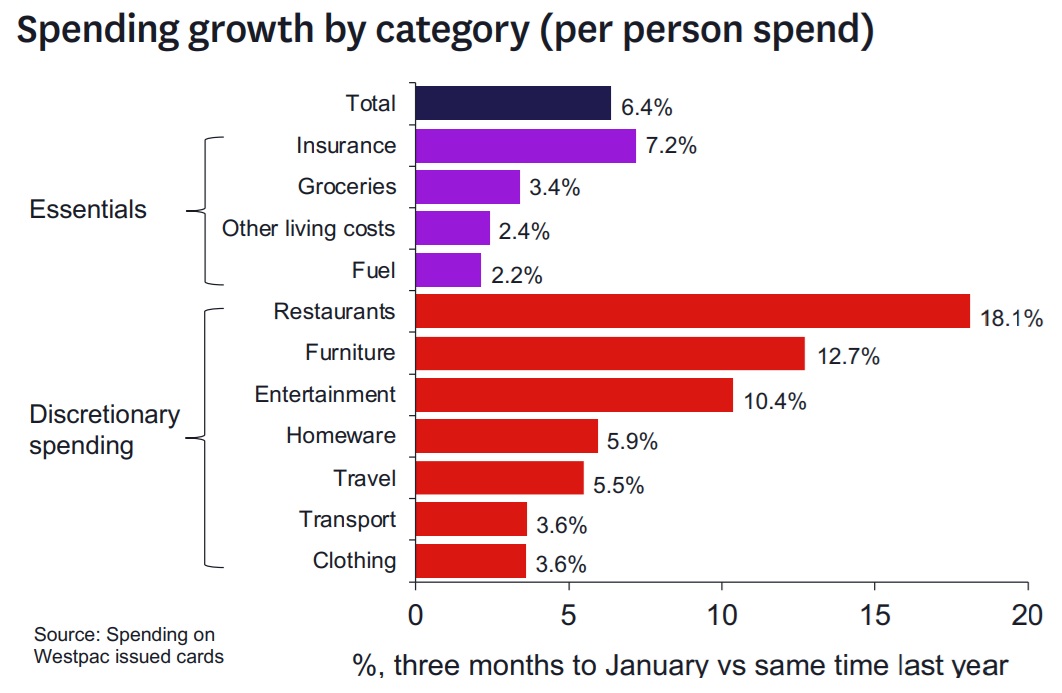

Westpac is reporting that retail spending on its cards was up 6% in January compared with the same month a year ago.

In Westpac's latest Retail Spending Pulse bulletin, senior economist Satish Ranchhod acknowledges that some of the lift in spending is just due to higher prices, with consumer prices rising by 3.1% over the past year.

"...But even accounting for the lift in prices, consumers’ spending appetites look like they’re on the rise as we’ve entered 2026," he said.

He noted that households have been spending more on essentials like food, petrol and utilities as the cost of living has continued to rise.

"More encouragingly, however, there has also been a lift in discretionary spending. There have been particularly large increases in spending in the hospitality sector, as well as increased sales of furnishings and other household durables."

Ranchhod said there have been "particularly large" increases in spending on dining out and entertainment activities - and notably, such increases aren’t just seasonal lifts related to the summer holidays.

"Households have also been dialling up their spending on furnishings and other durable items for the home."

However, there are still some areas where spending has been soft, including clothing. In part that reflects continued strong competition from large online and offshore-based retailers, Ranchhod said.

Widespread mortgage rate fixing means that it’s taken a while for the impact of interest rate reductions to pass through to households, he said.

"However, large numbers of mortgages have rolled over in recent months, and the related fall in borrowing costs has boosted disposable incomes right across the country."

Ranchhod said with economic activity and inflation picking up in recent months, the RBNZ’s cycle of easing interest rates has come to an end, and some mortgage rates have been pushing higher.

"Nevertheless, average household borrowing costs are set to continue dropping as borrowers roll off the higher fixed mortgage rates that were on offer in recent years and on to lower ones. For instance, one-year fixed mortgage rates are around 80bps lower than this time last year, and the two-year mortgage rate is around 200bps lower than in 2024."

Ranchhod said while the pickup in spending has been encouraging, many retailers have faced tough trading conditions and rising operating costs for an extended period. This has squeezed their operating margins, with particularly challenging trading conditions in sectors like apparel.

"However, retailers are feeling more optimistic about the outlook for 2026, with an increase in forward orders and plans for hiring."

3 Comments

Here we again with the incessant spin from vested interests. Card spending up 6%, Retail prices and the cost of living have risen and continue to rise, much greater than the stated 3.1%, in actual fact they are much higher if we were to get true picture presented without the obligatory massaging by vested interests. The nationwide drivers for increased sustainable spending do not exist. The increase in the cost of living is much greater and obvious even to blind Freddy.!

Restaurants finally back in black.

I've certainly been doing my bit to assist in that regard.

RIP The Grove, SPQR et al but new classic joints will rise from the ashes.

🥂

Not very useful data IMO. Much better to look at spending by income group.

For ex, in the US, the top 10% of earners now reflect a record 49% of all consumer spending. This percentage has risen +13 points over the last 30 years, marking a dramatic shift in spending power.

At the same time, the bottom 80% of earners represent just ~37% of total consumer expenditures, down -11 percentage points since 1995.

This means the top 10% account for a record 33% of US GDP, as personal consumer expenditures account for 68% of total economic output. Meanwhile, the bottom 80% account for just 25% of the US economy.

Asset owners are the only winners in the Anglosphere economies.

https://www.marketplace.org/story/2025/09/17/top-10-of-earners-make-up-…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.