QE

Inflation lies at the heart of economic thinking and decision making. What are the core causes? Is inflation distorting our economy? Can we do better? The new Governor of the RBNZ seems to think we can do better and plans a ‘laser focus’ on inflation

7th Dec 25, 6:00am

48

Inflation lies at the heart of economic thinking and decision making. What are the core causes? Is inflation distorting our economy? Can we do better? The new Governor of the RBNZ seems to think we can do better and plans a ‘laser focus’ on inflation

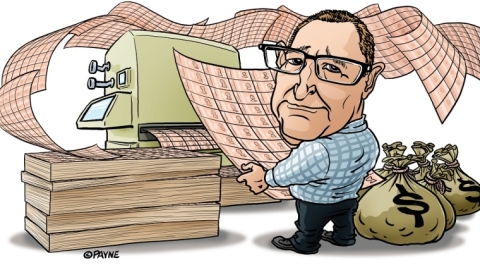

Large scale asset purchases remain 'in our toolbox for specific circumstances of extreme economic turbulence,' RBNZ's Paul Conway says

16th Oct 25, 9:56am

2

Large scale asset purchases remain 'in our toolbox for specific circumstances of extreme economic turbulence,' RBNZ's Paul Conway says

Research by the Reserve Bank argues the money lost on the Large Scale Asset Purchases during the pandemic was offset by more economic activity and lower debt costs

15th Oct 25, 11:45am

12

Research by the Reserve Bank argues the money lost on the Large Scale Asset Purchases during the pandemic was offset by more economic activity and lower debt costs

Latest figures show RBNZ now has over $26.7 billion worth of cash for intervening if necessary in foreign exchange markets

29th Apr 25, 9:33am

Latest figures show RBNZ now has over $26.7 billion worth of cash for intervening if necessary in foreign exchange markets

As Adrian Orr abruptly departs the Reserve Bank, it's a good time to think about what type of central bank we want

9th Mar 25, 8:49am

11

As Adrian Orr abruptly departs the Reserve Bank, it's a good time to think about what type of central bank we want

Latest monthly figures from the Reserve Bank reveal our central bank now has over NZ$22 billion worth of 'foreign currency intervention' capacity

28th Aug 24, 3:22pm

9

Latest monthly figures from the Reserve Bank reveal our central bank now has over NZ$22 billion worth of 'foreign currency intervention' capacity

In the latest episode of our Of Interest podcast, Steven Hail gives the MMT perspective on the monetary system, inflation, climate change & more

27th Jul 24, 9:14am

43

In the latest episode of our Of Interest podcast, Steven Hail gives the MMT perspective on the monetary system, inflation, climate change & more

As we await the start of cuts to the Official Cash Rate, David Hargreaves questions what damage may have been done by the recent heavy-handed and sledgehammer-like interest rate hiking cycle

21st Jul 24, 6:00am

156

As we await the start of cuts to the Official Cash Rate, David Hargreaves questions what damage may have been done by the recent heavy-handed and sledgehammer-like interest rate hiking cycle

Latest monthly figures from the Reserve Bank reveal our central bank has seen a decrease in its 'foreign currency intervention capacity' of NZ$732 million last month - the first drop in a year

25th Jun 24, 3:52pm

4

Latest monthly figures from the Reserve Bank reveal our central bank has seen a decrease in its 'foreign currency intervention capacity' of NZ$732 million last month - the first drop in a year

Influential RBNZ survey shows another decisive drop in the expectation of future levels of inflation in a result that will give the RBNZ comfort ahead of its Official Cash Rate decision next week

13th May 24, 3:41pm

21

Influential RBNZ survey shows another decisive drop in the expectation of future levels of inflation in a result that will give the RBNZ comfort ahead of its Official Cash Rate decision next week

Richard Werner argues the Bank of Japan raising interest rates for the first time in 17 years was a move to support the US dollar

19th Apr 24, 11:34am

21

Richard Werner argues the Bank of Japan raising interest rates for the first time in 17 years was a move to support the US dollar

Kiwibank economists say central banks will ultimately need to have looser inflation targets in a 'world of rapidly rising, climate-related, costs

13th Mar 24, 9:34am

46

Kiwibank economists say central banks will ultimately need to have looser inflation targets in a 'world of rapidly rising, climate-related, costs

Gareth Vaughan on ANZ NZ's erroneous OCR call, a $30t gamble that changed the world, tackling surcharging & more

5th Mar 24, 10:06am

23

Gareth Vaughan on ANZ NZ's erroneous OCR call, a $30t gamble that changed the world, tackling surcharging & more

Kiwibank economists say that after some 'ferocious barking' and 'a lot of huffing and puffing' about potential interest rate hikes, the RBNZ has 'stripped off their wolf skin'

4th Mar 24, 11:41am

23

Kiwibank economists say that after some 'ferocious barking' and 'a lot of huffing and puffing' about potential interest rate hikes, the RBNZ has 'stripped off their wolf skin'

Reserve Bank leaves Official Cash Rate unchanged at 5.5% and says risks to the inflation outlook are now 'more balanced' but there is a limit to its ability to 'tolerate upside inflation surprises'

28th Feb 24, 2:13pm

104

Reserve Bank leaves Official Cash Rate unchanged at 5.5% and says risks to the inflation outlook are now 'more balanced' but there is a limit to its ability to 'tolerate upside inflation surprises'