The great foreign cash stash is continuing at pace for the Reserve Bank.

New monthly figures out from the RBNZ show that our central bank boosted its 'foreign currency intervention capacity' by a further NZ$810 million dollars last month.

Early in 2023 the RBNZ announced that - in effect it would be building up a war chest of foreign currency in the event that it needs to intervene in the foreign exchange markets.

The central bank indicated that the amount it had available would be rising in future months. But it gave no indication of by how much this would be, or what the ultimate size of a war chest might be, or when that might be accomplished.

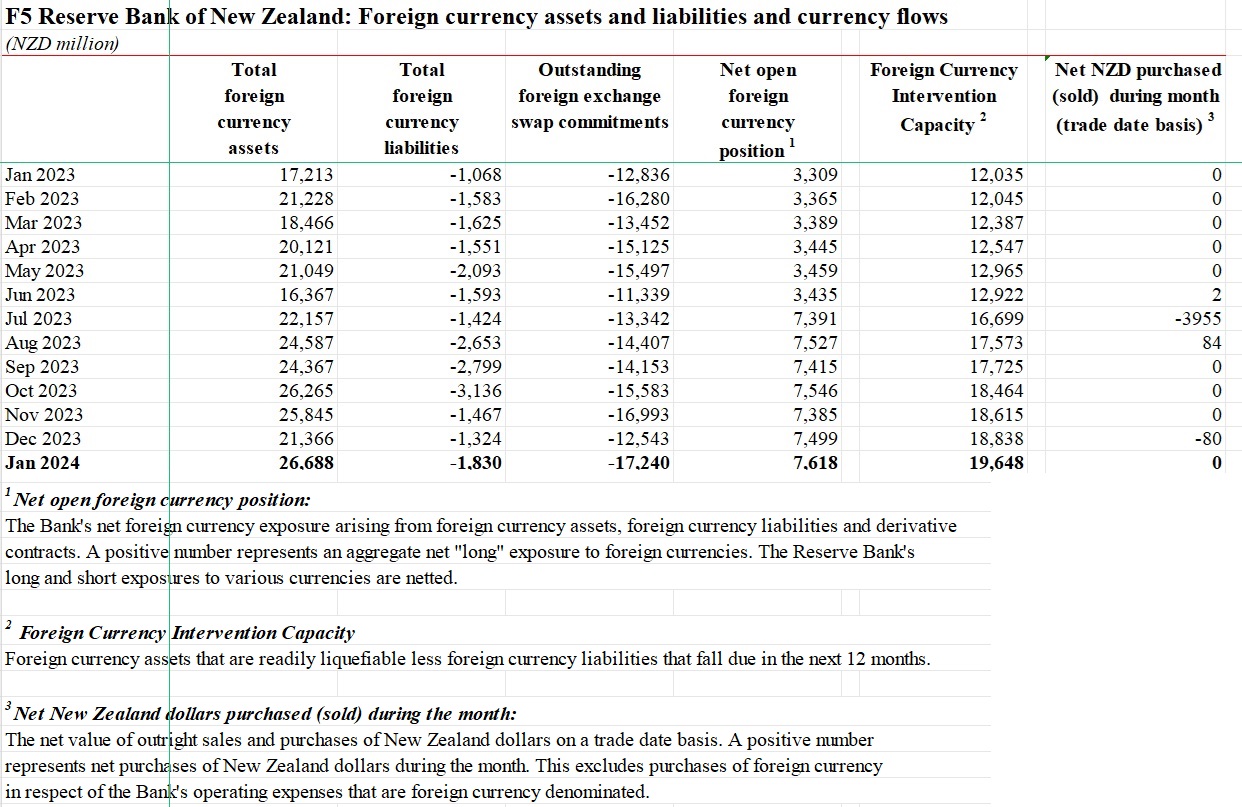

The latest month's addition of NZ$810 million worth of foreign currency intervention capacity now brings the war chest up to NZ$19.648 billion worth. That's up by some NZ$7.613 billion - or 63.25% - on the amount that the RBNZ had available as of January 2023.

The increase in January 2024 was the largest monthly increase in the foreign currency intervention capacity total since August last year.

The full figures are contained in the abridged spreadsheet at the bottom of this article.

Up till the start of last year the RBNZ had fairly consistently maintained a level of around $12 billion worth of foreign currency available for intervention. So, the war chest has already been increased in size by around two-thirds, with no indication of how large it might get.

However, the RBNZ has made reasonably clear it is nowhere near finished building up the foreign currency war chest yet.

In a speech last year RBNZ Assistant Governor Karen Silk said there was no clear answer to the question of what the right level of foreign currency reserves the Reserve Bank (RBNZ) should hold.

"We will not be commenting on the target level of reserves agreed as that information is considered market sensitive but will note that achieving it is a process that will occur over a number of years. This is because we seek to avoid undue risk to market liquidity from our actions in reaching agreed levels," Silk said.

The big and noticeable move the RBNZ made during last year was when it sold nearly $4 billion of New Zealand currency in July. However, it doesn't just raise its overseas currency holdings by directly selling New Zealand dollars.

Silk explained this in her speech:

"Unhedged reserves are raised by selling NZD in exchange for foreign currency in the spot foreign exchange market. This transaction results in us owning foreign currency, and the value of these assets will fluctuate in line with increases or decreases in the exchange rate," says Silk.

"The hedged reserves are raised by lending NZD in exchange for foreign currency, generally in the cross-currency basis swap market. We effectively borrow foreign currency under long term contracts and are not exposed to movements in the exchange rate, because all the foreign exchange rates are agreed at the start of the contract."

Westpac New Zealand Chief Economist Kelly Eckhold, who formerly worked as the RBNZ's manager of foreign reserves and at the International Monetary Fund, said in an episode of interest.co.nz's Of Interest podcast that the RBNZ's foreign currency intervention capacity is likely to increase significantly over the next two or three years.

Eckhold pointed out the RBNZ's total level of foreign reserves hadn't changed substantively since 2008, and the economy's about 80% bigger now and the foreign exchange market has probably doubled in size. The RBNZ has intervened in currency markets sparingly in the past, and the new framework doesn't mean this will change.

"When you see this rather large and abrupt change in the level of reserves going on here it's a consequence of the fact that the framework hasn't been reviewed for a very long time," Eckhold says.

(There's detail in this story on the RBNZ's approach to intervening in the currency markets).

The RBNZ describes the foreign currency intervention capacity as foreign currency assets that are readily liquefiable less foreign currency liabilities that fall due in the next 12 months.

9 Comments

From the back of the class, what does this achieve? Because it's chicken feed in terms of daily forex trading in NZD crosses. I understand that the US, Japan, China can intervene in markets quite effectively, but can we say the same about foreign currency intervention by the RBNZ?

J.C.

I am wondering the same thing. NZ$20bn is petty cash in that market.

So many questions....

Hard to draw any meaningful conclusions without a much longer time series, say also weighted by GDP.

Short $7.6bn Kiwi gives them an incentive to shock with a dovish statement, how do they manage these conflicts? I know they don't reward staff on p&l (do they?), but a nice dividend to the Crown makes the RBNZ look good.

They do this because our currency is crap and devaluing daily and when it completely shits itself into hyper inflation they will try and save our currency by propping up the exchange markets with this so called slush fund.

argumentum ad odium

20 billion...or around 3 months of FX deficit.

Marginal at best

if push comes to shove 20 billion will be meaningless

The true position is only $7b, the rest is foreign currency they have borrowed and have to ultimately repay in that currency.

The cynic in me says it's their attempt to prop up the USD so they can be right about their monetary policy position.

Small number, big problem, sustainability of lifestyle at odds with reality, as we continue to live beyond our means

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.