Summary of key points: -

- US and New Zealand inflation outcomes hold the key for future NZD/USD exchange rate direction

- Can the Kiwi dollar catch up to the Euro gains?

- The Federal Reserve under fire – what it means for the US dollar value

US and New Zealand inflation outcomes hold the key for future NZD/USD exchange rate direction

Over coming months, the questions will be answered as to how much both US and New Zealand inflation rates will increase.

If the US inflation rate does not increase to the level currently feared by the Federal Reserve and financial market participants, due to Trumps import tariffs, their interest rates will be cut earlier and larger this year – devaluing the US dollar’s value. Other economies are nearing the end of their monetary policy easing cycles, just as the US recommences theirs. Of course, the contrary outcome with inflation will mean US interest rates staying higher for longer and the US dollar holds at current levels or recovers some of the lost ground over recent months.

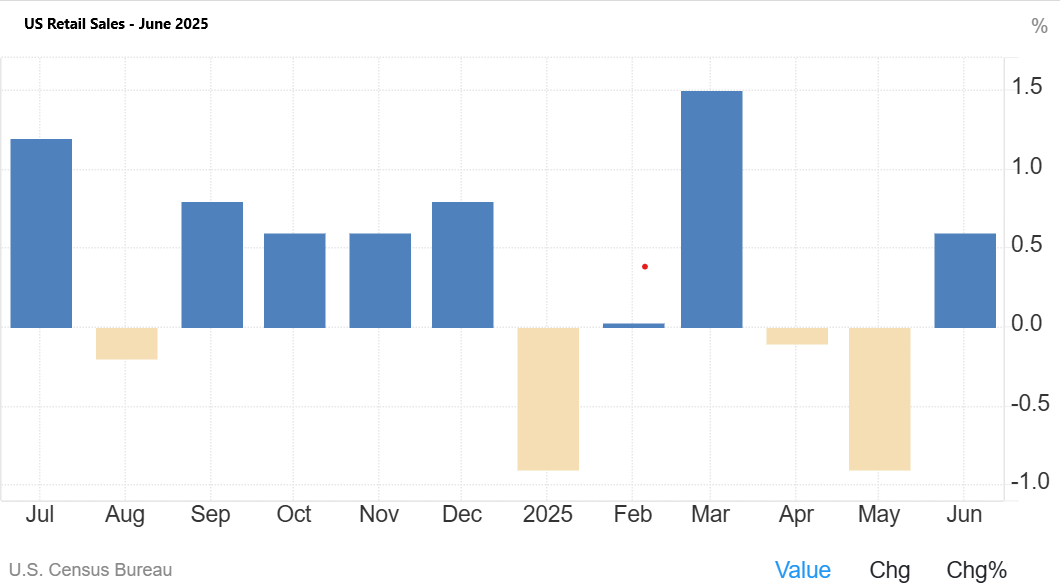

Last week’s US CPI inflation result (headline) for the month of June was bang on prior consensus forecasts at a 0.30% increase. The core inflation measure at 0.20% increase was less than the +0.30% forecast. There would normally not be any great FX or interest rate market reaction to such an unsurprising and in-line result. However, as there was some minor evidence of tariff costs coming through on the good side, the immediate market reaction was to send interest rates and the US dollar higher. Markets love reacting to the newswire headlines with instant conclusions without bothering to dig into the weeds of analysis behind the numbers. The June inflation figures were a case in point, with the more material side of services inflation continuing to decline (rents and healthcare). The same could be said for US Retail Sales numbers for June the following day. On the surface, the 0.60% increase was much more positive than the prior consensus forecasts of a 0.10% lift. However, delving into the detail reveals some major revisions downwards in prior months, leaving retail sales “flat at best” over the last six months (refer to the bar chart below).

The other economic data crucially important for the Fed’s deliberations on the timing and extent of recommencing interest rate cuts is employment trends. Last month’s Non-Farm Payroll’s numbers were interpreted by the markets as stronger than expected at an increase of 147,000 jobs, well above expectations of just a 100,000 increase. Yet again, closer analysis indicates that most of the job increases were public sector schoolteachers at the state level. Hardly a ringing endorsement of the private sector adding jobs and the labour market remaining “robust” as many Fed members contend it is.

US import prices rose 0.1% in June against forecasts for a 0.3% gain, whilst May’s prices were revised lower, from 0.0% to -0.4%. An interesting outcome as it perhaps suggests some willingness from foreign manufacturers to absorb part of the tariff costs. Maybe President Donald Trump will be right on this response after all!

We still do not know precisely what the final tariff percentages are so that the Fed can get the “clarity” on the impact on inflation they require. However, we are getting closer to that point with the tariff on Japanese imports likely to be 25% and European goods 15% or 20%. The 1st of August is now the new deadline date to get these agreements in place. The Fed will also need to know how much of the tariff costs is absorbed by the players along the supply chain before having confidence on any inflation forecast. There are so many improbable outcomes and that is why the Fed is so divided on the issue. On the balance of risks, they will likely hold off from cutting interest rates this month but get going again in September. Either way, it is still not that positive for the US dollar value.

New Zealand’s CPI inflation numbers for the June quarter are released on Monday 21st July and there may be some surprise in store. Consensus forecasts range from a 0.30% to 0.60% increase with the RBNZX at +0.50%. A result above 0.60% could be on the cards with food and electricity prices rising over recent months. Apart from house rents it is difficult to locate any other prices that have decreased over the last three months. A higher-than-expected inflation result will remove any prospect of a further RBNZ 0.25% OCR cut in August. That in turn would aid the NZ dollar to recover back above 0.6000 from its recent USD driven foray into the 0.5900’s.

Can the Kiwi dollar catch up to the Euro gains?

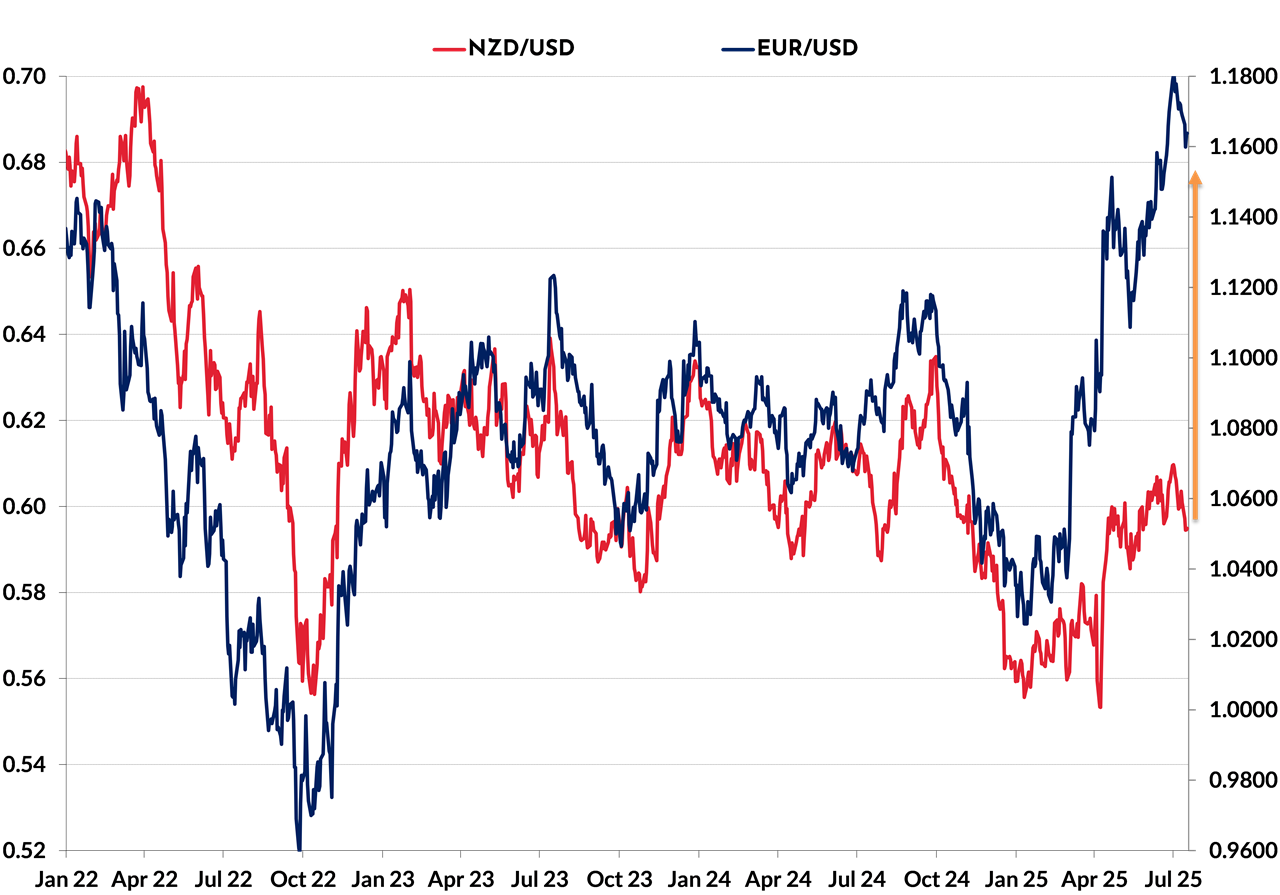

As the chart below clearly shows, the NZD/USD exchange which is normally closely correlated to EUR/USD movements, has seriously lagged the Euro’s appreciation against the USD over the last six months. There are three fundamental reasons as to why currency investors and traders have not bought the Kiwi dollar to the same extent that they have sold the USD for the Euro: -

- Our interest rates remain well below those prevailing in the US. Our OCR is 3.25%, the US Fed Funds interest rate is 4.33%. Our two-year swap interest rate is still 0.50% below the that of the US. If there was not this interest rate disadvantage the Kiwi dollar would have attracted some more buyers as an alternative to the USD.

- The New Zealand and Australian economies (and currencies) are regarded by currency investors and traders as very dependent on China. Up until recently, the view was that Trump’s tariffs would damage the Chinese economy and that would not be good for the antipodean economies and currencies.

- Massive investment/fund management related capital flows have exited the US markets and returned home to Europe. European investment managers shifting from over-weight US to underweight US has strengthened the Euro on its own accord.

The first two impediments for the Kiwi dollar are now abating. The RBNZ are not likely to reduce our OCR to below 3.25% or 3.00%, on the other hand the Fed will recommence cutting rates in July or September. The interest rate gap is set to close to zero over the next six months. The FX markets will price-in that likely outcome well in advance of that time frame. The reality is emerging that the Chinese economy is not being hurt too much at all by Trump’s tariffs. Reduced exports to the US are being rediverted to Europe and the rest of Asia. Chinese industrial production and retail sales are back increasing at an annual rate above 5.00%.

Chinese demand remains strong for protein imported from New Zealand, resulting in our economy having a robust export-led recovery.

At some point global currency players will recognise just how much the Kiwi dollar is out of line to the Euro. The lower NZD/EUR cross-rate at 0.5100 confirms this miss-alignment. Exchange rate correlations do break down, however it seems the causes of the NZD: EUR breakdown have now changed, so an adjustment back seems much more likely.

The Federal Reserve under fire – what it means for the US dollar value

The constant attacks on the Chairman of the US Federal Reserve, Jerome Powell by Donald Trump and his henchmen does nothing to help the confidence of the rest of the world that the Fed can remain independent of political interference. If Trump was to appoint the replacement for Mr Powell much earlier than the May 2026 due date, it would undermine the independence and credibility of the Fed and weaken the US dollar. The financial market’s attention would be all on the Chairman-elect’s stance on the economy, inflation and interest rates.

The leading candidate to be the new Chairman is Kevin Warsh. Mr Warsh was clearly staking his claim last week with a statement that the Fed requires major reforms, a regime change and that interest rates should be immediately lowered. He also wants a closer policy relationship with the US Treasury, which would seem to undermine the independence of the Fed to conduct its monetary policy.

An existing voting member on the Fed’s FOMC committee, Chris Waller states that he is prepared to step into the Chair’s role to replace Powell if President Trump asks him. Mr Waller may well be a dissenting voter at the July Fed meeting, as he is also advocating for immediate interest rate cuts. He believes the Fed must be ahead of the eight-ball as he sees soft private sector hiring weakening the labour market.

It is legally questionable as to whether Trump could dump Jerome Powell and if he did so it would be litigated to the Supreme Court. The larger question is whether any other members of the Fed would all resign in sympathy if Powell was removed. Such developments would seem unlikely, however with Trump anything is possible! One view is that Trump will keep Powell is place as his political whipping boy (someone to blame if the economy goes south) in the lead-up to the mid-term elections next year.

Whatever the future developments with Trump and Powell, the forex markets will reflect the global unease with the removal of the Fed’s independence by selling the US dollar lower.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.