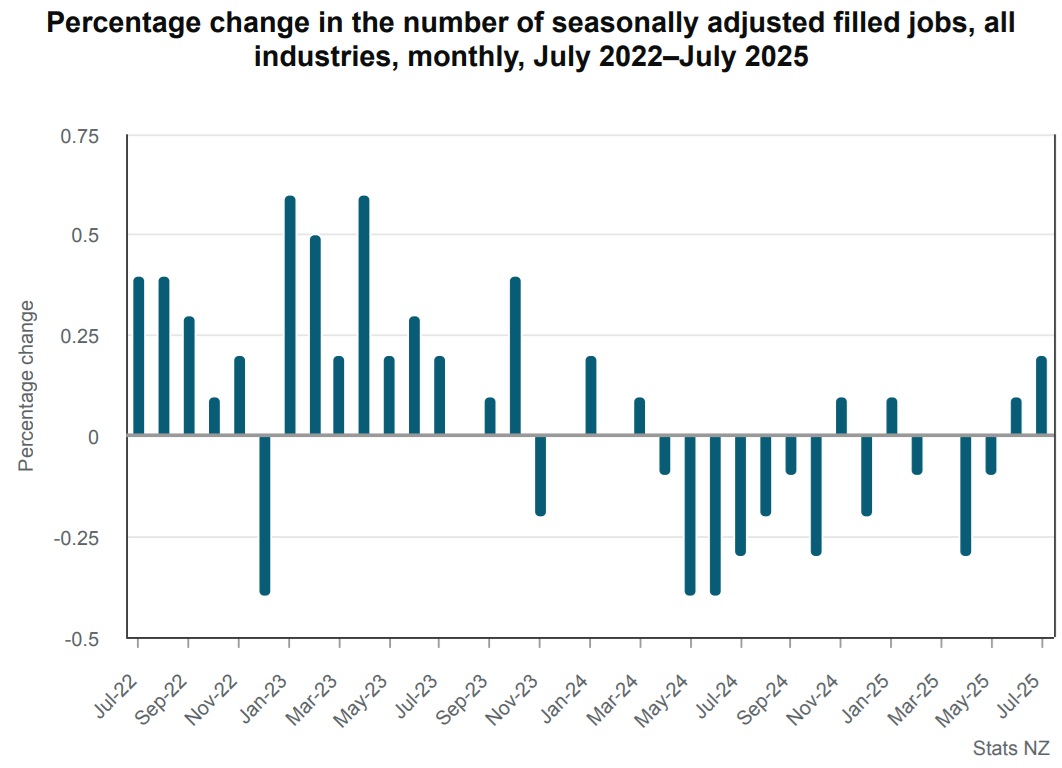

It's very early days - but the jobs market may be turning for the better.

The latest figures from Statistics NZ's Monthly Employment Indicators (MEI) show that in July there was a seasonally-adjusted 0.2% rise in filled jobs, following on from a 0.1% rise in June.

That's the first time we've seen consecutive monthly gains in nearly two years.

We have to be cautious with this data, since in recent times the monthly figures have almost invariably been revised down. However, the June figure, which was initially announced as a 0.1% rise - is still showing as a 0.1% rise.

The MEI figures are not directly comparable with the official unemployment figures as they are sourced quite differently - coming from Inland Revenue data - but they have tended to be quite a good indicator of future trends.

The official unemployment figures for the June quarter came out on August 6 and showed the rate of unemployment rising to 5.2% from 5.1%. The Reserve Bank (RBNZ) thinks it will go higher, to 5.3% in the quarter we are now in.

Last week the RBNZ lowered the Official Cash Rate to 3.00% from 3.25% and strongly signalled it would likely drop it to 2.5% before the end of the year in order to provide some stimulus for the economy to recover, after an apparent stall in the June quarter.

The RBNZ will be watching closely for any upturn in the labour market, which in economic turns is often referred to as a 'lagging indicator', - in the current circumstances meaning that unemployment would still be rising when the economy is actually starting to pick up.

Stats NZ said highlights of the job figures in July, compared (seasonally-adjusted) with the June 2025 month, were:

- all industries – up 0.2% (5,503 jobs) to 2.35 million filled jobs

- primary industries – up 0.5% (532 jobs)

- goods-producing industries – down 0.1% (470 jobs)

- service industries – up 0.3% (5,293 jobs).

The rise in primary industries again highlights the strength in the primary sector at the moment, with high dairy and meat prices, but the rise for the service industries - which have been struggling - will be seen as encouraging. It follows a 0.2% rise for service industries in June.

In terms of the actual monthly figures, in July 2025 compared with July 2024, there were 2.33 million actual filled jobs, down 18,316 jobs (0.8%).

By industry, the largest changes in the number of filled jobs compared with July 2024 were in:

- construction – down 5.6% (11,276 jobs)

- manufacturing – down 2.3% (5,427 jobs)

- administrative and support services – down 4.6% (4,562 jobs)

- education and training – up 2.0% (4,181 jobs)

- health care and social assistance – up 1.3% (3,610 jobs).

By region, the largest changes in the number of filled jobs compared with July 2024 were in:

- Auckland – down 1.5% (11,664 jobs)

- Wellington – down 1.6% (4,152 jobs)

- Manawatū-Whanganui – down 1.5% (1,679 jobs)

- Canterbury – up 0.5% (1,600 jobs)

- Hawke’s Bay – down 1.0% (830 jobs).

By age group, the largest changes in the number of filled jobs compared with July 2024 were in:

- 15 to 19 years – down 8.5% (10,284 jobs)

- 25 to 29 years – down 3.4% (8,660 jobs)

- 30 to 34 years – down 2.5% (7,282 jobs)

- 20 to 24 years – down 3.2% (6,871 jobs)

- 35 to 39 years – up 2.2% (5,923 jobs).

4 Comments

It certainly has a feel of green shoots about the place. A couple more OCR cuts roughly pencilled in to boot. As it warms up fruit and veges will get cheaper. Nicer weather.

Given the current earnings reports from NZ business are we likely to see ongoing spending cuts and job losses over the next few months? As firms look to protect margin and return to profit.

Or have these firms already done all their restructuring and are now moving forward and looking to hire again? Not sure - we'll have to wait for Q3 numbers.

We're nowhere near peak unemployment yet. The worst is still ahead

I am hearing positive signs for some small business but I think bigger corporations will be told be head office to cut staff yet

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.