This week’s Top 5 comes from Professor Siah Hwee Ang, the BNZ chair in business in Asia who also chairs the enabling our Asia-Pacific trading nation distinctiveness theme at Victoria University.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

1. China’s slow down faster than predicted.

Only a few months ago we predicted that the Chinese economy would grow close to 6.5% in GDP in 2019.

After all, in 2018 alone, China’s GDP grew another 6.6% – a dollar value of US$1.18 trillion which is the equivalent of Mexico’s entire GDP in 2017. Mexico is the world’s 15th largest economy.

But now, the International Monetary Fund (IMF) has downgraded its forecast for the world’s second largest economy to 6.2%.

China has expressed the view that it needs stable growth, as China’s Vice-President Wang Qishan said “Speed [of growth] does matter. But what matters more is the quality and efficiency of economic development”. But the drawn-out trade war with the US does not help much.

It remains true that a stable, growing China is healthy for the global economy in the mid to long term.

The pace of the drop this year might provide some indication about China’s ability to manage the inevitable (slow down) and adversity around its presence in the global economy.

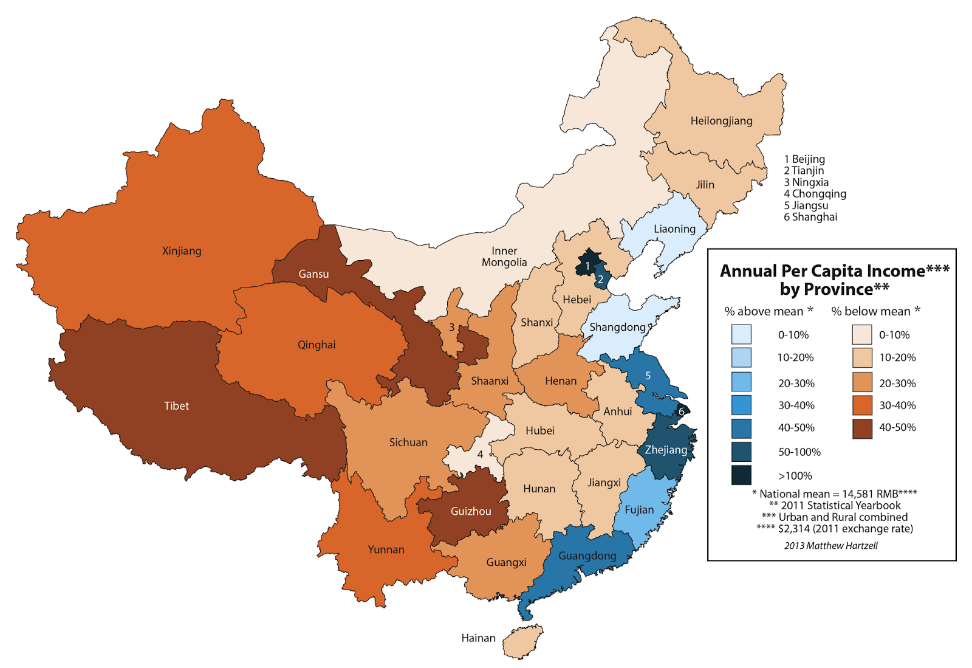

2. China’s uneven economic development across its regions continues.

There is little doubt that the regions across China are diverse when it comes to cultures and languages.

Yet, the diversity of economic development across the regions can be even more telling.

According to the McKinsey Global Institute, there are four tier-one cities, 46 second-tier cities in China, 193 third-tier cities and 696 fourth-tier cities in China.

While we should expect tier-one cities such as Shanghai and Beijing to take the lead on economic growth, most of the growth in consumption is likely to come from the lower tier cities.

Urbanisation of the cities itself poses a challenge, as every time there is a relaxation of rules around the Hukou system – China’s internal migration rules – migrants from other cities often flood into the top-tier cities.

The debate on whether China is a developing nation continues: parts of China are so well developed that some argue that the country should no longer hold developing nation status.

As China grows in many aspects, its rising population should cause it to stop and ponder its plans for transformation and tackling inequality issues, beyond urbanisation and urban employment.

3. In China, a comment can be worth a billion dollars.

As China develops, it is now easier to travel to many regions in the country without meeting the requirement for Chinese language skills.

While there will always be some cultural challenges for foreigners, it is not too difficult if visitors are courteous.

Recently, swine flu has hit China again, causing major changes in pork prices and knock-on effects on trade. The situation receives particular attention in light of the ongoing China-US trade war.

Just over a week ago, a London-based UBS economist made a comment in his podcast, “Chinese consumer prices rose. This was mainly due to sick pigs. Does this matter? It matters if you are a Chinese pig.”

The comment about “Chinese pigs” was interpreted to refer to the Chinese people rather than the pigs as animals.

And these days with the strength of the social media in China, a comment such as this can go viral.

UBS sought to defuse the situation immediately by apologising and meeting with officials to clarify. But the damage control can only go so far.

A China Railway Construction Corporation (CRCC) bond deal worth a billion dollars immediately fell through.

And that’s just for starters. We should all keep a close eye on this development.

2019 is the Chinese Year of the Pig. Though it may well have been an honest mistake, one must be culturally and linguistically sensitive in putting ‘Chinese’ and ‘pigs’ back-to-back.

4. The Belt Road Initiative (BRI) is moving along.

China held the second Belt Road Forum in late April this year. Leaders from 37 countries attended the forum.

While China continued to showcase the multifaceted nature of this initiative at the forum, a few countries were more keen to provide feedback on the ambiguous nature of it, and air their concerns around debt issues relating to borrowing for infrastructure projects.

China agreed to address these concerns.

It is clear though that the BRI is here to stay, as it was written into China’s CPC Constitution at the CPC 19th National Congress in October 2017.

This is now linked to tourism, education, foreign direct investment, yuan internationalisation, air space, energy, and technologies amongst many others.

The statistics show that China’s trade volume with other BRI countries reached US$1.25 trillion in 2018, accounting for 27.4% of China’s trade figures.

More telling is the 13.3% growth in trade with these countries year-on-year, as compared to China’s trade growth of 3.6%. Little wonder that China is bent on pushing more resources and attention onto the BRI.

5. Some consumption observations in China.

We know for a fact that the Chinese government is pushing for its economy to become more consumption-driven.

The Chinese have a savings culture and there is plenty of consumption potential there.

Recent trends indicate that China’s online retail sales grew a whopping 24% in 2018.

The number of online shoppers in China increased from around 46 million in 2007 to over 533 million in 2017.

The gross merchandise volume of China’s e-commerce market grew more than six-fold from 4.8 trillion yuan in 2010 to an estimated 32.7 trillion yuan in 2019.

The biggest winners from this situation have been in the service sector, such as tourism, movie theatres and restaurants.

As we all know, sometimes we prefer to see an item in person before purchasing it. This is especially relevant for high value goods. In this case, purchasing from online platforms may not always work as it is often hard to make a pre-purchase assessment based solely on online images. Hence, the innovation of the livestreaming, where items are streamed live to potential shoppers. Livestreaming shopping is becoming a hit in China.

The Asian population, including China, is facing a rising obesity challenge. Whether it’s about health reasons or for convenience, meal replacement products are a welcome solution. Such products are now trending in China and sales are expected to rise by at least 5% each year.

25 Comments

祝祖国,国泰民安,繁荣富强。

赞赞赞。

Sure, praise your Motherland xingmowang.

A few lies don't seem to matter to you, like this one as an example.

Laughable if it wasn't so serious.

Watch China's Propaganda In Action: Foreign Ministry Claims Massive HK Protests Were "Pro-Extradition"

https://www.zerohedge.com/news/2019-06-26/watch-chinas-foreign-ministry…

And then there's the Uyghurs and Tibetans in so-called re-schooling camps.

More like indoctrination as in 1984.

Nice. More people need to call out this horrid regieme. We have been complicit. Shameful.

Did you see news of the first of the Chinese banks to collapse today? Posting profits in last filing in 2017 with a default rate of just 2% of loans - then default . Do you think there will be many others Mr Xingmowang?

https://mobile.abc.net.au/news/2019-06-28/baoshang-bank-collapse-hits-l…

没有法治,什么是繁荣和力量?大量腐败官员。

我知道你一定以你的国家为荣,因为我是我的。

why there's no toilet paper in China.

https://www.youtube.com/watch?v=np4OwQaJItY

Here is a question; If I understand it correctly there is no social welfare system in China, interesting in itself for a country purporting to be socialist or communist, and they have a saving culture. This saving culture makes sense as people save to protect themselves and provide for some form of retirement. But now they want to increase consumption? These two just don't meet up! The consequences can't be good.

Chinese don't have big hobby spend either. The government is so controlling that a lot of bigger western style recreational consumption spending activities doesn't exist. You don't see people playing in parks, you don't see mountain biking or road cycling or skiing or sailing or off-roading or tramping or... You do see people going to restaurants but mostly people just watch TV, play video games and other low cost entertainments, and there is little space for toys. With all their spare money being ploughed into housing and education with occasional ostentatious excesses like porsches if they are rich. So property is pumped up to insane levels - and parents are having to buy their sons houses too if they want to have a chance of attracting one of the scarce (girls killed or aborted) available women. I don't see how they can transition to western level consumption spending.

The people are not dumb, they know that if you do energetic outdoor exercise you will get more than your quota of lung cancer causing dust in your lungs. But additionally, these things are just not in their culture. Their grandparents and parents were way too busy earning a crust to have any hobby or sport.

" there is no social welfare system in China" - now I can tell you that is wrong. "Welfare reforms since the late 1990s have included unemployment insurance, medical insurance, workers’ compensation insurance, maternity benefits, communal pension funds, individual pension accounts, universal health care, and a carbon tax." (from https://en.wikipedia.org/wiki/Social_welfare_in_China)

The government has been rolling out this "New Rural Co-operative Medical Scheme" now, which makes sure everyone is covered. Annual contribution of NZD$80 can get 60% of your surgery and hospitalization cost covered. Plus, you don't have to wait a month to get admitted. Those who have been protesting against PHARMAC for inadequate funding of new treatments will be surprised to see the new medicine and treatments that are funded by the public healthcare system in China (in those blue developed area though. Uneven benefits among different regions is the problem).

The fast improving welfare system is one of the reason why the saving and spending habits are changing among Chinese.

Your first comment - you refer to all the programmes as "insurance". Who pays the premium if it is the people then it is not social welfare but insurance. Even the health programme you mentioned is health insurance, no matter how cheap it seems. On that how affordable is it for ALL Chinese, not just the middle classes?

"They" are two different people. The govt and the public.

The govts everywhere want more things being bought.

The newly urbanised in China have been buying all sorts of property and baubles. Property is an attempt to amass some retirement money. (If the value holds up long term: unlikely within China where land is not part of the deal). The baubles, no that's straight out lifestyle change and "pecking-order" enhancing indulgence.

A few hickups have occurred like the stock market correction, peer to peer lending fraud and the US waking up and taking action on Chinas' trade policies. But there has not been a good proper recession there yet. So, consumption will still be happening to a certain extent. However, without welfare, this will definitely be to their detriment in the long run.

Having said all that, if you are an ex-govt employee there are super payments made.

The top five interesting things today in NZ are about China? No subtext there...

Yes, just the size of the bear is astonishing. And to think, today, still less than 7% of Chinese have passports.

Any thoughts about the astonishing propensity for Chinese folks to move money out of their country ?

Anyone would think they don't trust their government...

Only reasonable scenario I can think of doing that out of distrust of the government is when the money is not legally earned. Otherwise it is mostly because they have extra cash to do so. 1. The money is after higher returns. 2. Diversification. And the money will move back when circumstances change. Somewhat like Chinese sending their kids to study overseas. Saw astounding increase over past 20 year. But more students are returning home after getting the degrees than before.

You must want to believe that people are moving money out because they hate communist China so much, the ideology, pollution etc. No, wise ones won't do that. They would probably get residency elsewhere, or vacation out of the country when PM 2.5 is too high but keep the money work for them back in China.

One factor: the Chinese must love the concept of owning the land component of their Western property.

Yes, there is no private ownership of land in China. NZ$ 1 million can only get you a 30 m2 apartment in Shanghai with 70 year right of use. But can buy you a full section in a country that self claim to be "100% Pure", with a house on it!!! You are practically giving away the land to them. Yes, Please!

100% it took living in Dubai and observiing how they protect their property against foreign ownership to realize that the west just sells itself off like a cheap whore

You seem to have zero experience with authoritarian regimes. These regimes are pretty much like Mafia. If you have wealth, regardless of how you have amassed it (e.g. drug trafficking or genuine technical innovation in shipping), the government will simply take it away from you. You have two option: to part with your wealth or to hide it or move it out of their reach. This is not to say that there is not criminal money in money flowing out of China. Just that criminal roots of the money is not necessarily why it is moved (actually, without knowing much from China, I can confidently say that the regime is behind any criminal ventures that make serious money).

Xi Jinping wants China's armed forces to be "world-class by 2050 (read: America-beating)

https://www.economist.com/china/2019/06/27/xi-jinping-wants-chinas-arme…

No imperial ambitions?

In CCP, lies are worth more than metaphors, and porky pies can be worth trillions of dollars plus yet another Nation under surveillance and in peril.

CCP used to stick electric cattle prods down the Tibetans throats... and they are concerned about a

metaphor?

I don't say China, since the people of China don't have the human right to freedom of speech, it's the Authoritarian, Totalitarian Regime of the CCP. Lies, espionage, infiltration, genocide and re writing history.

CCP never get concerned with a metaphor. But God they play nationalism well when they want to! No more "hurting of Chinese people's feelings".

'Porky pies' - careful with your porcine references, man.

Did anyone else find this a propaganda driven piece of BS?

Thanks, i will try.. it made me chuckle since my children come home from school saying that daily - it's the teacher's polite way of getting the truth out of her five-year-old learners of late. Good point though. Oh yep, and smells like propaganda to me.. bugs me a bit, saw it coming years ago though, everybody was too afraid of the um....... yeah, regime until President Trump. Blessings and freedom;

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.