Bank of New Zealand's economists have published a detailed research report questioning the still-high valuations of residential, rural and commercial property in New Zealand.

BNZ said prices had fallen in some cases since 2008, but remained significantly above their fundamental valuations when compared with inflation adjusted trends, price to income multiples and yields.

"While a good amount of adjustment has been made to date, a greater sense of realism may yet be required," BNZ said in the report available here titled NZ Property Markets Yielding to Fairer Value.

It said property prices last appeared grounded in reality back in 2003 and had become unhitched since then.

However, property buyers were beginning to become aware that conditions had changed and valuations may still be stretched, it said.

"There are signs already that the populace is completely rethinking what constitutes fair value for a property, of whatever sort, especially on the growing realisation that credit channels will not be as open-ended as had become accustomed to," BNZ said.

It said many investors were beginning to consider risk adjusted yields again after years of being blinded by the prospect of capital gains. It warned of a potential for a long grind lower of values.

"As capital-gain pretensions peter, beware a long slog to sensibility," it said.

Here is the full report below.

NZ Property Markets Yielding to Fairer Value

All manner of New Zealand’s property markets have struggled over the last couple of years. What’s going on, where are we in the process and what does the future hold? Well, while a good amount of adjustment has been made to date, a greater sense of realism may yet be required. How will we know when we’ve found a base? Well it will probably be when valuations are based on decent risk-adjusted running yields (remember those?), as capital gain expectations rightly fade from the equation.

Perspectives, Please

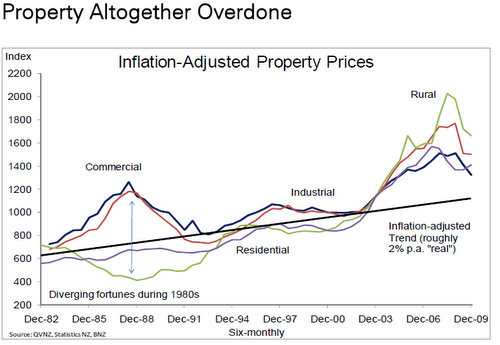

To get a handle on what’s playing out we believe it’s essential to step back a bit in time. Indeed, probably back to circa 2003, when property markets last looked well grounded in their fundamentals. From around that point something seemed to be unhitched and everything was pretty much off to the races from there. Just a couple of years ago, of course, the NZ economy was incredibly over-heated. It seems like a distant memory now. But resources of all description – whether plant, premises or staff – were stretched to breaking, meaning core price and wage inflation was bursting its banks. But property prices had become even more inflamed. And we’re not just talking about houses.

Land prices mushroomed. Commercial and industrial property prices soared at double-digit rates. New Zealand’s biggest asset price cycle over recent times, was arguably in farms. Collectively, it was probably the broadest and biggest property price “boom” the nation has ever experienced. It was also, however, mainly bubble and bluster associated, as it was, with a rapid accumulation in debt. So those expecting a reversion to those heady days, even something resembling it, are fooling themselves. What we’re actually aiming for now, across the range of property markets, is a return to reality.

A finding of one’s feet.

While virtually all of New Zealand’s property markets became “richly priced” in the few years to 2008, it’s unclear as to how much of the requisite rebalancing has transpired to date. This opaqueness is essentially because of limitations in the available data. Nevertheless, the following are our general impressions. We can start with oft-overlooked farms. Having burgeoned in price over 2006-08, their subsequent correction seemed an obvious reaction to the way international dairy prices essentially halved between early 2008 and early 2009, during the global recession. However, despite world dairy prices having reclaimed broad robustness over the last twelve months or so, farm prices have failed to rebound much, if any.

In any case, how much of a price cycle have we really seen in farms, and in which farm types? The Real Estate Institute’s rural statistics show the simple median sale price of all farms dropped more than 40% between mid- 2008 and mid-2009, and has gone about sideways ever since. That gives the appearance of a complete pruning of protuberance. However, how much of this is real as opposed to just reflecting the type and size of farms being sold. This is where the Quotable Value NZ rural price index comes into its own, as it attempts to control for farm-type, size and quality. And this index slipped just 15% between 2009 H2 and 2008 H2, to rest comfortably above the level of 2007 H1.

The QVNZ indices also questioned the notion that it’s been dairy farms that have swung and suffered the most. The dairy farm price index (to 2009 H2) fell 15% from its peak – bang in line with the overall rural index. The price of fattening land actually dropped a greater 23%. And while the price index for horticultural land had fallen about 11%, we suspect its viticulture sub-component fell by much more than this (such are the travails of New Zealand’s “overgrown” wine industry at present).

It is also difficult to get a good fix on commercial and industrial property price adjustments to date. While there has been plenty of anecdotal evidence of big price falls (especially in lower-grade premises), the last “official” nationwide data point we have is the QVNZ indices for the second half of 2009. And these registered an 11% fall in respect of commercial property and 13% for industrial, from 2008 H2 peaks. Residential property price indices have also not looked as bad as some of the stories, and earlier prognostications, were pointing to.

Again, with reference to the quality-controlled QVNZ measures, we note that their reading for the March quarter of 2010 was about unchanged from the previous quarter, to be 6.4% higher than a year ago. The most recent level was down just 4% from the late-2007 peak. So, can we really say there has been a generalised property price slump across homes, business premises and farms in New Zealand? Not by the look of some of the key evidence available.

But might this simply mean we’re not getting a clear read from the data (perhaps because of sales illiquidity?) such that a more noticeable correction is yet to be registered? That is the question.

Ongoing reservations

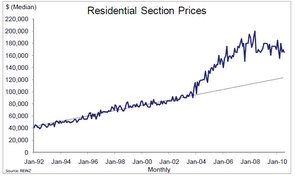

Accepting the accuracy of the QVNZ property price indices at hand, as a good example, what’s clear is they still look high when set against their long-term trends. As an expositional device, the various indices in real (inflation-adjusted) terms show that property prices in the latter half of 2009, although down, were still well above any reasonable trend, having last looked “about right” back in 2003. Incidentally, we can even throw residential land (“section”) prices into the analysis here.

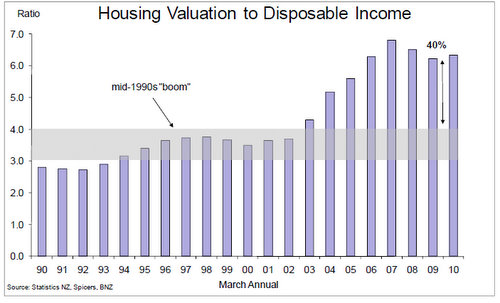

While we’re not aware of any QVNZ measures on such, we do note that the REINZ median sale price measure took off like a rocket from about 2003. And while it has come off the boil over the year to July 2010, it remains well north of trend (which, by the by, is part of what’s stymieing a bigger recovery in new home building activity in our opinion). We get a similar impression of over-altitude by looking at other rough valuation metrics. Farm prices, for example, while off a bit, still seem lofty in relation to pastoral export receipts (especially when excluding the less-stretched looking dairy farm valuations). Commercial property prices appear high compared to the rents they are getting. And home prices are still very much on the high side relative to household disposable income and rentals.

Groping for Decent Yields

This, of course, is another way of saying that property investment yields remain implicitly low (albeit not quite as low as they were at the height of the property froth).

Sure, yields of all description, including wholesale and retail interest rates, are cyclically depressed. However, it is inaccurate to say that they are low, absolutely. And interest rates, as a general rule, can only tend to rise in line with (presumed) economic recovery. It’s all about normalisation. So those wanting to guard against miscues in property markets over the coming period will do well to;

• Take Government/Rating Valuations (which are only ever crude historical distribution devices) with more than just a grain of salt If one must use historical comparisons, try to go back a number of years – with, say 2003, serving as a much sounder reference point than two or three years ago, when things were frothy

• Most importantly, bring everything back to yields – explicit or implied – and risk-weight these yields for things like tenancy duration/health and renegotiation risks on rents. \

• Compare these risk-weighted yields to market “riskfree” interest rates (recognising the latter are probably biased to rise over the coming years, meaning debt rollover issues need thinking through).

• Benchmark these yield-based valuations to what has “normally” prevailed since the early 1990s (the approximate start of New Zealand’s inflation-tamed environment, following the inflation blow-outs of the 1970s and 1980s).

This general emphasis on (risk-adjusted) yield is only reinforced by the likelihood that capital gains will be far from assured over the coming years, with even ongoing risk that further price correction might be needed in some property markets before a solid footing is found. We would certainly put housing in this camp. This, of course, will be a complete reversal from the “boom times”, when many property buyers would seem to have been tolerant of unusually low yields (and negative net returns in the case of many housing investors) in the presumption of strong capital gains.

Sure, this strategy, worked out for a while – for houses, for land, for commercial and industrial premises, and for farms. But it’s now reversing, as such things invariably do. Easy come, easy go – but the higher debt loads remain. Indeed, there are signs already that the populace is completely rethinking what constitutes fair value for a property, of whatever sort, especially on the growing realisation that credit channels will not be as open-ended as had become accustomed to. In the rural area, for example, it’s interesting that there are few signs that farm prices have bounced back to any discernible degree, even though commodity prices certainly have. In the realm of commercial and industrial property, effective yields are backing up.

And while home sellers are holding out to achieve “recent valuations” buyers are only prepared to pay what they think is a “reasonable price”. There’s a big gap between the two. This price-discovery process will continue. It could yet surprise people in how drawn-out it is and where it gets to in the end. There are some big questions rightly being asked. While we can’t be sure of the results, and timings, we do think the best compass will be a decent risk-adjusted yield in respect to whatever property market you are dealing in.

60 Comments

Love your post Paul....succinct...yes indeed..!

But there are other things worth discussion round these parts...it's just that many of the types (no pun intended) that frequent property blogs don't seem to want to read anything that may be a little involved or detailed.

It's a fair reflection on our instant gratification society.....make it quick ...make it tasty...and set the polarity to minimum energy expenditure.

la la la tra la la la......it's Friday

indeed nonny indeed. Ole' ....Olly

BERNARD.........Get this twat off........ lincc282...........all over the site selling shit.

Tony's perma-bull views were getting to be an embarrassment, he's been told to STFU

KiwiD....he may yet unleash lassie...a.k.a ..Mark H. he popped out of the woodwork on the SFC blog .....I think it was....gone to ground again.

oops mate I didn't pan down......Bingo guess whose here...?

Tim,

You read me like a book website ;)

cheers

Bernard

BH has said as much in an article a way back.

It seems even bank economists are eventually capable of elementary deduction. Wonders never cease.

And builders margins are?

Family member build a house recently, the work quality wasnt that hot, it took longer than expected, basically because it seemed the labour was not there that often and infact the builder and the labour just stopped turning up to finish the house near the end....more profit elsewhere it seems.

and placemakers margins are?

I was doing house improvements up until 5 years ago. Personally I know look at what Placemakers want for materials and just dont bother it makes little sense to improvethere is not much return and Im using my free labour....so I just maintain....

Is this costing across the board? not sure, again from personal experience, 2 years ago I got an alternator repaired for <$500 as a new one was >$950...it failed in Feb and a new one was now $708....so I saved for 6 months, bought it 2 weeks ago for $588...

For me this comes back to not just looking at houses being over-valued in isolation....I seem to hear ppl saying they have to charge such and such because that's what it costs them, so lets look at the inputs....one of the biggest is [servicing] debt and the other energy...private businesses are from the data heavily indebted.....I wonder if it isnt crippling them...and forcing them to have higher prices than needed....

Is regulatuon to high? not convinced its significant, sure its higher, but who's insisting it is? why the ppl often they want protection from the sharks. You and other libertanz seem happy to say this again and again, do we have some independant research showing these increase in costs? because I have no context.

Also lets be serious Mark as a Libertarian you have a pathelogical issue regarding anything that comes from a Govn....planning, regulation etc etc so we just have to question your deductions in that light.

regards

Mark

Isn't the missing link in the argument about build vs buy the price of residential sections?

I agree the cost of building and building consents is inflated and an artifificial floor of sorts.

But one of the reasons for the recovery in building activity in mid 2009 was a sharp drop in residential section prices.

Surely land prices are still over valued and when they come down that will fire up construction again and bring down overall prices?

However, I agree there's some 'red tape' built into land prices given the 'smart growth' policies of some councils and the land banking that goes on.

But at some stage gravity will kick in to land prices...

cheers

Bernard

Hey ...who gave you that point....no cheating....now you just take that off right now mister....that's got something to do with conflict of interest or something hasn't it..?

Did you notice Marks little gag ..? he even announced it .....?...eh ...huh..?

Build cost will not remain the same.

They will be lower, and by a goodly margin.

Demand driven by lower incomes.

I know, I went there.

And reading the trends youth will have more debt, less likely to get a decent job and hence probably leave home later in life....aka Japan....

That ratio climbing doesnt look that improbable (Ok 3 might be a bit much....

Its one of the things I have problems with, trying to forecast/plan the future 2% growth for the last 10 years does not mean 2% growth for the next ten...however trying to plan is way better than doing diddly.

regards

Whats a cow worth? $600? $1200?

regards

Well one of the weaknesses of the BNZ’s analysis appears to me to be that they have failed to take into account the cost of new builds, whether it is for residential, retail or industrial properties. It's all very well saying commercial properties are over valued wrt to yields etc., but if an average 7% yield values a modest commercial property at say $300,000 but it costs $550,000 to build it new, then, Houston, we have a problem. Obviously the cost of building the damn thing (or replacing it/ renovating it) must also enter into the equation when figuring out a properties true value, and determining whether it’s over valued or not, and by extension, the whole asset class. If building cost is ignored and values are pushed down to make more satisfactory yeilds then there would be little incentive for building any new buildings.

And we know what shortage of supply means………

What about if the cost of building and the materials are way to expensive?

regards

You jump away from demand too quickly DB....the public are voting with their wallets that new builds are still cost bloated...so the demand has buggered off...and the skilled labour that supped on bloody hefty hourly rates for 5 years are without work...off they go to aus and as they depart so to does another chunk of demand. You think 'shortage' of housing when you should be thinking 'shortage of demand'.

Apart from some kitchen deals and whiteware sales..care to point out any reductions in the cost of materials. Wood...concrete...steel...labour...glass...gib....???

David

I think the key issue is the cost of land.

cheers

Bernard

which reminds me, someone is conspicuous by his absence, this week.

Fell through the cracks?

What I want to know is...why would a bank report the truth...when to date they have run with BS.

Are we witnessing a strategic positioning to generate activity by booting vendors in the bum with a dose of reality finance....an effort to speed up the price decline...to hasten the death of the bubble?....it stands to reason that this is what the BNZ is on about...the demand for credit has gone bush and they want it back...fast!

"and the Reserve Bank runs the risk of becoming irrelevant in its attempts to influence Monetary Policy"

Bollard's policies made this happen many years ago!

Cripes Big B looks like you get your weekend off after all........some big guns come out to play.....ya young scamp.

i just wish the property market would hurry up and crash.!!

i sold my house in 2006 for 150% profit on purchase price and have been renting in paradise by the beach ever since.

now.. i want to buy another house...well, to be truthful i actually want to get another dog and rentals don't allow that.

i'm happy to spend around 600K but until these deluded buggars who overpaid in the last 2 years get real on their prices my only hope is the likes of the starship troopers on here (who's comments are read far and wide.) casting the voodoo and scorning or glamming the market down to reality?!

keep on rockin' team...donald needs a dog...not some trousers?

I've mentioned before, I did $370/sq.m. in 2004-5.

Gotta think outside the square.

TS --you sure on your $2500?---that,s $375000 for a 150m2 house in 1990---seems a bit on the high side.price,s at present for a average 150 m2 wit out too many bells and whistles running at around $1300---$1500p/m2--do your own numbers

also are bunnings having an impact?----they did in australia

Yes, the banks do seem more prepared to allow their back room boys out on their own these days.

Presumably they were aware of the same data when things were really overexcited but were a) ignored b) told to shut up and stop whining and c) threatened with decapitation if they breathed a word of it in public. Banks have internal politics too I believe.

Be nice to them, they have been in the dark for a long time.

his perm caught fire whilst shooting a pepsi commercial !

Not "was a bubble"........... it bloody well is a BUBBLE.

"Build costs are up around 30-40% from 2003 levels" - Not surprising is it, since the price of existing house has gone up by at least that since then. Who on earth would want to pay more for an old item than for a new one, especially when the new item also has better features (in the case of houses, insulation, double-glazing etc)? No one would do so for a car, TV etc. Why should houses be any different?

And of course if there is an opportunity to make more money, the businesses involved will take it so I'm not overly surprised that "they took advantage of the boom by putting up rates".

Yep, land is definitely overpriced. Looked for a section in Chch for a long while and the price per m2 was stupid. We didn't pay a lot less where we are now but we have 50 times more land to show for it (which in turn can provide resources, eg food, if not an income)...and free-range kids.

TV1 'business' interview minutes ago (sat am)....informative...NO....detailed...NO.....useful ...NO!

It went something like this..

"So what's happening out there?"

"Err buyers ummm errr I think that errr arm well hopefully"

"And will the spring bring a change?"

"Well it errr vendors ummm maybe but there is hope errr spring umm"

"Well thankyou for that...it's helped heaps...now to the banking sector"

I'm amazed he didn't yell "Look over there!" and run away.

Some wild variations in build costs being quoted. $2500m2?

I worked for a major house company turning out good quality homes for around $1100/m2 that's floor coverings, appliances etc., ready to move in. Section and driveway, service connections etc. excluded. So the median type home - 3 bed with garage, single level 170m2 on a concrete slab comes to under $200,000 inc GST Good sections are available for $100,000 or less depending on your area. You can have a far better home than the used market home @ median $340,000 if for no other reason than it's new.

Have a close look at some of this junk. A lot of these homes built in the last thirty years have major expenses looming - if not nearing the end of their useful life. Kitchens, bathrooms, roofs, floor coverings, decks and joinery are either stuffed or have maybe ten years left in them.

I agree with Elley, comparing replacement cost as a justification for high secondhand prices is misleading - same as for a car really.

Fair comment Kiwidave but ..... is a cheap new home a better buy than a 1920s expensive build, that remains a rigid frame of heart native timber with a heart Matai floor and roofing steel several times as thick as the 'new' stuff....Include modern plumbing and new wiring....insulate the ceiling and the inside of the exterior walls and the under floor....that only leaves the windows...not that hard to upgrade to 'double glazed'. Fit a logburner with a wetback and slap a solar water unit on the roof. The house was built on piles well above ground to start with and so no worries with airflow. Any crook piles can be replaced.......what do you think?

True enough Wally, some of the stuff built many decades ago will outlast some of more recent vintage. Not to say that the modern timber framed kiwi home isn't a great concept though (see how they came through the recent earthquake) and if it's well built and maintained shouldn't easily double the fifty plus years minimum standard requirement.

However a lot of this secondhand stuff is poor value and not a valid comparison with good quality new homes built under the current regulations IMHO.

I prefer the pre WW2 houses not just because the construction and materials are better, but also because they're available in the small cottage sizes that stupid councils won't allow any more.

Tell you what KD....if our useless media ever got off it's arse and bothered to send a film crew to a Scandinavian country to do a series on what a proper wooden home amounts to.....your Kiwi families would spit their dummies with anger at the shite they are sold.

Go take a look at quality........ http://www.slcd.co.uk/

Then look at the prices....... http://www.slcd.co.uk/index.php?main_page=index&cPath=77

Walls 245mm thick...have a gork at the Talltoppen 120.

And it's not Pinus Radiata shite either.

Karelian pine

So we are trapped into a system that bloats the cost of building rubbish...bloats the cost of land...oh wait...we don't have to buy new houses do we!...other options: living on a boat...in a big old bus....a tent in the bush.....under a bridge.....sooo many options.

Give us a link to someone who has done it please anon....help us all out mate.

With the level of house-obsession over the last few years it wouldn't surprise me. Have certainly had to suffer through a lot of photo-albums full of riveting pictures of drying concrete and piles of dirt.

Have heard a lot of sneering and snobbery from people over kitset houses, as though they're too trashy for their precious subdivisions.

Clearly. But I've seen control-freak lawn-nazi types literally wrinkle their noses in disgust as if kitset homes were the equivalent of living in rusty caravans in the front garden and cooking hedgehogs over open fires.

Dunno Wolly. Our previous place was built around 1970 and we did do a number of these things: new bathrooms, new modern kitchen but kept the old joinery cos I loved the rimu (used the opportunity to insulate the walls in those areas), insulated the ceiling & HWC, put in new aluminium-frame double-glazed windows everywhere (not hard but expensive), new heat pump and still, it was so damp and cold and mouldy. We found that retro-fitting and renovating was way more expensive than building new, the result was a patched-up house and quite frankly, it showed (in the sense that it was no way as good as if it had been properly designed to start with). Insulating all the walls would have involved a complete reclad/regib and the cost of doing that would have been prohibitive.

In comparison, the new place is, well, hardly comparable in terms of warmth and comfort. One thing we couldn't do in the old house was changing its orientation: they clearly hadn't heard of passive solar heating in the '70s, which also means that solar panels wouldn't have been very efficient (as an aside, I'd love to have a rotating slab that can be moved a few degrees to one side or the other - would require flexible pipes but I'm sure it's do-able!). So yep, the lower quality of the wood is definitely a negative in new builds but I still wouldn't move back into an older home.

Bad move that alloy Elley...stuff acts like refrigeration bars...wiped out any gain from the DG.

The makers used to produce an extrusion with a thermal barrier but some burke decided it should stop.

Plenty of options and ways to insulate an oldy but the key is the initial cost of the joint. Done properly they are great homes that will outlast the new stuff by a century at least.

I'll bet you the owners try dam hard to recover as much of the hardwood from the Dean homestead. You won't see that being dumped. Some fine massive beams are being torn out of those buildings being demolished in the city. You can bet the demo blokes will be separating them out for later use.

Whingers r having a party thinking that PI's are dying They show great stupidity. Whingers dont know big dfifernce between houses and commercial property. Commercial property makes heaps. Beat bank deposits all ways Also has big tax depreciation on top.

NZ Herald Sept 11: "Direct office retail and industrial produced average return of 10.8% from 1994-2009 whch was better than bonds average 6.5% " (Independent Property Databank) (IPD)

Commercial 1. Whingers nil.

It's an obvious Poe - occasionally he slips up and the parody shows through.

quietly joins the storytime circle

Tell us a scary commercial property horror story, please.

There is an Aussy site, Morning Money/Morning Weekend run by a Kris Sayce, that puts this one to shame. If you want really negative people, go to that site, many negative types here on Interest.co.nz are quite positive by comparison! If you read the Sayce one you might think Australia is next to a Third World country at present. At least nobody, incuding Wolly, has even remotely suggested that NZ is like that, have they?

They still think empty used-house-salesman hard-sell slogans actually mean something, bless their hearts.

Many clever people make big money from horror stories . More horror makes more money for people who not whingers. Smart investors making heaps. Whingers losing heaps. Soon smart people have all the money . All others just workers. 40 years work for peanuts and then die.

Smart people 1. Whinger workers nil

That's like trying to pay off gambling debts by putting money into the pokies.

'Save Our Home' presented by matching financial advisor and real estate bimbos? Yeah, would be interesting to see a follow-up on how that strategy is working out for them.

Just checked to see if it was still streaming at tvnzondemand, but apparently not. Was interesting that it showed a huge cross-section of people in huge financial trouble from getting sucked into the bubble, from naive Gen Y who swallowed the line that it only goes up, to delusional boomers who were 'preparing' for retirement by running up mortgages.

Had to chuckle at the earlier posting by The man is a Schoolkid (appropriate title by the way), who feels that positive people are not realistic as they 'think happy thoughts will make them rich" Well I'm realistic knowing that 3 good quality properties, over and above our own home, with 90+% equity, generates a pretty good additional income, and this situation was not the result of being a negative harper and carper. Sure prices go up and down, but with a bit of effort and positiveness one can make progress. Be positive, be happy!

Anonymous, don't be so negative, numerous people who own properties do not have any or much debt, and can handle a drop in prices And don't assume they won't have savings.

Realistically, some people over-rate the good when things are in the up cycle, and over-rate the bad when things are in the down cycle. Human nature seems to be suseptible to 'greed' and 'fear', best to be positive and steer a realistic course in-between.

Wow ....I am alone here......hooooooweee!.... whats this one...? 178 of the property snore for the weekend......? anything resolved yet...?

Monday's Headline .....

Tony ..A. and Mark Hubbard go bear on property.

Our page three Alien...this week....The Man's back.

Christov, don't know about Monday's headline, but have you seen Bernard's Sunday one? n Bernard is being less negative now ( see Sunday Herald)

Under the heading, ' Kiwis, count your blessings", Bernard gives 10 reasons to be cheerful after 2 weeks of gloom. Anonymous, as BH now is realising, may they be also 'an antitode for being a permanent harbinger of doom'.

I'll be checking it out that's for sure...ta..

I just run off and watch the AB's again first....ah Sunday....then I've a curry to cook...yum.

No worries anon...property values never go down in aussie and anyway they have Queen Gillard to run their lives for them now...what could possibly go wrong!

Big risk that China driven boom idea anon...not saying it's not happening...just that it comes with risks. Yes the RBA will raise again maybe to 5.25 by mid 2011. Bolly's ocr game play cannot save the banks here from an international credit crisis and therefore the move to floating may be a move to float without lifejackets for many. That is the ever decreasing space between the rock and hard place...recovering world growth must bring higher rates....low rates promise endless stagflation. Take your pick. Hey....you seen any sign of the 170ooo jobs English promised his 6 part strategy would create? Another week and another 250oooooo borrowed to pay the interest debt of previous borrowings....noddy noddy on we go.....remember that tune!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.