floating rates

[updated]

ANZ the first bank to raise floating mortgage rates following last week's OCR hike. They are passing through less than the full +75 bps to floating rate borrowers, but all of it to their bonus saver account. Term deposit savers get less

29th Nov 22, 2:34pm

145

ANZ the first bank to raise floating mortgage rates following last week's OCR hike. They are passing through less than the full +75 bps to floating rate borrowers, but all of it to their bonus saver account. Term deposit savers get less

[updated]

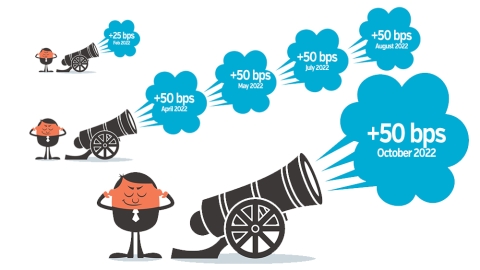

Most banks have been slow to respond to the October 5 RBNZ +50 bps hike to the OCR. They are only now getting around to making floating rate adjustments with Westpac, and now ASB & BNZ seven days after the OCR change

11th Oct 22, 4:31pm

21

Most banks have been slow to respond to the October 5 RBNZ +50 bps hike to the OCR. They are only now getting around to making floating rate adjustments with Westpac, and now ASB & BNZ seven days after the OCR change

ANZ is the first bank to raise floating mortgage rates following the Wednesday OCR hike. They are passing through the full +50 bps to floating rate borrowers, but only +40 bps to Serious Savers

7th Oct 22, 12:21pm

86

ANZ is the first bank to raise floating mortgage rates following the Wednesday OCR hike. They are passing through the full +50 bps to floating rate borrowers, but only +40 bps to Serious Savers

[updated]

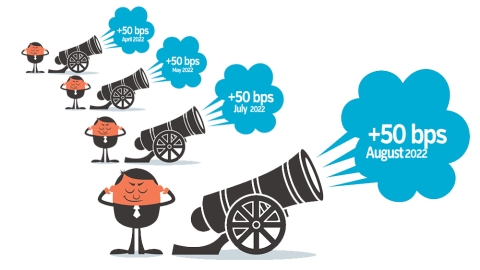

Following a fourth consecutive 50 bps RBNZ OCR hike accompanied by a not-so-hawkish outlook, banks have started to raise their floating rates - the first from Kiwibank, then ANZ

17th Aug 22, 2:55pm

18

Following a fourth consecutive 50 bps RBNZ OCR hike accompanied by a not-so-hawkish outlook, banks have started to raise their floating rates - the first from Kiwibank, then ANZ

[updated]

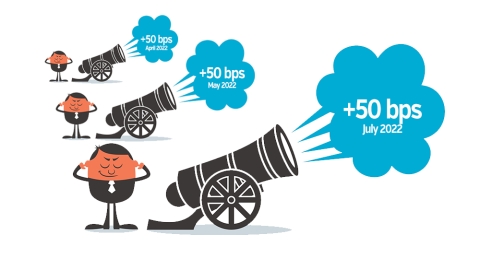

Following a third consecutive 50 bps RBNZ OCR hike accompanied by a hawkish outlook, banks have started to raise their floating rates - the first from BNZ, then Kiwibank

14th Jul 22, 9:23am

20

Following a third consecutive 50 bps RBNZ OCR hike accompanied by a hawkish outlook, banks have started to raise their floating rates - the first from BNZ, then Kiwibank

[updated]

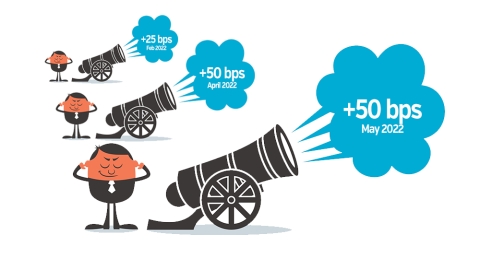

ANZ and BNZ join Kiwibank with increases to floating mortgage rates and savings rates following the 50 basis points OCR hike

27th May 22, 12:19pm

52

ANZ and BNZ join Kiwibank with increases to floating mortgage rates and savings rates following the 50 basis points OCR hike

[updated]

ANZ moves fast after the OCR rate hike, raising its floating rates plus a full range of other home loan rate increases, with others likely to quickly follow

13th Apr 22, 5:25pm

149

ANZ moves fast after the OCR rate hike, raising its floating rates plus a full range of other home loan rate increases, with others likely to quickly follow

We track the changes banks made to their floating rates after the Reserve Bank cut its official cash rate by 25 basis points

9th May 19, 11:07am

11

We track the changes banks made to their floating rates after the Reserve Bank cut its official cash rate by 25 basis points

Our mortgage rate table has expanded today to include Mike Pero Mortgages, and Liberty Financial

11th Sep 16, 4:25pm

Our mortgage rate table has expanded today to include Mike Pero Mortgages, and Liberty Financial

Can you afford that first home? In today's Take Five Amanda Morrall looks at some cool tools and calculators to help with the decision

18th Apr 12, 12:52pm

32

Can you afford that first home? In today's Take Five Amanda Morrall looks at some cool tools and calculators to help with the decision

Westpac slashes variable mortgage rate to 5.69%; 6 mth to 5.29%

14th Sep 09, 3:20pm

Westpac slashes variable mortgage rate to 5.69%; 6 mth to 5.29%

Floating rates falling

13th Mar 09, 1:23pm

Floating rates falling

Video: Fixed mortgage rates will not drop much

19th Feb 09, 7:42pm

Video: Fixed mortgage rates will not drop much