NZ government bonds

Westpac's Imre Speizer says significantly higher Australian cash rate shouldn't directly impact NZ rates if its cause is Aussie specific

7th Feb 26, 9:00am

24

Westpac's Imre Speizer says significantly higher Australian cash rate shouldn't directly impact NZ rates if its cause is Aussie specific

Nicola Willis 'won't overreact' to forecast fiscal changes as ANZ economists say ‘substantial policy change’ is needed to tackle the likes of ageing population costs

16th Dec 25, 6:59pm

6

Nicola Willis 'won't overreact' to forecast fiscal changes as ANZ economists say ‘substantial policy change’ is needed to tackle the likes of ageing population costs

Delay in economic recovery has led to ‘small deterioration in the fiscal forecasts’, Treasury says in its Half Year Economic and Fiscal Update as it expects a widening fiscal deficit and forecasts surplus to return in 2029/2030

16th Dec 25, 1:15pm

12

Delay in economic recovery has led to ‘small deterioration in the fiscal forecasts’, Treasury says in its Half Year Economic and Fiscal Update as it expects a widening fiscal deficit and forecasts surplus to return in 2029/2030

Large scale asset purchases remain 'in our toolbox for specific circumstances of extreme economic turbulence,' RBNZ's Paul Conway says

16th Oct 25, 9:56am

2

Large scale asset purchases remain 'in our toolbox for specific circumstances of extreme economic turbulence,' RBNZ's Paul Conway says

Research by the Reserve Bank argues the money lost on the Large Scale Asset Purchases during the pandemic was offset by more economic activity and lower debt costs

15th Oct 25, 11:45am

12

Research by the Reserve Bank argues the money lost on the Large Scale Asset Purchases during the pandemic was offset by more economic activity and lower debt costs

New Zealand’s fiscal health improved after Budget 2024 but tax cuts kept operating deficits open, full Financial Statements show

9th Oct 25, 2:06pm

4

New Zealand’s fiscal health improved after Budget 2024 but tax cuts kept operating deficits open, full Financial Statements show

The drums for fiscal stimulus keep on banging as the Government leaves it to RBNZ monetary policy to stimulate the economy

24th Aug 25, 6:30am

55

The drums for fiscal stimulus keep on banging as the Government leaves it to RBNZ monetary policy to stimulate the economy

Latest figures show RBNZ now has over $26.7 billion worth of cash for intervening if necessary in foreign exchange markets

29th Apr 25, 9:33am

Latest figures show RBNZ now has over $26.7 billion worth of cash for intervening if necessary in foreign exchange markets

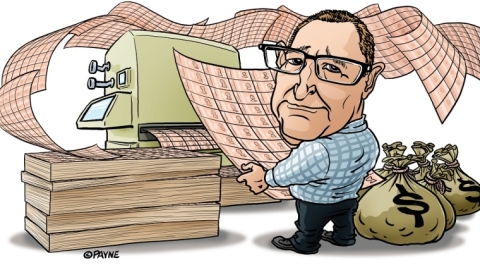

Balancing the budget without tax increases or austerity measures may require a Christmas miracle

18th Dec 24, 7:38am

131

Balancing the budget without tax increases or austerity measures may require a Christmas miracle

The Coalition Government will not balance its budget within the forecast period, as Treasury forecasts a weaker economic recovery

17th Dec 24, 1:05pm

203

The Coalition Government will not balance its budget within the forecast period, as Treasury forecasts a weaker economic recovery

NZDM says total book size for $5 billion government bond issue exceeded $23.9 billion

22nd Oct 24, 3:02pm

6

NZDM says total book size for $5 billion government bond issue exceeded $23.9 billion

Latest monthly figures from the Reserve Bank reveal our central bank now has over NZ$22 billion worth of 'foreign currency intervention' capacity

28th Aug 24, 3:22pm

9

Latest monthly figures from the Reserve Bank reveal our central bank now has over NZ$22 billion worth of 'foreign currency intervention' capacity

In a new episode of our Of Interest podcast, Westpac's Imre Speizer explains the importance of swap rates & why interest rates are heading lower

27th Aug 24, 5:00pm

8

In a new episode of our Of Interest podcast, Westpac's Imre Speizer explains the importance of swap rates & why interest rates are heading lower

Nicola Willis says she will use fiscal drag to help pay down public debt, despite calling it a flaw in the tax system

31st Jul 24, 8:15am

29

Nicola Willis says she will use fiscal drag to help pay down public debt, despite calling it a flaw in the tax system

Latest monthly figures from the Reserve Bank reveal our central bank has seen a decrease in its 'foreign currency intervention capacity' of NZ$732 million last month - the first drop in a year

25th Jun 24, 3:52pm

4

Latest monthly figures from the Reserve Bank reveal our central bank has seen a decrease in its 'foreign currency intervention capacity' of NZ$732 million last month - the first drop in a year