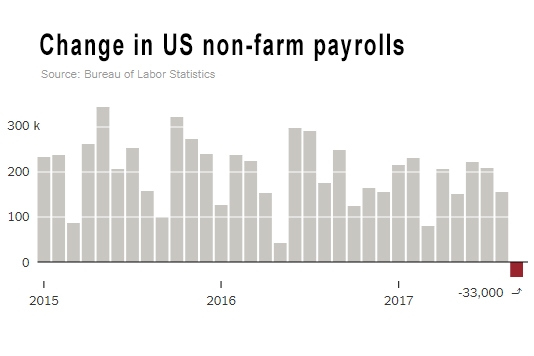

Over the weekend, the US employment report came in very weak in terms of employment levels.

Non-farm payrolls actually fell -33,000 in September from August which itself was a lowish +169,000.

That is the first fall since 2010.

The change in total nonfarm payroll employment for July was revised down from +189,000 to +138,000, and the change for August was revised up from +156,000 to +169,000. With these revisions, employment gains in July and August combined were -38,000 less than previously reported.

However, the September data weakness was attributed to the impact of a series of hurricanes. Employment in "food services and drinking places" was particularly hard-hit.

Having said that, this survey reports that "In September, average hourly earnings for all employees on private nonfarm payrolls rose by 12 cents to $26.55. Over the past 12 months, average hourly earnings have increased by 74 cents, or 2.9 percent." That takes average weekly earnings to US$913.32, the highest average is in the mining industry at US$1,466.10 (+4.4%) and the lowest average in the "leisure and hospitality" industries at US$404.30/week (+3.2%). The lowest rises came for employees in the durable goods manufacturing industries which were up +1.8% to US$1,151.54/week.

The US unemployment rate was reported lower at 4.2%. (The New Zealand equivalent rate is 4.8%.)

Wall Street reacted to this data in a relatively muted way. It was influenced more by other data.

And analysts said they expected the US Fed to look past this employment weakness and push on with its interest rate rises this year.

The UST 10 year yield rise to 2.37%, up +2 bps on the day.

The US dollar rose on the news, pushing the New Zealand dollar down to 70.9 USc, its lowest level since May 30, 2017.

Meanwhile, CNN Money's "Fear & Greed" indicator reached a record high on the "greed" index.

1 Comments

Again, we don’t really know what the headline payroll figure might have been if there had been no disruptions from Mother Nature. Thus, the -33k can be set aside. Instead, we should focus on prior months where no such distortions are present.

The BLS has revised downward the Establishment Survey for the past three months; a few substantially. The monthly gain for July 2017 was originally reported as a solid +209k. As of the latest update, the monthly gain stands at just +138k, which had it been released that way in early August would have produced a starkly different prevailing mood. It was far more in line with the August 2017 report, released in early September, one that did thoroughly disappoint across-the-board. Read more

As reported earlier today, in one of the most closely watched statistics in today's payrolls report, the BLS reported that the annual increase in Average Weekly Earnings was a whopping 2.9%, above the 2.5% expected, and above the 2.5% reported last month. On the surface this was a great number, as the 2.9% annual increase - whether distorted by hurricanes or not - was the highest since the financial crisis.

However, a problem emerges when one looks just one month prior, at the revised August data.

What one sees here, as Andrew Zatlin of South Bay Research first noted, is that while the Total Private Average Weekly Earnings line posted another solid increase of 0.2% month over month, an upward revision from the previous month's 0.1%, when one looks at the components, it become clear that the BLS fabricated the numbers, and may simply hard-coded its spreadsheet with the intention of goalseeking a specific number.

Presenting Exhibit 1: Table B-3 in today's jobs report. What it shows is that whereas there was a sequential decline in the Average Weekly Earnings for Goods Producing and Private Service-producing industries which are the only two sub-components of the Total Private Line (and are circled in red on the table below) of -0.8% and -0.1% respectively, the BLS also reported that somehow, the total of these two declines was a 0.2% increase! Read more

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.