By Gareth Vaughan

New Zealand owned banks have recorded a clean sweep at Roy Morgan Research's inaugural annual New Zealand customer satisfaction awards.

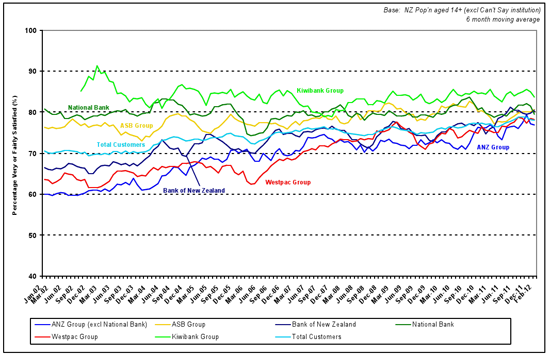

Kiwibank has been named Major Bank of the Year, a category for banks with at least 7.5% market share, and SBS Bank won the Financial Institution of the Year award. When broken down month-by-month over 2011, the news for locally owned banks only gets better. Kiwibank won all 12 months in the Major Bank category and in the Financial Institution category, SBS won eight of 12 months with the Co-operative Bank winning three and TSB Bank one.

"Kiwibank has consistently satisfied its customers over quite a long period," Michele Levine, Roy Morgan Research CEO, told interest.co.nz in a Double Shot interview.

"When it comes to the overall financial institution, any financial institution regardless of how big they are, it was SBS Bank. They topped the list there. Again, with very, very strong customer satisfaction. This is a more contested area with more players. And with smaller players you're likely to have a little bit more changing going on in customer satisfaction. They're very close, the numbers are very close, these are relatively high levels of satisfaction."

The other contenders in the major bank category were the Australian owned behemoths - ANZ and sister bank National, ASB, BNZ and Westpac.

In the Financial Institution of the Year category the other eligible contenders -aside from TSB and the Co-operative Bank - were Rabobank, Kiwibank, the big five Australian owned banks, AMP, Tower, AXA and GE Money.

The success of New Zealand owned banks continued into 2012 with Kiwibank again coming top in the major bank category for January and TSB winning the financial institution category for January.

'A good time to be thinking about customer satisfaction'

Levine said in difficult economic times like the present, customer satisfaction got even more important.

"In tough times, tough economic times like you're having here in New Zealand, the most important thing to do is to understand your customers, what they need and give them that," said Levine. "What we see in tough times though is many companies will actually start cutting costs. Really what they need to do is understand what their customers want and how to satisfy them."

"So now is really a good time to be thinking about customer satisfaction."

Roy Morgan's awards stem from a survey of about 12,000 New Zealanders across the country. All up, awards have been dished out to 24 categories across six industries. Aside from banking they include gongs for the likes of coffee shop of the year, airline of the year - both domestic and international - store of the year in a range of categories including clothing, department store, furniture, hardware and liquor. Then there's telecommunications awards, ones for electricity and gas providers and car maker. See who all the category and industry award winners were here.

"We find out from those people which companies they deal with, which coffee shops they've been to, which banks they bank with. So we then identify a really good cross section of customers of each of these operations and we ask the customers how satisfied they are with that bank, or that coffee company, or that telecommunications company," Levine said.

"We ask them on a five point scale - very satisfied, fairly satisfied, not very satisfied etc - and we look at the percentage that are very or fairly satisfied and the one that gets the highest percentage is the winner."

See more here on how Roy Morgan scores customer satisfaction.

People are most satisfied with their cars

She said Roy Morgan's customer satisfaction measures are the same across all industries meaning the company can compare overall satisfaction levels across a range of industries.

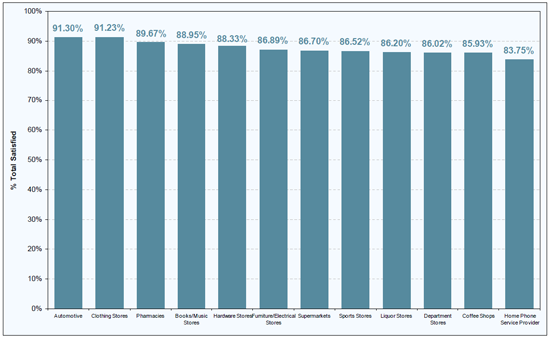

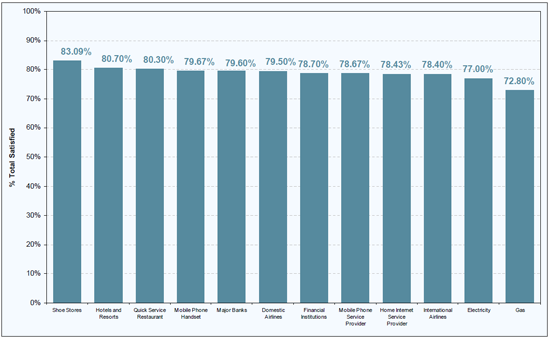

The charts below show automotive customers as the most satisfied ranging down to gas customers as least satisfied. Financial institutions came in above only electricity and gas providers, international airlines, internet service providers and mobile phone service providers.

Levine said there weren't really any surprises in terms of the industries whose customers were more and less satisfied.

"People are really satisfied with their car so automotive is pretty high. We have something like an average of 91% are very, or fairly satisfied with their car and I say that's not surprising because you kind of choose your car, you live with your car, you get used to your car. In general it's considered a she and she might have these problems, but it's your car."

"People are satisfied with clothing stores and they're satisfied with pharmacies, for instance. They're much less satisfied with things like their gas or their electricity and are a bit more critical of things like telecommunications issues . What does that mean? I think it's about what they're expecting and what joy they get from the product or service," Levine said.

"If you go in and buy something at a clothing store you walk out with something that you've chosen. You're predisposed to feel fairly satisfied unless you then have a problem with it."

"On the other hand it's really hard to get excited about your electricity. I know there's a lot of people who work for electricity companies and that's their life, but at the end of the day as a consumer, your electricity's there. The only time you think about it is if something goes wrong,' said Levine.

"I think generally the customer satisfaction equation is about customer expectations and how well they're met."

4 Comments

I agree with Kiwibank winning, its gotten easier and quicker to deal with them as time has gone on, Im very happy...thumbs up to their service desk.../ help centre....

regards

"Financial institutions came in above only electricity and gas providers, international airlines, internet service providers and mobile phone service providers."

This suggests where ppl have choice and there is competition those industries have to try harder, more monopolistic sectors on the other hand show up as on the bottom....

Personally I cant wait for the high speed fibre broadband so I can get off Telstraclear......that awful auto telephone system of clear's just hacks me off.

Vodafone I left 2 years ago and Ive never regreted it...2 degress is as good, cheaper and their support lines and web site way better........

Telecom have a bunch of poor english speaking support ppl that either dont know their products or seem to constantly mislead and the quality of the line to india seems to suck.........so 3G for instance is a ripoff....

</rant>

;]

regards

the people that i know who have changed to kiwibank all retain accounts with their original banks.

the big 4 will always be the big four and seen to be safer than the rest.

meanwhile unless big changes happen at nz post kiwibanks profits will be diverted to hold up a struggling business.

I was with National Bank for years and got thoroughly sick and tired of their condescending lacklustre attitude when I had a considerable $ value to invest. They wouldn't negotiate and it took three months, numerous phone calls and emails (with accompanying spreadsheets) for me to convince them their calculations were incorrect. Not even an apology but instead "that's just how our system works things out". So I called Kiwibank (they couldn't have made it easier) and set up everything over the phone, basically they couldn't do enough and were willing to listen/negotiate and give me exactly what I wanted - when I wanted it. ANZ/National -are simply hopeless and BNZ asked me to walk around with a bank cheque for 6 figures, instead of arranging a transfer on my behalf. Been with Kiwibank now for 6 months and I have a personal banker, don't have to go in to a branch and just arrange everything over the phone and any changes I wish to make are no longer a problem...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.