By David Chaston

The last quarter to September 2017 has proven to be one of the more active for funds moving up and down our various performance tables.

However Aon has firmly entrenched itself as one of the leading managers in KiwiSaver across most of the sectors. ANZ remain a strong proposition despite some of their returns slowing.

And Mercer remains the best Default fund based on our regular savings return calculations.

Milford, Generate, BNZ, and QuayStreet (formerly Craigs Investment Partners) are all high-ranking in various categories and over different time periods. These schemes are not eligible to receive our 'best in class' award as they have not been going for the full period of our analysis.

And that is because the only fair way to assess since-inception returns is to have all those compared, exposed to the same business cycle. Since 2008, the business cycle has been very specific. Those funds that started later did not endure the tough start most did, and it seems unfair to compare them in a mis-matched environment. So we don't. We will in the future when we have been though more than one business cycle, but the current cycle is still in play and there will be some time to go before we can start that fuller comparison.

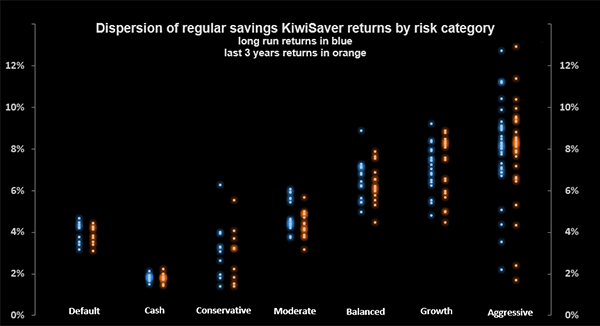

Overall, returns over the long term remain strong across the leaders. Those with KiwiSaver funds in the bottom quartile will not be so happy as their returns continue to lag. The longer time goes on, the more clearly the track record is revealed The gap between the top and bottom in each sector is still wider than you would expect from a competitive market. This is shown graphically in the chart below, all up to September 2017:

Track record performance is only one way to assess a manager. There may be funds who have either changed managers, or have changed the strategies they are using. We are not measuring any of that. However, you should look out for these changes. The market prospects may bring a manager's strategy back into favour, or take one out of favour. These are reasons why the standard advice is that 'past returns may not predict future returns' - however our tracking clearly shows track record is still an important factor.

In some of the more conservative sectors of KiwiSaver, the difference between the top funds and the equivalent Default funds has shrunk. Investors in schemes with a risk profile of Moderate do not appear to be being rewarded for taking on additional risk. The bottom half of funds in the Balanced Growth, Growth and Aggressive are also clearly not.

Our September 2017 reviews of the Default, Moderate, and Growth funds can be found here, here and here. Our June reviews of Conservative, Balanced Growth, and Aggressive funds can be found here, here and here.

Top of the list

The big difference in this review from our last one is that returns over the past three years have softened witn markets nearing their peaks. Capital gains in equity prices have leveled off, and bond returns have moderated or even reversed as interest rates stabilised and look to rise as "the great unwinding" is signaled.

We award our special 'star'

There is only one fund that is both best-in-class on an all time basis, and over the past three years.

This is the list of the top funds at September 30, 2017, based on our regular savings return model. For comparative purposes, we have only used those managers who have been in existence for the entire analysis period of April 2008 to September 2017.

The table below highlights the best funds in each main class and the range of returns between the top and bottom performers.

1. The Conservative Fund data in the table excludes cash and default funds.

2. There are now nine default funds, however, only five have been in existence for the full period of our analysis.

3. Insufficient number of funds to provide data.

For explanations about how we calculate our 'regular savings returns' and how we classify funds, see here and here.

The right fund type for you will depend on your tolerance for risk and importantly on your life stage. You should move only after receiving appropriate advice and for a substantive reason.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.