Summary of key points: -

- Australian dollar on the cusp of a major appreciation

- Imminent Federal Reserve Chairman-Elect announcement negative for the US dollar

Australian dollar on the cusp of a major appreciation

Last week’s Australian GDP growth numbers for the September quarter did nothing to settle the debate as to whether the Aussies are on course for sustained expansion, or whether their economy has problems that will hold it back as an underperformer. The Australian economy grew by 0.40% over the quarter, well below prior consensus forecasts of a 0.70%/o.80% improvement. On the face of it, a much softer outcome than expected that would normally cause serious questions as to the underlying strength in economic activity. However, it pays to look behind the headline numbers to understand what is really going on. A rundown in inventories (stocks of good on hand) over the September quarter detracted 0.50%. Strong export demand in the mining/resources sector caused the decline in inventory levels. Certainly not a negative for the economy, as when the stock levels are rebuilt GDP growth will expand at a higher clip.

The reaction by the foreign exchange markets to the seemingly poor GDP result was somewhat muted, the AUD/USD rate initially dipping from the 0.6570 level at the time to 0.6550 on Wednesday 3rd December. However, once the inventory factor was realised, the Aussie dollar was quickly back on its upward path, posting impressive gains through Thursday and Friday last week to close at 0.6640 against the US dollar.

The arguments for the Australian economy entering another surge of expansion centre on population growth from strong immigration inflows, strong private investment (for AI-related data centres in particular), rising house prices driving higher consumer spending and continuing positive export performance. The counter arguments suggest that higher than expected inflation is making life tough in the mortgage belts of Sydney and Melbourne, wages are not keeping up with the rate of inflation and that potential interest rate increases next year will hold back investment and spending. The Reserve Bank of Australia (“RBA”) has already expressed concern about the Australian economy exceeding its speed limit i.e. productivity is so poor than any growth will push up inflation. The current annual growth rate at 2.00% is not high by Australian standards, however the RBA are worried about the implications for inflation. The financial markets in Australia did a rapid U-turn on interest rates two weeks ago when the CPI inflation rate for October came in at a higher than forecast 3.80% (annual headline rate). The money markets are now pricing-in interest rate hikes by the RBA next year.

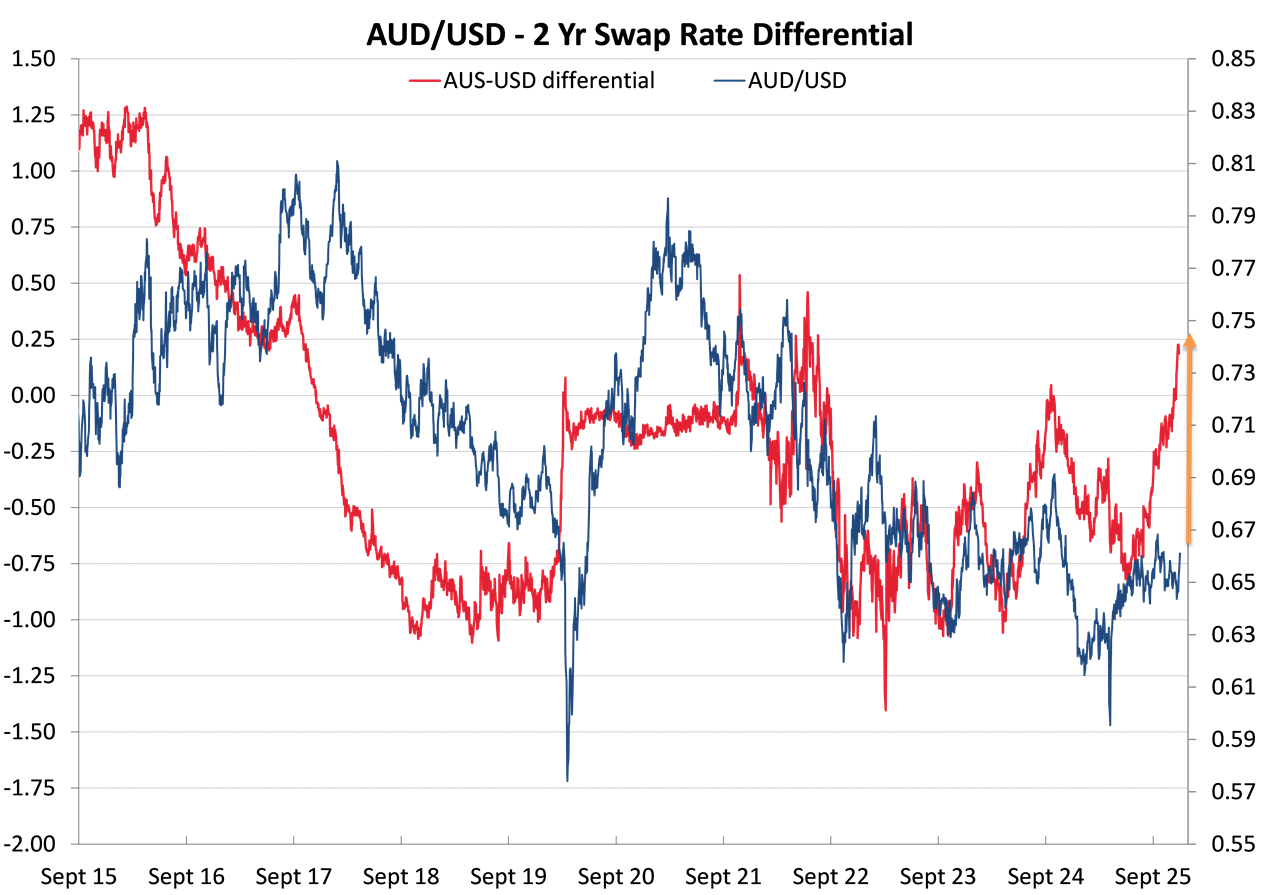

Over recent weeks, the Australian two-year swap interest rate has moved sharply higher, jumping up from 3.30% to 3.80%. As a consequence, the interest rate differential to US tw0-year interest rates has rapidly closed up from Aussie rates being 0.50% below the US rates back in August, to now being 0.20% above the US Rates (3.80% verses 3.60%). Interest rate differentials, especially the change in interest rate differentials, is one of the most powerful drivers of currency movements. Up until last week it appears that the Australian dollar was not responding to the positive change in interest rate gap, however the global FX markets are now responding with interest to buy the Aussie dollar increasing.

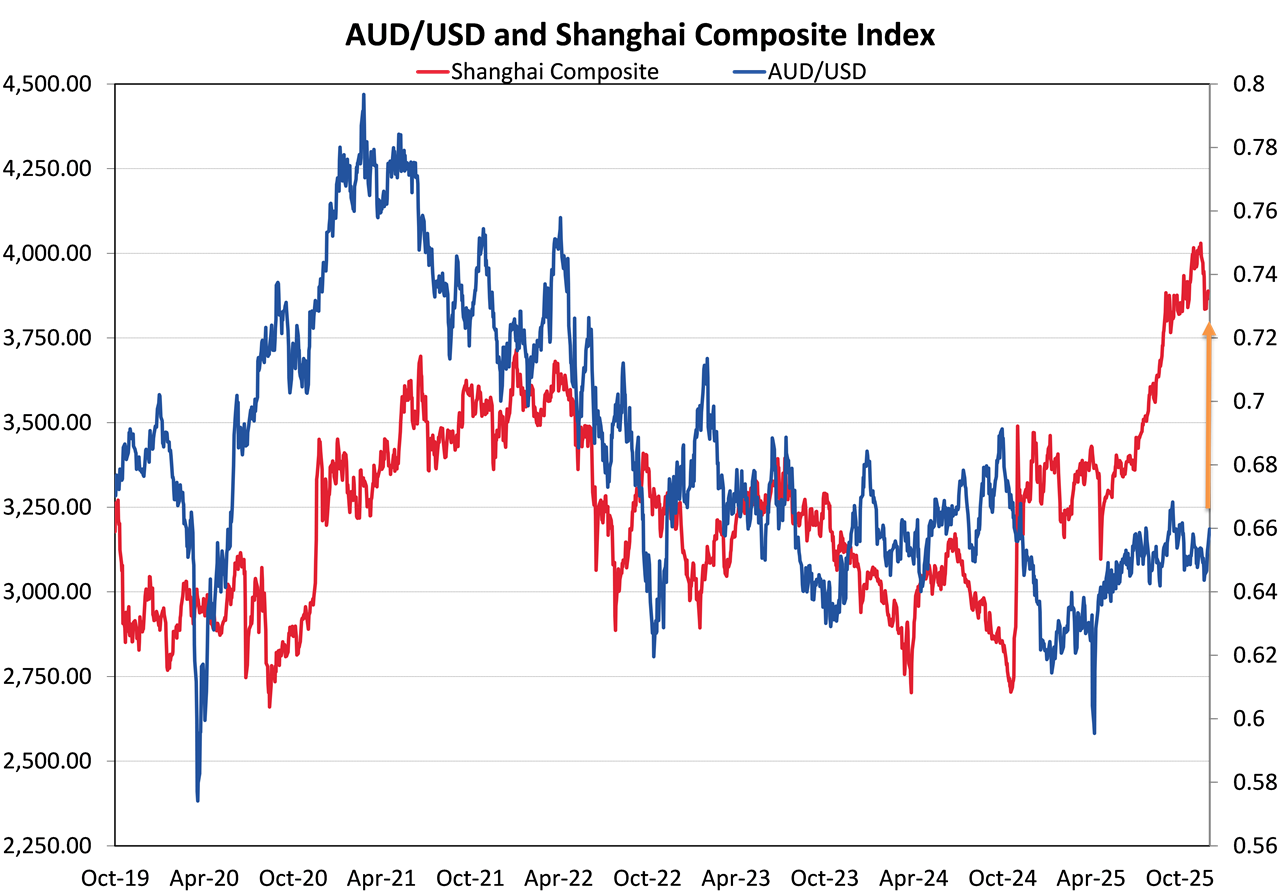

What has been seen as holding the Aussie dollar back from the expected appreciation is the strong linkage to the Chinese economy. Whilst Chinese economic news/data has been more across the page over recent months, their share markets have made strong gains this year. The AUD is traded as a proxy currency for all things China, the chart below suggests it has some catching up to do.

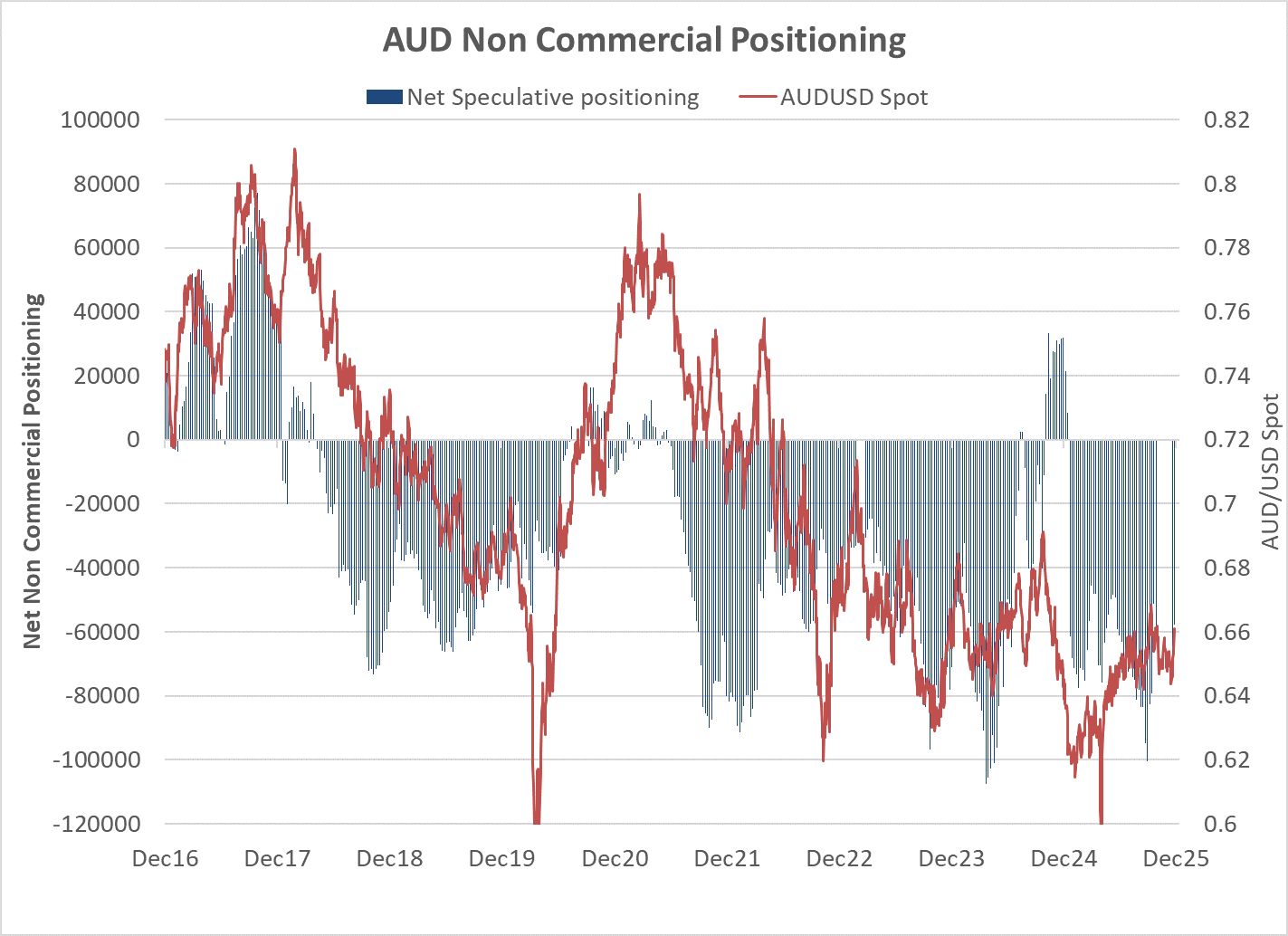

Speculative currency positioning in the Australian dollar (refer to the chart above) has been consistently short-sold the AUD against the USD for the last two years as Australian interest rates were below the US and the punters received the forward points advantage. That interest rate gap has now dramatically changed and already the number of futures contracts short-sold the AUD has reduced from 100,000 to 60,000. As the Australian dollar appreciates, instead of the expected depreciation by the speculators, additional AUD buying is inevitable.

The Aussie dollar has been a serial under-performer over recent years as global trader and investor interest dropped away. However, that situation has now changing and the prospect of Australian interest rate increases next year is the polar opposite to interest rate cuts in the US. The interest rate differential has shifted from a negative for the AUD to a massive positive (first chart below).

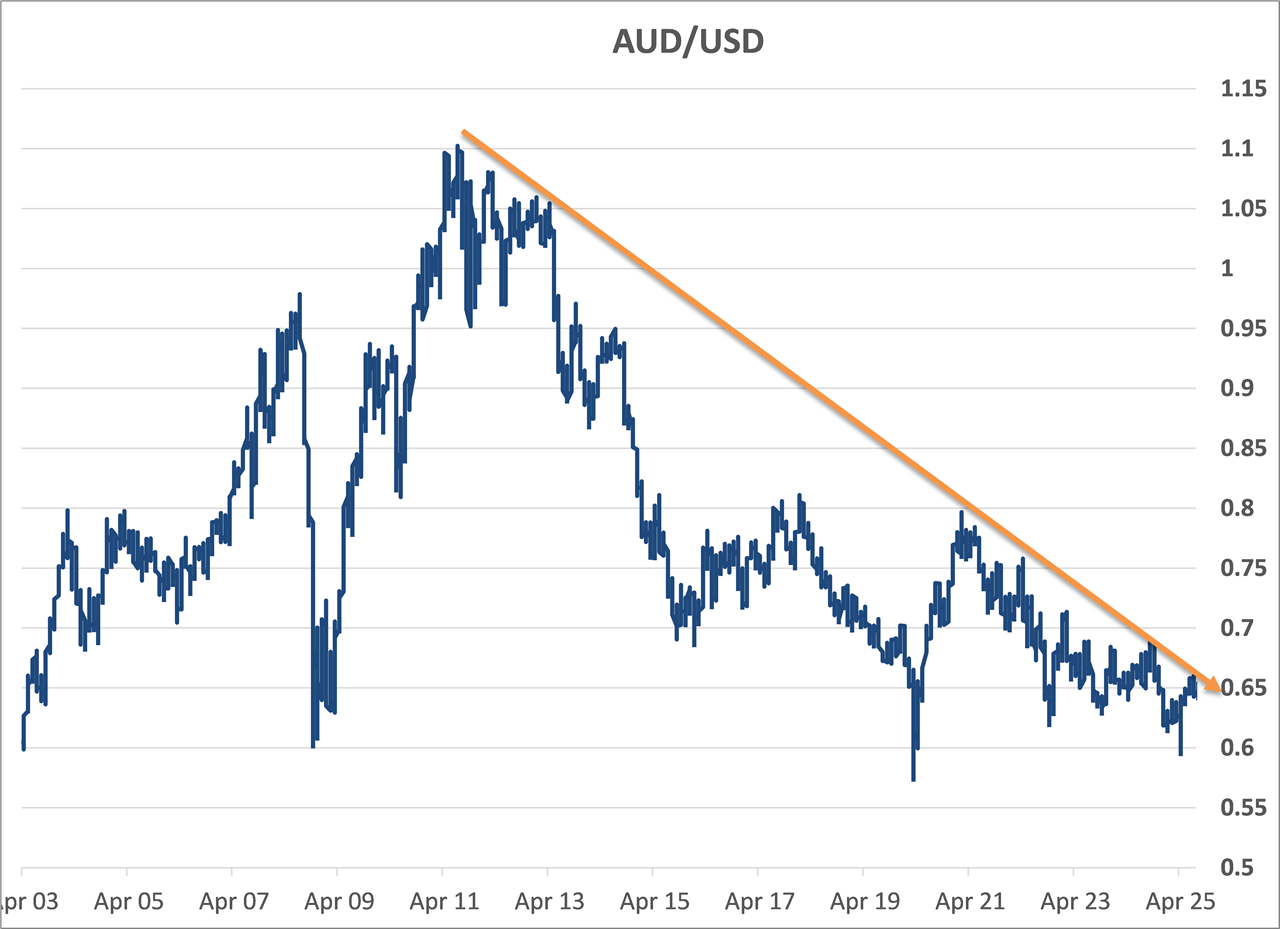

On all measures, the Aussie dollar appears to be on the cusp of major gains to well over 0.7000 against the USD. The second chart below indicates that the AUD/USD exchange rate is poised to break above the downtrend line that the AUD has been below for more than 10 years. The New Zealand dollar does generally follow the Aussie dollar, albeit over recent months the Kiwi has underperformed the Aussie as we cut interest rate aggressively. The sharply lower NZD/AUD cross rate to 0.8700 has been the result. A major four cents plus appreciation by the Australian dollar over coming weeks/months looks likely to pull the NZD/USD exchange rate to back above 0.6000.

Imminent Federal Reserve Chairman-Elect announcement negative for the US dollar

Bookmakers in the US appear super confident that Trump’s current economic advisor, Kevin Hassett will be appointed to be the next Chairman of the Federal Reserve. Current Chair, Jerome Powell does not have his term end until May 2026, however an early announcement of his replacement is widely expected as President Trump exerts his political influence over the Fed. The Polymarket betting site’s odds of Kevin Hassett being nominated increased from 30% in November to 73% last week.

Kevin Hassett is currently Trump’s National Economic Council director, and he has been a vocal proponent of interest rate cuts, and he has even suggested that he would support slashing interest rate aggressively. A career economist, Kevin Hasset was Trump’s key coordinator on economic policy in Trump’s first term as President. Before his stints in the White House, Hassett was an economist at the American Enterprise Institute, a conservative think tank, where he published extensively on tax and trade policy.

Investors around the world are not that thrilled that a close Trump ally could lead the central bank. If an announcement on Hassett’s appointment is made before the end of the year, he becomes the Fed Chairman-Elect, and the media and markets will become totally focused on his views and not those of Jerome Powell. The appointment is clearly another negative factor for the US dollar value as global investors/fund managers lose confidence in the independence of the Federal Reserve. Just another reason to “sell America” as the Trump autocracy manipulates everything for perceived political gain.

It should be remembered that the Chairman of the Federal Reserve just has one of 12 votes in the Federal open Market Committee that decides on interest rates. Mr Hasset may have trouble convincing some of the more “hawkish” members of the committee to agree to his aggressive cuts.

In any case, the Fed will be cutting interest rates by 0.25% this coming Thursday morning with the focus being on their accompanying commentary as to the possibility of further cuts in 2026. The trade-off between softer employment and inflation being above their 2.00% target will also be under close scrutiny as the markets seek pointers on how quickly the Fed intend to reduce interest rates from 3.75% to 3.00%.

Whilst US inflation has moved up on import tariffs; it has not increased as much as most expected back in April when Trump first announced his tariff policy. Off course, much has been watered down since that time and declining services inflation is offsetting the increased goods inflation.

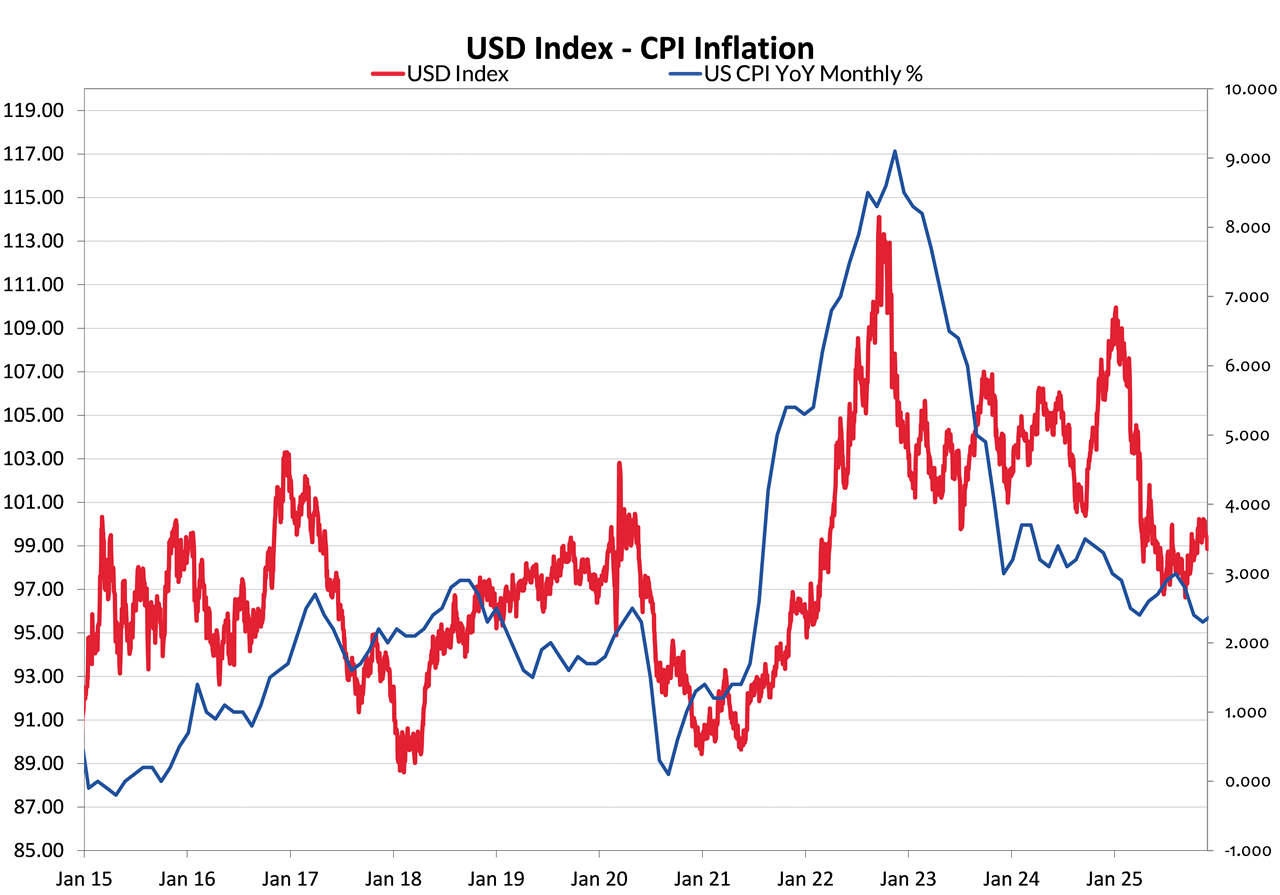

The USD Dixy Index traded above and below 95.00 through the 2015 to 2020 years of 2.00% inflation. The USD Index became elevated over recent years as interest rates were shoved up by the Fed in 2022. That is now changing as interest rates are cut.

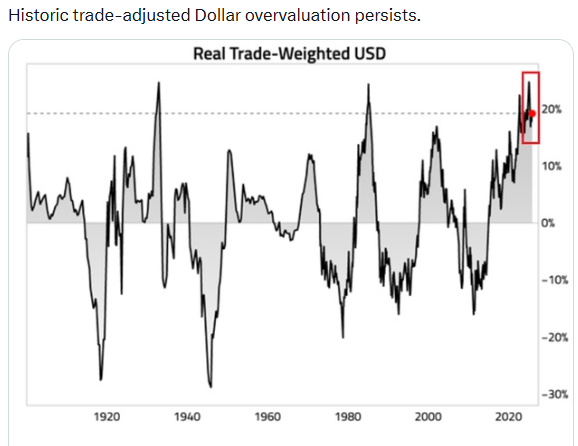

The second chart below indicates that the “real” (inflation adjusted) value of the US dollar is trading nearest its highest level in 40 years. The Inflation-Adjusted Broad Dollar Index is against 26 currencies based on relative competitiveness with trading partners. The Broad Index is now 20% above its long-term average. Investors around the world, as well as the Trump administration, are now realising that the US economy needs a lower currency value if their exporters are to remain globally competitive. Lower US interest rates, disinvestment from the US and reducing geo-political risks all still point to a lower US dollar value over coming years.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.