The Budget information document release on Thursday caused a bit of a stir and some excitable commentary. A few points stood out for me, particularly in relation to the ongoing controversy over the cost-of-living payment and its delivery by Inland Revenue.

We already knew Inland Revenue was less than happy to be involved in it, but some of the further documents released shed further light on it. Treasury's recommendation was,

“…if you wish to progress with the payment along the lines of the commission[sic], the Treasury recommends that Inland Revenue be the delivery agency, given they are the agency best placed to deliver such a broad payment in the short term.”

Inland Revenue, on the other hand, didn't want to be involved because,

“…delivering this payment, which is estimated to require around 1,000 staff at its peak for around two months, would have critical operational impacts on Inland Revenue while delivering the current COVID 19 economic supports. The addition of this payment to the portfolio of services that Inland Revenue already delivers would severely compromise Inland Revenue’s already stretched workforce.”

That's quite an admission from Inland Revenue. I guess some of the controversy about accidental overpayments of the cost-of-living payment to ineligible recipients is an assumption that Inland Revenue is highly efficient. In reality once humans are involved then on the precept of “garbage in, garbage out” there were always going to be a few errors involved.

What concerns me about Inland Revenue’s admission, though, is it does seem to point to perhaps the organisation is a little bit too lean and mean after its staff has been cut quite substantially by over 20%. We know it makes extensive use of contractors which as we discussed last year, led to an Employment Court case, which it won, by the way. On the other hand the admission that basically it needs to increase its staff by about 20% to manage something like this points to perhaps Inland Revenue being more stretched than it ought to be in staffing levels.

And that also indirectly does raise some questions about Inland Revenue’s enhanced capability following completion of its Business Transformation project. It is perhaps too simplistic to think that a couple of pushes of buttons is all that was needed to enable the cost-of-living payments to be made. But it does strike me as surprising that Inland Revenue has to devote a thousand staff and additional resources to deliver the payment.

Now, one of the other criticisms that emerged has been made about the payment is that only 1.3 million people have received it so far of the estimated 2.1 million. But in reality, it was known beforehand that all 2.1 million estimated eligible people would not receive a payment straight away. One of the papers notes,

“around 25% of potentially eligible recipients, around 500,000 individuals, will not receive this payment during the proposed August to October window because their assessment for the 2020 122 tax year is not complete”.

The paper goes on to explain that based on tax filing information for the year ended 31st March 2020,

“…around 38% of people who submitted an IR3 did so by the end of July, and 53% by the end of September 2020. Assuming the same pattern for the 2021/22 tax year, Inland Revenue expects there will be a long tail of IR3 filers who would not receive their cost-of-living payment during the proposed payment window.”

The paper notes this will mean Inland Revenue will have “increased contacts” as people will be asking why they haven't received a payment. This will then “have an impact on other services for taxpayers” such as Working for Families.

This is quite a reasonable point. But, of course, politics has intervened. And when you're beating a dog, any old stick will do. So, the Government is copping it for what was obviously something that would have happened in the first place.

The other point that comes across is a wider one around the future sustainability of the tax system. Treasury was pouring a lot of cold water on Ministers’ various spending plans and pointing out the unsustainability of what was being asked for. Treasury warned

“Meeting these new targets consistently will require you to maintain a balance between revenue and expenditure. Over the medium term this would require significantly constraining spending growth, unless your revenue strategy is adjusted to maintain a higher level of tax revenue-to-GDP in later years.”

As the Herald noted, that would mean finding new taxes to leave spending as a share of the economy higher over the long term.

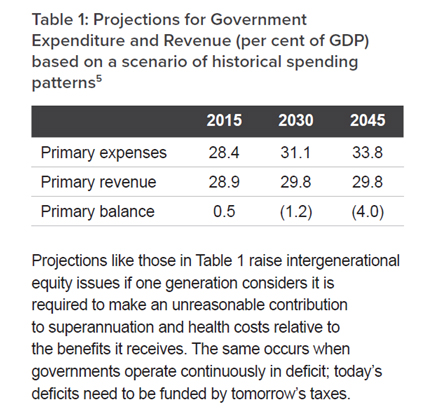

Now, one of the reasons the Tax Working Group recommended a capital gains tax was it had considered the long-term fiscal sustainability of the tax system based on the then current spending trends. Its Submissions Background Paper in March 2018 pointed out that based on then current projections, the Government’s primary expenses would rise steadily to reach 31.1% of GDP by 2030 and would actually mean that there would be a deficit of. 1.2% of GDP by then. The TWG recommended steps were needed to widen the tax base.

Those issues have not gone away and in fact will have been exacerbated because of the increase in borrowings that the Government incurred as a result of the COVID 19 pandemic.

We are not really having a discussion around how are we going to fund an ageing population, the increased demands on health and, as I pointed out last week, adapting to climate change. Every government seems to be stuck around keeping tax limited to 30% of GDP, Bernard Hickey has a long series of very interesting commentary on this.

National & Labour have tacitly agreed for 30 yrs not to lift the tax/gdp share >30% & not to run net core Crown debt >30% of GDP. That meant Govt & Councils (who have no GST or income taxes to benefit from GDP growth) have starved NZ of $100b of infrastructure investment...5/n

— Bernard Hickey (@bernardchickey) August 8, 2022

The Budget documents don't really address that issue in my mind, and it's something that, as I've said beforehand, we're going to need a serious discussion around how we expand our tax base and manage these pressures. Superannuation, remember, is now the second single biggest item of Government expenditure. This discussion isn't going to go away and inevitably it'll come back to the question of taxation of capital. We probably see the politicians fence around it during next year's election. But those pressures will remain.

Pressure derails OECD deal?

Now, speaking of politicians under pressure, President Biden had been struggling to get his Inflation Reduction Act through Congress. But this week he managed to do so after a few recalcitrant senators finally came on board.

There's a couple of interesting implications about this. Firstly, it appears to move forward the possibility of America coming on board with the OECD's global tax deal. And in particular, the Pillar Two proposal for a minimum corporate tax rate of 15%.

However, it's emerged that the Biden administration's changes to the bill in order to get it passed appear to be at odds with how the minimum 15% corporate tax rate % is going to work. The details are a bit complicated, inevitably, but the corporate minimum tax of 15% will apparently only apply to the book income, that is income reported in financial statements of companies with revenue over US $1 billion. It will also only apply on a group level rather than at a country-by-country basis, which is contrary to the intention of the OECD tax deal, of eliminating the practise of setting up subsidiaries in tax havens.

Some international tax experts are saying the Biden deal may not now actually be compliant with the global tax deal. That possibly opens it up for other jurisdictions to say “Hang on, we're not going to have that”. But ironically, it appears that US multinationals may in fact be keen to get the OECD Pillar Two deal passed through, because otherwise they may be exposed to additional taxes. So, watch this space. The point is, the Inflation Reduction Act is progress even if there are ructions still going on in Europe with Hungary now putting a spanner in the EU's need for unanimity to agree the deal.

The other quite interesting thing that emerged is that the US Internal Revenue Service, the IRS, got US$80 billion of extra funding. And there's a story from the Washington Post which explained why it needed that funding.

It includes an absolutely extraordinary photograph of the cafeteria in an IRS office in Austin, Texas. All that is visible is boxes and boxes of paper files, because the IRS had, as of the end of July, a backlog of 10.2 million unprocessed individual returns.

To give you an idea just how archaic the IRS’s system is, paper tax returns aren't scanned into computers. Instead, IRS employees manually keystroke the numbers from each document into its system, (this is what Inland Revenue previously had to do until its Business Transformation programme).

It is absolutely extraordinary what's going on with the IRS. I suggest every time you feel that Inland Revenue has dropped the ball and is hopelessly inefficient, thank God you're not dealing with the IRS. We had a situation where we sent the IRS a letter in January 2020 and we did not get a reply until August 2021, and we were possibly one of the lucky ones.

Giant jump in tax writeoffs

And finally, a little snippet emerged about how much use of money interest the Inland Revenue has written off in relation to the COVID pandemic funding. National MP Andrew Bayly asked the Minister of Revenue how much tax interest and penalties have been written off for the last three financial years. The response was in the year to June 2020, it was $17.8 million, in the year to June 2021, $22.5 million, and in the year to June 2022, $26.8 million. Quite reasonably substantial amounts.

But what was also revealed was how Inland Revenue had applied its increased discretion to write off use of money interest as a result of the COVID 19 pandemic. The total amount remitted between 10th June 2020 and 4th of July 2020 was $104 million, which is way above what I would have ever estimated. This amount probably relates to well over $1 billion of debt, possibly as much as $2 billion. It gives an idea of the fiscal impact COVID 19 has had and will probably continue to have.

Well, that's all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

*Terry Baucher is an Auckland-based tax specialist with 25 years experience. He works with individuals and entities who have complex tax issues. Prior to starting his own business, he spent six years with one of the "Big Four' accountancy firms including a period advising Australian businesses how to do business in New Zealand. You can contact him here.

17 Comments

Why is the cost of living payment process at bit of a mess ?

... because it was a bloody stupid idea , instituted by a bunch of incompetents who're too hopeless to even deliver a pint of beer inside a brewery ....

No need to deliver the pint, we will use the COL to buy them in London and toast the ever suffering tax payers of New Zealand.

Robbo's correct then , the COL payment is non-inflationary ... if its spent on a pint in London , or a coffee & danish in Copenhagen .... sacher torte anyone ? .... Yum ... thankyou , NZ taxpayers ... cheers !

They should have made another condition of getting the COL payment that you had paid a minimum of say $2000 income tax in the year to March. That would be very easy to do and would have flushed out the people who aren't here contributing.

.. or ... Robbo could have accepted that rising wages gradually pushes Kiwis into higher PAYE tax bands , and thereby adjusted the tax rates for inflation .... the commonsense way to approach it ... the way he will never choose ... unless the election is looming & Labour are still behind in the polls ... like Cullen did in 2007/8 ...

My pick is the 2023 budget will change the tax band levels to make the employment insurance cash flow neutral

It pays not to assume. We are full NZ taxpayers. We slipped in with a modestly paid spouse in a top 5% earning household. London is our holiday destination.

No , it is because we really , REALLY need CGT

The incompetence in this govt is breathtaking. Honestly, if they'd had a wee think before rolling this out, what could go wrong and the headlines...hmmm, it's Nationals to lose next year...

This is not the first time IRD's advice to the current government has been brazenly ignored. Now imagine if the current government is re-elected, having to form a coalition with the Greens, who insist on a wealth tax. Will the government expand IRD by several thousands in order to police this tax on assets and savings, which the Green Party tells us will include the family home?

You think emigration is high now? If the looney tunes go into coalition with Labour there will be an exodus.

I'm weighing quitting if Labour alone get back in.

So how does the need to widen the tax base sit with nationals tax cuts?.

Option 1:

> Take tax from everyone, launder it through the inefficient government machine and give a little bit back (to anyone, everyone and their dog).

Option 2:

> Take less tax from workers by lowering income tax.

Option 3:

> Lower GST.

This government is a joke.

"It is perhaps too simplistic to think that a couple of pushes of buttons is all that was needed to enable the cost-of-living payments to be made. But it does strike me as surprising that Inland Revenue has to devote a thousand staff and additional resources to deliver the payment."

The truth is somewhere in between. When this was first mentioned I knew the claim of a 1000, likely a combination of existing staff and contractors was absolute BS. At least the govt saw through that. I accept that some were incorrectly paid and probably others not paid due to the time frame and lack of data within the system. A wake up call to get those bank accounts up to date and a cherry on the top matching those not in the country and paying tax elsewhere. The latter is a heavy duty programming/query implementation. Probably a job for IT contractors.

Anyone who thought they should get it could quite easily apply. Some would want to fly under the radar for other reasons and not receive it.

Thanks Terry. I always enjoy your article even if I don't always fully understand every little thing. It all helps.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.