The very fast growth of 'buy-now-pay-later' schemes in New Zealand is starting to have an impact on the non-bank finance sector, both through increased lending occurring through these schemes, and borrowers then having a decreased capacity to borrow from more traditional lenders, according to KPMG's annual Financial Institutions Performance Survey (FIPS) of the non-banking sector released on Monday.

KPMG says there have been four main companies that have introduced a ‘buy-now-pay- later scheme’ in New Zealand so far, with one of these being Laybuy, who have 220,000 customers in New Zealand to date. Some of the biggest retailers currently using the Laybuy service are Glassons, Hallenstein Brothers, Stirling Sports and Barkers, among others.

"A number of more established survey participants noted quite an impact from these schemes," KMPG says.

"They noted that many of ‘their’ customers are going to the store and instead of buying up to a set amount that they could afford in cash, they might be doubling or indeed tripling that amount and buying and spending more using the lay-buy option."

According to KPMG this has two main impacts: Firstly, it puts the traditional finance transaction with other counterparties, rather than the traditional financier, and secondly, it uses up the customer’s capacity in relation to future loans with their more traditional financier.

"A number of players have said that these platforms have very quickly become their major competitors and pointed out they do not appear to be regulated. A question that was asked was for how long will they remain unregulated."

KPMG says participants in the non-bank sector will need to consider what their role in the disruption of their sector or niche will be, and how they either plan to disrupt themselves or others, or, where possible, how they will protect themselves from disruption as these new players emerge quickly.

And KPMG's Head of Banking and Finance John Kensington says: “It will be interesting to see how the regulators react to this type of currently non-regulated lending, given the minimal information obtained by these schemes from borrowers and the fact that many earn significant amounts of their income from late fees."

But business is good...

Notwithstanding this looming disruption though, the non-bank sector has continued its strong loan growth over the year.

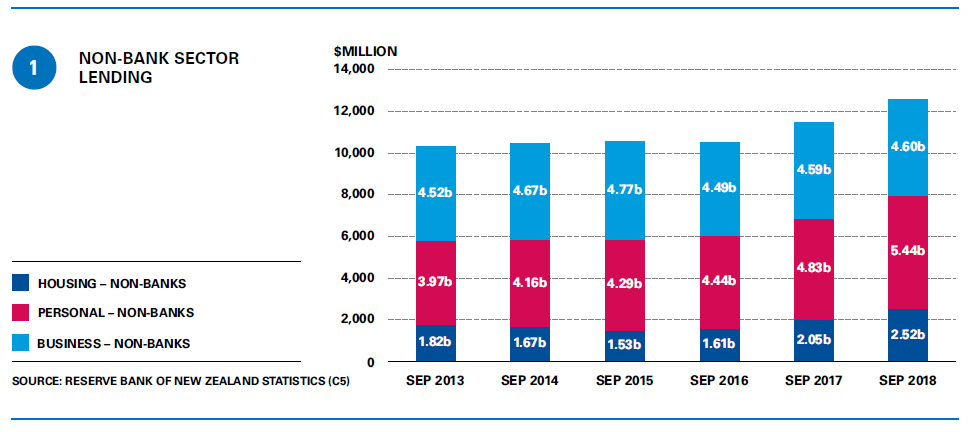

"Per the Reserve Bank of New Zealand (RBNZ) statistics, the non-bank sector has achieved a stellar 23.42% growth in its housing lending, an increase of $478 million to $2,519 million, as shown in Figure 1," KPMG says.

"This compares to an increase of $13,904 million to $252,319 million for the banking sector, or an increase of 5.83%. This result shows that while the non-bank sector has had strong growth, it is still a relatively small player in the housing sector lending (less than 1%); however, they have the opportunity to (and some do) make the most of their regulatory advantage with respect to loan-to-value ratio (LVR) restrictions imposed on the New Zealand registered banks not applying to them.

"However, the regulatory advantage in respect of LVR may be short lived, with the RBNZ relaxing LVR restrictions from 1 January 2019, as announced in its November 2018 Financial Stability Report. The extent to which the non- bank sector will be impacted remains to be seen, as the banks may continue to operate well within the regulatory imposed limits on them given the current climate around conduct and responsible lending."

Further opportunity

KPMG says there also appears to be further opportunity for the non-banks sector with the apparent slight credit tightening by the banks, especially around lending exposed to the housing market.

"Across the board all of the survey participants noticed reduced or little competition from the banks within their segment. It appears the banking ‘black box’, as it is referred to, has further shrunk with the banks lowering their risk appetite in this stage of the market cycle. This is at least partially due to the flow on effects of the Royal Commission of Inquiry into Misconduct in the Banking Industry in Australia. Non- bank participants are noticing banks are declining, and they are seeing, more bank quality applications than ever before. This is evidenced through participants having no shortage of applications or appetite for credit."

A number of these applications were coming from borrowers who are new to the non-bank sector, and may have been turned down for the first time by a bank.

KPMG says similar to the growth in housing lending, personal lending continues to grow, from $4.83 billion to $5.44 billion for the non-bank sector. This is against a backdrop of a stable economic environment, with low inflation and low unemployment helping to drive the continued demand. However, this stable economic environment is not mirrored by overall confidence.

"One thing that came out clearly during our interviews from a range of survey participants in the non-bank sector was that they have increasingly seen both the importance and benefit of operating in a niche and recognising what that niche is, from both a funding and lending perspective.

"Participants believed they more clearly than ever understood what their niche is, their market, and what their customers wanted, allowing them to achieve good results. For some participants, this was achieved through developing a digital front end allowing efficient acquisition of deposits or distribution of loans, and for others it was a particular target market that they were appealing to with a particular product.

Less competition from banks

"The majority of survey participants we spoke with observed that there was less competition from the banks in their sector this year, and they believed that the banks had probably slowed down their lending. This means that in many areas in which banks traditionally lent in, participants were subject to slightly less competition and greater opportunities were now available to them. A common metaphor noted by participants was that they felt it was like driving on a road where there was less traffic so they could clearly see where they were going.

"They have had less competition and were able to both see the deals that were better for them and see them more clearly. This reduction in competition was observed not only from bank competition, but also in the form of less competition between the various non-bank participants."

Talking about conduct

In the wake of the The Australian Royal Commission of Inquiry into the Banking and Financial Services industry and the subsequent review in New Zealand by the Financial Markets Authority (FMA) and the Reserve Bank, one of the topics discussed at length with non-bank participants was their view on conduct. In particular, the discussion focused on how they might measure up against a conduct framework and what impacts they might see coming out of the RBNZ and FMA review.

"Two key themes arose out this discussion. The first was that the non-bank sector, on the whole, does not feel that it is as exposed as the bank sector to a number of the conduct issues, mainly because their products are not as wide ranging nor as complex. In many cases, they also believe they do not have the same conduct risk, as they do not incentivise staff to undertake the transactions with customers and have a greater focus on service when compared to banks.

"Our view is this assessment may not sufficiently focus on exactly what conduct risk is, how conduct risk might develop in the future in light of the RBNZ and FMA’s investigations, and what follows on from them. Survey participants should also remain aware that what is considered appropriate conduct does change over time, and what is appropriate for a customer today may not be deemed appropriate for them in the future.

"The other theme raised was the question as to whether any rules that are going to apply to banks as a result of the conduct investigations will automatically apply to the non-bank sector, or whether there will be some period where the banks are under greater scrutiny and ultimately operate under tighter rules.

'Not the same issues'

"The overriding theme from discussions was that the non-bank sector felt it did not have the same issues as the banks and that they were in a relatively good position in respect to conduct. This has led to a ‘wait and see’ approach being adopted by many."

KPMG says that one of the impacts that may come to light is that, as there is greater scrutiny on banks, and banks themselves start to modify their conduct frameworks they may became more cautious in their actions.

"As a result, there may be a larger number of customers who are declined credit. These customers will naturally move to the non-bank sector to seek the service they need. This provides the non-bank sector in effect with a greater number of customers.

"However, this may present a risk, as these customers are the ones that present a higher risk, as most have not met the particular criteria for qualifying for certain financial products. Given that non-bank participants may not have a conduct risk management that is as mature as the banks, and their overall awareness of conduct is less front of mind, it may simply shift customers who are getting declined by banks to a non-bank lender to provide the same level of finance or product.

"While this more cautious approach by the banks may result in a slight tightening of credit, as they rationalise things to ensure they are fully compliant with the RBNZ and FMA’s conduct expectations, this in turn may push borrowers to the non-bank sector and if all the demand cannot be met (due to capital, liquidity and other risk constraints in the non-bank sector), it could lead to credit not being available to some potential borrowers in the market.

"Non-bank participants should re- emphasise the need to put conduct front of mind in everything they do, even if they believe that they are already doing the right thing by their customer."

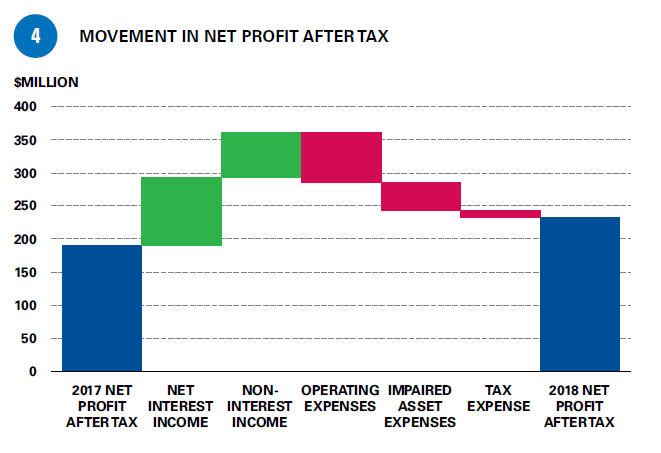

Strong year of profits

The survey has revealed another strong year (up to September 2018) of profits and lending growth for the non-banking sector. Net profit after tax (NPAT) among the 25 non-bank financial institutions surveyed showed an increase of $44.34 million (22.97%) over the year resulting in a total NPAT of $232.61 million.

KPMG's Kensington says the real story behind the profit growth was the strong growth in lending during the period combined with the margin on that lending improving slightly.

"This increase is primarily due to banks tightening their lending criteria, possibly in light of findings from the Royal Commission of Inquiry into banking misconduct in Australia and some bank customers having to borrow elsewhere. This action by the banks has led to more business opportunities being seen within the non-bank sector. In addition, a strong economy with continuing economic growth has driven the increased demand for credit by consumers. Of the participants surveyed 22 of the 25 have made a profit, with 16 increasing their NPAT over the previous year," KPMG says.

Total assets

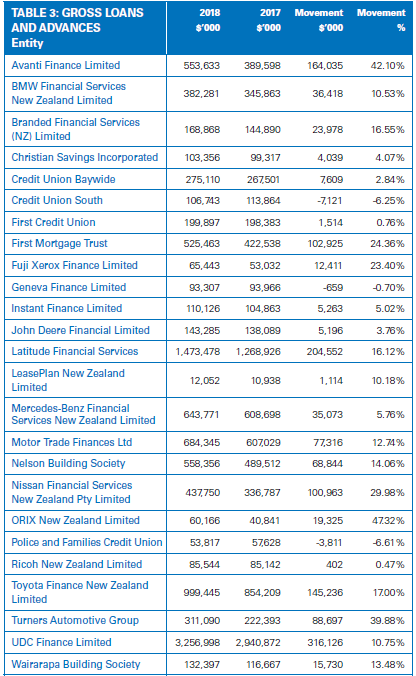

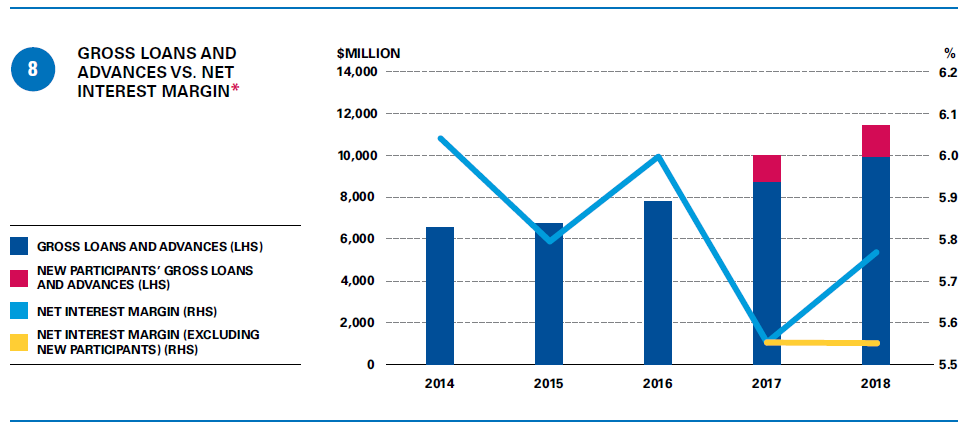

The sector has seen another year of strong asset growth, up 14.73% ($1.80 billion) to $14.03 billion, with 24 of the 25 survey participants increasing their total assets. Gross loans and advances have also increased, relatively in line with total assets, at 14.24% ($1.43 billion) to $11.44 billion, with 22 of the participants increasing their loan books.

KPMG says participants are now looking to shift their focus on increasing the yield on and the quality of their loan books rather than growing for growth’s sake.

"With applications increasing, participants can be more selective about their growth without slowing too much."

Asset quality

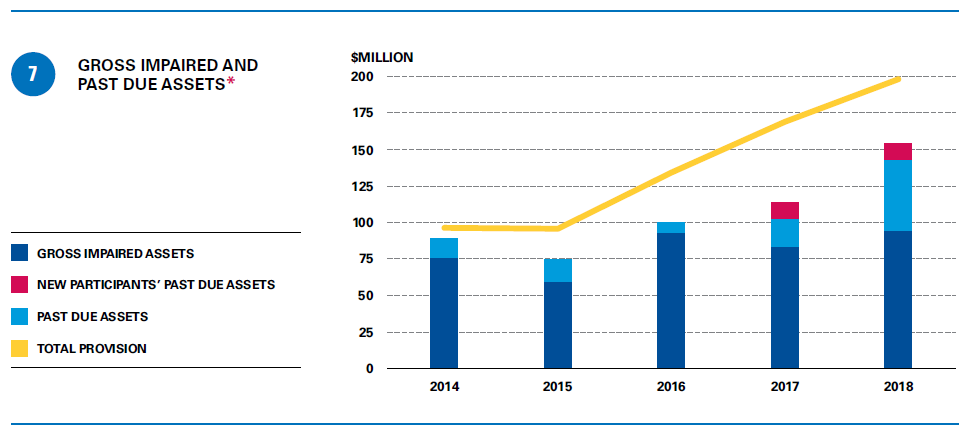

The ratio of impaired asset expense to average loans and advances rose by 46 bps to 0.84% for the non-bank sector this year. The main driver for this was Fuji Xerox whereby the ratio jumped from 2.42% in the previous year to 12.27% this year, and the inclusion of Latitude Financial Services, which is not included in the 2017 sector ratio and has a ratio of 2.91% in 2018. However, 16 of the 25 participants saw increases in this ratio, including the largest three, UDC, Latitude and Toyota Finance.

In absolute terms, impaired asset expense rose by $42.06 million to $90.45 million. This is predominantly driven by Latitude (up $22.88 million), Fuji Xerox (up $6.09 million) and UDC (up $4.96 million). While Latitude did see a strong increase in loan growth during the year of 15.81%, the increase in impaired asset expense was 134%.

Provisions for impairment increased by 17.28% over the year to $198.30 million. Looking at its component parts, collective provisions rose by $20.24 million (14.94%) to $155.69 million, and specific provisions rose by $8.98 million (26.7%) to $42.61 million.

The increase in collective provisions can be primarily attributed to Latitude, up $9.54 million (27.52%) compared to growth in gross loans of 15.98%.

However, KPMG says it should be noted that the 14.94% increase in collective provisions for the sector was largely in line with an increase in loans for the sector of 14.18%.

The increase in specific provision for the year was mainly driven by Fuji Xerox, up $3.60 million (120%), and UDC, up $3.09 million (52.79%).

However, for UDC, the increase is off the back of a decrease in 2017. The provision in the current year is essentially in line with the provision in 2016, and is still a relatively small amount compared to their overall loan portfolio of $3.2 billion.

Loans in arrears over 90 days but not impaired, for participants that disclose this information, has been flat for most participants except for Latitude, up $4.13 million to $15.47 million, which largely in line with their overall loan growth percentage. A large decrease for First Mortgage Trust was also noted, down $4.60 million to just $0.26 million.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.