Business confidence is continuing to improve overall - but there's been another sharp fall in activity indicators for the residential construction sector, according to the latest monthly ANZ Business Outlook Survey (ANZBO).

ANZ senior economist Miles Workman said business confidence lifted another 11 points in September to -37, while expected own activity rose 2 points to -2.

"Activity measures generally lifted modestly. Inflation pressures remain intense and are easing only very slowly," Workman said.

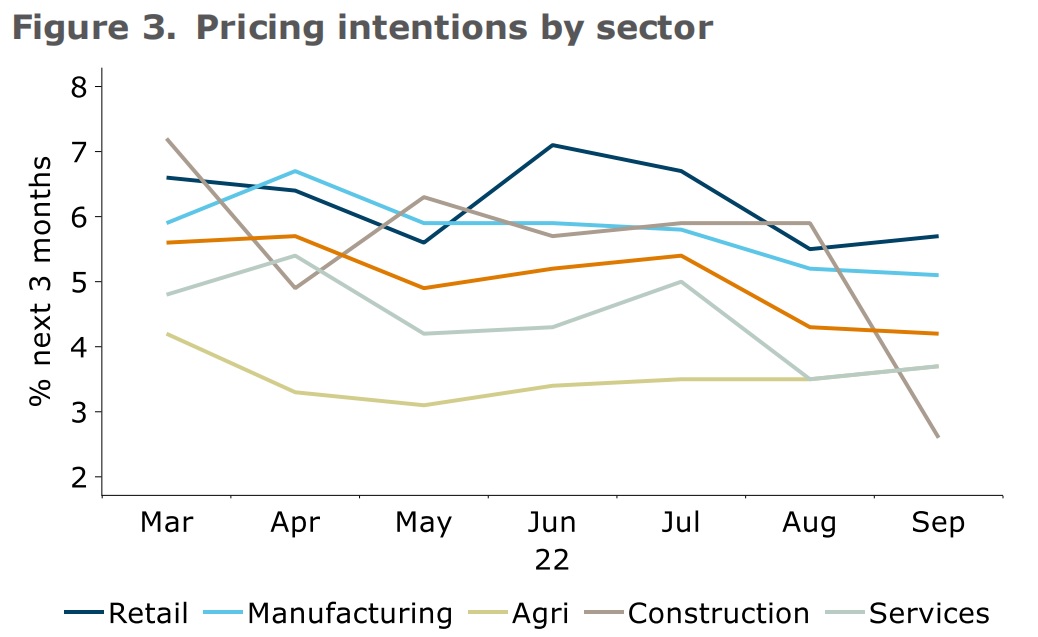

"Pricing intentions eased 2 points, yet is still more than three times the 1992-2020 average. Inflation expectations eased only slightly, and at 6% are still three times the inflation target midpoint.

"Pricing intentions, cost expectations and inflation are at best a little off their peaks, and remain very high," he said.

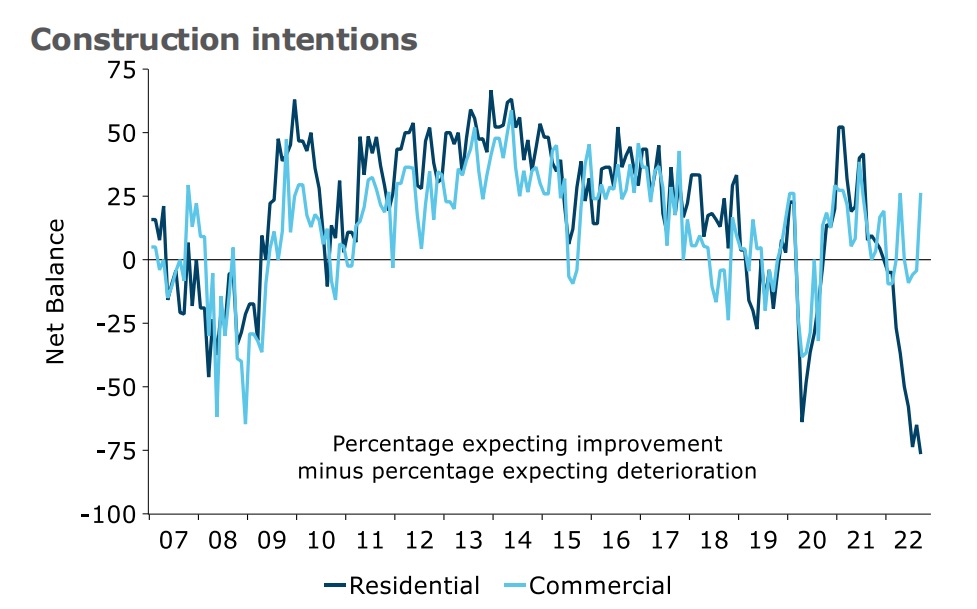

Residential construction intentions dropped sharply again, to a new all time low for the survey - although interestingly, commercial construction intentions had a sharp bounce.

But consistent with the falling intentions in the residential construction sector, pricing intentions in the sector dropped very sharply, particularly when compared with how elevated these intentions have remained elsewhere.

Workman said by sector, an intention to raise prices is most widespread in the retail sector (92% of firms intend to raise their prices in the next three months) and manufacturing (75%).

"The lowest proportions were in agriculture (52.9%) and services (60%).

"Construction sector price intentions have dropped the most dramatically, from 94% in March to 63% this month.

"As regards a specific numerical estimate of where firms’ own selling prices will be in three months’ time (figure 3), the strongest were in retail (+5.7%, down from a peak of 7.1% in March) and manufacturing (+5.1% versus a peak of 6.7% in April) (note these aren’t annual percent changes).

"Again, construction is the outlier in terms of how far pricing intentions have fallen."

Workman said the New Zealand economy "is at a delicate juncture".

"It’s fair to say that demand has not yet rolled over as feared as the Reserve Bank has raised interest rates.

"But insofar as the RBNZ can just keep on going until they see the cooling in demand they need to tame inflation, that’s likely to be a temporary reprieve, if not an outright double-edged sword for firms that have considerable debt.

"Inflation pressures are easing, but painfully slowly. It’s not enough for the RBNZ to see inflation pressures top out and ever so gradually fall. They will be concerned about the chance that wage and price-setting behaviour will change in structural ways that make bringing inflation down more difficult.

"We expect that the RBNZ will need to deliver a policy rate closer to 5% than 4% to get on top of inflation pressures.

"Meanwhile, similar dynamics are playing out globally as central banks take on inflation in over-stretched economies, and in some regions, very nasty energy shocks.

"Global interest rates have risen abruptly as markets assess not only likely average policy rates and inflation over coming years, but also the sustainability of fiscal positions in some highly indebted countries.

"Volatility seems likely to be a hallmark of the coming weeks and months; this could impact on both business and consumer confidence here in New Zealand, even if the causes are far away."

Business confidence - General

Select chart tabs

45 Comments

Surprise surprise on residential construction….

It was hilarious listening to a snake oil salesman spruik residential construction earlier this week at a conference that dear Mr Hickey was chairing.

You build it they will come, but only if you lower price by 20% so many developers are going to hit the wall.

Exactly

I turned down an estimation role 6 months ago with a reputable group home builder. Main reason was my own concerns about medium to long term outlook in the sector.

Sounds like a good call.

I am relatively bullish beyond the next 2-3 years.

I think 2023 and 2024 will be a shocker for the residential construction sector.

Agreed, will sit tight in civil infrastructure for now. By the end of 2023 I'll have my Diploma in Construction (QS strand) complete and can reassess.

Just chuck an hourly rate out at the market for contract work. High End Resi still pumping and won't stop being silly IMO. You just have to deal with interior designers and eco advisors.

Agreed, if you're going to touch residential construction follow the money, avoid group home crowds like the plague.

I'm still a spring chicken, so even when I finish my qualification I won't have any residential construction experience so would be prudent to spend a few years getting some real world experience.

I'd advise seeking out a smaller crowd who are really onto and going under their wings.

Group home crowds are generally a meat grinder. If you wanted to find the fastest route to getting disenchanted with construction, it's either them or a company that deals with the housing ministry.

Agreed. Large development on the hills above Orewa still trying to sell 400m2 sections at 742k. Maybe they too are waiting till 2023/2024😂

""We expect that the RBNZ will need to deliver a policy rate closer to 5% than 4% to get on top of inflation pressures."

Does this translate into four consecutive interest rate hikes of 50 bps, to achieve an OCR of 5% p.a.

Protests, in election year, is best avoided.

I tend to agree, nothing to lose now by pushing up OCR by 100pts

get the shock factor, steady the dollar, inflation drops quicker, hopefully OCR can neutralize earlier

Residential construction fell off the cliff just before and after the GFC. My work in the sector was severely impacted by that.

Quite scary to see how much worse business confidence is in the sector even compared to 2007/2008…

Mentioned it on the Breakfast Briefing in more detail, but one of my clients with heavy exposure to both resi and commercial construction is seeing this play out in real time. Inquiry for the residential product (used by builders, painters etc) has collapsed but commercial side is still very strong.

Yep.

It’s playing out exactly as I have been predicting for the past 1.5 years.

Yes you have, well done! Chocolate fish for you, lol

Maybe I will actually be able to get a tradesman soon? Currently just get laughed at or ignored as only small jobs.

Yep I have a couple of little jobs I want done. I will hold for another 6-9 months then see what availability and quotes are like…

Just find someone good and pay labour and materials.

Quotes for small jobs, yuck.

Here's a laugh -

Family member just offered an unemployed due $40 an hour as safety observer. The guy said no...wanted $65. ffs... he just had to sit on his a#se.

The health workers in the family just shook their heads in disbelief.

Man does this country have some real issues to sort!!

And that is the issue affecting New Zealand's productivity. The number willing to work for a living is shrinking.

The costs have sky-rocketed....builders price fixing on FB sites....if they can get it, good on them but not in my world...quality is absolute rubbish from some....no shame. This country believes in redistribution of money irrespective of value add....in fact, it is across a lot of the developed world....now is the time to focus on money into sustainable growth. Get with it, or struggle.

the RBNZ can just keep on going (= raising rates) until they see the cooling in demand they need to tame inflation

The problem, as I have often said, is the delay between a policy change (raising the OCR) and its effects on the desired outcome, and then the further delay in reporting the outcome, being inflation. (which I believe is still only being reported every 3 months in NZ)

Today' inflation is a result of the loose monetary policy of 2021, likewise today's tightening won't be felt until 2023. By the time the RB sees a meaningful drop in inflation being reported, it's policy setting will be well and truly out of date.

I tend to agree but with everyone playing the same game, if we are to hold now we become the outlier, short term dollar plummets (even worse than now), inflation rises more as a result. RBNZ shits their pants and hits the panic button.

We might as well go harder and get over it earlier, the pain is coming regardless...

Also agreed

This basic fact is being missed by most. The surge in the economy took place at the back end of 2021 (we can debate whether that was due to monetary policy). For example, when people say earnings are through the roof, they are typically quoting year-on-year stats, without realising that the growth reflected in these stats happened more than 6 months ago (after a Covid slump in mid-2021). The economy has been flatlining and teetering on the edge for 6 months and only the opening of the borders saved the day (temporarily) for the last GDP release.

Thank god for that, last thing we need is more houses clogging up our towns and cities.

yes all this construction is hurting the people mover sector which has boomed as a result of their utility as a tiny home...

There will be cheap HiLux's coming

Were HiLux's ever expensive?

yes, once you add on the 30k of accessories that most tradies seem to need - must cross alot of rivers to get to the building site so have to have winch, bullbar and snorkel

Hilux's were 2008/09. 22/23 will be Ford Rangers.

I remember back in 08 every man and his dog had a sign written brand new Hilux. Then they all seemed to disappear over the next 6 months or so.

Always amuses me when a new business gets itself nice new cars.

You do that after 3 years, minimum.

Not sure why anyone would buy one of those new build townhouses - a $700k townhouse with a 20% ($140k) deposit is going to cost $1500 a fortnight on current 2 year fixed term mortgage. Plus insurance and rates. You can rent one for $1000 a fortnight, and earn another 4% ($5,600) a year on your deposit money in the bank to offset that rent.

In Auckland, at least, you will also struggle to get a 2 bed townhouse for less than 750-800k, other than in some really rough locations.

We have plenty of those shoe boxes in wellington, I can't work out why anyone would pay $880k for a 2dbrm 70m² on no land in a "not so great area".

Increasingly people *can’t* buy them, even if they want to. Try stress testing a 700k plus mortgage at 8.5%

This Time next year will see cheap sections for Africa, land developers desperate to off load sections, mortgagee sales, no buyers, and election bribes from Stalinda to offset the cluster she has created.

Standby for a big recession.

True that, I have capital in the bank ready to buy, at fair value. Til then, yous are droimin.

I would seriously consider a new build next year, however, as my requirements 5 bdrm ~250m² house is likely to cost above $650k and the section over $400k. Add in the extras it doesn't make sense when I can just buy a nice existing home for around $700k. I'd like to contribute toward a greater overall housing supply in NZ to help make housing more affordable for others. But the maths doesn't add up, why is the build cost so high?

Short answer; compliance costs and labour shortages.

Add lack of economies of scale and lack of competition.

Eh, I reckon you could half per m2 build costs if you removed compliance costs.

There's not a whole heap of margin in house building, most crowds are lucky to net 5% which is peanuts considering the outlay and time involved.

Having operated in a bunch of markets in NZ, Auckland's generally cheaper because of the bigger supply of (often imported labour). It is probably the worst place to be a tradie. Except maybe depressed areas.

The economies of scale for sure when it comes to materials and infrastructure.

Shorter answer is: suppliers taking the Mickey: material costs i.e. if you are "in the know", you can get certain products at $Y but if you don't know, you pay $Y x 1.2. Then you have margin on margin on margin....NZ made shower alcove from a large box retailer $1750 but to buy a near identical NZ made shower alcove from a middle supplier it will cost $2,600.

Vector will charge a developer $150k to connect power but after evidence and challenge presented, the cost drops to around $30k.

Developers used to just take the costs and hand them on - now it is time for them to question their costs and really understand their operating environment.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.