Last December, I argued that while some of US President Donald Trump’s policies would be stagflationary (reducing growth and raising inflation), such effects would ultimately be mitigated by four factors: market discipline, an independent US Federal Reserve, the president’s own advisers, and the Republicans’ thin majorities in Congress.

The script has played out as predicted. The reaction from stock, bond, credit, and currency markets forced Trump not only to back down from his “reciprocal” tariffs against most of America’s trading partners, but also to beg China to sit down and negotiate. In the game of chicken between Trump and Chinese President Xi Jinping, Trump lost. Market traders trumped the tariffs, and bond vigilantes proved more powerful even than the US president – just as the political strategist James Carville observed a quarter-century ago.

Then came the game of chicken with Fed Chair Jerome Powell. Again, Trump was the first to blink – at least for now. Markets swooned when he suggested that he would fire Powell, and he soon backpedaled, declaring that he has “no intention” of doing so. Meanwhile, Powell has made clear that the president has no lawful authority to remove him.

Similarly, while lunatics like Peter Navarro, Trump’s main trade adviser, initially gained the upper hand – appealing to Trump’s self-image as “Tariff Man” – this did not last. Once markets stumbled, those advocating an “escalate to de-escalate” tariff strategy, such as Treasury Secretary Scott Bessent and Stephen Miran, the chair of the Council of Economic Advisers (a former colleague of mine), seemed to prevail.

Finally, some congressional Republicans have come out in support of legislation to limit the president’s authority to impose tariffs, and many other political players – from state governors and attorneys general to business groups – are suing the administration for what they describe as an unlawful overreach.

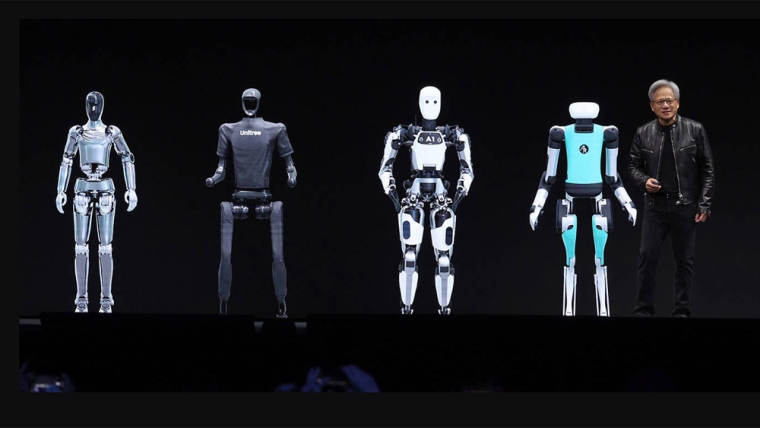

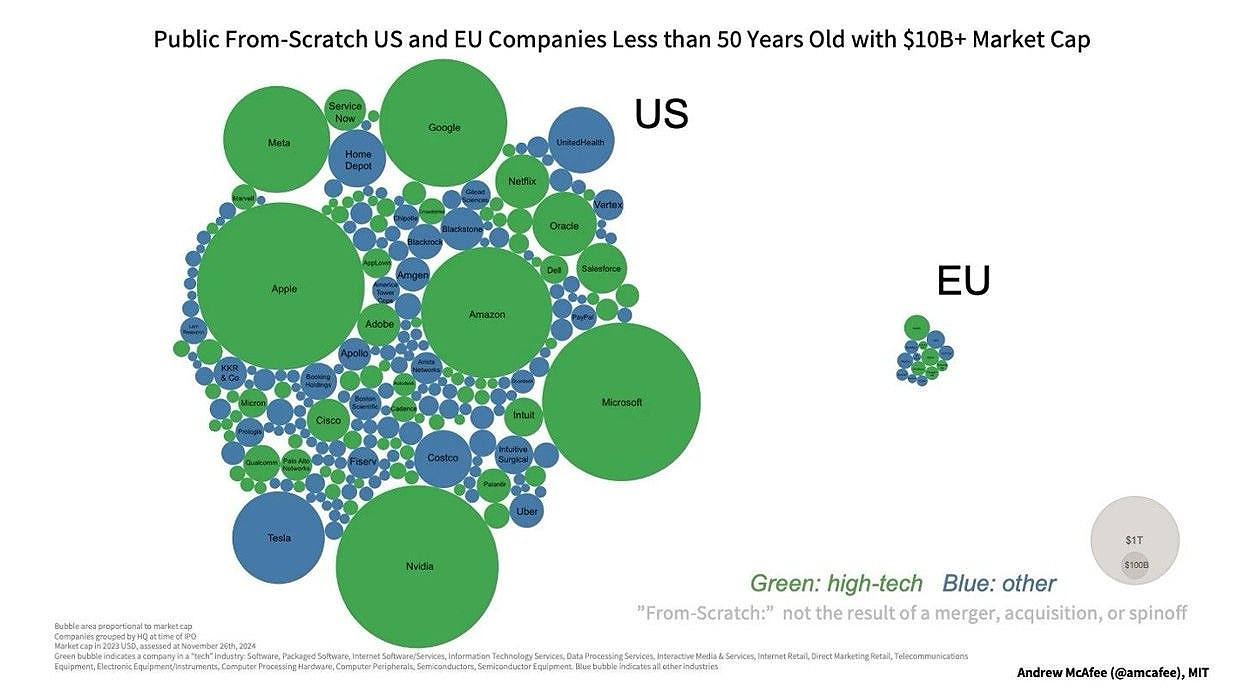

Beyond these four guardrails, there is also the technology factor. The US economy’s potential growth will approach 4% by 2030, far above the International Monetary Fund’s recent estimate of 1.8%. The reason is obvious: America is the world leader in ten of the 12 industries that will define the future, with China leading in only electric vehicles and other green tech. US growth averaged 2.8% in 2023-24, and productivity growth has averaged 1.9% since 2019, despite the pandemic-era dip.

Since the launch of ChatGPT in late 2022 – something I predicted in my 2022 book, Megathreats – AI-related investments have driven a US capital-expenditures boom. Even tariffs and the resulting uncertainty have not fundamentally changed the guidance from most big tech firms, AI hyper-scalers, and others. Many are even doubling down on AI investments.

If growth goes from 2% to 4% because of technology, that is a 200-basis-point boost to potential growth. Yet even draconian trade protections and migration restrictions would reduce potential growth by only 50 bps at most. That is a four-to-one ratio between positives and negatives; technology would trump the tariffs over the medium term.

As I recently argued elsewhere, even if Mickey Mouse were president, the US would still be on the way to 4% growth, because US private-sector innovation promises to offset bad policies and erratic policymaking.

The AI-driven investment boom also implies that, with or without high tariffs, the US current-account deficit will remain high and on an upward trajectory (reflecting the difference between sluggish savings and booming investment). But since America’s exceptional growth will survive Trump, portfolio inflows will continue despite the trade-policy noise. Although fixed-income investors may pull out of US assets and the dollar, equity investors will remain overweight on US assets, perhaps even doubling down. Any substantial weakening of the dollar will be gradual, and the greenback will not suddenly lose its role as the global reserve currency.

Over time, higher growth, combined with existing redistribution policies, will weaken populist forces in the US. Meanwhile, Europe will continue to face the headwinds of demographic aging, energy dependence, an overreliance on Chinese markets, weak domestic innovation, and stagnant growth hovering around 1%. The 50-year innovation gap between America and Europe will only widen as AI-driven growth moves from logarithmic to exponential.

In this context, hard-right populist parties may well take over in most of Europe, as they already have done in some countries. With the US apparently drifting toward illiberalism, Europe might currently look like the world’s last bastion of liberal democracy; but this narrative could be flipped over the medium term.

Such an inversion becomes more likely if Europeans continue to ignore the recommendations by former Italian Prime Ministers Enrico Letta and Mario Draghi. In his report on European competitiveness last year, Draghi pointed out that inter-EU tariffs on goods and services are much higher than the ones Trump has threatened. One silver lining to Trump’s bullying is that it could force Europe to wake up.

To be sure, US inflation will surge above 4% this year. Trade deals with most countries will limit the tariff rate to an undesirable but manageable 10-15% level, and a likely de-escalation with China will leave that rate at around 60%, on average, driving a gradual decoupling of the two economies. The ensuing shock to real (inflation-adjusted) disposable incomes will stall growth by the fourth quarter of this year, perhaps leading to a shallow US recession that will last for a couple of quarters.

But a Fed that remains credibly committed to anchoring inflation expectations will be able to cut rates once growth stalls, and a modest rise in the unemployment rate will weaken inflation. By the middle of 2026, US growth will be experiencing a strong recovery, but Trump will have been damaged politically, auguring a loss for his party in the midterm elections. Fears of the US descending into autocracy will be alleviated. American democracy will survive the Trump shock, and, after an initial period of pain, the US economy will thrive.

*Nouriel Roubini, Professor Emeritus of Economics at New York University’s Stern School of Business, is Chief Economist at Atlas Capital Team and the author of Megathreats: Ten Dangerous Trends That Imperil Our Future, and How to Survive Them (Little, Brown and Company, 2022). Copyright: Project Syndicate, 2025, published here with permission.

9 Comments

Things tend not to turn out as bad or as good as expected. We muddle through and carry on.

Not this time.

Humanity is bumping up against the global Limits to Growth. And at 8 billion, our species is 6-7 billion overshot.

And the writer is energy/resource blind. Meaning the piece is ..... misguided.

You know it's bad when the economist known as Dr Doom is deemed optimistic

Chuckle.

But at the end of the day, their perceived status is dependent on the system continuing.

Hence this puff-piece.

That's going to go for literally anything published that's not promoting the end of the world as we know it though.

Of which there's plenty of resources, if one wanted to comment on those.

Yes, an interesting label. It sure does sound like that.

For starters in his list of mitigating factors;

such effects would ultimately be mitigated by four factors: market discipline, an independent US Federal Reserve, the president’s own advisers, and the Republicans’ thin majorities in Congress.

He misses out on the Courts altogether, which are the ones blocking the majority of Trump's authoritarian excesses.

https://www.justsecurity.org/107087/tracker-litigation-legal-challenges…

But more importantly, there is no discussion of the effects of the new tax package if it gets through. Debt ceiling raised means more borrowing - means more exposure to bond vigilantes - or more specifically sovereign bond holder vigilantes.

A total guess, but I think Mark Carney has the gravitas to lead a multinational effort of inflicting further strategically-timed pain. He's at the White House tomorrow - I'm guessing he won't be attending a fire-side PR chat after the meeting.

The Europeans are about to snaffle US scientists - a reversal of 1945, and a very meaningful one.

The US is headed for irrelevancy and failed-statehood. Probably always was...

And engineers, I suspect. Although Canada will be another choice for them.

This segment in the first sentence you highlighted is utterly delusional, and immediately highlighted this as another blatant Republican puff piece, as somebody else pointed out, Kate...

"... such effects would ultimately be mitigated by four factors: market discipline, an independent US Federal Reserve, the president’s own advisers, and the Republicans’ thin majorities in Congress..."

#1 What "market disciplines" - what a joke.

#2 The Fed is 100% owned by a cartel of thieving private bankers - you would have to reside under a rock to claim that it is independent.

#3 The President's advisers exist in a delusional cuckoo land - there is no mitigation emanating from them - quite the reverse

#4 The Republican majorities in Congress mean that Trump gets away with murder with his Executive Orders because the Rs in there are too scared of him to cross the floor and call him out on his criminal behaviour.

It is a constitutional crime to set tariffs (except in the case where a state of war has been declared by Congress) or to go to war for that matter, without the approval of Congress.

The separation of powers as you point out, Kate, in the case of the judicial have been breached, just as they have with most of this torrent of illegal EOs.

Decisions regarding the setting of Tariffs and waging wars were supposed to be the jurisdiction of Congress (the legislative branch) for good reason - to restrict the power of a deranged head of the executive branch of government (the President) to unilaterally place the entire country in strife.

Trump loves tariffs because, unlike most taxes, the income they generate goes directly into the treasury revenue account where Congress has zero jurisdicton over how it is spent - this way he gets to blow it without congressional oversight.

Trump knows that his majorities in Congress are tenuous and that even a few R who cross the floor to challenge his carrying out of these constitutionally illegal EOs, would severely hamper his dictatorial behaviour.

All the indications are that this admin is preparing for another $10 trillion of disguised money printing, along with the biggest wealth heist from the working class in 249 years.

This oaf is operating in a complete detachment from reality - he and his appointed sycophantic courtiers have bypassed all of the constitutional safeguards that were put in place to avoid the repercussions of an unhinged nutjob becoming POTUS.

Mainstreet is beginning to realise that they have been duped into voting in a lunatic who is setting the stage for, not just an obscene wealth transfer, but a complete reset of the dollar.

If his grand plan is successful the central planners and technofeudalists that Trump has installed in the executive, will have complete control over every single aspect of the working classes and beneficiaries' lives.

The pitchforks will be unleashed as it dawns on America that they have been duped....... again.

YCHMTSU

Col

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.