US President Donald Trump’s new National Security Strategy offers a misguided assessment of Europe, long regarded as America’s most reliable ally. Unrestrained immigration and other policies derided by administration officials as “woke,” it warns, could lead to “civilizational erasure” within a few decades.

That argument rests on a fundamental misreading of Europe’s current predicament. While the European Union does face an existential threat, it has little to do with immigration or cultural politics. In fact, the share of foreign-born residents in the United States is slightly higher than in Europe.

The real threat facing Europe lies in its own economic and technological backwardness. Between 2008 and 2023, GDP rose by 87% in the US, compared to just 13.5% in the EU. Over the same period, the EU’s GDP per capita fell from 76.5% of the US level to 50%. Even the poorest US state – Mississippi – has a higher per capita income than that of several major European economies, including France, Italy, and the EU average.

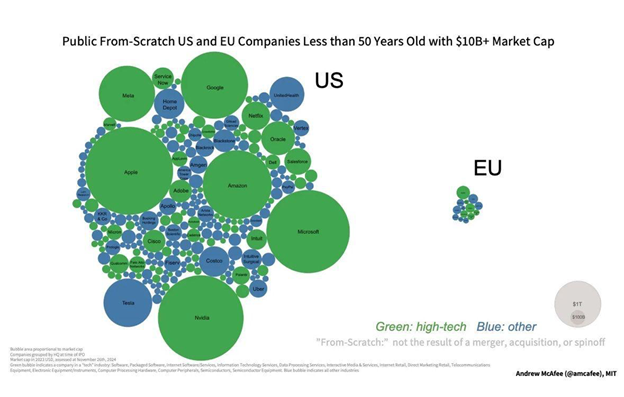

This widening economic gap cannot be explained by demographics. Instead, it reflects stronger productivity growth in the US, largely owing to technological innovation and higher total factor productivity. Today, roughly half of the world’s 50 largest technology firms are American, while only four are European. Over the past five decades, 241 US firms have grown from startups into companies with market capitalizations of at least $10 billion, compared with just 14 in Europe.

These trends raise a critical question: Which countries will lead the industries of the future, and where does Europe fit in? The race for technological leadership now spans a wide range of fields, including AI and machine learning, semiconductor design and production, robotics, quantum computing, fusion energy, fintech, and defense technologies. Europe enters this race at a clear disadvantage.

Whether the US or China currently leads the industries of the future remains open to debate, but most observers agree that it’s essentially a two-horse race, with America still ahead in several key areas. Beyond that, innovation is concentrated in countries like Japan, Taiwan, South Korea, India, and Israel. In Europe, by contrast, innovative activities are largely confined to the United Kingdom, Germany, France, and Switzerland – two of which are not even EU member states.

It is hardly a surprise, then, that while the US and China dominate global technological rankings, Europe finds itself far from the top. And the outlook is anything but reassuring, given that the next wave of innovation is widely expected to be more disruptive than anything we have seen over the past half-century.

The technological gap between the US and Europe can be attributed to several factors. First, the US has a far deeper and more dynamic ecosystem for financing startups, while Europe still lacks a genuine capital markets union, limiting the scale and speed at which new firms can grow.

Second, Europe is hampered by excessive and fragmented regulation. A US startup can launch a product under a single regulatory framework and immediately access a market of more than 330 million consumers. The EU has a population of roughly 450 million but remains divided among 27 national regulatory regimes. An International Monetary Fund analysis shows that internal market barriers in the EU act like a tariff of around 44% for goods and 110% for services – far higher than the tariff levels the US imposes on most imports.

Third, cultural attitudes toward risk-taking differ sharply. Until relatively recently, a failed entrepreneur in some EU countries (like Italy) could face criminal penalties, while in the US, a tech founder who has never failed is often seen as too risk-averse.

Fourth, the US benefits from a deeply integrated academic-military-industrial complex, while Europe’s chronic underinvestment in defense has weakened its innovation capacity. Technological leaders like the US, China, Israel, and, more recently, Ukraine spend heavily on defense, with military research often producing technologies that have civilian applications.

Despite this, many European political leaders continue to frame higher defense spending as a tradeoff between security and social welfare. In reality, free-riding on US defense spending since the end of World War II has limited the type of innovation that could have generated more of both through higher productivity. Paradoxically, sustaining Europe’s social model will require greater investment in defense, beginning with meeting NATO’s new spending target of 3.5% of GDP.

If Europe allows its technological lag to grow over the coming decades, it risks prolonged stagnation and continued economic decline relative to the US and China. There are, however, reasons for cautious optimism. Increasingly aware that Europe faces an existential challenge, policymakers have begun to advance serious reform proposals. The most notable examples are the two major 2024 reports on EU competitiveness and the single market by former Italian prime ministers Mario Draghi and Enrico Letta, respectively.

Europe also retains considerable strengths, including high-quality human capital, excellent education systems, and world-class research institutions. With the right incentives and regulatory reforms, these assets could support much higher levels of commercial innovation. With a better environment for entrepreneurship, Europe’s high per capita income, large internal market, and elevated savings rates could help unleash a wave of investment.

Crucially, even if Europe never leads in cutting-edge technologies, it could still significantly boost productivity by adopting and adapting American and Chinese innovations. Many of these technologies are general-purpose in character, benefiting both adopters and pioneers.

All of this leaves Europe at an inflection point. As Ernest Hemingway famously observed, bankruptcy happens “gradually and then suddenly.” So far, Europe’s technological decline has been gradual. But if it fails to confront its structural weaknesses, today’s slow erosion could give way to a sudden and irreversible loss of economic relevance.

*Nouriel Roubini, Professor Emeritus of Economics at New York University’s Stern School of Business, is Chief Economist at Atlas Capital Team and the author of Megathreats: Ten Dangerous Trends That Imperil Our Future, and How to Survive Them (Little, Brown and Company, 2022). Copyright: Project Syndicate, 2025, published here with permission.

12 Comments

The USA has not innovated and grown economically sufficiently to generate the wealth to repay 38 trillion dollars of debt.

So go to war and take the resourses of another despot state?

Plenty of despots to chose from.

Whats the point of having the most powerfull military in the world?

- if it not flexed, once in a while.

I recall that pdk was forseeing this some time ago and look, the fleet is outside Venezuela already so it might as well be them.

Trumps not a fan of the narco trafficing that comes out of South America, yet loves the oil!

Two of these issues are partly solved by these interventions in Venezuela.

The US leads by far, in oil/gas field innovation and production efficiency. Its an USA homegrown super skillset. The flagging (yet massive reserve) oil production of Venezuela, can be made great again, by the US oil supermajors.

Maduro could not see and accept the exit and golden parachute he had on offer.....that window is now obviously closed.

Why the invasion of Venezuela I wondered on the sudden news? Perhaps the explanation is the risks to USA dollar and economy described here https://www.youtube.com/watch?v=ZMnLnRkcikw ?

oil (energy)

Frank,

Perhaps it's not just the oil, but the fact that Venezuela has heavy oil which American refineries can process, while much of the oil produced in the US is lighter and is largely exported. My reading suggests that this is also to do with protecting America's status as having the world's reserve currency in the face of increasing competition from the BRIC countries.

It is indeed the oil that the US can refine (and the oil that provides diesel)....and the fact that their own tight oil has plateaued and is set to start declining.

dp

Frank,

Perhaps it's not just the oil, but the fact that Venezuela has heavy oil which American refineries can process, while much of the oil produced in the US is lighter and is largely exported. My reading suggests that this is also to do with protecting America's status as having the world's reserve currency in the face of increasing competition from the BRIC countries.

Fascinating video. Thanks for posting the link.

Can you or anyone else give links to corroborate the points in the video regarding the USA reducing their strategic oil reserves and to Venezuela intending to sell oil to China in Yuan instead of USD?

I'm not saying the video is wrong, but more proof is always preferable.

Edit: There is this from Sky News UK in December :

Why Trump cares about Venezuela’s oil | News UK Video News | Sky News https://share.google/g8BgwyE49HBMoXv0a

I can't corroborate, but find the explanation in the video coherent, rational and an explanation for USA Govt. behaviour, but there are other explanations offered in the media such as an Epstein distraction, and military ones related to China and Russia influence on Venezuela. I doubt that the USA military action is part of any coherent strategy, but rather it makes sense in that the grifters in control likely have enormous numbers of experiences and dedicated concentrated thoughts fostered over decades around how to get enormous amounts of wealth for themselves without producing anything useful, combined with the nationalistic fears that the USA economy will be crushed (38 trillion debt) without the Venezuela oil under their control, with some truly capable back room strategists subtly slipping their plans into the grifters thinking.

Facinating read Nouriel. Especially the below snippet. Thankyou.

"An International Monetary Fund analysis shows that internal market barriers in the EU act like a tariff of around 44% for goods and 110% for services – far higher than the tariff levels the US imposes on most imports."

The EEC, and then the EU were meant to unify and harmonise the regulatory environment in the European Union in everything from trade practices to sausages to nuclear power.

Unfortunately, the regulatory regimes that have resulted are of a mind-altering complexity with endless administrative revisions over definitions and carve-outs, and may actually be harder to navigate than the older local regulations becasue the EU-wide rulings keep being revised.

It's also created a self-perpetuating regulatory industry (although the EU is not alone in that) that seems to have an almost infinite amount of material to try and control, and penalties for making mistakes can be severe.

It's not an appealing environment for innovation and change. Makes you wonder if the abundance agenda has any possibility of finding traction in Europe.

Is the US any different (in essence)....the regulation and tax regime in California is worlds apart from Florida. The problems the EU face are not that dissimilar to the problems of of the US...growth (of output) is stagnant or declining in both.

I'd cite Sausages.

The 27 EU states have been scrapping for literally decades over finding a unified definition of what constitutes a sausage that offends noone.

It's emblematic of the mindset, it's not good for innovation, and we have gone down that path as well.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.