Interest.co.nz ran a car insurance survey during March to dig deeper into the costs of having a vehicle.

As good as it can be to have a set of wheels that can drive you anywhere you please, the cost of car insurance can dim the joy of owning one.

Insurance premiums across the board are currently rising at a pace households are struggling to keep up with during a cost of living crisis.

Statistics New Zealand’s Consumer Price Index (CPI) data shows insurance generally up 14% in the year ended March 2024. This data is useful – but it’s also out of date.

Although official data confirms the swift increase in expenses, there’s still a lack of detailed information regarding specific types of insurance, such as car, contents, and home insurance.

In our survey, we only asked readers about prices and premiums. We were really interested in finding out which insurers were charging what, where, and how much premiums were going up.

We had 562 people participate in our survey with all responses anonymous.

Here’s some of the interesting things we found, out starting with the data.

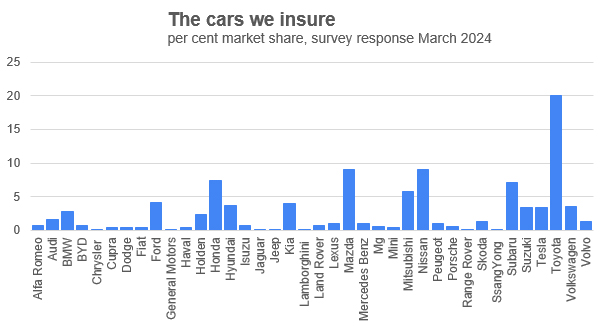

The most common car brand was a Toyota – 20.1% of survey respondents drive a Toyota. Mazda and Nissan drivers came in second equal at 9.1%.

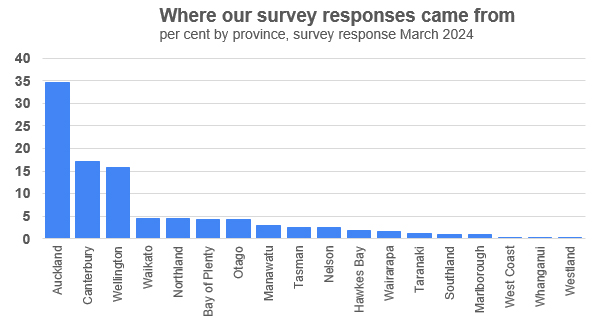

Auckland drivers made up the biggest percentage of the survey respondents – at 34.5%. Canterbury came second at 17% and Wellington third at 15.8%.

In terms of age distribution, 87% of respondents comprised drivers aged 25 and above, while the remaining 13% were under 25.

We also asked about motive power – we were curious to see what types of vehicles respondents were using. We found 66.4% of respondents were petrol vehicle users, 14.6% diesel, 10.7% pure electric vehicles (EVs) and 8.4% were driving hybrids.

Canterbury had the most diesel users – 24.4% – while Auckland had the most EV users – at 36.7% – and hybrid users – at 37.2% – which makes sense when considering the size of the city’s population.

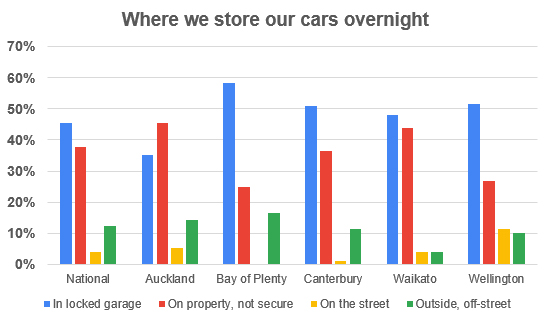

Where are people storing their vehicles? Well, 45.6% of survey respondents said they store their car in a locked garage.

Another almost 40% said they parked their cars on their property in either a carport or a parking space.

12.5% of respondents parked outside but away from the street, while the remaining 4.1% parked directly on the street.

Here’s what we learned from respondents’ comments.

People are moving to less expensive insurance cover

Due to the increasing premiums, many people mentioned they were shifting from comprehensive to third party car insurance cover.

“I am considering moving to third party only given the age of the car yet the premiums are rising - also sceptical about the agreed value being actually paid out in full if the car was written off,” one person commented.

“On fixed income, premium price increase last year created the need to reduce coverage away from comprehensive to third party, fire and theft," another individual remarked.

Some people surveyed said they were considering, or had decreased, the value of their vehicle in an effort to trim the costs of their rising premiums.

Others had gone down another route and upped the cost of their excess in an effort to bring the premium increase down to a more manageable cost.

“Previous increases were mitigated by an increase in excess from $500 to $1000, but this year no change to excess and the premium increased 22.6%,” one person said.

“My premium would have been $100 more if I hadn’t changed excess from $400 to $500,” another said.

A few people noted that the value of their car was decreasing but their premiums were increasing “substantially.”

Call for mandatory insurance

“Third party car insurance should be compulsory and the lack of this insurance should be punishable. No motor vehicle should be allowed to be used without this insurance,” a survey respondent said.

“Got to have it. Should be compulsory - no insurance, no reg. Even if only 3rd party,” another added.

New Zealand has never had a mandatory insurance law around vehicle insurance. The Crown-backed Accident Compensation Corporation (ACC) which began operating in 1978, is the country’s only nationalised insurance scheme and covers anyone who is injured in an accident.

ACC covers motor vehicle injuries which the Crown entity funds via its motor vehicle levy which charges drivers through their car registrations and at the petrol pump.

Satisfaction v dissatisfaction

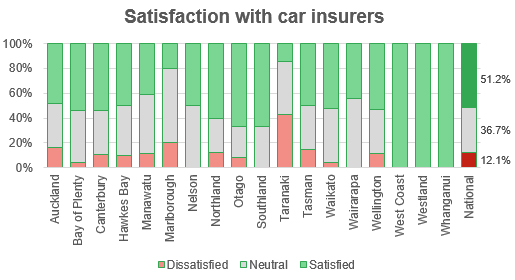

In our survey, we asked people to rate their satisfaction with their insurance provider from a scale that ranged from very satisfied to very dissatisfied.

Despite the strong commentary in some of the survey responses, satisfaction levels were pretty high.

Almost 16% said they were “very satisfied” and another 35.4% described themselves as “satisfied”. “Neutral” came in at 36.7%, “dissatisfied came in at 7.3% and “very dissatisfied” came in at 4.8%.

The cost of loyalty

Many people commented that there was no acknowledgement of loyalty to customers in the insurance market and it pays to shop around for the best deal – if you can find it.

“There’s generally no discount the longer you stay insured. Looking around for new prices doesn’t always work,” said another.

“You need to shop around or the insurance company will see you as a captive market,” one person surveyed said.

“Like most things there is a ‘loyalty penalty’,” another person said, adding that they'd saved $400 by moving to another insurance provider.

Premiums are rising – but the pace they’re rising has a wide range

The vast majority of those surveyed said their car insurance premiums have risen dramatically in the last year.

This isn’t surprising as insurers have been trying to recover from the damage the Auckland floods and Cyclone Gabrielle did to their books and hiking their premiums.

The news of these increases weren’t a surprise but the size of a lot of them was. It appears to be working if the recent financial results/the gross written premium growth (GWP) from IAG New Zealand and Suncorp New Zealand are anything to go by.

The majority of people who took the interest.co.nz survey reported a 20% to 30% car insurance increase. Some reported their premium increases climbing as high as 40% to 50% more than a year earlier.

“The 24.5% increase in premiums this year was on the top of a 14.7% increase last year. Our premiums are now 8% the value of the vehicle,” one person wrote.

“Has gotten too expensive for comprehensive insurance, massive premium hike of 30%+,” a person said.

“Necessary evil,” wrote another.

“In 2022 my car insurance was $852 and now it's almost double, has been increasing at 50%p/a. This is for a car that's worth $5,000 - $7,000,” another person said.

We’re digging into more detail around the rise in premiums we found in our survey with further articles to follow.

Thanks to all those who participated in our survey.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

42 Comments

I haven't had car insurance cover for over 20 years ago. I can still remember feeling 'naked' driving to work for the first time without cover - it made me a safer driver overnight! Still hurts when I have to fork out over $1k for a new windscreen with a stone chip in the 'wrong place'.

Not even 3rd party?

No, it was a principled decision. I didn't see them holding up their end of 'the deal' in that they weren't offering long term peace of mind, just peace of mind until you make a large enough claim or multiple similar claims.

All I'm really doing is placing myself in a position where I have to take responsibility for my actions behind the wheel. Perhaps we should ban insurance altogether and make everyone do the same. Which bank wants to pay top dollar for that land that has been flooded twice in the last 100 years, who wants to lend money on those houses on the flood prone land? The beginning of the end of the FIRE economy - I could live with that.

Murray, I might be missing something however I don't see how not having any 3P insurance is either "principled" or "responsible"?

I think that it should be a minimum legal requirement here as it is in many other countries.

Consider how you might feel if some uninsured drunk/drugged idiot took out your vehicle/you/your family. Or even a medical event with the same result.

If you’re worried about other people hitting you then insure for it. Murray has chosen not to and has every right to do that. And long may that continue to be an option.

So you should pay for other people's right not to cover damage they cause? Can't say I agree with the logic in that.

3rd party is cheap. Just over 100 bucks a year. It's pretty easy to imagine over 100k in damage caused by even the best driver. And if you are injured such that you have no recollection of the accident, it's hard to fight being blamed.

I don’t understand your first paragraph. How are you paying for someone else who is self insuring?

Self insuring is fine if you can afford the loss (we self insure all our own assets including the house). But you don't know what the cost of a 3rd party loss could be, so 99% of people don't know if they could afford it. Hence we have 3rd party insurance.

If you have an accident and kill someone (your fault), will your insurance put it all right? Bring them back to life? Of course not, so do you still drive - because it could happen?

Now I'm about to play devil's advocate, but not having insurance made me a more defensive driver overnight. So I'm less likely to kill someone than when I had full insurance. Who's doing 'right' by society now? The person with insurance that takes more risks because they won't be on the hook for the $ damage or the one who lowers their chances of having an accident and killing someone in the first instance (due to not having insurance).

Still think it's 'cut and dried'?

Good on you for doing your utmost to be a careful driver. But as you say, it's never cut and dried. The worst drivers often have no insurance at all, so potentially being on the hook for damage has clearly had little effect on them. And me and you are standing there looking at our car they have written off with them having no means of compensating us.

I am struggling with your assertion that insurance can get withdrawn from innocent people after being paid out for a stolen vehicle. There must be more to that story.

The more careful driving was an unanticipated side effect. Another side effect has been that I have owned lower value cars (sub 40k) than I otherwise would have due to the possibility of needing replace it overnight in the scenario you describe.

I am struggling with your assertion that insurance can get withdrawn from innocent people after being paid out for a stolen vehicle. There must be more to that story.

And the insurance companies would like you to keep struggling with it. Otherwise, you may well be like me and say, 'well what's the point if they're going to cut and run' at the first sign of a decent payout. They aren't going to advertise it. Is it really such a stretch though? A property I was looking at within a camping ground was excluded from the 'group insurance' i.e. you had to arrange your own due to it being close to the cliff edge. I get why they want to cut high risk, but that's no peace of mind to me when whether or not I'm high risk is determined by if someone else happens to steal my car. I was buying insurance for long term peace of mind (asset protection), but they were only offering it for a maximum of 12 months at a time.

principled - because insurance is not available to people who through no fault of their own have it withdrawn (for example, stolen vehicles). Sure, they pay this time, but won't reinsure you so really whether or not you drive is at the whim of the insurance company. I do not think they should have that say but it's exactly what those that advocate compulsory insurance are requesting. Those who haven't had these conversations with insurance companies will not 'understand'.

responsible - as stated, I'm a more responsible driver (defensive driver) without insurance than when I had it. More careful and not looking to dodge responsibility for any damage I cause. It's like the covid vaccinated complaining about the unvaccinated - why care when if they're already 'protected' by the vaccine (or in this case, insurance).

some uninsured drunk/drugged idiot took out your vehicle/you/your family

No doubt sad, but insurance will not protect me from that. I can of course replace my vehicle tomorrow with cash on hand. As I said, they're selling short term peace of mind at most, nothing over 12mths on offer - you just haven't learnt that yet (and I hope you never have to).

Are you happy with the possibility that you may make a mistake and write off a $100,000 car which you will have to pay for or go bankrupt?

Yes, or I wouldn't drive. It's really quite liberating, in a world we control less and less I have some control here.

Are you happy to hand the decision of whether or not you may drive to a private insurance company? (assuming you like the idea that everyone should have insurance)

I guess it's up to you...but best you don't want to inadvertently reverse into someone elses Ferrari or expensive car, or worse have even a minor at fault accident with an EV or expensive car that is written off. And what happens if in a moment of inattention you reverse into a building and the building catches fire? I fully understand wearing the risk on your own car, but not having 3rd party insurance in the event you damage someone else's vehicle or property is quite irresponsible in my opinion.

I guess it's up to you

That's not necessarily true for many, which is my point. It's up to the insurance company and their criteria of whether or not you are given insurance (by extension, the 'right' to drive if you're in the no insurance = shouldn't be allowed to drive camp).

Am I taking more potential $ risk than if I was insured? Definitely, but the probability is low. I don't buy lotto tickets.

On the other hand, I have not paid around 50k in premiums that I otherwise would have thus far so there is some compensation for the added risk.

And yes, 'expensive' cars do get an extra-large following distance!

Almost getting to the point where you'd consider setting up a company for the sole purpose of the company owning the car. Then drive it without insurance and rely on limited liability.

Plus there is the depreciation to consider.

Won't work. There is no taxable activity.

Won't work. A driver without insurance gets sued, not the company.

Comprehensive = other parties insured + car insured

Third Party, Fire, and Theft = other parties insured + car for fire & theft, but not collision damage to your car

Third Party = only other parties insured

No Insurance = You get sued for damage, either by an insurance company, or by another un-insured person

Many third party policies have an uninsured driver cause that will pay you to a certain amount if an uninsured driver hits you.

I would recommend giving this local start-up a try - https://quashed.co.nz/

Free, very quick and easy to enter your insurance details and within 48 hours they will send through quotes from a range of insurers. I used this to compare both house and car insurance a few months back (although in our case our current insurance was still the cheapest so I did not change).

If the car is only worth 3-5k third party with fire and theft, plus the windscreen insurance I would say.

I have 2 motor vehicles: 2020 Suzuki Vitara & a Nissan 4wd 1997. I have done all the above (reducing insured value, increasing excess) to inhibit recent years premium increases 40 - 50% with no claims or crimes. I have just changed the Nissan to 3rd party only @ $149pa (most of its use is off road which isn't covered anyway).

I check alternatives annually, am currently insured with Tower who remained the cheapest by at least 20% (also have home & contents with them).

Tends to prove the level of rip off the insurance companies are. Too quick to take profits at the expense of their clients.

Technically, any premium lower than the cover is beneficial. It just appears to be a rip-off because we want to absolve ourselves of all cost in the event of something that we don't view as our fault, i.e. act of god, nature, other road user, etc..

This isn’t surprising as insurers have been trying to recover from the damage the Auckland floods and Cyclone Gabrielle did to their books and hiking their premiums.

Of course, once they've recovered from the financial damage there won't be any subsequent pullback in premiums, because by then everyone will be "used to" paying more.

Our contents insurance renewal just came through with a 33.4% hike over last year. Seems to me the insurance industry is doing its best to de-risk. Eventually the only people left with comprehensive insurance will be those who can afford to self-insure most items themselves, while those who need comprehensive can only afford third party.

As an aside, Hastings DC rates also get a solid 21.6% lift this coming year for us, and we're toward the lower end of the rises. Urban dwellers seem to be 23%+.

The "loyalty penalty" is a tough one. I have experienced this first-hand when comparing rates online. I could insure my car with a different insurance company to the insure I currently use but I'm reluctant to do so. I'd save a couple of hundred bucks per year. So why don't I? I made a claim on my house insurance (which is with the same insurer) after a neighbour damaged part of my property. My insurance company was a dream to deal with and went over and beyond. As such I am sticking with them - they really stepped up when I made a claim. I just wish they were a bit cheaper!

Agreed, my premiums went up substantially on everything, house cars contents. I got quotes from 5 other companies and could have saved up to $800 per annum; but when I delved into the details of the benefits offered, they were substantially less in the cases of the lower price policies. And the AA was 20% more than my current insurer even after their members discount. Go figure.

Consumer Affairs ought to set up a website price comparison similar to the electricity company price comparison one, Powerswitch..

ABSURD.

My full car insurance in NZ is 14% of the vehicle's value with the premium having increased about 30% since last year.

This means car insurance companies are roughly working on damage to 1 car in 7 (7 vehicles *14% = 100%) equal to the full value of the vehicles.

This seems incomprehensible.

Overseas my full car insurance was about 7% of the full value or 1/2 that in NZ.

Now imagine it was compulsory.

The thing with compulsory insurance is that they will be compelled to insure those that they would normally refuse. It’s obvious which way premiums will go after that.

There's no compulsion to insure anyone who shouldn't be on the road. It's beyond crazy to allow so many appalling drivers with no insurance to use the road. Link the number plate to the insurance, and use Number Plate Recognition to do the rest. Anyone who shouldn't be driving, can't. DUI twice? You're dangerous, insurance won't touch you, you can't drive. Why do we allow recidivist drunk drivers to get behind the wheel?

If you're 17 and want a fast car, insurance premiums will be so high you won't be able to afford it - tough, get a slower car and learn how to drive for a few years.

I'd also go for retesting everyone every 10 years, fail and you're back on L plates until you pass. Two tonnes of metal at 50kmh is dangerous, drive responsibly and considerately. And insure yourself so when you make a mistake it won't cost you a lot more in the long run.

There's no compulsion to insure anyone who shouldn't be on the road.

Incorrect, should read:

There's no compulsion to insure anyone

It's entirely at the private insurance companies discretion and not to do with ability to drive. A risk to them, does not equal a risk to other drivers/road users (of course it may do). For example, loss through theft.

It’s obvious which way premiums will go after that.

My point exactly!

In my location overseas:

a) Insurance is compulsory. A vehicle cant be reregistered annually without it.

b) Cameras pick up license plate numbers. Unregistered cars are tracked down.

c) Fines must be paid before a vehicle is reregistered.

NZ is way way behind the 8 ball.

What type/level of insurance is required? (or what location if that isn't too personal).

Can the required insurance be denied and/or does the rate vary according to driver history?

Love the make a rule and actually enforce it aspect. Unsure it would be allowed here in case it unfairly targeted certain groups.

My premium on a Vero insurance went up by more than 3 times of inflation! Then I checked prices with other providers, and all of them were in a similar range. It looks like a cartel type operation.

We need to shop around, I've kept my insurance flat for the last 3 years by moving companies, and devaluing the car. Again as with home insurance they keep trying to over insure you, so you pay them bigger premiums and when the damage comes, they'll only pay you what market rates are (unless you have agreed a fixed value).

Nobody in NZ seems to shop around for insurance, insurers are STUNNED when I ask them to match/beat someone else.

I think insurance should probably be compulsory for anyone under 25. NZ has avoided it because insurers have managed to successfully argue that they don't actually want to insure high risk drivers.

Let's be honest, when people raise the 'compulsory 3rd party' thing it's basically because it's how they do it in Britain. Most countries don't have compulsory insurance - they build it in to registration or another mechanism just like we do. So can we stop with that myth?

NZ doesn't need a compulsory system, and our insurance is vastly cheaper than most countries because the personal injury aspect of cover is handled via ACC. Your insurance mainly is about property. So we don't need the "what if you hurt someone" argument, because that is dealt with by ACC.

FWIW in the UK the situation is similar. The insurance companies are required to pay a levy into a fund, and that is used to cover personal injury caused by an uninsured driver. Effectively a tax on all the people who do pay for insurance. Their rate of uninsured drivers involved in accidents is similar to ours, but their payouts are much higher because over there they still have whiplash claims and all that crap.

When you are insuring 3rd party, it is mainly in case you cause property damage. So if you can afford to self insure in the event you write off someones Ferrari, then that is up to you, just like it would be if you decided to take a sledge hammer to it.

Personally I can't afford to take that risk, so I have comprehensive. It is far, far cheaper (around 1/3) of what it would be if I needed the same policy in the UK. And that is even taking into account British drivers have about half the motor vehicle accident rate per km traveled that we do in NZ.

Plus their road tax is far higher than ours, both on registration and fuel. That's the price of a motor obsessed culture I guess.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.