By Bernard Hickey

The Reserve Bank of New Zealand (RBNZ) has left the Official Cash Rate (OCR) on hold at 2.5% as expected, but it lifted its forecast for wholesale interest rates and warned more about inflationary pressures than economic weakness.

This prompted some economists to bring forward their expectatations of the first OCR hike to as early as December from January or March. Wholesale interest rates rose around 10-15 basis points and the New Zealand dollar strengthened almost a cent to 82.4 USc.

Reserve Bank Governor Alan Bollard later told Parliament's Finance and Expenditure Select Committee the market had "slightly over-reacted" to the forecast and had been "overly hawkish" in trading after the interest rate decision and the publication of forecasts. The currency dropped around a third of a cent after the comments and was trading around 82 USc in afternoon trade.

Releasing its June quarter Monetary Policy Statement (MPS), the bank said the economy was recovering after the shock of the February 22 earthquake in Christchurch and underlying inflation was expected to rise.

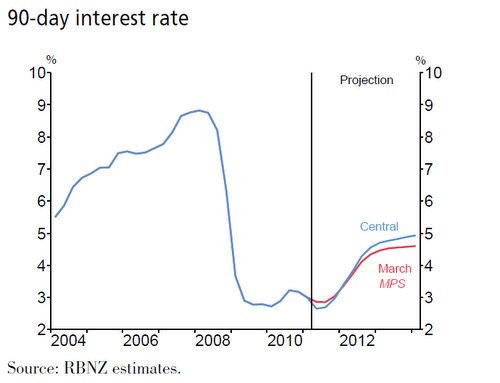

The RBNZ said a gradual increase in the OCR would be required over the next two years to offset this increase in inflation, but that it had left the rate on hold for now because underlying inflation remains constrained. It increased its forecast for the 90 day bill rate by around 25-30 basis points from its March MPS. See the chart below.

It sees the 90 day bill rate rising to around 4.8% by early 2013 from 2.6% now, implying an increase in floating rates would rise to just under 8%.

The RBNZ also commented that the strength in the New Zealand dollar was negatively affecting exporters and constraining the rebalancing of the New Zealand economy towards exports and away from consumption and borrowing.

However, it made no comments in the MPS about intervening to push the currency lower. The RBNZ intervened to push the New Zealand dollar lower in mid 2007 when the trade weighted index pushed above 75. The TWI is still only just above 70, despite the New Zealand dollar being higher against the US dollar than it was then. The Kiwi has weakened vs the Australian dollar since then.

“The outlook for the New Zealand economy has improved since the publication of the March Statement," Reserve Bank Governor Alan Bollard said.

“Economic activity has been significantly disrupted by the Christchurch earthquake. However, while many firms and households – particularly within Canterbury – continue to be adversely affected, it appears the negative confidence effect of the earthquake on economic activity throughout the rest of the country has been limited," Bollard said.

“The early signs of recovery noted in the March Statement have continued. Despite some continuing signs of weakness in the world economy, commodity prices remain very strong and firms expect to increase their hiring and capital investment. Reconstruction in Canterbury is projected to add about 2 percentage points to GDP growth over 2012, and boost the level of activity for several years thereafter," he said.

“Despite the strong outlook for export earnings, household expenditure is expected to grow only modestly. Household debt remains very high and is expected to constrain retail spending and the housing market for some time. Continued fiscal consolidation will also act to dampen activity."

'Currency over-valued'

The Reserve Bank commented the New Zealand dollar had appreciated substantially over the past two months.

"This appreciation, supported by high export prices for primary producers, is negatively affecting other parts of the tradable sector, constraining rebalancing of the New Zealand economy," Bollard said.

He added in a subsequent news conferencen that the currency was over-valued, but he said he was reluctant to intervene as it did not change the long term direction for the currency.

See my comment piece here on the RBNZ doing nothing to stop New Zealand's propensity to borrow overseas and sell assets to pay for unsustainable spending.

'Inflation building'

“Headline inflation is currently being boosted by recent increases in indirect taxes, food and petrol prices, and surveyed expectations of future inflation have edged up. Despite this, indicators of capacity usage and core inflation suggest underlying inflation remains constrained," Bollard said.

“As GDP growth picks up, underlying inflation is expected to rise. A gradual increase in the OCR over the next two years will be required to offset this, such that CPI inflation tracks close to the midpoint of the target band over the latter part of the projection. The pace and timing of increases will be guided by the speed of recovery, but for now the OCR remains on hold.”

Economists react

Westpac economist Dominick Stephens said the RBNZ had altered its stance on future monetary policy and he now expected the RBNZ would hike in December, rather than the January he had previously forecast.

"Both the press release and the Monetary Policy Statement were firmly focussed on the upcoming surge in economic activity, combined with strong export commodity prices, that would together put upward pressure on inflation. This stood in marked contrast to the March and April Statements, which tended to focus more on the potential downside risks stemming from earthquake-related disruption," Stephens said.

'We have long been signalling our expectation for a steep and long-lived series of interest rate hikes - that expectation remains unaltered. In particular, we are very sceptical that the peak in 90-day rates will be as low as 4.9%, as implied by the RBNZ's projections," Stephens said.

The RBNZ appeared to have much greater faith in the longevity of New Zealand's terms of trade boom, Stephens said.

"And naturally, if one is more comfortable with NZ's strong external position, one becomes more comfortable with the high exchange rate. This appears to be the Reserve Bank's new position. The TWI is now forecast to remain above 65, helping to keep inflation low," he said.

"The Statement emphasised upside risks to the relatively hawkish projection. In particular, the RBNZ outlined three important judgements – that construction costs would remain contained, that New Zealanders would continue to focus on paying off debt, and that increases in inflation expectations would be short-lived. The clear implication is that if these judgements are wrong, rates could rise sooner and/or faster than projected. Unsurprisingly, the Statement gave most attention to the risks around inflation expectations, reiterating that the RBNZ has been monitoring inflation expectations ‘even more closely’ since last year’s GST increase."

The 2 year swap rate rose 14 basis points, Westpac said.

BNZ Economist Stephen Toplis said he was sticking to his picks for 25 basis point rate hikes on December 8, January 26 and March 8.

Today the Reserve Bank woke up to the fact that the New Zealand economy is, indeed, on a relatively firm footing, despite the Christchurch earthquake," Toplis said.

"And with that firm footing comes heightened inflation risk. Accordingly, while maintaining the cash rate at 2.5%, the Bank issued a clear warning that the first hike in interest rates is not only getting closer by the day but that when that hiking process starts it will be more aggressive than it, and the market, had been anticipating."

ASB economist Nick Tuffley said the Reserve Bank now seemed more concerned about inflation and he also pulled forward his OCR hike forecast. He now saw a January hike rather than a March one.

"The RBNZ has become more comfortable that the wider economy is starting to pick up but less comfortable about the inflation outlook. Both of these factors raise the risk of an earlier tightening than we have previously thought," Tuffley said.

Tuffley said he expected a higher currency than the RBNZ expected.

"Despite the frustrations of a strong NZD, there was no hint of a desire for intervention in today’s announcement," Tuffley said.

The RBNZ’s own interest rate forecasts now implied a first hike as early as December, he said.

"That is where the risk lies. Signs of a brisk recovery would quickly reduce the need for the insurance cut put into place after the February earthquake. The RBNZ’s nervousness about inflation expectations is another potential trigger of an early hike: if inflation expectations remain elevated between now and the November survey then a December hike would be very likely," he said.

"We still judge that the RBNZ has time to wait, and will need time to wait for certainty about recovery and reconstruction. Last year was a lesson about lifting interest rates too soon. And there is still far too much uncertainty about Christchurch’s reconstruction for the RBNZ to have a clear picture of when inflation from that source will appear. That uncertainty is unlikely to be resolved sufficiently for a number of months. Importantly, we think the reconstruction risks being less rapid than the RBNZ assumes. If so, the RBNZ will likely rethink the monetary policy implications."

"Finally, the preponderance of floating mortgage rates and steep yield curve means monetary policy’s bite will be relatively swift and effective. That gives the RBNZ some leeway, and some comfort, should it become apparent that inflation is getting up a larger head of steam than currently forecast. Our January call is later than the market is pricing in, for the above reasons. It comes conveniently after Q3 GDP signal the extent to which activity is growing once the initial earthquake disruption abates. "

"December is the main risk to our call, if the recovery and reconstruction appear on track to meet RBNZ expectations. But any earlier than December is far too soon to resolve uncertainties about the reconstruction impact on inflation, or the persistent of the recent lift in inflation expectations. But once tightening starts, we expect the persistent nature of inflation drivers to prompt sustained OCR increases to 4.5%."

Tuffley said the market had moved to fully price in a 0.25% rate hike from the RBNZ by the end of 2011, and expects rates to be around 3.75% based on December 2012 OIS prices.

ANZ economists said the RBNZ's upward revision in its 90 day bill rate projection triggered a rise in swap rates and the New Zealand dollar. The strong currency had been subtly endorsed, ANZ's economists said.

"The new track is roughly 25bps higher than the March forecasts by the end of 2012, but importantly this is around 50bps higher than market pricing had been," ANZ said. "The 90-day track also implies a December start to the tightening cycle, which is in line with our view but was not fully priced by the market – until today."

ANZ economists said they struggled to see inflation heading down towards 2% as the RBNZ forecast.

"There is much discussion in the Statement on inflation expectations, a lot more than usual. For now, the RBNZ is looking through the recent spike, putting it down to high petrol prices, which have since subsided. But should inflation expectations stay high, the RBNZ will not be able to ignore this," ANZ said.

"The RBNZ notes that “indicators of excess capacity are mixed, with some suggesting that there is less slack in the economy than might be expected given this weak activity picture.” Our view is that the economy has a lower margin of spare capacity, given the lack of investment over the past few years, which is why we think inflation pressures will emerge sooner rather than later."

ANZ's economists said the RBNZ was aware that last year’s surge in confidence proved to be a "head fake."

"The RBNZ will not want to make the same mistake again in reacting to confidence readings only for the recovery to fail to take hold. The upward sloping yield curve and high proportion of mortgages on floating rates give the RBNZ confidence to sit on the sidelines for longer."

They said there was no active attempt by the RBNZ to try to jawbone the currency down – either in the statement or during the Governor’s press conference.

"This suggests that the RBNZ may be fairly relaxed about the current level of the currency."

ANZ economists said they were happy to stick with their forecast for a 25bps hike in the OCR in December view, but "we wouldn’t rule out the first move being a 50bp increase."

"This goes against the grain of “gradual” rises in the OCR and should not be confused with us becoming overtly hawkish. We expect slow and steady rate increases beyond that and a sub 5 percent OCR endgame. However, a 2.5 percent OCR simply looks inconsistent with the growth and inflation outlook, and we expect the tenor of data from July in particular to increasingly bear this out."

Fed Farmers warns on rates and debt repayment

Federated Farmers warned farmers to prepare for higher interest rates, partly because of the Reserve Bank's comments and partly because of a tightening of rules on capital for bank lending to farmers. See Gareth Vaughan's article on the bank lending rules.

“The hold is not a surprise although the more bullish outlook and a clear signal that tightening will come, possibly is,” says Philip York, Federated Farmers economic and commerce spokesperson.

“Well before the Reserve Bank begins a tightening of monetary policy, farmers may see an increase in the cost of borrowing. This is in response to new Reserve Bank capital adequacy ratios for farm lending. The cost of any increases will be watched closely by Federated Farmers," York said.

He reiterated that farmers were likely to repay debt with the proceeds from the export boom rather than go on a spending spree.

“Given farmers will prioritise debt reduction in order to bank an increasingly bright commodities picture, we restate our firm belief commodity income will not be a threat to inflation," York said, adding on-farm inflation remained a problem and the government needed to reduce spending and borrowing to reduce the upwards pressure on the currency," York said.

“The big concern is that those outside the farm gate are anticipating windfalls that won’t come, as farmers grapple with gearing ratios and increasing costs of borrowing," he said.

“The best way to bring down the dollar is for Government to constrain its spending and with it, the borrowing programme."

HSBC economist John Bloxham said there was now a chance of a rate hike earlier than the December quarter.

"Six weeks have gone by and the Governor has shifted his tone from rates are on hold for ‘some time’, to rates are on hold ‘for now’. What will another six weeks bring?," Bloxham said.

"The case is building for a reversal of emergency rate settings. We still expect the next hike in Q4, but the risk is for an earlier move," he said.

(Updates with new video, more detail, NZ$ and swap rate reaction; Westpac economist's comments; BNZ economists comment; ASB economists' comments; ANZ economists' comment; HSBC economist's comments; Bollard comments in FEC committee; chart showing slightly higher RBNZ forecast for 90 day bill rate from March MPS; Fed Farmers comments; link to full MPS, link to my comment piece)

40 Comments

So what did he hope to achieve by this:

The New Zealand dollar has appreciated substantially over the past two months. This appreciation, supported by high export prices for primary producers, is negatively affecting other parts of the tradable sector, constraining rebalancing of the New Zealand economy.

On the one hand he says a high NZD is bad for rebalancing, on the other hand he says it is justified by high commodity prices and then goes on to talk up the NZD. Well Allan please wake us up when you finally decide if a high NZD is a good or a bad thing. We're up US0.7c post MPS, speculators just love this sort of spineless fence-sitting.

"The RBNZ also commented that the strength in the New Zealand dollar was negatively affecting exporters and constraining the rebalancing of the New Zealand economy towards exports and away from consumption and borrowing."

That isn't constraining it nearly as much as the continued artificially low interest rates. If you rig the economy so that bad bets on property come good, then how do you expect people to stop doing it?

Can someone tell me why the CPI figure that used to base our interest rates on does not include by far the biggest expense - housing (i.e. rent)?

@notch

This is irking me for a long time, it is a farce really and one more confirmation that official figures about inflation rates are kept (dishonest) low, to make us believe all is not really so bad.

In our everyday life in our wallet we know better.

"in our wallet we know better"

Lets seperate out what we are trying to learn or comprehend from the economic data ie trends and the future.

1) Core inflation rate is used as the CPI is too volitile to set the OCR against....and core is still very flat at about 2% no matter what the CPI is doing. Core is in fact showing signs od dis-flation...and at <2% already taht means a recession/depression is sneaking up on us....and that costs jobs....

Also core does not include fuel...CPI does, now if you used the CPI to set the OCR it would be rising to combat the uncombatible ie fuel cost jumps so your wallet would get a double whammy, from fuel and then against from interest payments, do you really want that? that to me makes no sense.

2) CPI varies across the year so in parts of the year its increasing but drops back later...

My wallet isnt feeling that bad.....I just bought a Makita table saw (2704) for $1448, over $300 knocked off its shop price (and 3/5s of the list price of what makita says its worth)...I bought clothes this month from farmers for the kids with 30% to 50% off....and some of it was already at a sale price....sure some things are holding their prices, some things are going up, others are not....make sure you are looking overall.

"official figures about inflation rates are kept (dishonest) low" indeed I think a web site shadowstats.com? shows inflation in its various historic calculations and compares them with nwere and todays methods, and you are right it isnt pretty.

regards

Can someone tell me why the CPI figure that used to base our interest rates on does not include by far the biggest expense - housing (i.e. rent)?

The CPI does include rents, you muppet. It also includes the cost of constructing a new residential dwelling. They're part of the 'Housing and household utilities group'.

What the CPI doesn't include is the sale price of a pre-existing home from one consumer to another - the reason for that is it's a "net-zero" expenditure transaction within the same sector. The same principle applies to the private sale of any other item from one household to another (eg; a private trademe sale of a used car from you to I).

The CPI does also include the associated costs of the house sale: Legal and RE fee's etc.

Looking into this a bit deeper, I was indeed incorrect, at the RBNZ website they state that they use the following:

Housing – House Price Index, Quotable Value Limited.

for thier CPI.

Why wasn't CPI inflation going (more) gangbusters over the housing boom period considering most houses doubled in value, and this is the biggest expense for most people?

I guess the devil is in the (flawed) calculation's used.

We’re broke and we don’t need blarney

http://www.irishcentral.com/story/roots/ireland_calling/were-broke-and-…

Also last week we learned that the interest payments on our huge debt burden are now eating up HALF of all the income tax raised in the state. And of course the debt is still growing at a dizzying rate because the state is still spending tens of millions every day we don't have

FYI I've added comments from Westpac economist Dominick Stephens, who has pulled forward his expectation for the next rate hike to December from January.

He suggests the RBNZ is turning a blind eye to the currency's rise because it is helping with inflation.

He sees a steeper rise in the OCR than the RBNZ appears to be suggesting.

cheers

Bernard

Well Bernard, nobody comments on the NZ$ demand from rugger fans flocking in for the Cup, that is going to make the NZ$ dearer.

jury is still out on Flocking...michael....Sned's thinks we might have to socialize the loss...shhhh.

Aussies will find it tough at 1.2300, maybe watch it at home in their giant screens. Hope not.

The influx of tourists for the RWC over its two months isn't even as much as NZ sees in its two busiest months at the height of summer.

If the cup can't garner as much excitement as regular tourist attractions then is it really that big an event?

Can't help but wonder if Key would be .".Keen".. on a tobin tax at the money laundromat...if not why not...? there is no bad Revenue .....is there..?

The way to fix our economy is high interest rates. High rates would destroy the debts and create opportunities by lowering asset values and reducing our huge 37 billion dollar interest bill. Its painfull for those with high debts and it would take a few banks out but its the best way to fix us, it would force our government to deal with structural problems that are leading us to the same fate that awaits Ireland.

".... it would take out a few banks.." There is your answer. It is not politically acceptable to allow a few banks to collapse. A government bailout would increase the debt problem. So I'm afraid you'll have to wait for a slow and painless deleveraging instead.

@tim

but the debt leaves us in a never ending recession. As Stephen Hulme put it 'we have unpayable liabilities'. If we have unpayable liabilities then ingoring it isnt going to improve the situation, as I tell my children problems dont improve with age like a red wine. On top of this we know that oil at over $100 a barrel leads to recession in the wes,t the oil prices are holding up a remakably well, the recession will only get worse and worse as low interest rates destroy the value of money.

The RBNZ is a fiction Like corporations and governments...

The banks can’t validate the debt because they never sustained a loss; they can’t verify any claim against me because I am not the NAME they are billing – more on this later. They can’t produce a copy of the contract because one doesn’t exist. What exists is an unenforceable unilateral contract. What the banks refer to as ‘your contract with us’ is not a valid bilateral agreement since the four requirements of a lawful, binding contract were not met on the credit card ‘application’, namely:

1. Full Disclosure (we are not told that we are creating the credit with our signature);

2. Equal Consideration (they bring nothing to the table, hence they have nothing to lose);

3. Lawful Terms and Conditions (they are based upon fraud); and

4. Signatures of the Parties/ Meeting of the Minds (corporations can’t sign because they have no right, or mind, to contract as they are legal fictions).

Credit cards are win/ win for the banks and lose/ lose for everyone else – it is the slickest con game on the planet.

HOW I CLOBBERED EVERY BUREAUCRATIC CASH CONFISCATORY AGENCY KNOWN TO MAN, by Mary Elizabeth Croft.

This is about credit cards and banks but theres more, very interesting...

What has any bank ever bought to the table? This is why Iceland will not miss the Bankers Iceland clued up and you should to!

I'll add this link here........hope it resurfaces for discussion..http://www.independent.co.uk/news/business/news/hundreds-of-economists-call-for-tax-on-currency-speculation-1899534.html

the problem with currency speculation is it has reached epidemic proportions and has permeated to the top ..........

lets see if we can find an example in Godzone politics....um er ah...I know....

There is turning a blind eye and then there is this bullshit.

Of coarse economists insist on a tax for currency speculation.

Its more muddle in the muddle of muddle. Ask the economist where this free market is? LOL there has never been one!

i used to fix cars and build houses why would I want to go back to that when i can trade currency at home off a lap top?

I learnt from all the examples set by politicians corporations and banksters looting the system for private benefit 1990-2011.

Lol your PM Key is a looter worked at one of the best places for looting...be-aware Keys agenda and Goofy is the globalist agenda. Keys orders are from far away in Europe...look where party leader Clark went to the UN in other words job well done you have sunk your farm into a debt hole....

Fixing cars and building is the road to slavery plus I provided free accounting for the IRD...

Frack them!

There is nothing in you statement Sepherial I have not implied already......my question stands

If there is to be no tobin tax on currency spec (esp short)...why not...? because everyone does it is not an answer but a complicit sanction of the problem.

You can state the same thing for trusts etc etc but its all about who's where and in the currency game your up against the Bankster, the only individuals who will be paying are small independant players like me, a bank like Goldman Sacks can print money at will...

it would - as always - target the wrong players these things always do - unintended consequences comes to mind.

Ask ya self what has any economist ever got right?

nothing I can think of....like politicians its all BS....the proof is in the world around you...

We absolutley agree on "the world around you" principal Sepherial.....but I've just got this old fashioned streak in me that makes me want to flush the shit out occassionally.......of course I'm coming at this with an axe to grind....so my position is tainted with self interest....but ah..! is that not so for us all, and indeed becomes the way of the world around us.

The dung ridden rat heap piles ever higher as I stratch n claw selected morsels to embelish my status and advance my position in the heap to one with a view of the rats below...scratching and clawing ....ad nauseum.

Open any closet door on any revolutionary and you find a closet aristocrat...

Unfortunatly the elite usurp most things that come around.

My conclusion one force controls both sides left and right north and south east and west its obvious whats going on to the thinking human we are being played off....

Most come at these questions we pose and rants we rant about, have a self interest component its called survival mate!

We have been programmed this way, but at least some of us are questioning just what the hell is going on, the majority are asleep....

The lie is different at every level!

Thats why its hard to pin down what is what and "is" in legal terms has 18 different meanings...

We can fix all this by selling the whole NZ to the highest bidder. But no point advertising NZ in Trademe 'cos all Kiwis are all broke or getting that way. I am living in Australia enjoying the big fat pay salary packet from the chinese (mining company). If someone can pass me all the details I am happy to put it in ebay!

Good to hear from you, CM! How's the weather, and more importantly, d'ya reckon you'll be back? Or just putting that shared renter in Ponsonby on the market, and staying in the Land of Oz?

hey there St. Nick.....MattS did a nice piece on Financial Repression at 9.43 am 90 at 9 yesterday

link if you like..http://www.interest.co.nz/news/53784/90-seconds-9-am-bnz-bernanke-says-us-recovery-uneven-frustratingly-slow-no-sign-qe-iii-nz#comment-623165

Thx, sir! I knew I'd seen it on here somewhere....

yes Nicholas if you follow on down the page I believe Bernard pops in the link to the original piece he did on it....good read.

Greeting NA,

In Brisbane life goes on as usual.. Brisbane City Council announced yesterday that they will be borrowing 1.3 bil for their work programs - that hardly raised an eye brown! Yes I will be selling the shared renter in Auckl - once it's off the fixed term renting aggreement. House price here in QLD dropped on average 14% so might be a good time to buy a roof over our head.. btw, NZ will always be home!

Could be! But there are projections about re a 25% decline down the road from you on the GC and up on the SC, and more to come next year. So no clues as to what my actions will be when we get there in November... same as here really!

I've updated with Alan Bollard's comments at the Finance and Expenditure Select Committtee that this morning's market reaction to the MPS was an over-reaction.

'We have long been signalling our expectation for a steep and long-lived series of interest rate hikes - that expectation remains unaltered. In particular, we are very sceptical that the peak in 90-day rates will be as low as 4.9%, as implied by the RBNZ's projections," Stephens said."

I suspect we wont even get to 4.9%.........some ppl in particualr expect a recovery, they dream of one so they can go back to the same old same old ponzi schemes, buying, lending and selling property nad making a killing....more like suicide IMHO.

regards

FYI I have added in comment from Fed Farmers warning about higher rates and farmers repaying debts.

cheers

FYI from the NZMEA on today's comments from the RBNZ

The Reserve Bank Act’s objectives must be changed to include tradable sector growth say the New Zealand Manufacturers and Exporters Association (NZMEA). Inflation targeting might have worked at the headline level but only at the expense of the tradable sector; domestic inflation has tracked well above the target band. New Zealand must follow most other developed nations and look to implement alternatives.

NZMEA Chief Executive John Walley says, “The Reserve Bank can claim that under the Reserve Bank Act objectives it’s doing a good job.”

“A quick look at the economy clearly shows this is not the case. Growth coming out of the recession has been weak despite record terms of trade and strength in two of our major trading partners, Australia and China. The high dollar is made worse by interest rate differentials between New Zealand and those in Europe and the United States.”

“There are a number of actions the Reserve Bank could take, particularly through capital controls, to strengthen the traded economy and provide faster GDP and job growth,” says Mr Walley. “While the only target remains inflation these initiatives are not considered.”

“John Key mentioned yesterday that regular currency intervention was unlikely to change the direction of the exchange rate. This is debatable but in any event other options are available and necessary.”

“Other countries are taking action to lower their exchange rates, whether through quantitative easing in the United States and the United Kingdom, capital controls in Canada and Brazil, direct currency management in China and Singapore, or regulatory prudential mechanisms in Turkey and elsewhere. We must also act to protect our tradable sector; a change to the Reserve Bank Act would be a good start in this process.”

FYI have added comments from HSBC's Paul Bloxham that a rate hike could come sooner than the December quarter.

FYI have added BNZ's Stephen Toplis picking 25 basis point rate hikes in December, January and March.

'No analysis of where extra jobs will come from'

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10731213

"[Acting Economic Development Minister David] Carter said the number of smart companies doing well should not be underestimated.

The Ministry of Economic Development and New Zealand Trade and Enterprise needed to identify those companies and work with them, Mr Carter said."

Bad news, Dave. They're all overseas. You see, unless you're into agriculture there's absolutely no future in New Zealand for a budding entrepreneur, so they head offshore to someplace where new and good ideas aren't laughed at for not being dairy farm-related.

Not only that, there are these guys called "Venture Capitalists" who don't live in fear of their own shadows, and who don't believe only dairy farming and residential property to be worthy of investment.

So, Dave, that's why NZ's so-called economy revolves around nothing but cows and houses, and probably always will. And it's why we will probably always be an undesirable backwater, single-mindedly (and funnily enough mindlessly) racing towards Third World status.

But you and your mates should look for exciting news ways to prevent Kiwis from becoming educated, such as pricing them out of polytechs and universities for instance, so that the few robber barons perched at the top can continue to pay minimum wage while whinge about the lack of skilled staff available in this country.

I don't know where all these boofheads think the economic strength is coming from....I'm really struggling for work, most people I know are too. Things are definitely worse for me and my peers this year than last, because some of the legacy projects from the stronger economy has finished / are finishing

Some of the "usual suspect" companies are still getting work, because NZ has a form of cronyism bordering on corruption

Sure dairy exporters may be doing well, but they make bugger all % of the population, and most of them are paying off debts anyway

bank boofheads like Tony Alexander seem to put a lot of stock in "Business confidence surveys". Well they are a load of bollocks! So what if 57% of people surveyed think the economy will get better - its off a crap base so its all relative!

And Rodney Dickens dismisses the value of these surveys nicely here:

http://sra.co.nz/pdf/BusinessConfidence.pdf

The wool is being pulled over our eyes people, trust me!!!!

We have reached the point where this economy exists and is allowed to operate for the benefit of the banks...isn't that right Mr English?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.