The resilience being seen in card spending by Kiwis evaporated last month, with total card spend dropping by a seasonally adjusted 1.9%.

That followed a gain in the previous month that had appeared to go against the expectations of a looming slowdown.

But the May figures paint a much more convincing picture of a slowdown emerging.

Stats NZ said the total value of electronic card spending, including the two non-retail categories, decreased by $174 million (1.9%) on a seasonally-adjusted basis in May 2023.

Total retail spending fell 1.7%.

The non-retail (excluding services) category decreased by $51 million (2.4%) from April 2023. This category includes medical and other health care, travel and tour arrangement, postal and courier delivery, and other non-retail industries.

The services category was up $1.4 million (0.4%). This category includes repair and maintenance, and personal care, funeral, and other personal services.

"This is the first time since December 2022 that only one industry saw a rise in spending, and the first time since February this year that total card spending fell," Stats NZ's business performance manager Ricky Ho said.

Westpac senior economist Satish Ranchhod said retail spending "was much weaker than expected in May". Westpac economists had expected a small rise.

"Weakness in retail spending has been widespread," Ranchhod said.

"There were sizeable falls in spending on household durables (like furnishings) and hospitality. That was despite a fall in fuel prices over the month."

Ranchhod said the softness in spending is particularly surprising given the lift in population growth in recent months as migration inflows have surged.

"Today’s weak spending result highlights the growing pressure on households’ finances," he said.

"Retail prices are continuing to rise at a rapid pace. We’re also seeing increasing numbers of households rolling on to higher mortgage rates. We expect those factors will be an increasing drag on household spending over the months ahead.

"Today’s result reinforces our expectations for a downturn in domestic economic conditions over the coming months."

ASB senior economist Kim Mundy said households are now feeling the pinch "and we don’t expect this to change any time soon". She said that consumer spending is "likely to remain soggy over the second half of 2023".

"Living costs are still rising (including steep increases in debt servicing costs for mortgage holders). At the same time, households have run down savings which has weakened household confidence and the willingness to spend," Mundy said.

"However, strong net migration will help to put a floor under consumer spending. The housing market could also provide some support to consumer spending. Thanks to strong population growth we expect house prices will soon turn higher again."

Mundy said, however, that whether or not strong population growth stems falls in aggregate spending, per-capita spending will remain weak over 2023.

"Nevertheless, we expect the RBNZ will be relieved to see the consumer demand balloon deflating. And falling consumer spending is consistent with our view that the current 5.5% OCR [Official Cash Rate] is likely to be the peak. But inflation is still high and, as discussed above, the risks are not all to the downside. As a result, it’s far too premature to be thinking about OCR cuts."

In actual terms, retail card spending was $6.4 billion, up 3.3% ($203 million) from May 2022.

Annual inflation, of course, was running at 6.7% as of the March quarter.

Stats NZ says values are only available at the national level and are not adjusted for price changes.

Electronic card transactions data covers the use of credit and debit cards in shops and online, and includes both the retail and services industries.

Total retail card spending fell $113 million (1.7%) in May 2023 compared with April 2023, when adjusted for seasonal effects.

The 'core' retail spending, which excludes fuel, fell 1.2%.

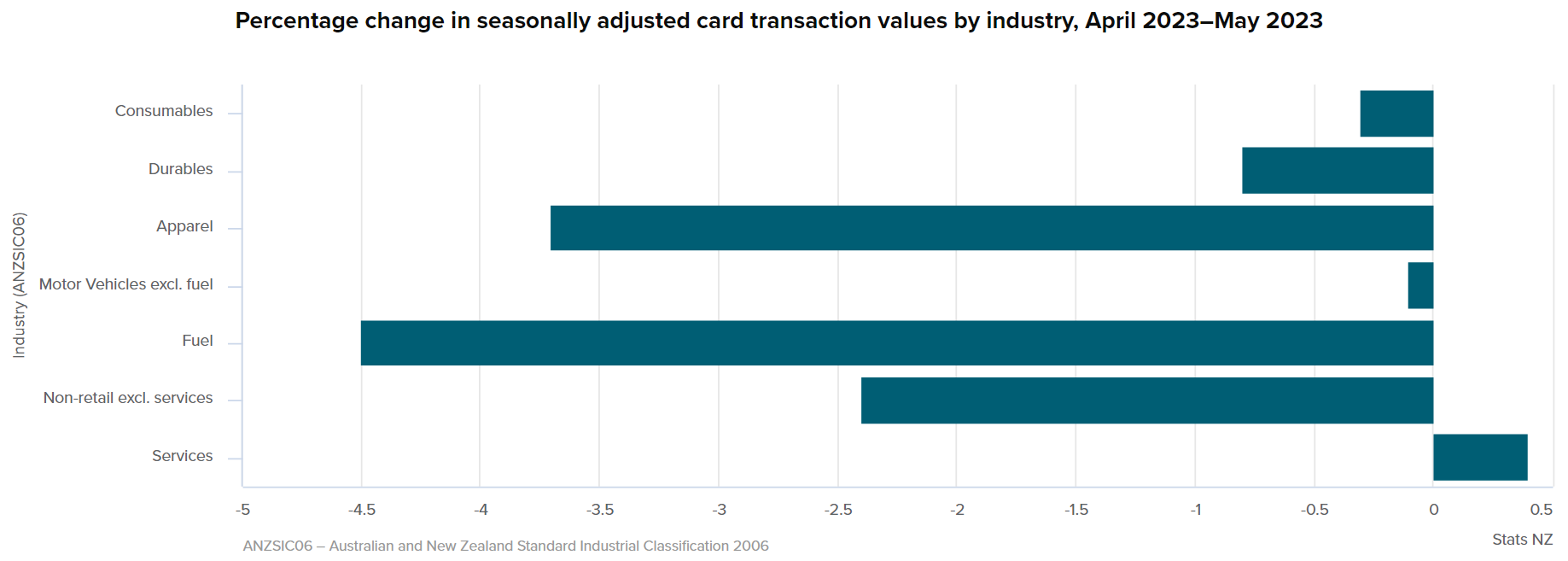

Seasonally adjusted card spending fell across all retail industries (including consumables, durables, apparel, fuel, and motor vehicles), as well as the non-retail excluding services category. Services was the only industry that saw an increase, rising $1.4 million (0.4%) compared with April 2023.

The largest contributor to the fall in retail card spending was fuel, down $25 million (4.5%), followed by apparel, down $13 million (3.7%).

These are the main highlights in terms of movement provided by Stats NZ:

- motor vehicles (excluding fuel), down $0.2 million (0.1%)

- consumables, down $6.8 million (0.3%)

- apparel, down $13 million (3.7%)

- durables, down $13 million (0.8%)

- fuel, down $25 million (4.5%).

43 Comments

Lots of kiwis go to foreign locations during winter and spend there. Last year they didn't go.

So this drop is because we are not getting visitors at the same number as kiwis going overseas and spending there.

Nothing to see here. Plenty of money there in the market to be spent and no one is poor in NZ. Look at the prices of our houses. Who says we have poor in this country. 🙄😁😁😁😁

Where did all the cashed-up migrants and tourists disappear to then? Are they all busy in auction rooms all day?

Nothing to see here. Plenty of money there in the market to be spent and no one is poor in NZ. Look at the prices of our houses. Who says we have poor in this country.

Your vibe and reckon are similar to the water cooler in-group consensus I have come across.

I mean, it’s not really “down” year on year, so I think you are overstating the impact of tourism:

“In actual terms, retail card spending was $6.4 billion, up 3.3% ($203 million) from May 2022.”

The number of kiwis I know taking their spending overseas this winter is scarily high. Most will be back for spring but a fair few are gone for good.

Been waiting for it to happen but to be honest 1.9% is nothing. You can pretty much carry on as normal and drink just one less coffee a week. When it hits 10% you definitely have a downward trend.

-1.9% adjusted down another 6.4% for inflation is pretty much -10%

I feel so guilty for this outcome. I put the car and the boat on the card in April.

Well done you!

From personal experience you have to keep using the old credit card up to the max quite often, and pay it off each month of course, or the bank will start to mutter things like "It looks like you aren't using the full limit of your card any more, so how about we cut it back a bit (or a lot!)."

But do they really do that? My bank never has, TSB.

I never go anywhere near my limit, and never got such a message the only thing I have gotten is an offer to increase it.

In the 6 months Mar 21 - Aug 21 there was 53.5 billion of new mortgage lending at interest rates starting with a 2. Every month those people are rolling off their fixed rates and a month or so later finally realising how F%$&*D they are. Then they stop spending on everything but essentials.

More stress coming for household budgets with subsidies on fuel excise, RUC and public transport ending in a couple of weeks.

My workplace has announced a restack for the start of July as many are planning to travel to work not more than once a week from the current 2-3x. There is an ambitious plan to slash our fixed expenses by another 20-30% over the next few months to avoid passing on the entirety of business cost increases to our clients.

"There is an ambitious plan to slash our fixed expenses by another 20-30% over the next few months"

Are the main fixed expenses of your business, rent and staff costs?

We are a small technical consulting shop focusing on key markets in Aussie and, to a lesser extent, NZ. Our staff costs although fixed are on recovery basis - company is employee-owned with utilisation targets at team and individual levels.

Our non-client facing work has always been offshored to providers in Manila and Bangalore, and since Covid an increasing portion of our client-facing work is going out to SE Asia as well due to lack of local talent.

Correct, I have friends in that situation. All are either looking for, or have already recently secured, higher paying jobs to soften the blow and drop the mortgage down before refix time. On the plus side, pot-lucks are coming back into vogue!

So fuel spending is down 4.5%, and due to the increase in price by 5.3% end of the month.

It also accounts for 43% of the "main highlights"

These are the main highlights in terms of movement provided by Stats NZ:

- motor vehicles (excluding fuel), down $0.2 million (0.1%)

- consumables, down $6.8 million (0.3%)

- apparel, down $13 million (3.7%)

- durables, down $13 million (0.8%)

- fuel, down $25 million (4.5%).

In actual terms, retail card spending was $6.4 billion, up 3.3% ($203 million) from May 2022.

maybe is just hear what I want to hear sometimes too

First rise since February this year that total spending fell ... you mean.. three months ago?

One could almost think this was just noisy fluctuations - and the net loss of 82,000 people since february helps explain a bit too. Seems we're actually spending more per head still.

Net loss? You mean 65k gain https://www.stats.govt.nz/news/net-migration-gain-driven-by-non-new-zea….

Always bugs me that Stats NZ don't use their retail deflator and CPI data to publish card spending stats in 'real terms' (i.e. inflation adjusted). If they did, you would see that card spending in real terms is back to late 2018 levels - despite the increase in our population.

Demand for consumables (like food) has been dropping for many months - at the same time as prices have been going up. This might upset the economists, but the prices in our shops are driven by the prices of imports and other key input costs - not by the level of domestic demand.

Stats already publish deflated retail sales which are comfortably, albeit not spectacularly, above 2018 levels. The card data is probably more of a leading indicator, it seems silly to use it to study long term trends given that the popularity of payment methods changes over time. I can't see why you'd bring it up rather than quote the existing retail stats, unless you have some sort of agenda to push

The last retail sales data (2023Q1) basically gives you an idea of sales in February 2023 - the card spending gives you May 2023. It's a pretty important leading indicator and would benefit from being presented with deflated prices.

Incidentally, if you look at the retail sales data (2010 deflated prices per capita - Table RTT015AA) you will see that 2023Q1 was pretty similar to 2018 figures actually.

In terms of an agenda - I am open about that! I think it is important that people see that despite the 'queues at the Briscoes car park' nonsense - consumer demand is collapsing and the people still shouting for further rate hikes to 'tame inflation' have an austerity fetish.

Just had a look at air New Zealand flights.

one way flights to LA are significantly higher than one way flights to Auckland from LA……..capacity based pricing model telling a story perhaps?

Not what i'm seeing, $738- $880 outbound, $742 -913 inbound for economy. Not a significant difference.

Personally I've not had a personal credit card for 20+ years. Debit card only. Did have a corporate credit card though. Used sparingly.

Credit cards are great, depends on how you use it. Love the points I get, most times I go into Mitre 10 the purchase is free using the dollar rewards. Pay it off every month its really convenient. Credit card spending is going to bounce next month anyway with the fuel tax going back on, that's easily the 2% right there.

Credit cards are great, depends on how you use it. Love the points I get, most times I go into Mitre 10 the purchase is free using the dollar rewards.

Agree Zwifter. Most people love credit cards and the benefits. I'm a bit of a maverick.

JC

Fine that you choose not to have a credit card.

However, you mustn’t travel too often.

Most accommodation providers on arrival now require a credit card or will want a bond (some local providers require $1000 which can take a number of days to reappear in your account) as surety against damage.

As for booking in advance, in most cases a credit card number (without being charged) can assure a booking whereas if you are using a debit card you are very likely to be paying at least something at time of booking.

As for a rental car, not only is a credit card often required when booking, on collecting it you can expect a considerable bond to be paid upfront if you don’t have a credit card.

Do all those things with a Visa debit card. Even had a CitiGold card (minimum cash balance of JPY10 million to first qualify) but no credit card facility.

Visa debit baby!!! Can't get yourself into debt if you only spend your own money, and are able to save bits and pieces in every aspect of expenses.

Zwifter, I agree it depends on how you use them.

I’m exceptionally happy with my credit card and use it most of the time - except when the merchant charges fees and for the past 35 to 40 years I’ve paid it off every month.The minor positives are not having to worry about cash and debit card balances, and not having non-interest bearing funds sitting in a debit card..

However, the two biggies with my BNZ card are:

Firstly, no cost international travel insurance underwritten by AIG which I use 2 or 3 times a year which probably saves me well over $1000 a year (and it includes cover of claim excess on domestic rental cars), and

Secondly it earns me Fly Buy points which I can convert to KiwiSaver contributions which last year came to well over $500 (which being over 65 I can draw out immediately if I so wish).

These more than off-set the annual card fee.

Anyone else using a credit card less with most stores charging a processing fee now?

Yes.

Yip. What pisses me off is the variance in processing fee. Some are taking 3%!

Criminal

I suspect that this will get worse. My anecdotal impression is that in the last month or so a lot of retail prices have been kicked up significantly. Almost like a dam has burst. I suspect as I said a while ago that inflation may well tick upward again instead of droppings as hoped. This will flow through into a wage price spiral. Could get ugly? A bit of a dilemma for Orr with the election coming up.

PSA have advised the average wage increase in the public sector over the last 12months is around $7-9k. DOC getting 9% pay rises this year alone just because of cost of living. Public sector is scrambling to retain staff as they leave for other ministries that pay better to offset cost of living. At some point the buck will have to stop, my thoughts are after the next election there will be a fair few restructures in govt departments and this will allow them to decrease staff costs and halt any further pay increases apart from performance pay. Those who remain won't be able to jump ship anymore as the competition for jobs will be far greater so they will hold their ground to retain work. The recession is coming, we're all just waiting until the indicators finally help us realise we are off the cliff and the ambulance is not sitting at the bottom as the workers were laid off

Isn't this like -8.3% when adjusted for inflation then?

It's lean & mean out there. No problem getting car parks, if I can just get through the bloody roadworks. Mind you, the roadworks are a bit like car parks these days. Have struck the extra card charge a few times already. This has made me think again twice already. Bought a mate dinner in the weekend. It wasn't worth it. Not only was it over-priced but the food was very average. Pot luck season has just arrived.

100%. Caught Speights ale house out last month chucking average meal prices up by $4-5 across the board due to increases in the cost from the slaughterhouse. $42 for a pub steak and chips? I can get a roast for that and some frozen chips at the supermarket, have friends around for dinner and have a better time and cheaper booze.

Sounds like if you have experience in butchering, now would be a great time to open up a local butchery as people would far rather get a reasonable price for irregular cuts of meat at a local and support them than feed any more of their hard earned money into the supermarket duopoly, especially if it is closer.

The numbers don't surprise me at all. I've noticed a significant decline in the number of younger people eating at cafes and restaurants. Most of them are full of Boomers - the only demographic who can afford it.

Yes and soon the restaurants and cafes will price themselves into oblivion as even the boomers refuse to pay $10 for a scone etc

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.