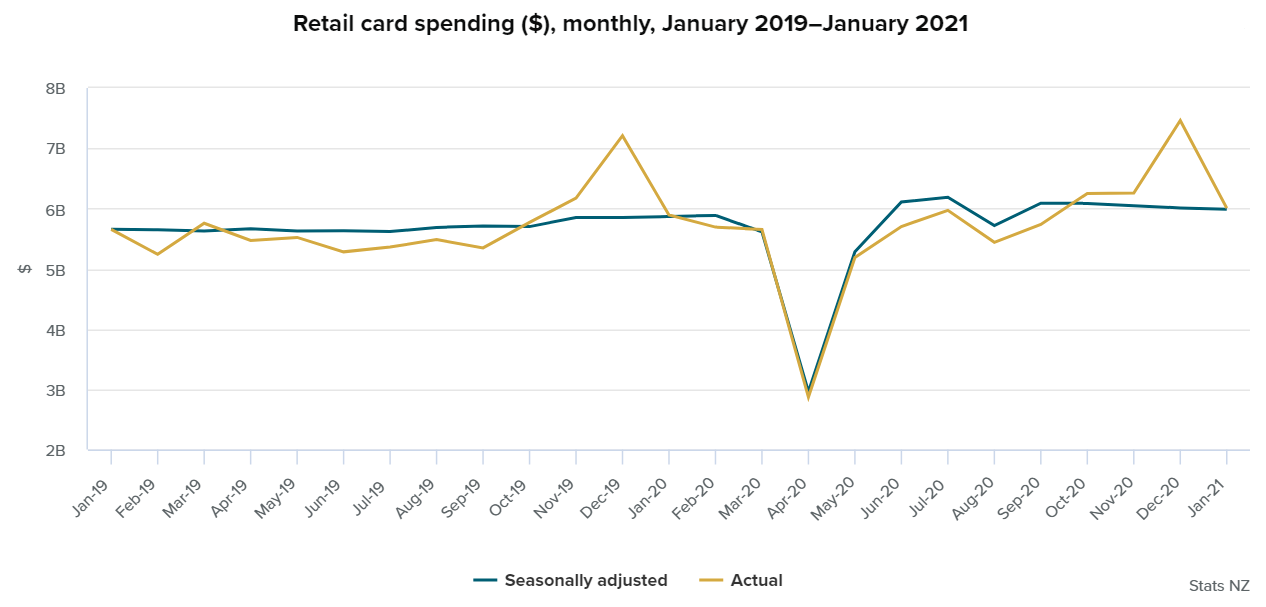

Statistics New Zealand says retail card spending dropped slightly on a seasonally adjusted basis in January.

After the disruptions last year caused by Covid 19 and the lockdown Stats NZ stopped producing seasonally adjusted figures because of the massive distortions in the figures.

So, January's figures are the first to be measured by the newly reintroduced seasonally adjustment.

However, seasonal adjustment has NOT been reintroduced yet on the hospitality industry as Stats NZ says there still has not been any return to a clear seasonal pattern due to the Covid disruption.

The absence of international tourists is hitting the hospitality industry, with accommodation in particular down.

In terms of the figures that have been seasonally adjusted, Stats NZ said spending in the retail industries fell 0.4% ($24 million) in January, while spending in the 'core' retail industries (excluding fuel and vehicle components) fell 0.7% ($39 million).

By industry, the movements were:

- durables, up $34 million (2.1%)

- motor vehicles (excluding fuel), up $3 million (1.7%)

- fuel, down $1 million (0.3%)

- apparel, down $7 million (2.0%)

- consumables, down $31 million (1.3%).

- In actual terms, hospitality was down $60 million (4.9%) compared with January 2020.

While the hospitality industry has been doing it tough, electronic card spending on the furniture, electrical, and hardware sub-industry was up $104 million (17%) in January, compared with the same month in 2020.

"Following the Covid-19 national lockdown in 2020, spending on furniture, electrical, and hardware has been higher than in previous years," Stats NZ's business insights manager Sue Chapman said.

“This may reflect people nesting at home because they are unable spend on overseas travel.”

ASB senior economist Jane Turner said retail spending has been an area that proved much stronger than expected over the winter months, helping support a quick bounce back in NZ economic activity.

"There was some concern that retail spending may start to soften considerably over the summer months, as the absence of foreign tourists starts to take its toll. And while some slowdown in spending has appeared, the fall is not as large as feared and overall spending trends have remained reasonably resilient (to date)," she said.

"From this data at least, it appears that NZers are doing a pretty good job at providing some offset to the impact of reduced foreign tourist inflows. Going forward, it will be hard to escape the headwinds of slower population growth on spending growth. In saying that, a resilient labour market and a pick-up in wage inflation could be just the ticket to continuing to support NZ’s retail sector."

Electronic transactions

Select chart tabs

4 Comments

In December Auckland house sales were up 52%

Provisional REINZ figures for January show 13% rise

LVR and other factors are slowing market

Spending on OO houses, and staying in them, picking up?

I suspect the spending had been flat rather than falling. The trend now is BNPL.

The clear winners from pent up household savings are those in the business of home renovation, furniture and vehicles.

On the consumables front, the loss in retail revenue from tourism is not the entire story with plenty of hotels & motels repurposed as MIQ facilities (and for emergency housing), earning government dime.

I always wonder where cash sales fit with these figures? The use of cash has fallen off a cliff, so I'd imagine retail is doing it much tougher than these figures suggest.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.