October 1 starts the second month of Spring. We are supposed to be well into the upswing of the residential sales cycle.

This is also when banks and other mortgage lenders launch their new season incentives, usually around interest rate 'specials'.

But this year, things are eerily quiet on that front.

Yes, we have had some minor tweaking, but the emphasis has been on 'minor'.

And real estate sales volumes, while picking up will still likely be in cycle lows when the September data is revealed over the next two weeks. No upside records are expected.

However, now is a good time to assess interest rates. The market is positioned competitively.

Almost all institutions have 'special' rates, fighting rates distinguished from their 'standard' rates.

'Special' rates require at least 20% equity, and are usually only available for owner-occupiers. Sometimes they require you to sign up to other bank products, like a credit card, KiwiSaver, or a bank insurance product.

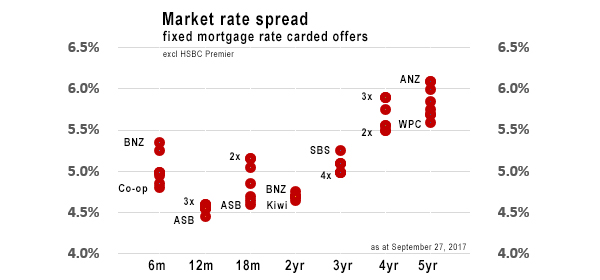

One feature of current rate offers is the compressed range on offer. The difference between the highest and lowest one year carded rates is just 14 bps (ASB is offering 4.45% at the low end whereas BNZ, Westpac and SBS Bank are all offering 4.59% at the high end.)

For two years fixed, Kiwibank is offering 4.65% at the low end, whereas BNZ is offering just 4.75% at the top end, a range of only 10 bps.

The range widens as the terms get longer but there are four banks offering a lower three year rate than ANZ, BNZ and Westpac are offering for an 18 month rate.

Margins-to-swap for terms 12, 18 and 24 months are all about +2.45%. Margins at this level are 'normal' - rarely do they fall below 2% which is a natural pricing barrier. That suggests about how much wiggle room is available from carded levels. They rise from there for longer terms.

All banks will negotiate, but the extent of their flexibility will first depend on the strength of your financials, and secondly on your persistence and tolerance for doing the shopping-around work. It is intensive work.

Our analysis excludes HSBC Premier which have the lowest rates for almost every term except for 6 months fixed. HSBC's Premier offer has conditions that are more restrictive than what most banks require, but if you meet them they clearly have a superior rate offer all round.

See all banks' carded, or advertised, home loan interest rates here.

Here is the full snapshot of the fixed-term rates on offer from the key retail banks.

| below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at September 27, 2017 | % | % | % | % | % | % | % |

| Swap rates | 1.99 | 2.03 | 2.11 | 2.20 | 2.39 | 2.56 | 2.71 |

|

4.99 | 4.55 | 5.15 | 4.69 | 4.99 | 5.89 | 6.09 |

|

4.95 | 4.45 | 4.60 | 4.69 | 4.99 | 5.49 | 5.69 |

|

5.35 | 4.59 | 5.05 | 4.75 | 5.09 | 5.89 | 6.09 |

|

4.99 | 4.55 | 4.65 | 5.09 | 5.75 | 5.99 | |

|

5.25 | 4.59 | 5.15 | 4.69 | 5.09 | 5.89 | 5.59 |

|

4.80 | 4.55 | 4.69 | 4.69 | 4.99 | 5.55 | 5.75 |

|

4.85 | 4.09 | 4.09 | 4.29 | 4.89 | 5.29 | 5.59 |

|

4.99 | 4.59 | 4.85 | 4.69 | 5.25 | 5.49 | 5.85 |

|

4.85 | 4.55 | 4.65 | 4.69 | 4.99 | 5.55 | 5.69 |

In addition to the above table, BNZ has a fixed seven year rate which is 6.15%.

And TSB Bank still has a ten year fixed rate of 6.20%.

9 Comments

I'm seeing a return to 0.9% of total HML Value in cash contributions from the major banks along with some discounts on rates, biggest yet was $5500 for $650k lent (80%) with discounts to 3 and 4 year rates.

"Across (Australia) more than 860,000 households are estimated to be in mortgage stress, with more than 20,000 in severe stress, or a rise of about 1 per cent to about 26 per cent to the end of August.....About 46,000 are estimated to risk default..."

So who really thinks interest rates are going to rise?!

http://www.afr.com/personal-finance/more-than-30000-of-the-nations-rich…

The only central bank to increase rates is the Bank of Canada. Long gone are the days of bold brave interest rate shifts by central banks. Instead they pussy foot around and pretend that all the bubbles they inflated aren't their fault.

The rates are going up but so incredibly slowly as to be irrelevant. How much more debt can we take on before it collapses by itself?

Sorry Dictator ? The US Fed has already hiked four times and is more likely than not going to hike again before Christmas. But agree slowly, as will the others that are primed to go in the next 6-12 months.

I don't think they will rise. However, not becasue a particular market cannot afford to pay their servicing costs (i.e. interest) as you seem to imply.

If oil took off and you had a whole lot of drillers willing to pay high interest rates for capital spending it must surely push up interest rates (as demand for capital increases). If Aussie home owners cannot pay these new higher rates that is not relevant. The banks would say "sell and give me my money back so I can seek greater returns from the drillers".

I just do not think interest rates will rise because there are few opportunities out there for investors to make big returns.

That is just not true at all. Heathly returns are being acheived by many fund managers. Just look at our KiwiSaver fund analysis. And among the best is the NZ Super Fund. That investor posted a +10.2% return before tax and after costs. And they are not unique.

What you are probably referring to is low returns for bank term deposits. But expecting higher returns there for very low risk and no work is the not normal nor likely to return anytime soon. That pre 2008 period characterised by finance company offers is long gone.

Higher returns requires accepting some level of risk. It can be done prudently as the NZSF shows. You are not really an 'investor' unless you accept some risk. More of a 'parker'.

Does it matter if interest rates rise, or not?

If they don't, it simply implies that productivity is expected to be flat - right?. i.e. the return to investing is very low.

The consequence of this is that without productivity increases, wage increase are impossible for the vast majority of the population (sure there will be hierarchical adjustments, but not standard increases for everyone) . That essentially means that those people banking on income increases to underpin their ability to repay their debt are stuffed either way.

So if interest rates don't increase, it doesn't matter. Those that are currently in stress are still unlikely to ever be able to drag themselves out of it.

Bw - just be aware of an evenly bigger crisis looming in the country that sets the benchmark global interest rates, the US and its massive impending pension crisis which has been driven by overpromising, under funding, and most specifically, too low interest rates which are producing sub-par returns even at a time of equities strength. Doesn't get much media yet, but when this blows the consequences for global rates is huge.

We moved to HSBC almost 18 months ago because they offered sub 4 interest rate plus maximum cash incentive. It's almost time for a renewal and still HSBC offering the best interest rate in the market. Only minus is that they don't have a mobile app! Glad we moved, please note that moving bank is not a cumbersome exercise.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.