By David Skilling*

The geopolitical aftershocks of Russia’s invasion of Ukraine continue. The invasion and the Western-led response are accelerating the emergence of a more fragmented global economy, in which global trade and investment flows are shaped by shared political values and interests – values-based globalisation, or what Janet Yellen recently called ‘friend-shoring’.

But alongside intense geopolitical developments, recent events suggest elevated domestic political risks in countries from China to the US that could impact on the global outlook.

Political incentives may be local, but in a deeply connected world the consequences are not. Particularly in autocratic regimes with limited checks and balances, radical decisions can be made quickly – from the invasion of Ukraine to China’s Covid lockdowns – and with far-reaching implications. And democracies, notably the US, are under strain – creating exposures for the rest of the world. Political risks in systemically important countries are sitting at highly elevated levels.

A closed China

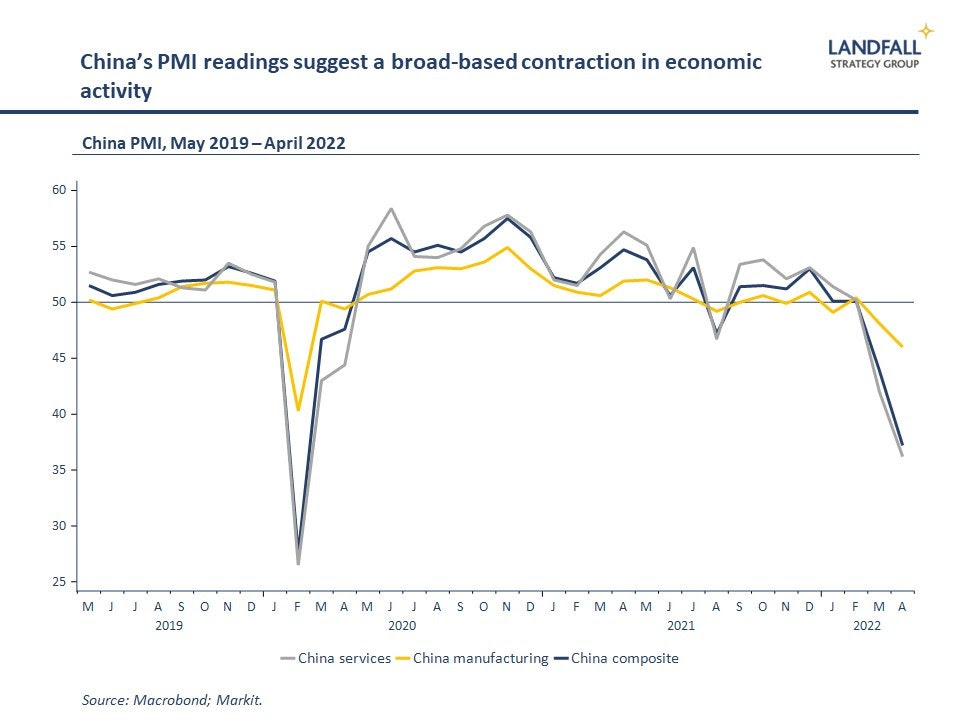

With the possible exception of Russia, China is the biggest single location of near-term domestic political risk. President Xi, who plans to secure a third term at the Party meetings in November, is presiding over draconian lockdown policies in Shanghai (and elsewhere) in pursuit of China’s zero-Covid policy.

But the contagious nature of Omicron, a low vaccination rate among the elderly, and ineffective Chinese vaccines (and a refusal to administer more effective western vaccines) have put Chinese authorities in a bind. The rigid lockdowns are exerting substantial economic and social costs on the population – with no clear end-point – and are also creating mounting political risks for the leadership.

The risk is less of regime change or mass political protest in China – or even of Mr Xi not securing a third term – but of increasingly repressive, inward-looking policies (Hong Kong’s experience is cautionary). The Chinese economy is softening; and it was already in weak shape prior to the recent lockdowns partly because of a series of political decisions on the technology and property sectors. Things could get worse, despite recent macro stimulus measures.

The potential for poor political decision-making in Beijing has clear spillovers into the global economy: weaker demand, disrupted global supply chains, and so on. And the political incentives facing the CCP seem to be for a more closed stance, reinforcing China’s inward turn.

This closed, autocratic system of decision-making, with highly concentrated personal rule, has clear parallels to Russian decision-making. This led to the strategic disaster of the invasion of Ukraine; and could similarly lead China into poor choices. An invasion of Taiwan, still a priority for Mr Xi, is unlikely in the near term (and is even less likely after the Russian invasion), but the probability is not zero in this decision-making environment.

China is the largest political risk in the world, because of this highly centralised decision-making. There is enormous key person risk at the heart of the global economic and political system.

Shining light on the hill?

The second location of systemically important domestic political risk is the US. Recent disclosures about the attempted coup after the last Presidential election, and the response to this week’s leaked Supreme Court draft judgement on abortion rights, remind how deeply divided the US is.

The US has staged the strongest post-Covid recovery of any large advanced economy. And Warren Buffet famously warned never to bet against America. That has been sound advice over time. The challenge is to figure out when political dysfunction overtakes the economic dynamism of the US. It hasn’t so far, but there are growing concerns.

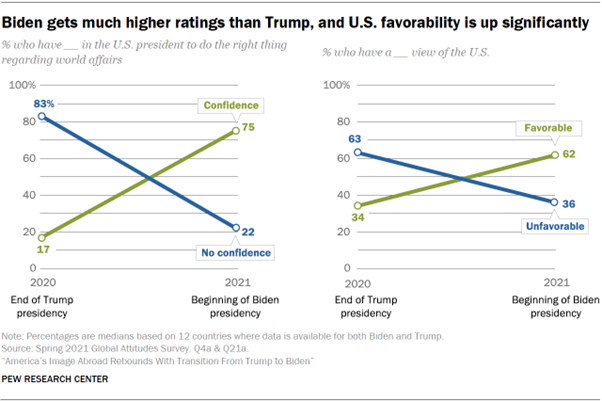

These political dysfunctions mean that the US is able to do little at federal level beyond fiscal stimulus. This will be worsened if the Democrats lose Congress in the November mid-terms, as is likely. And a Trump (or Trump surrogate) victory in 2024 would likely mean a return to the chaos of the Trump Administration with its erratic decision-making and degrading of norms and institutions.

These political risks have international implications. Mr Biden has handled Ukraine in a very different way than Mr Trump would have. And another Trump-like Administration would likely not be inclined to work with coalitions of other countries; from NATO to groupings like the Quad in Asia. For all of Dr Yellen’s talk of friend-shoring, many in Europe and Asia are not sure how friendly a Trump-like Presidency would be. EU/US relations are strong at the moment, but there is doubt that this will last – which strengthens the case for European strategic autonomy.

Elsewhere

Political risks also lurk in Europe. Populist parties haven’t gone away, with persistently high vote shares in several European countries. Rising interest rates could cause economic and political stress in southern European countries, from Greece to Italy, that still have high debt loads. And Brexit continues to impose costs on the UK – and the low-quality UK government has little capability to make the best of the post-Brexit environment.

Higher rates of inflation are causing political stress around the world, particularly higher food and energy prices. Households are being squeezed, and wage growth is generally not keeping pace with the cost of living. The distributive impacts of higher inflation make it a potent destabilising force in politics.

It is not all bad news. President Macron comfortably won re-election over Ms Le Pen (and is inaugurated tomorrow) on a policy platform that was effectively a choice between an open or closed French policy stance. And from Italy to Germany and the Netherlands, the political centre is still holding.

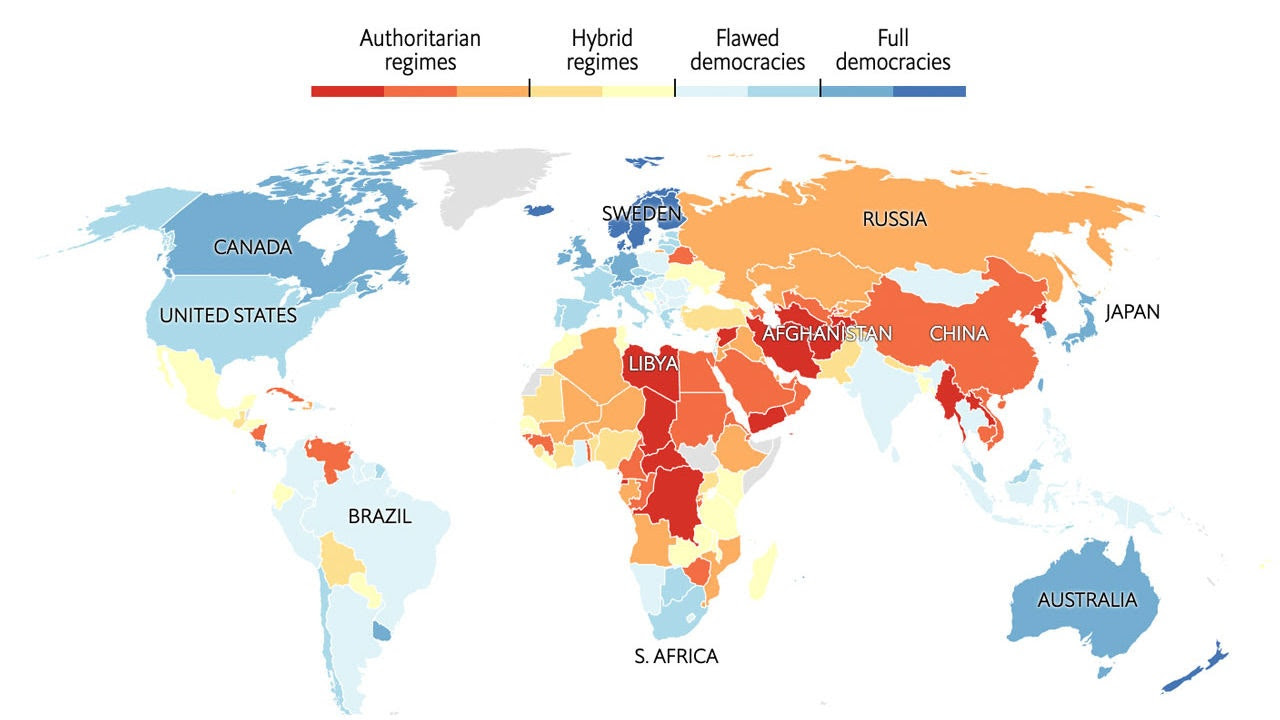

More broadly though, there are higher levels of political risk worldwide. On a GDP-weighted basis, levels of democratic strength have been reducing over time with larger amounts of global GDP controlled by a handful of leaders in autocratic systems (see the Economist chart below). I have described this weakening of institutional strength, and the accompanying increase in political risk, as ‘the world as an emerging market’.

Autocracies can deliver good outcomes for a time, but they are less good at sustaining performance. At best, there is a mixed economic record in countries from Turkey (inflation rates of 70% reported this week) to Brazil and Hungary. The distribution of possible outcomes is much higher in autocratic regimes.

Prepare for events

Just as geopolitical risk assessments changed quickly after Russia’s invasion (which was not the consensus view on February 23), so too firms, investors, and governments should prepare for disruptive changes in domestic politics. Recent experience shows how quickly certainties can change: the Brexit vote and Mr Trump’s electoral win in 2016, were both unexpected – and dramatically changed the global risk landscape, upending markets and corporate strategy.

'Events, dear boy, events', UK Prime Minister Harold Macmillan on the greatest challenge for a political leader

The way in which geopolitical developments play out (decoupling, friend-shoring) will depend importantly on domestic political dynamics in China, the US, and elsewhere. For example, China looks likely to continue to turn inwards, and there are risks around the sustainability of the US commitment to values-based coalitions of countries that have been developing.

The heightened potential for disruptive political events and actions in key economies matter for these economies directly, as well as for those exposed to the global economic and political system (which is to say, almost everyone – and particularly small economies). Domestic politics can’t stay local.

Chart of the week

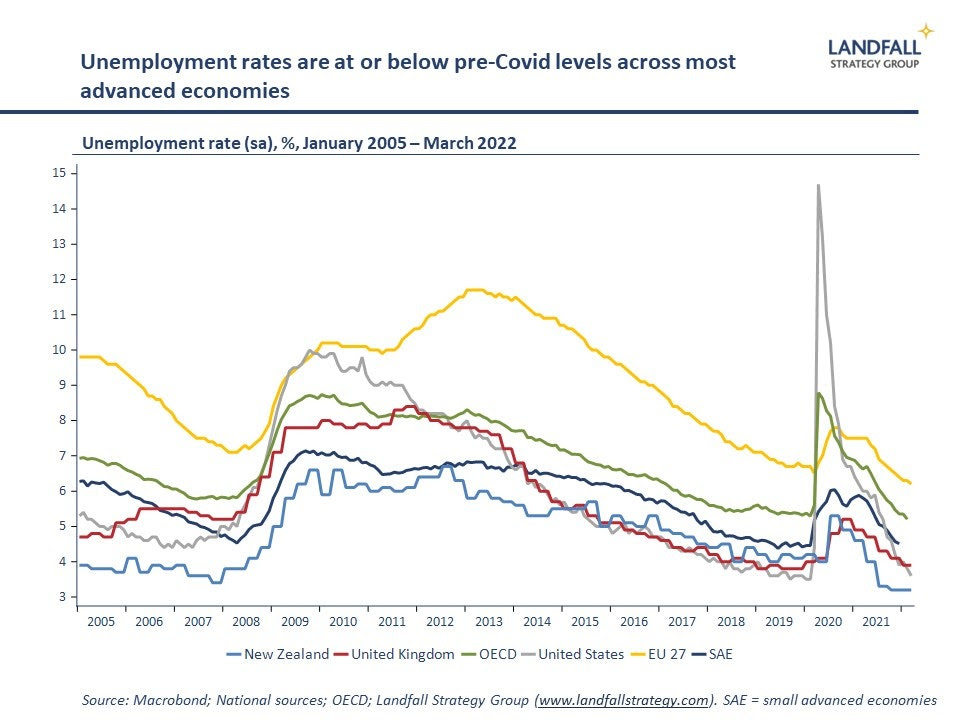

Despite a slowing global economic recovery, labour markets remain very tight across advanced economies. Unemployment rates are at or below their pre-Covid levels in the EU, the US, New Zealand, and elsewhere. Firms around the world report that labour shortages are increasingly a binding constraint on output growth – although wage growth remains negative in real terms in many advanced economies.

24 Comments

The global trade theory was nice; make your enemies friends by bringing them into the fold and trading with them. And it appeared to work, for a time.

But unfortunately there's two large Autocracies wanting to be top dog, and the very nature of their repressive governance means they can't compete at the bleeding edge.

What good is turning out massive populations of science and engineering grads if you're controlling what they see, hear and think.

It'd be nice to retire the US as global sheriff, sadly theyll probably be needed for the coming decades but as David alludes they may lack the fortitude for the job.

Physics, engineering, math are all disciplines of absolutes. They cannot be subverted by social constructs, critical race theory, or the Great Wurlitzer of the media. Yes, there are limits to their bodies of knowledge, as Kurt Godel noted of math, and Heisenberg noted of physics. But neither of those are open to influence: they are inherent to the knowledge domains.

So saying that "What good is turning out massive populations of science and engineering grads if you're controlling what they see, hear and think" has zero bearing on the value of the disciplines thus perpetuated.

But having those 'massive populations' is an immense strategic advantage in terms of coping with the choppy waters we are all facing....

Whereas having 'massive populations' of graduates trained in (fill in the blank) Studies is not exactly a recipe for (take your pick) social cohesion, pragmatism, innovation, efficiency, productivity, wise resource extraction and use, or indeed, Sustainability at above-subsistence levels of comfort....

They are all absolute sciences, but to push them forward requires a certain level of dynamism. You don't get that when you're trying to exert crazy levels of control in your populace.

China and Russia have shrinking populations which is their other archilles heel.

There's plenty of faults in the West also, but Russia and China play out like bad movies we've already seen.

Those sciences are indeed absolutes - including the limits they set. It seems that every time we overrun out habitat, two things happen. One - usually in the last 100 years of an Empire - monuments to 'selves' are built. Traditionally done with slave labour; the energy-source of antiquity. The other is that rational discussion seems to be quashed by those who are controlling the overshot system. It seems that in trying to protect their power, those elite will do whatever is necessary - hence the erratic actions and the appearing as wallies.

This writer is one of the most perceptive we are getting. Thanks for the piece.

The truth is that democratic governments, although preferred by the world, as measured by emigration statistics, is under threat.

In the USA, Jan 6, is a watershed in history. Had the then President succeeded in clinging to power, would the West, as we know it start to crumble?

Will Mr Tucker sing praises?

Democracy long pre-dates America and one rather suspects it will post-date it as well.

Friendshoring. Yes. So we need to be good friends with Oz. Annoying as they are, they are all we really have.

I did my bit - met one 40 years ago and brought her home.

Worked out well, mostly.

Over the last decade New Zealand Prime Ministers have been more in the habit of extending friendly overtures and warm words to China than Australia.

But not because they prefer China to Australia. Australians are self-confident so any criticism is like water off a duck's back whereas the Chinese are very touchy - a politician mention the Dalai Lama and shiploads of NZ exports are turned around but you can badmouth any and every Australian and it will not disturb trade.

Australia may even possibly have a worse Govt...but much better satire than NZ

(Warning: NSFW)

And in the background of the worldwide political dysfunction the climate moves on. The only country to address population growth has been China and it may backfire, however it has increased its chances of feeding its people and maybe reaching a stable state . The western democracies are in a type of unstable dynamic and maybe from chaos will come order by their democratic nature . This is unlikely to occur in autocratic regimes as David points out they tend to worsen over time . Putin and Xi are past their use by date only they don't see it that way .

The geopolitical aftershocks of Russia’s invasion of Ukraine continue. The invasion and the Western-led response are accelerating the emergence of a more fragmented global economy, in which global trade and investment flows are shaped by shared political values and interests – values-based globalisation, or what Janet Yellen recently called ‘friend-shoring’.

Countries are going to have to choose. Are they going to have to operate their homes without energy, their factories without energy—and energy consumption per capita is directly connected to GDP for the last 150 years. Every chart shows energy use, GDP, and personal income go up together.

So, what are countries going to do when they can’t afford to pay the higher prices for energy? Well, Janet Yellen, who was the Federal Reserve head and [now] the Secretary of the Treasury says, ‘Well, what we’re going to do is use the International Monetary Fund to preserve America’s unipolar hegemony.’ I think she used almost those words. We have to keep American control of the world and we’re going to do it through the IMF. And that means in practice using the IMF to create special drawing rights, which will be sort of like free money, the bulk of which will go to the United States to support its military spending abroad for all of this huge military escalation. And it will enable the IMF to go to countries and say, ‘We will help you pay your debts and not be foreclosed on and get energy, but it’s conditional.’ On usual conditions: you have to lower your wages; you have to pass anti-labor legislation; you have to agree to begin selling off your public domain and privatize.

The energy and food crisis caused by the NATO war against Russia is going to be used as a lever not only to push privatization, largely under control of US investors and banks and financiers, but it’s also going to lock countries into the US orbit all the more, both the Global South and especially Europe.

One casualty is obviously going to be Europe and the euro. The euro has been plunging in value day after day after day, as people realize that it’s lost its export markets in Russia and much of Asia, and now at home, too, because exports require energy to be made. Its costs of imports are going up, especially energy. It’s agreed to use, I think, now $3 billion to build new port facilities to buy US natural gas—liquified natural gas at three to seven times the price that it’s paying now, which will make it almost impossible for German firms to produce fertilizer to grow crops in Germany. The euro’s plunging.

The largest plunge of all has been the Japanese yen, because Japan imports all of its energy and most of its food and is keeping its interest rates very low in order to support the financial sector. And so, the Japanese economy is being sacrificed and squeezed. And I think this is…you can’t say, ‘Gee, this is an accident.’ This is part of the plan, because now the United States can say, ‘Of course we don’t want your yen to go down so much that your consumers have to pay more. We will, of course, give you SDRs—special drawing rights—and we will give you American aid. But we do want you to rewrite your constitution so that you can have atomic weapons on your soil so that we can fight against China to the last Japanese. Just like we’re doing in Ukraine, let us do it for you.’

And, of course, the Japanese love that. The government loves that idea. They love sacrificing the population, which is what they’ve been doing ever since the Plaza Accord and the Louvre Accord of the 1980s that basically wrecked the Japanese industrial economy from this huge upswing to just a mass shrinkage.

So, those are the economic effects of the war. And in the newspaper, you think the war is all about Ukrainians and NATO fighting Russians, and it’s really a war by the United States to use the NATO-Russia conflict as a means of locking in control over its allies and the whole Western world, and in Janet Yellen’s words, re-establishing American unipolar power. Link

It's been obvious to most knowledgeable financial commentators after the first two weeks or so of the war that the EU will suffer fairly badly economically, in particular Germany and it'll favour the US as well as emasculating Russia. The only thing Sleepy Joe hasn't done to swing it more towards the US is to sort out the US's energy policy. By that I mean talk the talk but don't walk the walk as far as the Green New Deal is concerned. As an American acquaintance said, wait for the elections around November where he predicts the Dems will loose 70-80 seats .

All politics is not Local but how our local politicians reacts to it and act or does not react, does effect local.

I hope you are right Audaxes. The alternatives are frightening. Just look at our own communist state here in NZ over the past 2 years. ''Let me out of here!'' Choice is good. Having health officials running your country is not.

After watching the Yanks mess things up globally for the past 50 years, I was thinking they were on the way out. What I now see now is America deciding to use the Ukraine opportunity to confront one of their most persistent pains in the arse. Putin may have some big guns & a big mouth but to date (at least) he seems to be making some big mistakes. Having Russia as a part of Europe is the goal. They have all the energy the EU will ever need for now, so if I were them, I'd be planning how to take Putin out & get some form of democracy or friend-shoring regime in place. If Europe doesn't, China will.

As for the energy running out, well (sorry PDK) but so far so good. After many thousands of years of humanity on planet Earth we use more energy today than we've ever do. Why's that? Science of course. Will we ever run out of energy? Some types will disappear, others will be developed. The one fundamental of life is energy, in all its forms, so we just have to keep developing better forms of it. And we will.

. Just look at our own communist state here in NZ over the past 2 years

Oh dear. If you truly believe that statement your pseudonym is very apt.

I didn't think there were too many from the McCarthy era still alive. He drank himself to death when discredited, as I recall.

Probably believes it while collecting the pension, NZ's only universal socialist benefit.

Having Russia as a part of Europe is the goal. They have all the energy the EU will ever need for now, so if I were them, I'd be planning how to take Putin out & get some form of democracy or friend-shoring regime in place. If Europe doesn't, China will.

Conflict Threatens to Derail U.S. Goals

European countries are dependent on Russia to various degrees, but generally more so than the U.S., and therefore their sanctions against Russia are not fully aligned. European panic about Biden’s unprepared remarks in Poland that Vladimir Putin “cannot remain in power” reveals that if the U.S. side harbors the unstated goal of regime change in Russia, it will greatly intensify divisions between the U.S. and Europe.

Rising interest rates could cause economic and political stress in southern European countries, from Greece to Italy, that still have high debt loads.

What makes Greece and Italy likely to default isn't just higher debt loads but very low birthrates and a high rate of emigration among their working age population. There are fewer taxpayers and ever more debt they are expected to service.

"" very low birthrates and a high rate of emigration among their working age population "" isn't that NZ?

You could say it's any heavily urbanised country, but if there's a spectrum Greece and Italy are sitting at a birthrate of 1.3 (vs 1.7 for NZ) and sustained rates of net negative people movement.

As a dual Italian New Zealand citizen there’s way more to be concerned about here than in Italy right now. Italy has very low private debt and a very solid diversified economy, unlike NZ. If China goes rouge and property collapses what do we have left? Very little as far as I can see…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.