The biggest thing we took away from our car insurance survey, run during March, was just how much car insurance premiums are increasing.

Is car insurance becoming unaffordable? It is, alongside insurance in general, according to some of our survey respondents. The insurance industry, however, says premiums are rising for a reason.

Official data tells us insurance premiums are rising – in the March quarter, insurance costs were up 14%, according to Statistics New Zealand.

As we noted when we first opened the survey, only general detail is available about how the costs of car insurance are changing.

The rising costs of car repairs, coupled with the increasing complexity of vehicles such as EVs and hybrids, pose challenges for insurance companies in making money.

That’s not to mention the cost of climate change and the pressure and uncertainty it’s putting on insurers’ books as well as broader challenges like supply chain issues and inflation.

However, big profits are still being made in the insurance realm.

General insurer Suncorp – which has a majority stake in AA Insurance – reported a 20% gross written premium (GWP) increase to $1.4 billion in February. Although according to its CEO, Suncorp NZ’s insurance margin fell from around the 13% to 14% mark to about 9.2%. GWP is the total amount of money customers are required to pay for insurance coverage on policies issued by an insurer.

IAG New Zealand reported an 18.8% GWP increase to NZ$2.015 billion in February and its insurance margin rose to 20.8%.

And the listed general insurer Tower has told the share market twice so far this year it expects its full year underlying pet profit after tax (NPAT) to be higher than first anticipated.

As of mid-April, the general insurer is expecting NPAT to be greater than $35 million for the 12 months to September 30.

Digging deep

You can read more about the data results from our survey in this article here.

Our survey had 562 respondents with 90.7% of them saying they had comprehensive car insurance, followed by 6.9% with third party and 2.3% with limited.

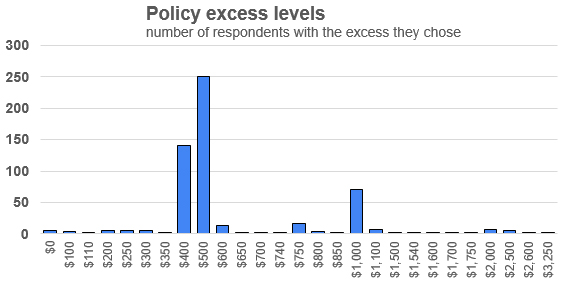

Here’s the spread of insurance excess – the amount an insured person has to pay before the insurer covers the rest – across the respondents:

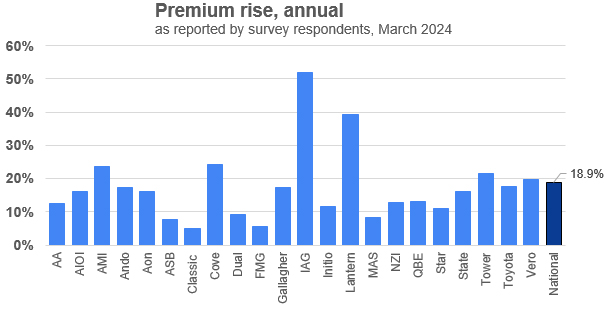

Although individual survey respondents reported wildly different premium increases, using the survey results from all respondents showed us car insurance premiums have risen 18.9% year-on-year.

Breaking that down by motive power, insurance for diesel vehicles rose by 28.2% according to our survey, was up 23.2% for EVs and 23.5% for hybrids.

Petrol only vehicle insurance rose 15.7% on average, according to the survey.

Our survey data showed us what survey respondents across the board were experiencing in premiums climbs, showing that using our data average, car insurance premiums have risen close to 20% in the last year.

Those numbers had more of a range on an individual basis though. Some survey respondents told us they were seeing smaller increases in the realm of 10% to 15%, while others reported a premium increase of over 20%, and some even higher in the range of 30% to 50%.

One person summed up the sentiment of many respondents around premium increases with the comment “up, up and up,” with another describing it as a “monopolised ripoff”.

“Price increases well over reasonable levels,” wrote another.

Across responses to our survey and the resulting data, we’ve heard car insurance premiums in general are increasing rapidly across the board. It's increasingly making it difficult for households to manage during a cost of living crisis.

The premium increases during a cost of living crisis means insurance is a struggle for those who can afford it, and is becoming out of reach for those who can’t.

What the insurers said

Tower, AA, and IAG New Zealand all said premiums are tailored to individual circumstances. Suncorp, which is Vero's owner, didn't comment.

Ron Mudaliar, Tower's chief underwriting officer, said premiums are set case by case and attributed rising prices to inflation and supply chain constraints.

“While each insurer prices their policies differently and Tower is doing our best to keep premiums down, across the board we have seen insurance pricing increasing due to inflation and supply chain constraints,” he said.

AA’s head of pricing Chris Taylor also emphasised premiums can change annually based on various factors, including claims expenses and customer-specific details like car value and driving history.

“The excess level a customer chooses will also impact premiums, so we encourage customers to contact us directly for a quote that accurately reflects their personal circumstances,” he said.

Similarly, Alex Geale, the executive manager of IAG New Zealand said that pricing considerations include driver age, location, car details, and the insured sum.

She said IAG NZ “regularly review our pricing to ensure customers are paying a fair amount for the cover they receive.”

“Premiums are also affected by external factors such as inflation, part costs and vehicle repair costs, which have increased significantly in recent years. Vehicles that cost more to repair will have premiums that reflect this,” she said.

Cost concern

Consumer NZ's investigative team leader Rebecca Styles said most people are “really concerned about the cost” of insurance, including car insurance.

In a car insurance survey Consumer NZ ran last year, the net amount who were moderately or very concerned about the cost of the car insurance was 52%.

“We're concerned about the cost and there's also concern about house and contents and all of the insurances essentially,” she said.

“It’s just all going up.”

She highlighted the widespread concerns about the escalating costs of insurance across various sectors, including car, home, and contents insurance.

Styles said consumers should explore cost-saving measures such as comparing quotes from multiple insurers, adjusting excess levels, and bundling policies for discounts.

While comprehensive coverage was preferred, even basic protection like third-party or third-party fire and theft insurance can help to mitigate risks, she said.

“We would advise you to have some protection rather than go without.”

When approached for comment, the Insurance Council of NZ, which represents general insurers, told interest.co.nz it wasn’t in a position to comment as it hadn’t seen the survey.

Under 25s

In our survey, 13% of respondents were under 25 year-old drivers. It was interesting to hear them talk about the high insurance costs for young drivers, with some calling them “very high”.

“The higher excess costs for claims for drivers under 25 is excessive. I understand the reason behind this policy, but I don't believe it's this excessive in other countries,” one person said.

“It has been expensive since I upgraded from my first car. It also didn't go down when I turned 25 after they made a big issue of being under 25 previously,” said another respondent.

There hadn’t been a material change in the volume of insurance policies acquired by young drivers under 25 or the extent of coverage they've chosen in the last three years, AA Insurance’s Taylor said.

She added that the cost of insurance for young drivers had increased in line with general cost increases over that period.

Tower’s Mudaliar said new motor policy sales to under 25 drivers has remained steady in the past three years – however the insurer had seen a recent downward trend since August 2023.

IAG’s Geale said in the last two years there had been “no notable change” in the number of policies issued to drivers under the age of 25 compared to other car insurance customers over that age.

Outlook

Based on the feedback from our survey and the data collected, it's evident car insurance premiums are experiencing a significant across-the-board rise.

The pace of premium increases means insurance has become a struggle for those who can afford it and is becoming out of reach for those who can’t.

How much will insurance premiums have risen in a year’s time?

As Consumer NZ's Styles told interest.co.nz: “I've never seen it go down.”

Thanks to all those who participated in our survey.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

12 Comments

"That’s not to mention the cost of climate change..."

And there we have it.

My full car insurance in NZ is 14% of the vehicle's value with the premium having increased about 30% since last year. This is insane.

This means car insurance companies are roughly working on damage to 1 car in 7 (7 vehicles *14% = 100%) equal to the full value of the vehicles.

This seems incomprehensible.

Overseas my full car insurance was about 7% of the full value or 1/2 that in NZ.

Half is still ridiculous high.

Insurance for public transport is probably more than the ticket pays for.

Interesting. Just insured our cars here in NZ - 30% premium increase over two years. Just insured our river boat in Europe - 0% increase.

Everything is becoming unaffordable.

Insurance is someone taking a bet that they can collect premiums and the payouts will be less than the premiums and underlying asset base they have to meet claims.

Its a business and if they cant make a return they deem good enough they are under no obligation to take the risk. If premiums get really high, and you assume they are making huge profits, someone will enter the market to get a share of those great profits.

From what I see insurers and under writers are leaving many markets here - obviously the return vs risk isn't worth it or else they can make more elsewhere.

Insurance is a privilege to have someone take a bet on covering your risk of loss not a right to have.

I find it absurd that one can get 3rd party cover for over a million dollars damage for pittance compared to full cover... This industry might very well price itself out of business ...because if fewer folk are attracted then cover costs will rise even more... I should like too see mandatory vehicle insurance for all drivers but if the industry is intent on making cover un-affordable for low income earners then what would be the point. The drive for YOY margins has limits and when everything is not to scale...it all starts to unravel..... Some companies have very poor customer service issues that do not align with the premium prices they ask.... Is it to be that only the wealthy can have cover?

I see some like "supply change difficulties" and get wary. Sounds important but exactly what and how.

Yes I could imagine more costly parts. But is that true? Does it need a 30% premium increase?

Or does it mean something else entirely.

Let's have some data. They need to stop the deceptive fluff

price gouging by our overseas owned insurance industry is nothing new,over 100 years ago it led to the govt of the day to create govt life and state insurance,successfuly causing real competition to lower premiums to an affordable level.

As a nz insurance car repairer I can tell you we have not had a labour rate increase in over 5/6 years of more than a dollar or 2. We have the one of lowest part markups in the world, and are expected to provide courtesy cars free of charge and assess vehicles at no cost to the insurer. Our contracts are ‘take it or leave it’ there is no negotiation. More repair shops close every year and our workforce is reliant on over 60% migrant labour because of this.

I am told whether it's accurate or not?? that Insurance Co's are upping all premiums across the board to help balance out the huge costs of the Cyclone and other weather costs/claims, plus you have to factor in the apauling driving standards in NZ, my wife has decided that she will drive a car no more as she just cannot cope with with the high risk driving of other drivers, does anyone give way to the right anymore!!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.