The number of mortgages issued in April plummeted - while the average size of them still continued to increase, reaching a record high, the latest monthly mortgage figures just released by the Reserve Bank show.

The latest figures show that in April 2022 just 13,939 mortgages were issued, which is the third-lowest figure for a month since the RBNZ started producing this data series in 2014. The April figure was down from the well over 18,0000 mortgages issued in March 2022.

The only lower figures were recorded in April 2020 - when New Zealand was to all intents and purposes shut - and in January of this year when the market appeared to have temporarily frozen completely in the wake of new changes to the credit rules.

So, that means two of the lowest months for the issuing of mortgages have occurred this year, as the house market adjusts big time from its bull run in 2020-21.

The amount of money advanced in April, at $5.664 billion was actually fairly respectable. That's in no small part due to the fact that the average-sized mortgage has now gone over the $400,000 mark for the first time, to over $406,000 in fact.

This is up 20.8% on the $336,000 average-sized mortgage in April 2021. And if we go back to 2019 (leaving out the pandemic-skewed April 2020 figures) it's actually up a whopping 64% on the $247,500 average-sized mortgage in April 2019 - just three years ago.

In terms of the numbers of mortgages issued in April 2022, the 13,939 is not far off a halving from the number issued in April 2021, (the total then was 25,261) when the market was still roaring and nearly $8.5 billion worth of mortgages were advanced. (The monthly record was set in March 2021 with just under $10.5 billion).

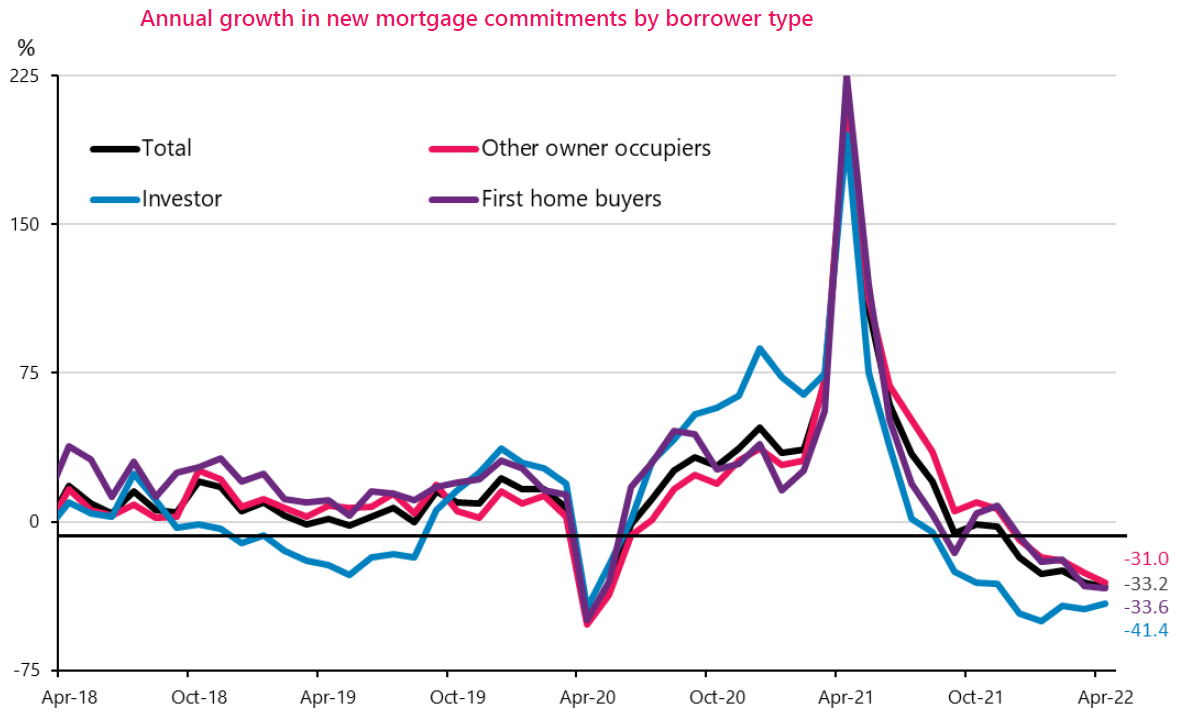

Looking at the breakdown of the mortgage monies advanced in April 2022 shows that first home buyers (FHBs) appear to be hanging tough in the rising interest rate environment.

The FHBs borrowed $1.046 billion in the month, which represented 18.5% of the total amount advanced and compared with just a 16.5% share for the FHBs in March 2022. It was in fact the first time this year the FHBs have month-on-month increased their share.

Incidentally, there were 1766 FHB mortgages issued in April, giving an average size of $592,000, which is the biggest average size this year, but not a record. That stands at the $595,000 average-sized FHB mortgage in December 2021, which was a big month for the first home buyers, with over $1.5 billion borrowed.

Investors borrowed $968 million in April 2022 and that represented 17.1% of the total - which is the lowest share for this grouping in any month so far this year. The figure in December 2021 was lower, however, with the share just 16.5% then.

The RBNZ has forecast that house prices might fall by 14% from the peak of the bull run to a trough in 2024.

These latest mortgage figures certainly paint a picture of a market that has lost its appeal - for now.

Given how quiet things already are, it will be interesting to see what happens over the coming winter months - the traditionally 'quiet' time.

44 Comments

Be quick!

Yep, we've listed our place. Hope I'm not too late.

Must be time to remove the LVR's again?

I'm just waiting for the sales pitch from The True Potentialist.

yes, let's hope so. need to buy some real estate to hedge against the out of control inflation.

now lets see, no LVRs, so higher % of debt in a crashing market with surging servicing costs....

Yeah that would be dumb

I just got a call from "Ray White" asking if I want to sell my house? ...WTF?

That's what they do isn't it?

Cold calling....first I heard of it?? But enjoy your sarc very clever?

but why? the inventory is expanding every day already, seems weird

Perhaps they have nothing else to do to keep busy?

Good old cold calls, they'll be out door knocking next. Without houses to sell and people to buy them they'll have to find a new job

If that fails, you might start seeing them pop up at traffic lights washing car windows. Business tie half undone, weeks of stubble and sweat stains under the arm pits.

And that's the female agents...

Where I live they are already leaving the industry. Generally those who got into it recently and therefore do not have a lot of profile in the community. It has reversed so quickly sentiment wise and volume wise. I can only presume there will be more leaving in the near future as it is going to get tougher out there as those interest rates continue to rise.

There was a guy on reddit in the personal finance section who was a mortgage broker saying he was making 10 - 30k a month up until November 2021 and he has made zero since then and looking for another job now.

They're doing that in Wellington (door knocking, not finding real jobs just yet).

Unemployed RE agents helps the RBNZ meet its employment mandate - don't they have to get sustainable unemployment up to 4.5% or thereabouts?

Received a flyer in the mail from a real estate agent in January asking to sell. I assume these are probably a mass deliveries, but found it funny nonetheless as we had only just bought the place in December.

Me too! Since everyone and their dog became a real estate agent last year competition over houses to sell must be hotting up.

this is what a smart and savvy agent does. they secure the listing so that another agent can't get it first.

These will be settlements from February when the CCCFA v1.0 meant if you bought KFC you couldn't be trusted with a home loan

Nothing has actually changed with CCCFA (yet), exactly as it is since end of '21, despite how it has been portrayed in the media

The latest figures show that in April 2022 just 13,939 mortgages were issued, which is the third-lowest figure for a month since the RBNZ started producing this data series in 2014

It's only possible to track this data back to 2014? Good heavens.

Banks have no business. Special rates to steal some business? (3% fixed for 10 years?)

If there are 2 loans on 1 property. Say 200 k fixed 1 year. 300 k fixed 2 years. Is that 1 loan for 500 k in these stats. Or 2 loans with an average of 250k?

592k as FHB average loan + 20% deposit 148k takes them up to 740 k. Which still dose not buy much.

I'm curious too. I noted last year in my credit history my 2 fixed periods showed as 2 separate loans, and same with my ANZ banking app these were displayed as 2 separate mortgages.

In Australia, they are considered two separate mortgages (one portion usually fixed, the other floating). If thats how the RBA reports them, chances are the RBNZ reports that way as well.

If you want a picture that shows how stupid and irresponsible the Reserve Bank was with all that easy credit; that graph shows it.

Yes removal of LVR's at the same time as emergency OCR cuts, could well go down as one of the worst pieces of financial regulation/promotion of financial stability, in the history of the RBNZ. I can't think of anything that even comes close.

It looks pretty much the same as graphs for the stock market. The graph for the housing market will soon look like that too - it just takes longer.

They may need to drop their prices they charge for the use of their funds (lower interest rates)

Running out of greater fools.

This is the recession signal.

Overseas liquidity is being injected into the economy at a slower rate, as less money is being leant to NZ Inc via mortgages. This is effectively quantitative tightening.

"Overseas liquidity is being injected into the economy at a slower rate, as less money is being leant to NZ Inc via mortgages."

Can you back that up with any numbers, or do you just say things that aren't true? March was a record amount of wholesale offshore funding by banks...... Both nominally and yoy% growth.

Looks like crash is picking up speed, house prices going back in time quicker than the DeLorean 2020 next stop 2016 and on.

You mean not going back fast enough. Banks will not raise rates if it kills new lending. Will be even more interesting if Orr keeps raising the OCR and the banks ignore him. 🤔

Carlos67 - something like that happened a while back ago - from earlish 2000s I think - when the RB was increasing the OCR, but the banks could secure really cheap 5 year funding overseas. So the best tactic was to fix mortgages for 5 years. I think we did this several times. We subscribed to Tony Alexander’s newsletter as he was really good at advising how to get the best mortgage rates. He was working for the BNZ then, but is still pretty good at advising on things like that. And imo he’s been pretty good on house price trends too.

Maybe they think they've made enough money /s

In reality they have their current pool of existing trapped mortgage holders to feed off, they're just playing with their food like a cat with a goldfish bowl.

Don't worry, the immigration flood gates are being opened now, and thanks to Jacinda's new immigration rules, they are all coming in on Permanent Residency visas and not temporary work ones, which means they can all buy houses.

How will new immigrants afford million dollar plus house in Auckland especially on New Zealand wages. Huge amount of young kiwi are leaving for better life.

Why would you assume they are all coming in with no money ?

Looks like its turtles all the way down

Watch the commercial banks closely. These buzzards know exactly what is really going on. There is no more terrible animal than a bank shareholder not receiving dividends, so these guys & gals (the banksters) have to make money, even on a down market. And with such a huge chunk of their business in residential real estate, they will have every incentive to create a profitable business for their lords & masters. There may not be quite as much doom & gloom as some people think. TBC.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.