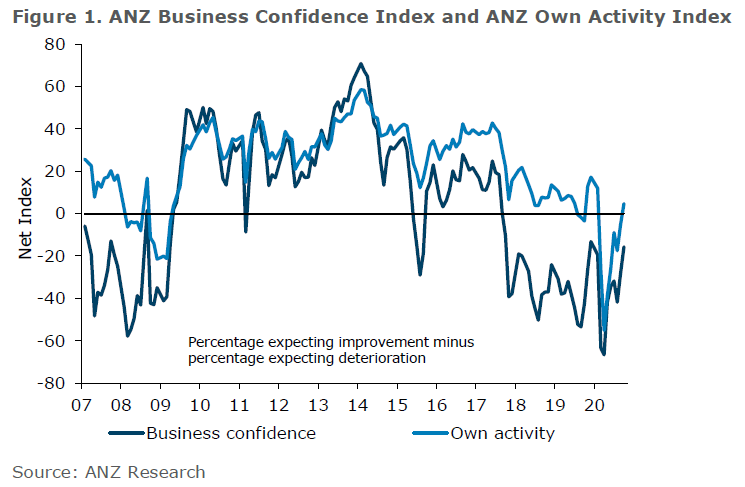

Business confidence has improved over the past month, according to the results of the latest ANZ Business Outlook Survey.

"Businesses remain relatively upbeat, and key activity indicators are holding up," ANZ chief economist, Sharon Zollner said.

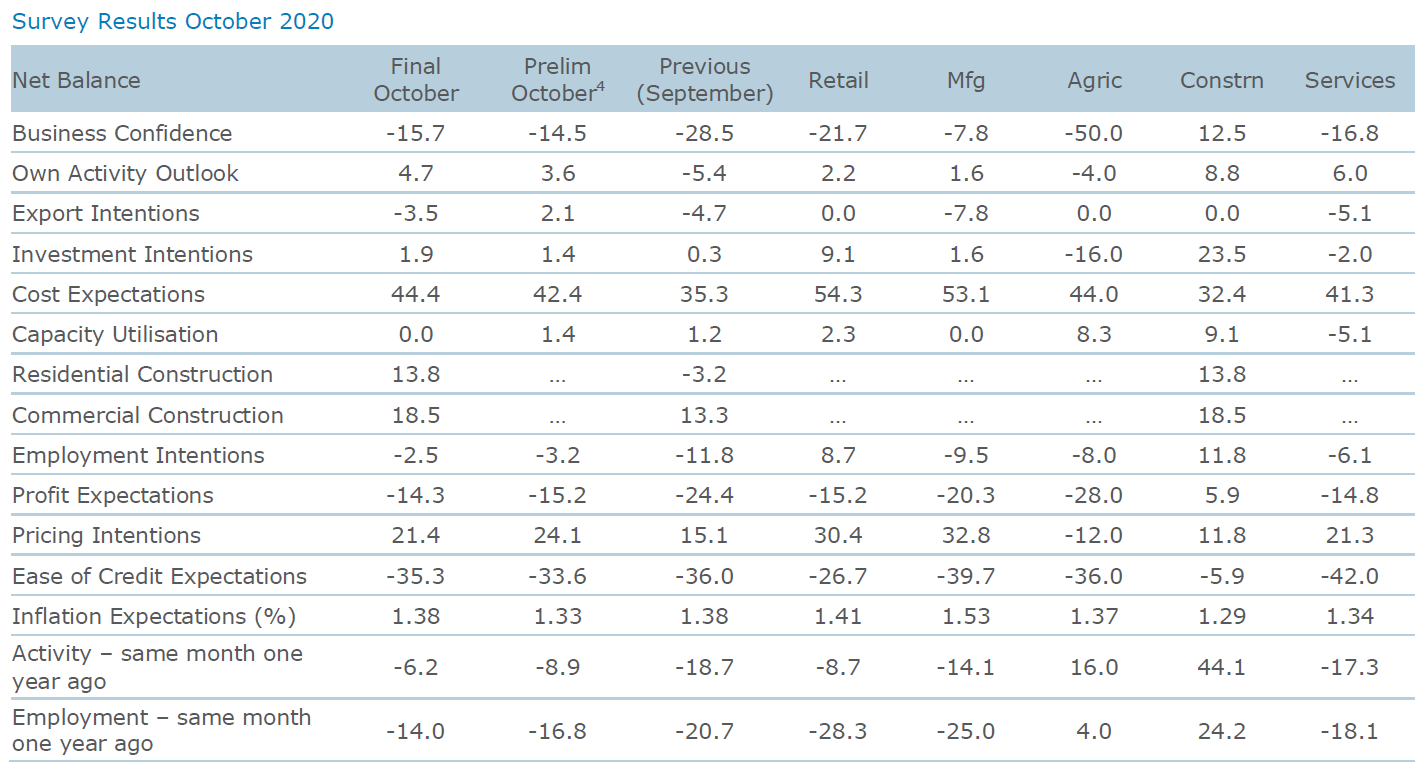

Construction is now by far the most positive sector - both residential and commercial. A net 14% of firms now expect higher residential construction activity over the next 12 months, which compares with a -3% net figure in September.

Zollner said commercial construction firms’ expected activity tends to be more volatile, "but it held onto last month’s sharp lift and indeed increased further, with a net 19% of firms expecting higher activity".

She said that businesses in general across the whole economy continued to have "stubbornly low" expectations of inflation (1.4% - which is below the Reserve Bank's explicitly targeted level of 2%) despite the fact that businesses are expecting to lift their own prices and are expecting their own costs to rise.

The low inflation expectations would be of concern to the RBNZ, she said.

The election (on October 17) took place during the compiling of these survey results.

Zollner said the levels of most activity indicators were little changed as October went on, despite the election.

"There was a mix of ups and downs – it’s no longer true to say that business activity and sentiment indicators are bouncing strongly across the board."

She said it was expected that businesses would face some tougher times as the cushioning impact of the wage subsidy faded.

"...But our best guess is that it’ll take at least a month or two to be felt. For now, the levels are encouragingly robust, on the whole."

Zollner said the global economic growth outlook was "looking precarious" as Covid-19 cases were rising and this fact likely explained nervousness being demonstrated by our exporters.

"The low export intentions and weakening in parts of the manufacturing sector speak to the fact that this is a global shock. Goods exports have been a bright spot in the economy and we expect that to remain the case: people have to eat, and global food supply chains are under pressure for a range of reasons this year.

“Challenges lie ahead for the New Zealand economy too, certainly, with the seasonal impact on tourism only starting to be felt and direct fiscal support waning. The housing market is supporting 'the vibe' but also starting to spark financial stability concerns.

"On the plus side, New Zealand has repeatedly successfully repelled community incursions of COVID-19, catching them early and closing them down without requiring further lockdown measures. The border can never be made 100% secure, but the second line of defence appears to be holding. Compared to the rest of the world, we are very fortunate indeed."

7 Comments

Profit expectations of Ag sector at -28, and cost expectations at +44, don't augur (auger?...sorry) too well for this our major export earner.....

It is unfortunate but this is simply the market forcing suppliers to adapt through diversification and innovation or risk facing doom. How long do we compete with

We're in a catch-22 here: we try to rescue our major export earner i.e. bulk agricultural trading through indirect subsidies (low-wage workers, ETS exclusion, few cleanup costs, etc.) but this could be coming at the growth of other sectors including specialty (non-bulk) foods exports.

If we are doing so well why are they collapsing interest rates?

"construction sector easily the most buoyant"

Funny, then, that Fletcher's shares aren't exactly soaring and have slipped the last few days.

I can't understand how building material companies in NZ aren't making huge profits, based on the price of building materials here, and the lack of competition in the market. What am I missing here?

Back in the mid-1980's I worked part-time initially, and then full-time for a while, between small-businesses, for Fletcher's new Placemaker's store in Manukau. The management were ex-army officers and on the whole they ran it quite well; but I could see that it was never going to work as there were too many staff for the number of customers. They also didn't have the super-efficient buying power and marketing nous of the likes of Bunnings. The store was closed down after a few years. So I would put the blame on the next layer of management up at head office, the strategizers ( the generals so to speak); I think it has always been this level of management that has been responsible for Fletcher's inefficient decision-making over the years......didn't former CEO Adams say as much when he prematurely left?

ANZ should be aware that Customers can go anywhere in this entire World.

And this one will.

You should never stiff a good customer, is my motto in business.

Cos they can take their business elsewhere.

Byeeeee.

https://www.msn.com/en-nz/money/other/anz-bank-profits-drop-27-percent-…

Taint just the Pandemic. But it adds to the problem....Look in the mirror ANZ......Oh and Mr Orr.

And the other 3 letter word...ASB.

https://www.msn.com/en-nz/money/homeandproperty/housing-boom-could-get-…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.