By Gareth Vaughan

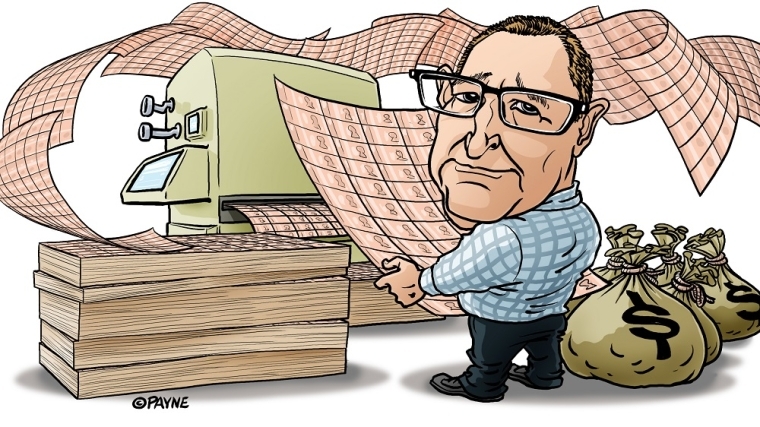

The cost of the Reserve Bank's buy-up of government bonds during its 2020-2021 quantitative easing (QE) programme has come into focus as interest rates have risen.

Notably the balances of exchange settlement accounts held by banks and others with the Reserve Bank soared as the central bank bought government and local government bonds off banks in the secondary market, peaking at $56.4 billion last December after averaging about $7.5 billion in the decade up to 2020.

Holders of the settlement accounts receive interest on their deposits at the Official Cash Rate (OCR), which has risen to 5.25% since the 0.25% Covid low.

Treasury says its best estimate of the expected direct fiscal loss from the Reserve Bank's QE, its so-called Large Scale Asset Purchase (LSAP) programme, is about $10.5 billion. It notes this has been partially offset by the fiscal benefits of the LSAP through stabilising the NZ government bond market and providing economic stimulus at a time of heightened uncertainty in 2020.

From a whole-of-government perspective Treasury says the LSAP withdrew fixed-rate government bonds from the market and replaced them with floating-rate settlement cash balances. This means the Crown has more floating rate liabilities, becoming more exposed than it would have been to rising interest costs.

In the latest episode of interest.co.nz's Of Interest podcast Paul Tucker, former deputy governor of the Bank of England and now a research fellow at the Harvard Kennedy School, speaks about the impact of QE on the public finances. Tucker's also the author of a recent paper called Quantitative easing, monetary policy implementation and the public finances.

"This has turned out to be a bad thing in many countries specifically because of how low world interest rates were during 2020 and 2021. Although it was essential for governments to protect families and protect small firms from the ravages of Covid and economic lockdown during 2020 and 2021, they would actually have done better to finance that by borrowing in the markets because long-term interest rates were remarkably low for states with a good credit rating, which includes my own and includes yours," says Tucker.

"Instead they exposed themselves to the path of short-term central banking interest rates."

Speaking to interest.co.nz on Thursday, BNZ Chief Financial Officer (CFO) Peter MacGillivray said BNZ currently has about $10 billion in its settlement account. And on Friday ANZ NZ CFO Amanda Owen said her bank's settlement account balance would be bigger than BNZ's.

Asked whether receiving interest at the OCR would now be lucrative for settlement account holders Tucker says; "Broadly yes. It depends on whether they pass it on to their customers. The banks are sitting on this large pile of cash with the central banks and suddenly that's paying a healthier rate of interest."

You can find all episodes of the Of Interest podcast here.

20 Comments

It's even more lucrative for the banks because they are not passing it on to the customers. How to run an economy into the ground by short-term self-interest again from the banks.

Hold on something is not right a finance minster called Grant Robinson stated at the peak that the Q/E wasn't going to cost NZ anything and that we were all Fwits for thinking that and he knew best. [ Irrelevant and unnecessary insult removed. You can make a point without making very low personal insults. Ed ]

"expected direct fiscal loss from the Reserve Bank's QE, its so-called Large Scale Asset Purchase (LSAP) programme, is about $10.5 billion"

Just one more reason the RBNZ should be sacked.

The frightening thing to me is that there are no safeguards to stop central banks making the same mistake again, nor will they own that mistake. We're left completely exposed.

Was it a mistake?

It appears there is a growing consensus that the RBNZ has made a massive error.

The best and only safeguard is to eliminate the 'Lender of Last Resort'. Only then will banks become responsible. Then we can let banks fail. Supply and demand.

No matter which way we look at it, we are reminded that "More Debt" isn't the answer. Who 'owns' it or where it's parked isn't really the problem. It's that we have an unserviceable amount of Private and Public Debt on our hands, and until that shrinks, we are just in a self-perpetuating destruction mode.

Shrinking Debt is the last, painful option we have. Yet here we are.

There can only be more debt, thats how a debt based fiat monetary system works...until it doesn't.

https://fred.stlouisfed.org/graph/fredgraph.png?g=13gzr

You can see LSAP impact on this M3 nzd chart from St. Louis Fed.

So, in a nutshell ....

1. The NZ Government borrowed at very low interest rates to throw money around to support NZ'ers during COVID. This was the right thing to do.

2. The RBNZ used extremely loose monitory policy (LSAPP FfLP, Near Zero OCR, removal of prudential tools, etc.) to create asset bubbles and now has a massive amount of interest to pay. This was the not the right thing to do.

Many of us would argue the NZ Government was already doing enough. But the RBNZ decided to play god and threw even more more - expensive money - into the fire pit.

These Masters of the Universe (Enron reference) at the RBNZ have much to answer for. I would shed no tears should they decide to fall on their swords.

Add in 3./ They knew the potential outcome of their decisions and failed to take appropriate action in a timely manner to correct it. Cue FLP running it's full course. What did they think the banks would do if they could make money for nothing? It's like giving a 5 year old $10000 and telling them they can spend it on whatever they want whenever they want and expecting them to save most of it.

The RBNZ used QE & other tools to create asset bubbles and now has a massive amount of interest to pay. This was the not the right thing to do...h

That's debatable.!

Did RBNZ LSAP caused asset price inflation? Technically not, I guess.

But the narrative send signals to market and banks started to turn on money creation tap mainly (or only) for mortgages. Banks created $250billion+ mortgages in that 2-3 years. I doubt if 50billion LSAP has any role in that.. bonds could could be used as collateral for fund transfer between banks anyways.

As mentioned the LSAP was done to stabilize bond market..

Like GR, I am also not a banker or economist :-). So happy and keen to get corrected

Economist Silvana Tenreyro of the Bank of England gave a speech were she stated,

"QE is an asset swap: it does not create new private-sector assets, which is how some may understand ‘money printing’ descriptions. Nor does it involve spending money in the sense that fiscal policy does. No private-sector banks, firms, households or governments end up with higher net worth from QE transactions themselves. QE affects the economy only to the extent it affects interest rates. There is no separate ‘money’ channel that can unleash inflation".

https://www.bankofengland.co.uk/-/media/boe/files/speech/2023/april/qua…

We also have this from Standard and Poor's,

"Many talk as if banks can "lend out" their reserves, raising concerns that massive excess reserves created by QE could fuel runaway credit creation and inflation in the future. But banks cannot lend their reserves directly to commercial borrowers, so this concern is misplaced".

https://www.hks.harvard.edu/sites/default/files/centers/mrcbg/programs/…

When the "lender of last resort" (RBNZ) wades into the market to "stabilize" it (your words) ... while at the same time throws cheap money (FfLP) ... while reducing the cost of borrowing to "only the retails bank's margin" (OCR at 0.25%) ... while removing prudential lending controls (LVRs) ... the message to the retail banks is clear.

Time to change the title 'lender of last resort' , same way as calling the old 'Reserve' accounts at RBNZ as 'ESAS' accounts ( Exchange Settlement Account System)

while reducing the cost of borrowing to "only the retails bank's margin" (OCR at 0.25%)

And also 'cost of borrowing' is technically incorrect - its the cost of 'exchange' between banks . 'cost of borrowing' will give the impression that banks borrow from RBNZ and lend out to mortgages by adding retail banks' margin.

But yeah - the 'guidance' in the RBNZ tone and removing LVRs gave the freedom to the retail banks to expand their mortgage assets . I was just saying LSAP did not have an impact on asset inflation . LSAP is just an asset swap .

The government doesn't borrow to spend as it is borrowing back its own currency and so it has to spend first first before it can borrow. Spending creates new central bank reserves and issuing bonds reduces these reserves again, while QE changes the bonds back into reserves again.

Economist L.Randall Wray, Understanding Modern Money: How a sovereign currency works, https://www.levyinstitute.org/pubs/Wray_Understanding_Modern.pdf

I've edited it slightly to remove the reference to QE.

The easiest way to describe QE is as follows: The central bank (or proxy of) enters the fixed interest securities (bond) market and buys up the bonds at higher prices than other other market participates, thereby causing the bond's yield to fall which has a flow on affect to all other interest rates settings, e.g. residential mortgages. It obviously has other affects too in that the seller of the bond now has cash whereas before they had an illiquid bond.

Are bonds illiquid? They can be bought and sold like any other asset. The bondholder purchased the bond because it was a safe asset and so is not likely to speculate with the money and so they may do no more than leave the money as a bank deposit and the banks themselves can't lend or spend the reserves created.

Standard and Poor's believes that QEs effects are modest, they say,

the ability of QE to lead to credit creation that otherwise would not have occurred being severely limited, one should not put much store in monetary policy's stimulatory potential in a deleveraging environment once the central bank has cut the policy rate to or near to zero and still needs to ease policy more. That is not to say central banks should not use QE. It is to say that expectations for how effective a policy tool it can be should be appropriately modest, and therefore due consideration should be given to using fiscal policy more actively and aggressively to calibrate overall macro policy to the required stimulatory level.

The government doesn't create money. The RBNZ does. An important distinction. There is separation of state and money issuance for very good reason - things don't turn out so well when government issues tons of currency. It doesn't do wonders for your exchange rate either.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.