By Patrick Watson*

The “Phase 1” US-China deal is signed, sealed, and delivered. Phase 2 is in the works but won’t happen any time soon. Investors celebrated anyway.

They’re not entirely wrong; Phase 1 represents some incremental progress and, for the moment, may keep the trade war from intensifying. It also handsomely rewards certain favored parties.

That’s about all the good news.

Phase 1 isn’t an economic game changer. Americans are still in a worse position than they were before President Trump launched the trade war, and this deal doesn’t repair the damage already done.

Here are seven reasons to hold your applause.

#1: The Ground Is Still Moving

Tariffs are manageable if businesses know what to expect. That’s not how Trump operates. He uses uncertainty as a negotiating tactic. He believes keeping the opposition confused gives him an advantage.

Unfortunately, it confuses innocent bystanders, too. If you are an import-dependent US company, you need to know your input costs with reasonable certainty—not just now, but a year from now.

They still don’t have such certainty, since everyone knows Phase 1 could easily fall apart or Trump could target other countries. So businesses remain reluctant to make capital investments and expand capacity. This reduces economic growth.

#2: Tariffs Are Still Higher Than Before

Before Trump launched this trade war in 2018, the average tariff on Chinese goods brought into the US was 3%. Now it is 19%, and that’s after Phase 1’s relief. And those rates apply to almost two-thirds of all Chinese imports.

Let’s also note, tariffs are a tax on American consumers. China doesn’t pay them, you do.

You’ve already paid a lot, you will keep paying a lot, and you aren’t going to get a refund… unless it will help buy your vote. Then you may see a few bucks.

#3: The Battle Will Shift Elsewhere

Media reports call Phase 1 a “ceasefire” or “truce,” but the firing hasn’t ceased. It’s not a truce when the warring parties simply agree to shoot smaller bullets at each other.

Meanwhile, we have other trading partners, and a president who likes using his trade powers to accomplish other goals.

This month, for example, the Trump administration threatened to impose a new 25% tariff on European automobiles unless Germany, France, and Britain cooperate on Iran sanctions.

Every industry must still wonder when it will get dragged into someone else’s fight. The trade war isn’t over. It’s just relocating.

#4: Fantasy Farm Purchases Won’t Help US Farmers

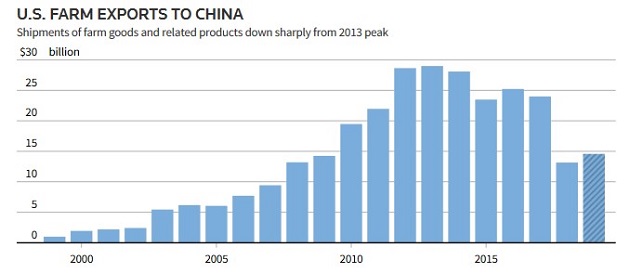

Phase 1 commits China to buy more US farm products—this year $12.5 billion more than the $24 billion in bought in 2017. Then in 2021, Chinese purchases are supposed to be $19.5 billion over the 2017 baseline.

In other words, the totals will be $36.5 billion in 2020 and $43.5 billion in 2021—far more than ever seen before.

To meet those targets, US farm production will have to grow considerably, and/or we will have to sell goods to China that would have gone to other countries.

We won’t know for a long time if this deal actually helps US farmers. But lower sales in 2018–2019 definitely hurt them.

#5: GMO Provisions Could Give Away the Farm

China agreed to offer an expedited review process for genetically modified agricultural products.

In the short run, this might help US farmers who produce GMO grains. But it might also give China the same biotechnology that lets US farmers produce higher-yielding crops. The Chinese could then grow products they now import.

US companies that sell GMO seed and chemicals might still make money. American farmers wouldn’t.

#6: “Enforcement” Mechanism Encourages Cheating

Unlike other trade deals, Phase 1 has no arbitration clause. What happens if disputes arise, as seems likely?

Well, the two sides will start with “bilateral consultations.” If that doesn’t work, they’ll have higher-level consultations. If they still can’t agree, the complaining side can retaliate however it wants. The other side can’t respond except by withdrawing from the entire agreement.

That means the US and Chinese governments will probably ignore lots of small-potatoes cheating that isn’t worth scuttling the whole deal. If it’s your small potatoes, you will just be out of luck.

#7: Phase 1 Rewards Socialism

If you think socialism and economic central planning are bad ideas, you should hate Phase 1. It promotes both.

Consider those agricultural purchase commitments. Exactly how will the Chinese government keep that promise? Beijing will simply order companies to buy US products, whether it makes business sense or not. Phase 1 depends on exactly the kind of “state control” the US ostensibly wants China to abandon.

This deal is, as one analyst called it, “Communism with American characteristics.” It compromises core American principles for short-term financial and political gain.

Out of Nowhere

I could go on, but you get the point. Phase 1 isn’t going to help either country’s economy much. The trade war is still on. Nothing in Phase 1 gives US businesses reason to make long-term capital investments.

That means 2020 will probably bring more of the same: low economic growth that is trending even lower.

Low growth is better than no growth, of course. But we missed a turnaround opportunity.

Worse, any of several brewing crises could cause major problems.

- The Fed is still pumping billions into the repo market with no sign it will end in March as promised.

- Boeing is nowhere near restarting 737 MAX production, even as its vast US supply chain begins laying off workers.

- Middle East instability could push world energy prices sharply higher.

Then there’s the president’s impeachment trial. While the Senate will probably acquit him, we should wonder what else might emerge afterward.

This Ukraine/Biden thing came out of nowhere just a few months ago. Something else could, too. And it might not be in Washington.

*Patrick Watson is senior economic analyst at Mauldin Economics. This article is from a regular Mauldin Economics series called Connecting the Dots. It first appeared here and is used by interest.co.nz with permission.

10 Comments

Some good ol' American scepticism from our friends in the USA. It has some merit, no doubt, but like most stories, it is a part of the story not the whole one, as most stories for this format tend to be.

The China game is The Big Game of this new Millennium no question about that. How we deal with & discuss things & get on with one another (or not) are the key questions for any country on planet Earth wanting to play this century. That's most of us, right? And for a small trade oriented country like NZ Inc which is now beholden to the beast from the East for almost a third of its means, one way or another, this is a scary prospect and/or moment in time for many reasons. The big one could be that our own trade deal with China is sidelined for no other reason than the Chinese are bullied into buying more American dairy produce, because of the Phase 1 Trade Deal just signed by the two big nations. I really hope I'm wrong, as a great deal of NZ's recent prosperity has come from the big buyers in China. China is so big that no country can ignore it now. But as we've seen, and as we will see I believe, is that things will change on a whim (or a tweet) & little fish like us will just have to make do the best we can.

I believe you are right Long John

China will probably take more US dairy at the expense of NZ dairy exports

It’s not likely anything can be done about that

It will be just like when Britain joined the EU & forgot about NZ

Best NZ make some deals with UK before the US after Brexit finalized

Ultimately though you are right NZ is so small it’s left the scraps

This decade will be turbulent.

The AUS bush fire, the US assassination of a Iran general, and the breakout of corona virus at the very beginning of this decade are very bad signs.

Yeah nah.

Nothing exceptional about those things really.

Relax, tomorrow is the year of the rat? let's just celebrate.. anticipating more 'hot year for RE market' as ANZ touted - forget anything else on this planet... property is the key in life.

That’s life get used to it

Patrick makes this comment "Let’s also note, tariffs are a tax on American consumers. China doesn’t pay them, you do." which is correct but only superficially. The principle behind tariffs is to make the price of a commodity from an foreign manufacturer equal or dearer than the same product made at home. It is about protecting jobs and capability. My question is at what level does an entrepreneur start saying "we can make and sell these things for a better price than that"? There are a lot of manufacturing plants in the US and elsewhere, many of which are struggling or losing money. The point of tariffs is to protect them, but they do much more.

An ability to manufacture a product for a given cost, in other words efficiently does much more than protect jobs and economic welfare, but builds and maintains capability, positioning companies and the country to develop manufacturing processes that are efficient and for new things, building self-sufficiency. This is what tariffs do.

China's undercutting of US manufacturing is a form of economic warfare, and if the manufacturers and investors in the US do not step up to the plate then China will still win. another question is there an opportunity in this for us in NZ?

Reason 8: Donald Trump is an idiot, racist, sexist, deplorable, liar, cheater, lazy, small hands, bad hair, very orange impeached loser.

Maybe but he’s way better than any democrat leader

You obviously don’t track the US market

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.