The Reserve Bank says its pandemic-era bond buying programme roughly offset its $11 billion fiscal cost by increasing tax revenue and reducing interest payments on Government debt.

Paul Conway, the central bank’s chief economist, gave a speech on the use of alternative monetary policy tools at Citi Australia & New Zealand Investment Conference on Wednesday.

New research released alongside the speech assessed the costs and benefits of the Large- Scale Asset Purchases (LSAPs), which were used in 2020 and 2021 as monetary policy stimulus after the Official Cash Rate was cut to its lower limit of 0.25%.

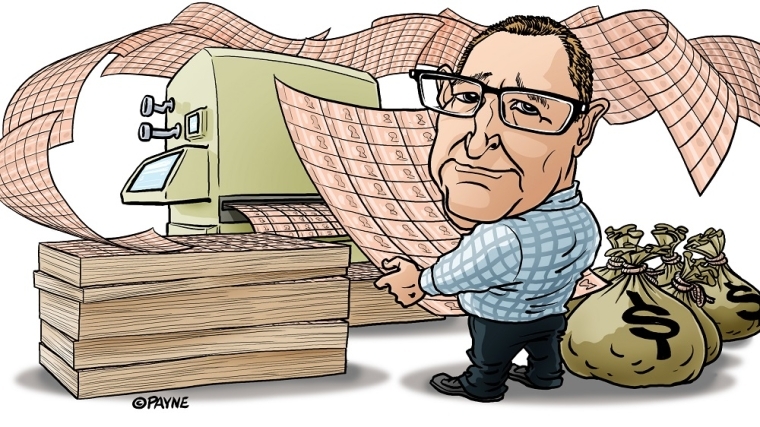

The LSAP saw the Reserve Bank buy about $53 billion of Government bonds from private investors to lower long-term interest rates and support borrowing during the recession. This decision was widely criticised after the Bank hiked rates to fight inflation, crystallising losses on its bond portfolio of roughly $10.5 billion or 3.2% of GDP.

But Conway said RBNZ research found the LSAP’s direct cost was offset by its indirect benefits. It first restored market confidence, then lowered long-term interest rates which held down the exchange rate and supported exports.

“By boosting economic activity during the pandemic, LSAPs increased government tax revenues. This higher revenue almost entirely covered the direct losses from LSAPs, leaving consolidated Crown debt virtually unchanged over the medium term,” he said.

The International Monetary Fund came to a similar conclusion in 2023 research, and Former Governor Adrian Orr often defended the policy as being worth the cost.

Still, Conway said the policymakers would have preferred to use negative interest rates if that tool had been available in 2020. The research showed similar economic results as the LSAP but without a cost to the Crown balance sheet.

RBNZ’s research also showed the LSAPs did not contribute materially to the subsequent rise or peak in inflation, although broader policy reviews have found the central bank should have tightened policy sooner to fight inflation.

Conway said buying $53 billion in government bonds through the LSAP programme and providing $19 billion in bank funding was similar to policies in Australia and Canada.

But NZ’s fiscal policy response was larger and longer. Treasury estimates the total cost of the pandemic response will cost $66 billion, or 20% of GDP — the second most after the United States.

“This lag and persistence in pandemic-related fiscal spending resulted in fiscal policy continuing to add economic stimulus while monetary policy became restrictive to reduce inflation and keep medium-term inflation expectations in check,” Conway said.

“In other words, containing inflation over this period required the OCR to be higher than otherwise if fiscal support during the pandemic had been more timely and temporary.”

*Also see this Of Interest podcast episode: Ex-Bank of England Deputy Governor Paul Tucker on how quantitative easing exposed government finances to rising interest rates.

12 Comments

Lower debt costs and more economic activity. I didn't notice that over the last 3 years.

If they hadn't been wasting our precious tax dollars we would be better off.

Rbnz sounds smug and all need sacking

It isn't tax dollars. It's reserves and typically in an action like this the RBNZ is trying to maintain liquidity in the banking and financial system by swapping cash for bonds. The loss in this case was a deliberate act to protect the value of private sector savings and assets. It's also technical - no-one in the private sector lost out - they were protected by this action. The RBNZ absorbed the loss on the public sector side of the ledger.

Government debt = private sector asset

Ultimately central bank mechanisms have become the be-all-and-end-all. Now that's not necessarily bad as long as people understand that and they're transparent about it. But they can't be transparent in some ways - they have to protect their own self interests and other stakeholders (banks for ex). The Keynesian camp can nod their heads in agreement with all this.

Anyway, I guess you could say Paul is expressing that here: 'Trust us as we know what we're doing [at least better than you] and our actions are for the collective good'.

What he's not talking about are the trade offs. And this is part of the problem as I see it. We're back to square 1 and nobody's the wiser. Of course, the more you understand the thinking and behaviors of the technocracy, then you can at least place your bets accordingly. I think the majority don't have much idea of what's going on. That's why they have faith in Ponzinomics without understanding that we're more or less in a command economy.

It's hard for reserve banks to be transparent because they have to go along with the mythology that the government is borrowing money and getting itself into unpayable debt.

This isn't what happens - governments have an overdraft at their own bank which they can use as needed to maintain the money supply, inflation and interest rates. Reserves create new money in the private sector to meet government spending.

Reserves are reduced - after they've been created - by tax revenue and bond sales.

"Reserves are reduced - after they've been created - by tax revenue and bond sales."

"If they hadn't been wasting our precious tax dollars we would be better off."

Let me argue they're not transparent because they know that they're winging it to some (or a large) extent and they have to balance the interests of all their different stakeholders.

What would the RBNZ know about value for money.

Given the spendup on their own costs, it does not seem so.

What would the RBNZ know about value for money.

Bingo. Well played sir (or dame or they/them).

Do as I say, not as I do. Where have we heard that before...

RBA took the loss on their balance sheet - NO political football of 11Bn increase in debt! Why are we flogging ourselves with puritanical neo-liberal accounting rules? I'd also note that it is likely not 11Bn - as the interest rates drop back down the 11Bn will likely halve.

We will have another black swan, the RBNZ printing is a good safety net - stability of the monetary system is their key role to keep NZ as a going concern... How do we print money in a smart way next time, how do me know where it is best to place that money next time?

You're onto it. People don't seem to get it and act like the reserve bank owes someone money - it doesn't. Government spending is always done with new money using the overdraft it has at it's own bank - which is technically limitless.

If the reserve bank carries a loss on its balance sheet that is because someone in the private sector has an asset. The governments debt does not sit on the private sector it's money the government owes to itself.

"but they would say that, wouldn't they."

Unlike so many other knowledgeable commentators...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.