Summary of key points: -

- The Fed and the markets have been fed a false pretence on the US economy

- Classic “game of two halves” for FX markets

- Disappointment at Trump’s 15% tariff on NZ exports to the US

The Fed and the markets have been fed a false pretence on the US economy

What an utter shambolic cluster!

The inaccuracy and unreliability of US economic data has been dealt another blow over recent days as previously announced Non-Farm Payrolls employment increases for May and June were revised dramatically downwards. Earlier this year, this column highlighted the fact that large historical revisions downwards in announced jobs increases by the US Bureau of Labour Statistics made a mockery of reported employment trends that the Federal Reserve place a lot of importance on in making monetary policy and interest rate decisions. We emphasised the dodgy nature of the data meant that the Fed should not totally rely on historical measures and should be more forward looking with survey and sentiment indicators.

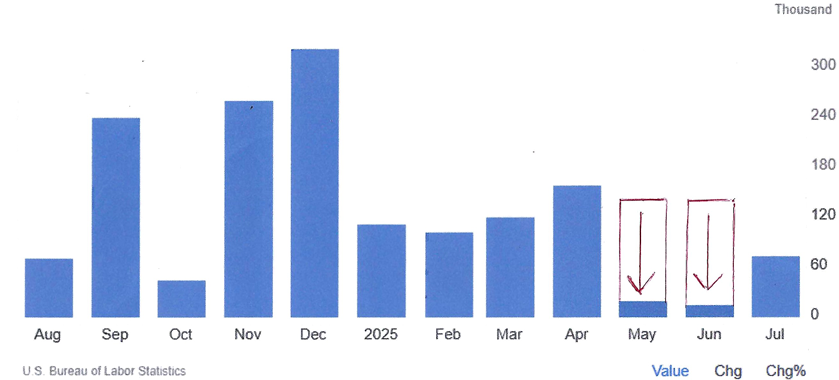

In releasing the July Non-Farm Payroll employment increase of 73,000 (well below prior consensus forecasts of +110,000), the Bureau of Labour Statistics revised the previous months of May and June sharply lower: -

- May revised down from the original release of +144,000 to just +19,000.

- June revised down from the original release of +147,000 to just +14,000.

US Non-Farm Payrolls Employment (monthly increases 2025)

Both the markets and the Fed have factored in “stable” and “robust” labour market conditions over recent months based on the originally released figures. Therefore, the Fed has been reluctant to cut interest rates any further as they say stable and balanced employment conditions does not suggest that monetary policy is overly restrictive at a 4.35% Fed Funds interest rate.

That conclusion and stance has now been turned on its head.

The Fed and the markets have been fed fake news and misinformation on the state of the US economy as measured by employment trends. A major re-think is now required on monetary policy settings in the US as employment has nosedived over the last three months. Many commentators are now calling for a 0.50% interest rate cut at the Fed’s next meeting on 17th September. The two Fed voting members, Michelle Bowman and Chris Waller, who dissented on the vote to hold interest rates stable at last week’s Fed meeting both justified their contrarian stance on the basis that monetary policy should be eased ahead of a major softening in employment, based off forward looking indicators. Waiting for the softening to occur before acting, means that you are acting too late. Ms Bowman and Mr Waller have been proven absolutely correct by this latest Non-Farm Payrolls jobs data. Yet again, the meagre 73,000 increase in jobs in the month of July was dominated by the healthcare sector. Big industry sectors such as manufacturing, retail, energy and construction are shedding labour. The US economy is not in the stable shape the Fed and the markets thought it was.

It can now be stated with much more confidence that the disruption and uncertainty imposed on businesses in the US by Trump’s tariffs has severely damaged the US economy. Now that we know with certainty that employment plunged in May, June and July, the Fed are compelled to cut interest rates under the second objective of full employment under their dual remit (the other being low and stable inflation). It is ironic that these massive jobs revisions come two days after Fed Chair, Jerome Powell was waxing lyrical about their high quality of their economic data compared to other countries! Like a lot of things in the United Sates of America, what appears glossy on the outside disguises a crumbling and rusty infrastructure underneath.

Foreign investors into the US have already lost confidence in US economic policy makers and have been withdrawing their money as a result. They now have a very good second reason to exit the US markets as they lose confidence in the quality of the economic data that the Federal Reserve so heavily depend upon.

The Non-Farm Payrolls jobs shambles comes out on top of the ridiculously historical data used to record house rents in the US that dominates the weightings in the CPI inflation index. The CPI is not an accurate measure of current market prices for rents as the data is 12 to 18 months out of date.

Classic 'game of two halves' for FX markets

The US dollar ended last week giving up much of the strong gains it had posted earlier in the week. It was a classic game of two halves, with the FX markets roiled by data shocks from all quarters. The US economy expanded at a much faster clip in the June quarter than prior forecasts, triggered the initial rebound upwards in the US dollar on Wednesday 30th July. On an annualised basis the economy grew 3.00%, above forecasts of +2.50%. However, the economic report was not as positive as the media headlines suggested if you view the full six months period since the start of 2025. It was a highly unusual situation for the US economy with a massive inventory build-up in the March quarter as importers stocked up ahead of the tariffs. The inventory build being negative for GDP, resulting in the economy contracting 0.50% in the March quarter. The exact opposite occurred in the June quarter with the inventory levels run down, which is very positive for GDP. As Chair Powell summarised, over the first six months of the year the US economy increased by 1.20%, well down on +2.40% for the same six months period in 2024. The FX markets reacted to the impressive +3.00% GDP headline, however further analysis (as the jobs debacle proved) confirms that the US economy is not as robust as many had convinced themselves it was.

The financial markets did not expect the Fed to cut interest rates at their Wednesday 30th meeting, however many interpreted the meeting tone as more hawkish than prior expectations. The Fed continued their ongoing theme that it was still too early assess the impact of tariffs on inflation. According to the Fed, the stable unemployment rate at 4.10% did not warrant a rate cut on that side of their mandate.

The US dollar strengthened further after the Fed meeting, however most of the USD selling appeared to be unwinding of the very crowded “short-sold” USD speculative positioning established after Trump’s Liberation Day back in April day. To be fair, a clean out of those FX positions was well needed if the US dollar is to have the capacity to depreciate further over the rest of this year.

In summary, the wild roller-coaster currency movements over the week were as follows: -

- The EUR/USD rate dropped from $1.1750 on 28 July to a low of $1.1400 early on 1st August, only to recoil to $1.1600 after the US jobs numbers on Friday night.

- The USD Dixy Index started the week at 97.50, appreciated to a high of 100.00 early on 1st August, before falling away again to 98.80.

- The NZD/USD exchange rate commenced the week at 0.6010, hit a low of 0.5860 when the USD appreciated after the Fed meeting, however recovering to 0.5920 at the market close in New York.

Further USD selling (higher NZD/USD rate) must be expected in the short term as market pricing for a Fed cut at their next meeting in September has jumped up from a 40% probability to over 70%. US two-year and 10-year Treasury Bond yields plummeted on the jobs shemozzle. The market two-year bond yield, which prices-in expected upcoming Fed cuts, plunging from 3.90% before the jobs data to 3.70%. Further declines to below the 3.50% level would see it breaking below the support line it his held above since August 2022.

Disappointment at Trump’s 15% tariff on NZ exports to the US

The final tariff on NZ product into the US market being lifted to 15% from the 10% we had hoped for is disappointing, however it is hard to see it damaging our export-led economic recovery too much. Just why the Aussies get a 10% tariff below our 15% most likely came down to US trade deficit with New Zealand, our 15% GST rate (it is a valued-added tax, not a sales tax, which the Americans do not seem to understand) and being not as close on security matters with the US as the Brits and Australians are.

There was no evidence of the NZ dollar being sold because of the 15% tariff news. It is also unlikely that the NZ dollar will be sold on its own account if the RBNZ lower the OCR for a final time to 3.00% at their next review on 20th August. That OCR cut expectation is already priced in to the NZD value.

The dominant determinant of NZD/USD exchange rate direction continues to be the changes in the USD side of the currency equation. However, for the first time in several years there is renewed foreign investor interest in buying NZ Government Bonds. Global investment funds diversifying asset allocations away from the US are certainly shifting into emerging market equities and bonds. New Zealand as an investment destination is not classified as an emerging market, however we come onto the radar in situations where alternatives are sought.

The chart below plots the NZD/USD exchange rate against the percentage level of our Government Bonds on issue held by foreign investors. Asian investors into our bond market tend to take the FX risk on the NZD denominated asset (i.e. unhedged), whereas US and European investors have FX policies to hedge the NZD FX risk when buying to bonds.

Non-resident holding of NZ bonds (red line on chart) has increased from a low of 40% in 2020 to 60% today. When the foreign holding were last above 60% in 2007/2008 and in 2013 to 2016 the Kiwi dollar was trading above 0.7000. The increased interest in NZ bonds by foreign investors is certainly not a negative for the Kiwi dollar’s value.

Another investment fund related positive force for the NZ dollar over coming months is the potential for the large Australian investment and superannuation funds to increase the FX hedge ratios on their USD denominated investment assets. A small lifting of the AUD/USD hedge (selling USD/buying AUD) on the US assets of the AUD4.1 trillion funds industry in Australia has major ramifications for the AUD/USD exchange rate. The latest USD recovery which pushed the AUD/USD rate below 0.6500 provides the market window for the Aussie fund managers to increase their USD hedges. Watch this space!

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

1 Comments

Employment collapse has been expected for some time. Big reductions in government spending and federal worker layoffs combined with the sales tax impact of tariffs.

My prediction is rising unemployment in the US and a major economic slowdown. Not that different to NZ's economy since October 2023.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.