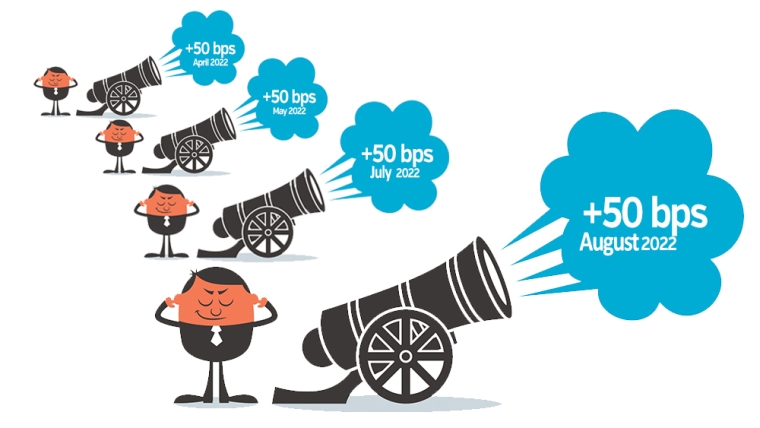

Kiwibank is the first to react to Wednesday's OCR rate hike, raising its floating rate from 6.00% to 6.50%.

At the same time, they raise some savings account rates, with their Notice Saver rates going up +40 bps, the online savings account going up +50 bps to 2.10% (but they dispensed with the 'bonus' on this account).

Kiwibank's move up differs from the July changes in that most banks held off for a day or three.

A raft of floating rate changes will probably follow over the next few days.

Update: ANZ has announced a +50 bps rise in its floating rate too. That takes its Floating home loan interest rate, and its Blueprint to Build rates to 6.84% and 4.08% respectively.

ANZ is raising its Business floating and Business overdraft base rates by +50 bps as well.

At the same time, ANZ raised its Serious Saver product, the total interest rate will increase +50 bps to 2.30% pa.

Here is the running tally of bank changes to floating rates which we will update as each announcement is received.

| Floating mortgage rates | Prior rate | change | New rate | Existing customers, |

| % | bps | % | effective date | |

| RBNZ OCR | 2.50 | +50 | 3.00 | 17 August 2022 |

| ANZ | 6.34 | +50 | 6.84 | 5 September 2022 |

| ASB | 6.35 | +50 | 6.85 | 1 September 2022 |

| BNZ | 6.39 | +40 | 6.79 | 9 September 2022 |

| Kiwibank | 6.00 | +50 | 6.50 | 5 September 2022 |

| Westpac | 6.39 | +46 | 6.85 | 7 September 2022 |

| Cooperative Bank | 6.25 | +40 | 6.65 | |

| Bank of China | 5.45 | |||

| China Construction Bank | 6.50 | |||

| Heartland Bank | 4.60 | |||

| HSBC | 6.34 | |||

| ICBC | 6.00 | |||

| SBS Bank | 6.29 | +50 | 6.79 | 5 September 2022 |

| TSB | 6.25 |

We will separately report the fixed rate increases when some arrive.

18 Comments

Hi David Chaston - do you remember this from Kiwibank a couple of years ago when they promised to shake up the lending market with competitive floating rates? Since then they slowly closed the gap back up to the majors and now are very much in line (especially given the majors are much more willing to discount from their headline rates)

Very disappointing from Kiwibank

https://www.kiwibank.co.nz/about-us/news-and-updates/media-releases/202…

That floating rate is getting very close to starting with a 7. The prophet might be right. The impossible might be possible.

I'm frothing to see what is contained in the first scroll! Shouldn't have to wait too long now.........

Does anyone care about floating rates in NZ...

Yes, anyone who's building a house.

For a new builds you can typically get discounts - seen by ANZ recently doing 3.58% & ASB 4.04%...

Pretty sure back my build is closed. But yes floating rates don't matter so very much.

Blueprint to Build is a discount off of ANZ's floating rate so tracks that and will presumably be going up 50bps shortly - still a great rate if you can get aproved.

Back my build (ASB) closed to new applications in April, which doesn't really tally with their PR push about how they're using FLP funds at all...

Or, it was so popular it used up the allocated FLP funds. Keep in mind that build loans are progressively drawn down...

Your typically only paying interest on the total build cost for a very short time before rolling over to fixed

Yep, but a lot of people are already paying a loan for the land they're building on, their existing homes mortgage or paying rent plus the monthly interest on their build. Even interest only you could still be paying thousands a month in interest while building, especially towards the end of the build. Building can be very tough financially

That’s why they are only tinkering with the floating rate now, their business pipeline is dry.

One more hike and we will be at 7%.

It is a shame the prophet has been banished from this forum.

I thought the prophecy of 7% was for fixed rates?

He never made a specific prediction hence why it’s been a pointless prediction all along.

Being right and being incredibly annoying are not mutually exclusive.

7% Prophecy was for end December but think it will be much before. Important - will house price be down by 30% (already down between 15% to 20%).

Ha, I've been stilling on a floating rate with a health discount for some time but it now looks like it might be time to go fixed for two.. wonder what discount they offer??

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.