income taxes

How does New Zealand's economy compare to nations we typically like to compare ourselves with?

23rd Jul 23, 8:08am

60

How does New Zealand's economy compare to nations we typically like to compare ourselves with?

Unless we can find some way of taxing wealth as well as incomes, New Zealand is headed for an intergenerational economic meltdown, Grant Thornton tax partner Murray Brewer argues

2nd Jun 19, 6:02am

70

Unless we can find some way of taxing wealth as well as incomes, New Zealand is headed for an intergenerational economic meltdown, Grant Thornton tax partner Murray Brewer argues

January tax collections show individuals paying 11% more in income taxes this year than last, but less for GST. Company taxes dip as well

1st Mar 19, 10:28am

8

January tax collections show individuals paying 11% more in income taxes this year than last, but less for GST. Company taxes dip as well

Ahead of the Government's new Tax Working Group, David Chaston casts a broad historical eye over NZ tax and how it's paid

26th Nov 17, 6:51am

47

Ahead of the Government's new Tax Working Group, David Chaston casts a broad historical eye over NZ tax and how it's paid

ACT has moved closer to the centre of the political spectrum with its tax policy. This has won it votes in the past. The question is whether it will do so in this election

6th Jul 17, 5:01pm

12

ACT has moved closer to the centre of the political spectrum with its tax policy. This has won it votes in the past. The question is whether it will do so in this election

Deborah Russell says that for all its technical attributes that make our tax system a model widely admired, it is not serving the broader economy or society well

18th Sep 16, 7:13am

43

Deborah Russell says that for all its technical attributes that make our tax system a model widely admired, it is not serving the broader economy or society well

Brian Taylor asks, Can tax be used to stimulate the New Zealand economy?

Huge international study matching tax approaches and subjective wellbeing scores shows that people feel better with 'distortionary' taxes, but growth is higher with 'non-distortionary' taxes: Motu

6th Apr 16, 5:35am

12

Huge international study matching tax approaches and subjective wellbeing scores shows that people feel better with 'distortionary' taxes, but growth is higher with 'non-distortionary' taxes: Motu

Key agrees with LGNZ that rates not perfect, but not interested in 'opening floodgates' to new council taxes and spending; suggests they use more debt, delayed rates for pensioners

3rd Feb 15, 10:07am

21

Key agrees with LGNZ that rates not perfect, but not interested in 'opening floodgates' to new council taxes and spending; suggests they use more debt, delayed rates for pensioners

Bernard Hickey points to planned crackdowns on tax evasion by big global tech companies in Europe and Australia and wonders why New Zealand is so quiet

5th Oct 14, 7:30am

44

Bernard Hickey points to planned crackdowns on tax evasion by big global tech companies in Europe and Australia and wonders why New Zealand is so quiet

We have a competitive tax system and we have growth. A major comparison of tax competitiveness across all OECD countries tries to suggest they are related

23rd Sep 14, 5:19pm

25

We have a competitive tax system and we have growth. A major comparison of tax competitiveness across all OECD countries tries to suggest they are related

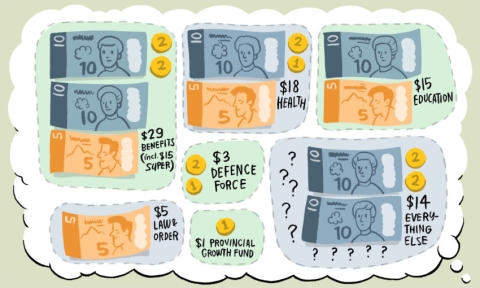

Matt Nolan looks at how fairness and redistribution work in the way taxes are designed and who actually pays after the resulting 'incentive' shifts

6th Aug 13, 9:50am

5

Matt Nolan looks at how fairness and redistribution work in the way taxes are designed and who actually pays after the resulting 'incentive' shifts

Matt Nolan looks at how taxes on consumption and capital income work, and how they differ from income taxes

25th Jun 13, 10:49am

9

Matt Nolan looks at how taxes on consumption and capital income work, and how they differ from income taxes

Matt Nolan looks at why we have income taxes, their benefits and the problems with efficiency and 'deadweight losses'

11th Jun 13, 10:14am

9

Matt Nolan looks at why we have income taxes, their benefits and the problems with efficiency and 'deadweight losses'

Matt Nolan looks at tax systems and how we can focus on fairness while keeping them efficient

28th May 13, 10:36am

13

Matt Nolan looks at tax systems and how we can focus on fairness while keeping them efficient