the EROEI of it even more.

We will indeed see Peak un-affordable oil which in itself is an interesting concept you (and others) put forward as most economists and commentators dont get it. So the Hubbert curve is symmetrical, it does not account for the economics of some of the remaining oil to be un-economic to extract even if technically it is, ie cannot be afforded by you and I, so the demand will indeed cuae a drop.

I am hopeful that we'll see Thorium nuclear plants that are intrinsically safe and in effect in-finite in feedstock. I dont think it will be the USA as the vested interest there have and are scuttling it. It will be china as they are going gang busters on it. Funny thing then is the USA will find its paying IP to china, ironic really.

Storage is at the moment far away ie batteries are expensive, dont last too long and weigh. So like the "unaffordable oil" I think "storage" will be similar.

Even in this case many parts of our economy have grown up around cheap liquid transport fuels and that includes the investment in them so migrating to new will take time and money. Robert Hirsch laid that out in 2005 and again when he re-visited it in 2012(?). So from the above we are going to change how we live and in a big way, assuming we dont kill ourselves in the process.

--edit-- missed that link, http://peakoil.com/consumption/the-great-global-famine-the-aftermath-of…

"Humanity has struggled to survive through the millennia in terms of Nature’s tendency to balance population size with food supply. The same is true now, but population numbers have been soaring for over a century. Oil, the limiting factor, is close to or beyond its peak extraction. Without ample, free-flowing oil, it will not be possible to support a population of several billion for long. Without fossil fuels for fertilizer and pesticides, as well as for cultivating and harvesting, crop yields drop by more than two-thirds (Pimentel, 1984; Pimentel & Hall, 1984; Pimentel & Pimentel, 2007).

Over the next few decades, there will be famine on a scale many times larger than ever before in human history. It is possible, of course, that warfare and plague, for example, will take their toll to a large extent before famine claims its victims."

inflation will come back when oil rises, industries are entrenched with needing oil, most countries are pumping as hard as they can except iran so once demand does pickup the price will come back

http://www.cnbc.com/2016/02/18/oil-to-go-to-50-by-the-end-of-the-year-a…

Iran will be on line, Libya. in BAU its hard to see why oil will go up and in fact not down. The unknown is the power that will be unleashed on each oil producer nation as its income collapses. So if one fairly big producer descends into riots and civil war the price will go silly.

I defiantly felt much better off in the days of bollard and labour when I used to get fairly good pay raises every year than I do with national and wheeler and hardly a pay rise to be seen.

But you've foregotten about the promised Key/English tax cuts. Aren't they due soon ? Surely you haven't foregotten the touted tax cuts ? You simply can't have foregotten. They'll make all the difference.

Far better than a pay rise !

Is anybody out there ?

Are you listening ? ? ?

That was BAU growing exponentially for ever on a finite planet, mathematically it could not last.

This weeks copy of The Economist. Headline is "World Economy. Out of Ammo?"

I personally think so. Having negative exchange rates is like flying the white flag.

Mark Twain Quote “Lies, Damn Lies and Statistics”

Anyone can play with figures when they don’t like what they see just like the RBNZ with CPI Inflation , Tarrot cards and Crystal ball don’t work

NZ OCR is one of the highest in the OECD and

Wheeler needs to grow some b@%%s and cut the OCR by 0.5-0.75bps with one foul swoop even with an OCR at 1.75% NZ would still be one of the highest in the OECD! this in turn would get the currency markets in a spin and devalue the NZ$ by 10% making it more realistic against other currencies. This would give the petrol companies an excuse to put up petrol by 5-10cents a litre which in turn would raise inflation (Economics 101) and help our export market, Companies would be able to pay down debt and spend/borrow to invest in jobs and R&D.

NZ National Govt Quotes “Stella Economy, Drop in dairy prices won’t effect the economy, Non resident buyers not a factor in Auckland housing market”

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.