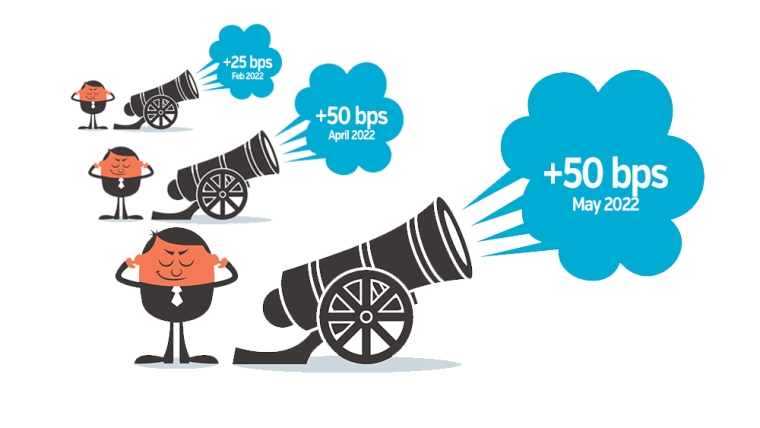

Wednesday's Reserve Bank 50 basis points Official Cash Rate (OCR) hike to 2.00% has now brought a first, slow full response - from Kiwibank.

The unexpected hawkish tone from the regulator has had banks reassessing how they will react across all retail rate changes that are necessary (for floating and fixed home loan rates, and for term deposit rate offers).

Wholesale swap rates rose sharply at the one and two year end of this market in the two days since the change. But these will affect fixed rate pricing rather than floating rates.

Ninety day bank bill rates rose from 2.23% a week ago to 2.40% on Thursday. They will probably be higher today, possibly to 2.45%, when the trading ends later. That is a +22 bps rise in five days, taking the rise from just after the previous OCR hike to +54 bps. Since early October 2021 when this rate hiking cycle started, the cumulative rise has been +190 bps and more has been priced in that the +175 bps delivered so far in OCR increases.

Kiwibank's latest floating rate hike Friday - the full +50 bps - also came with rises in some key savings rates. Their online call account has been raised +30 bps, the 30 day Notice Saver by +40 bps, and the 90 day Notice Saver account by +35 bps.

Update: ANZ is raising its home loan floating rate by +40 bps, and its business floating and business overdraft base rates will also go up +50 bps. At this time, ANZ have not advised any fixed rate changes. But they too are raising some key savings account rates. For Serious Saver, ANZ’s largest savings product, the total interest rate will increase +40 bps to 1.50%.

Updates: BNZ has raised its home loan floating rate by +39 bps to 5.94%, the same level as ANZ. Westpac is lining up at that same level too. ASB's website is showing their new floating rate now, a +50 bps rise.

Here is the running tally of bank changes to floating rates which we will update as each announcement is received.

| Floating mortgage rates | Prior rate | change | New rate | Existing customers, |

| % | bps | % | effective date | |

| RBNZ OCR | 1.50 | +50 | 2.00 | 25 May 2022 |

| ANZ | 5.54 | +40 | 5.94 | 16 June 2022 |

| ASB | 5.35 | +50 | 5.85 | 9 June 2022 |

| BNZ | 5.55 | +39 | 5.94 | 17 June 2022 |

| Kiwibank | 5.00 | +50 | 5.50 | 13 June 2022 |

| Westpac | 5.54 | +40 | 5.94 | 17 June 2022 |

| Cooperative Bank | 5.45 | +40 | 5.85 | 20 June 2022 |

| Bank of China | 4.45 | +50 | 4.95 | |

| China Construction Bank | 5.00 | |||

| Heartland Bank | 4.00 | -25 | 3.75 | 3 June 2022 |

| HSBC | 5.49 | |||

| ICBC | 5.25 | |||

| SBS Bank | 5.29 | +50 | 5.79 | 3 July 2022 |

| TSB | 4.79 |

We will separately report the fixed rate increases when some arrive.

52 Comments

Just before the Boxing Day Tsunami hit, there was a short time of great calm, when all the water rushed out from the beaches and everything was still and quiet.

This pause from the banks in the last 24 hours feels a bit like that. Kind of quiet stunned silence before all the rate rises come rushing in.

50bps was already priced into the fixed rates, they aren't going to move significantly in a hurry. Look at the swap rates, particularly the longer rates, they are below where they peaked a few weeks ago.

So I am still trying to wrap my head around things but is it loosely that OCR affects the shorter term rates but the longer ones are more affected by international swap rates so what RBNZ does has less effect there?

Bingo.

And longer terms are more affected by the supply and demand for long term lending like mortgages. Other articles are clearly suggesting the demand for morgage funding is decreasing significantly.

But the major banks didn't raise their fixed rates when they "peaked" a few weeks ago, did they? I wouldn't make a call so early as banks actually didn't expect such a hawkish tone from RBNZ on Wednesday. They will need to respond to it somehow.

It's the floating rates that you'd normally expect to move up immediately in response to the OCR hike... But the banks are still not moving, for some reason...

Fitzgerald/Pragmatist

Thanks for confirming.

but now I have learned the rules but now they don't get used....great ha ha

I am guessing that if the banks don't pass on the full amount,that the RB will raise them even more? Isn't the whole point of the RB raising them, so that banks also raise them?

It's not about this 50bps, it's about the expectation for the next 12 months. Swaps have rushed back up and I expect this will lead to increases in the 12 & 24m rates... after all, last time swaps were here (May 2015), the 12m average rate was 5.7% according to int.co charts

The one year swaps have rushed back up to the previous peak, the 2 year took a little step up, but still well below the peak, the longer terms have pretty much ignored it, still 0.4% below the peak a few weeks ago.

Interestingly enough the Ten year swap is 4bps lower than the 2 year according to interest.co.nz charts. What's happened to the duration premium?

This is just bringing them in line with the other banks, when the OCR was last at 2%, floating rates were around 5.6%, so maybe there isn't much to come

TimeToPanic cos Spruikers gonna Spruik

It seems like this has already been priced in, I wouldn't be surprised if we see some temporary discounts across key terms to win business...

you wish

Banks would likely be the only ones who can see the whole picture for how much inflation and increased interest rates have eroded disposable income as they can view all account transactions and track increases in weekly spend on fuel and groceries

Maybe them not immediately passing through rate increase is a strong signal that their customers are running out of ability to keep paying more?

None of the things you mention have any impact on how banks make interest rate decisions

Depends on your perspective I guess.

As a bank would you rather have fewer customers and maintain your profit margin (but risk that in a mortgagee sale you cannot recover the full amount of your debt if the house sale price has dropped below the value you loaned) or lower your margin so you are still making money, just not as much as before and lower the risk of losing customers to defaulted mortgages?

The billions of dollars in profits each year hint there could be some fat in the system

My perspective comes from direct involvement in bank pricing decisions in a previous role.

Your perspective appears to be purely hypothetical.

Hi Miguel,

You are right mine is purely hypothetical as I have never worked in banking, so if it is as you say then so be it.

Seems odd to not take a longer view of things and use all available information but hey I don't have my own bank so can only speculate

Miguel,

As I was barking up the wrong tree before are you able to share what the main factors are that the banks take into account for those decisions?

I'm sure Miguel will give you all you are after...if not...this intro video might help on Asset Liability Management and earning gap, duration gap, cash flow gap and liquidity gap.

Thanks

Do things like social license to operate come in to it at all, or is that out of scope?

I guess its over to society to decide if banks have been keeping up their part in the social contract and their role in terms of corporate social responsibility.

If they go bust through reckless lending and require a bailout then you might say they have failed, but then again so will have the RBNZ for poor oversight and regulation.

Short answer. First priority is net interest margin. The difference between cost of funds (how much they pay depositors and other funding sources) vs what they can lend that money out for (interest rate on loans). If funding costs rise, they will look to adjust rates on loans to recoup those costs.

Second priority is market share. This impacts where they set rates compared to competitors to help attract business (and not lose customers).

This is a massive oversimplification. But what a borrowers can "afford" to pay doesn't come into the picture when setting rates.

Thanks Miguel

On reflection I guess hadn't been thinking about how for most people a bank loan is a need not a want so they don't really need to stimulate demand. They are more like an electricity company passing along the increases because as a consumer you have no real alternative.

Lol, discounts? Banks are not charities. They are not going to make a loss...

Swaps have dropped. Bank lending has decreased. Customers are searching for better deals. Banks want market share. Banks want to increase profits.

"Bank lending has decreased". That's not correct. The number of mortgages issued has decreased but that's not equal to bank lending has decreased.

The amount of money advanced in April, at $5.664 billion was actually fairly respectable. That's in no small part due to the fact that the average-sized mortgage has now gone over the $400,000 mark for the first time, to over $406,000 in fact.

This is up 20.8% on the $336,000 average-sized mortgage in April 2021. And if we go back to 2019 (leaving out the pandemic-skewed April 2020 figures) it's actually up a whopping 64% on the $247,500 average-sized mortgage in April 2019 - just three years ago.

Swaps rates are coming back up again. Banks want market share. Yes, but to attract more deposits, hence kiwi bank increases its deposit rate, other banks will likely to follow too if they think RBNZ OCR forecast is accurate. One of the key data they will look into is CPI in June.

Ummm same article...

In terms of the numbers of mortgages issued in April 2022, the 13,939 is not far off a halving from the number issued in April 2021, (the total then was 25,261) when the market was still roaring and nearly $8.5 billion worth of mortgages were advanced. (The monthly record was set in March 2021 with just under $10.5 billion).

Clearly the total amount of lending is dropping...this is not want banks want. Less people buying, yes... what can they do? Fight for market share of existing home loan customers. How? Compete on rates and cash back offers... If you've got a mortgage you know the advertised rates are never the best rates the banks can offer, this is where you might see real discounts in particular...

More that they don't give a shot about their customers

yeah right - perfect for a Tui ad

Good work interest.co.nz

I imagine yesterday's article was the catalyst for the RBNZ to speak to the govt, who in turn would have "encouraged" Kiwibank to go first.

Kiwibank themselves should be congratulated. Passing through a full 2/3 of the increase to savers took real guts. /s

I watched Princes of the Yen last night and it does seem to have some scary parallels to what looks to be happening.

Not an exact match but close enough to make you wonder...

I remember hearing not long ago that "a million dollar mortgage isn't that much these days".

Aged like milk.

Building companies first to fall then people over leveraged as this happen house price’s tumble so more people see deposit disappear and in negative equity for years.

Bad things never happen in NZ. We are diffrunt.

... all kindness here , among the team of 5 million .... even during ram raids & drive by shootings , the kids are smiling ... Joy in Godzone ! ...

..yes and now the children of Harvard have also been touched and enlightened. We are so lucky.

The embarrassment, cluelessness and personal virtual signalling of Labour's foreign policy has reached a new level this week

... Americans love her , because they misheard her saying we only use guns in NZ for pest control , as " peace control " ... shooting placard waving mungbean munching hippies is still legal & applauded there ... as it should be ...

I feel ready to throw up when I see the adulation for her in America. For her to be held up as a demigod of gun control while we have firearm crime out of control here . The other vomit inducement is her being the patron saint of democracy, while we get co governance thrust upon us with no consultation and no mention of it at the last election. Three waters no mention at the election just rammed through despite widespread dissension and to top it off a racially split health system with once more no voter input more like an authoritarian state than a democracy .

Just another "sign of our success", a "good problem to have". Enriching ourselves off the young and coming generations could never go wrong.

A million dollar mortgage won't be much after 2 years of inflation

Same applies to the value of the house, although that is going backwards much quicker.

At current interest rates they would be paying about $1k a week just in interest.

maybe so if your wages have kept up with said inflation

Dear Kiwibank, please use the incremental margin gains to fund improvements to your shitty app. And finally get on the Apple Pay bandwagon. And stop having system outages which mean I literally cannot access my money. Thanks and have a lovely day!

INFLATION

CO2

Both are beyond NZ control as we are so small. Sure, reduce lending to curb the rate of house price increase, but we can't fight climate, nor international inflation.

Most of our goods / export prices are dictated on the global stage. Raising our interest rates will do nothing.

So why raise interest rates? - It will only damage us.

Same with climate change. Mitigate the effects - we can't fight it. The climate has always changed.

The irony being that if the government had not tried to fight imported fuel price inflation, we would probably be reducing our C02 emissions right now with petrol around $3.40 a litre.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.