This Top 5 comes from interest.co.nz's Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

So here we are in Auckland, back in COVID-19 Alert Level 3 with the rest of the country in Alert Level 2. It certainly does feel like Groundhog Day... Hopefully we're all back to Level 1 sooner rather than later. In the meantime, here's a bit of reading.

1) Global investors the least fearful and most greedy they've been in two decades.

Investors are the least fearful they’ve been in 20 years, and possibly the most greedy, according to a JPMorgan Chase & Co. gauge of cross-asset investor complacency. This may seem crazy in the midst of a global pandemic. But then you factor in all the stimulus from central banks and governments, and extremely low interest rates.

Here's Bloomberg:

A JPMorgan Chase & Co. gauge of cross-asset complacency based on valuations, positioning and price momentum is nearing the highest level since the time the dot-com bubble burst and some companies found out burning cash faster than they made it wasn’t quite effective as a long-term survival strategy.

Some of that get-rich-quick spirit has already been in display in 2021 from Bitcoin’s flirting with the $50,000 mark to the craze for cannabis firms and speculative warfare over penny stocks. Global equities have added $7 trillion since New Year, digital currencies have ballooned to a market value of $1.4 trillion and high-yield bond sales are raking in records.

Interesting to see the comparison to the dot-com bubble. I cut my teeth as a financial journalist in London during that period. It was an eye opener seeing tin pot tech companies post losses and their share prices promptly surge. Certainly the crypto-currency frenzy going on brings back some memories of those days.

Meanwhile, JP Morgan doesn't think the punch bowl's going to be taken away from the party for a while yet.

JPMorgan strategists seem to agree. While a “pause” is likely now, they say, there’s no reason to expect a substantive pullback from the rally fueled by the trillions of dollars being unleashed. The main risk on the horizon is a taper of bond-buying by the Federal Reserve once employment and inflation return to targets, but that’s not likely until later in the year.

“We’ve been comfortable advising investors to stay long most markets,” strategists led by John Normand wrote in a Feb. 12 note to clients. “When growth is above trend, monetary policy is ultra-loose and fiscal policy is on overdrive, markets tend to exhibit the financial variant of Newton’s Law: they stay in motion until acted upon by another force.”

Irish economist David McWilliams offers a solution to his country's housing woes. He describes a similar scenario to what we see in the New Zealand housing market. Albeit our market seems more out of control with prices rising faster here (19% last year).

Here [Ireland], we start with the price of houses as the foundational price and work around that.

We construct all sorts of wheezes to maintain this lunacy, irrespective of the reality of people’s incomes. We engineer help-to-buy schemes, shared-equity arrangements, first-time buyers’ grants, various interest rate products, 30-year mortgages, and buy-now-pay-later options.

All of these are designed to put people into long-term debt and short-term penury, in order to validate already inflated house prices. The implicit message is: “Don’t worry we’ll keep prices up, so you can eventually sell on to a greater fool and trouser the capital gain.”

The problem is that the greater fool is your children and their children.

The result is that, even in this pandemic, house prices in Ireland continue to rise, between 5 and 7 per cent throughout the country, despite the fact that unemployment has risen, businesses are boarded up and commercial rents are falling.

McWilliams offers an elegant solution. Trouble is it means house prices need to fall. Politicians from our two major parties, and seemingly plenty of their voters, plus our banks, don't want that.

There is a solution to this silliness. Our entire nation has been bullied into starting the conversation with house prices and working hard to validate existing prices, but we are getting things back to front.

Imagine abandoning the notion that the house price is regarded as totemic and everyone must worship at its feet? What about starting with income?

Let’s construct a little economic model of house prices and where those prices could be if we used wages rather than house prices as the starting point. It is generally accepted that rents of around 30 per cent of after-tax income are fair. Rents are the income that accrues to the property owner and should determine the value of the asset.

Let’s see how much people ought to be paying based on Irish wages.

The median family’s after-tax income in Ireland €3,750 per month. This means such a family should be paying rent of around €1,125 per month. In order to put a value on the asset and a fair price on the house for a landlord, let’s assume (very generously) that a landlord needs a 5 per cent yield to remain in the business.

At a 5 per cent yield, the house should be worth the annual rent (€1,124 multiplied by 12, or €13,488. If €13,488 constitutes 5 per cent of the price, then the total value would be €270,000 as the fair price of a home in Ireland.

3) Vaccines will mean opening our border to COVID-19 at some point.

Monday's news that the first batch of Pfizer/BioNTech vaccines has arrived in New Zealand was greeted with great fanfare. Writing before this news, Newsroom's Marc Daalder asked the very good question of what will happen once COVID-19 vaccines have been rolled out across New Zealand. He concludes that at some point we'll be abandoning our elimination strategy.

And the low level of ICU beds per capita Daalder highlights suggests some hard thinking about, and more investment in, our health system so we're better prepared for the next pandemic.

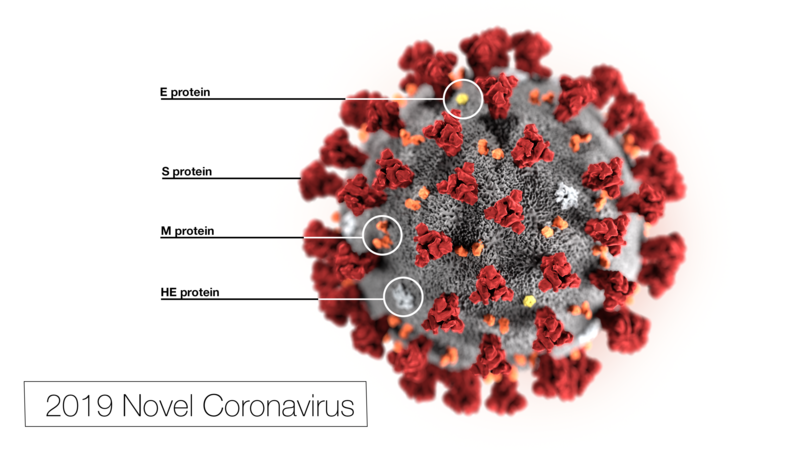

In a population without any natural immunity to the coronavirus and with insufficient measures to stop the spread - hand washing, mass masking and, for larger outbreaks, lockdowns - it can spread quickly enough to send large numbers of people to hospital. Around the world, countries have expressed confidence in their ability to handle rising case numbers before abruptly reversing course when the caseload puts their health systems on the brink of collapse.

In New Zealand, that brink is rarely far away. In March, we had just 176 intensive care beds, meaning sustained and widespread transmission would overwhelm our hospitals much faster than those of Italy or Spain, which both have many more ICU beds per capita.

Elimination, therefore, emerged as the obvious choice. The benefits are clear: We live under fewer restrictions than most of the rest of the world, we have enjoyed a faster recovery and we have seen far fewer per capita cases, hospitalisations and deaths.

To say, therefore, that we will at some stage abandon elimination is not to imply it was the wrong strategy in the moment. But as new, effective vaccines remove the threat of Covid-19 - a widely-vaccinated population is unlikely to experience an outbreak that could overwhelm our health system - the elimination approach may no longer be needed.

4) What if we never reach herd immunity?

Staying on the subject of COVID-19 - how can we escape it - Sarah Zhang of The Atlantic takes a look at whether herd immunity is actually achievable. To reach herd immunity she says the estimate is that between 60% and 90% of people need to have immunity either from vaccination or from prior infection.

A number of signs now point to a future in which the transmission of this virus cannot be contained through herd immunity. COVID-19 will likely continue to circulate, to evolve, and to reinfect. In that case, the goal of vaccination needs to be different.

While COVID-19 vaccines are very good—even unexpectedly good—at preventing disease, they are still unlikely to be good enough against transmission of the virus, which is key to herd immunity. On the whole, we should expect immunity to be less effective against transmission than against disease, to wane over time, and to be eroded by the new variants now emerging around the world. If vaccine efficacy against transmission falls below the herd-immunity threshold, then we would need to vaccinate more than 100 percent of the population to achieve herd immunity. In other words, it becomes downright impossible.

There are, of course, the anti-vaxxers to factor in. That means in western democracies the whole population simply won't be vaccinated.

The role of COVID-19 vaccines may ultimately be more akin to that of the flu shot: reducing hospitalizations and deaths by mitigating the disease’s severity. The COVID-19 vaccines as a whole are excellent at preventing severe disease, and this level of protection so far seems to hold even against a new coronavirus variant found in South Africa that is causing reinfections. This, rather than herd immunity, is a more achievable goal for the vaccines. “My picture of the endgame is we will, as fast as we can, start taking people out of harm’s way” through vaccination, says Marc Lipsitch, an epidemiologist at Harvard. The virus still circulates, but fewer people die.

At the same time, we don’t need to hit the herd-immunity threshold before transmission begins to slow. With less transmission, fewer people will get exposed, and if those who do are vaccinated, even fewer will become seriously sick or die. The pandemic will slowly fade as hospitalizations and deaths inch down.

We likely won’t cross the threshold of herd immunity. We won’t have zero COVID-19 in the U.S. And global eradication is basically a pipe dream. But life with the coronavirus will look a lot more normal.

5) The biggest bribe in the history of bribing and US$850 toilet brushes.

The ABC (Australian Broadcasting Corporation) has this fascinating story about Maria Pevchikh. She's head of the investigations unit in the Anti-Corruption Foundation of arch Vladimir Putin critic Alexei Navalny, who is currently in jail in Russia.

As the ABC puts it: "With a small staff of investigators and camera operators, Pevchikh probes the obscene wealth and murky financial dealings of the Kremlin-connected elite, producing video investigations fronted by Navalny."

Pevchikh helped find evidence of Navalny's Novichok poisoning. Her team's also behind a 113-minute YouTube expose titled Putin's Palace: History of World's Largest Bribe, revealing a vast estate allegedly built for Putin at a cost of around US$1.5 billion. It was released on January 19, two days after Navalny flew back to Russia following months of rehabilitation in Germany, to be immediately detained by police at a Moscow airport.

"The place is so expensive that it is probably the biggest bribe ever given in the history of bribing," Ms Pevchikh said.

Putin's Palace untangles an intricate web of shell companies, bank transactions and Putin allies involved in the decade-long construction of a "new Versailles".

"We managed to figure out the system that he'd built to be able to steal money from the state," said Ms Pevchikh of her team's work.

According to detailed models FBK investigators pieced together from building plans, drone video and photos taken by construction workers, the sprawling complex houses an underground hockey stadium, casino, ice rink, vineyard, "aqua disco" and a windowless hookah lounge with a pole-dancing stage.

Perhaps the most eye-popping details relate to what's inside — luxurious furnishings allegedly including couches worth tens of thousands of dollars each and $US850 toilet brushes.

The ABC notes Navalny's social media prowess enables him to bypass the Kremlin controlled state media, and to speak directly to Russians, especially young ones. Putin's Palace has been viewed more than 112 million times.

The extraordinary reach of the Putin's Palace investigation was no doubt fuelled by the timing of its release.

On January 17, after months of rehabilitation in a German hospital, Navalny flew back to Russia where he was immediately detained by police at a Moscow airport.

Two days later, Ms Pevchikh's team released Putin's Palace.

As mass protests erupted in hundreds of towns and cities across Russia, some demonstrators could be seen taking to the streets brandishing golden toilet brushes as a token of their anti-Putin rage.

"I hope it's damaging to Putin," said Ms Pevchikh.

Putin has denied any connection to the property.

85 Comments

Re item 2 - I think a big part of the problem is obsession with home ownership.

We need to move on, things have changed. We won't be able to go back to 'how it was'.

Renting needs to be a better, more stable experience and more affordable.

To the government's credit, they have started to move in the right direction.

The changes to LVRs may pull house price increases back, but they are likely to worsen the renting situation...

What a terrible idea. Allowing people to own their own home and eventually avoid one of the large monthly expenses (for the rest of their lives) is a very good way for people to put themselves in a secure financial position (and NOT because the paper value has risen).

Why should we just hand over housing in NZ to investors so they can extract more wealth from those who work for a living? What a terrible mindset. It's pretty sad to watch your opinion morph after purchasing a home. You now seem happy to pull the ladder up behind you. Pretty embarrassing to read.

If you can tell me how we can magically make housing affordable then that would be great. The reason why my view has changed is not because I now own, but because I think there are no realistic solutions to the problem.

You might recall that through most of 2020 - well after I had bought - I was advocating for home ownership solutions, including leasehold housing.

In fact I lobbied government on this and other ideas. So I think your assertion is patently unfair.

My view has changed because I see no genuine political appetite to solve the issue. In my opinion, leasehold housing would be the only way to solve the problem, and it has been discounted.

So if the govt isn't interested in that, there's no hope.

And if so let's get renting right.

I agree this government seems unwilling to make a serious effort to address the problem, but that doesn't mean we shouldn't advocate for solutions that will solve the issue. It's categorically false that this is a problem that can't be fixed - by saying so you simply let the government off the hook.

It just sounds like your opinion is "now that its not my problem, its all too hard". You can tell yourself otherwise if it makes you feel better, but I think you are fooling yourself.

Let's get a few things straight here:

- I *do* think there are things that the government can do to significantly address the problem, and leasehold housing is one of the main ones

- In approaching them on this issue, they dismissed it out of hand. I don't have the time or inclination to battle that

- I believe there are other things they can do to mitigate the problem, but that's only stuff at the margins

- I believe that some of the mooted solutions are unrealistic, questionable or with significant unintended consequences

- given that, I think it's best to focus on making renting a more equitable and affordable option

I am not alone in this view. Shamubeel Eaqub seems to have come to the same view.

So, what are the solutions Miguel?

First off, address the supply/demand issues for accomodation:

- Halt population growth from immigration (until balance is restored)

- Invest heavily in producing infrastructure for new suburbs (rather than Kiwibuilds buy existing sections and build on them)

- At the same time government can use its powers to acquire land at its undeveloped price from those landbanking it for profit to develop new suburbs and expand public housing

- Change council rates to work on land value, instead of land and improvements value to discourage landbanking

Reduce demand from investors

- Introduce DTI limits on investors and more severe LVR restrictions.

- Ban interest only loans on investment properties

- Land tax (and or Capital Gains Tax)

- Tax unused dwellings

Communicate to the public that house prices are too high, and that they will make an effort to correct the imbalance. Ensure that FHB who purchased within 3-4 years that they will be offered protection from banks foreclosing due to negative equity.

The real hurdle is deluded people (who own a single house) who think they get "rich" off escalating property prices, and successive governments who would rather prop up a bubble for four more years, than actually address the problem.

If Jacinda Ardern had shown the same bravery with the housing crises, as she did with covid, we would be able to address the issue and end up with a society that is much better off.

I agree with all of those things, and as you probably recall have advocated for a number of them.

But it won't be easy to achieve them, and even then I don't think they will profoundly address house prices. Moving forward, they probably would limit potential for increases though, which is something.

It's not hard to implement any of these. Just work to be done. May involve a little pain for overly bearish types but overall society would benefit in the long run.

Miguel... Exactly.

we could start by opening up more land -- we have plenty and no reason a 400m2 section should cost 700K -- then by breaking the building materials monopoly - we should not be paying 4 times what the americans are for the same type of materials -- adn then recuce the ridiculous costs of consenting through councils -- that might halve the cost of a new build overnight - giving our prefab industry a significant helping hand to invest in capacity increases - say interest free loans from all this covid borrowing

Solutions/significant interventions exist - just not the political will to make any of them happen

Opening up land - not so simple. And it's not a silver bullet

Materials - yes but small economies of scale will always be an issue.

not that hard though - and realistically its not that large an amount we would need to do -- just enough to lower the ridiculous current land price! - if the land dropped 200K -- no reason why the houses could not have solar/wind power - there own water tanks and spetic irragation systems as well as enough land for a decent garden to grow food / fruit - all much more sustainable in teh long term and there would still be change -

It all about a mindset - and a willingness to think big bold and thirty years down the track - Hell maybe we could go back to processing our own bloody logs into framing timber ... jobs for Kiwis, and not transporting the stuff 6000km one way and then importing it 6000km back !

but yes no silver bullet -- but even stating that this was goignt o happen and beginning the process would reduce prices as the market prepared for a significant increase in supply

There's buugger all land around Auckland that:

- isn't already urban or Future Urban zoned, or countryside living

- is in a large land holding

- is not hazard prone

- is not prime food growing

It's pure fantasy that getting rid of planning rules will solve the housing problem.

Section sizes these days, you can't even keep yourself in parsley

I think Mike Greer homes is onto something with their imported houses from Japan.

Again, small benefits at the margins

What the hell has this country come to that it has to import bloody houses now!?

New Zealand was importing kitset houses from Austria 50 years ago. Funnily enough they still stand proud. Kiwis arent actually very good at building houses, i'm sorry if that is news to you.

Yes, we use to assemble/build cars, but they were of poor quality and expensive compared to overseas imports.

We do individual excellence well, eg McLaren, Britten but we can't economically scale it in NZ.

And in the early 1950's we imported over 5,000 houses over a couple of years.

There is a large proportion of most NZ housing where the individual components are imported from overseas, and you can import far more components cheaper in many cases if we wanted to.

With only the concrete slab and labour required at this end.

If you say now that the problem is an obsession with homeownership, then in approx 20 years you will need to say we have the problem is our obsession with renting, and by then what are the options?

The property has to be owned by someone. And if that someone does not understand how to own a house without paying for non-value-added costs, the only way for rent to be 'affordable' is for it to be subsidized.

What the article is saying is, if the Govt. legislates for rents to be no more than 30% of disposable income, then that would force a top-down revaluation of the input costs.

However the input costs like land are already 'baked' and are too high, so what he is automatically suggesting is for land bankers to sell for far less, maybe at a loss. We all know what would happen, they would just sit and hold, and the housing shortage would become worse.

Without removing the restrictions to land supply, this would only make things worse. It's such a naive suggestion from someone who is meant to be a professional.

Anyway, we already do peg our rent (for a certain, but growing portion of the community) to a certain % of their income, with the taxpayer picking up the difference.

There are issues with McWilliams proposal but land supply is not one of them. He plans to strip out the unearned land bankers gain by acquiring state land - presumably at pre uplift value cost.

There's a book called "The Court of the Red Tsar". Surprise surprise its about Stalin no doubt emulating the Tsars. Seems Russia can't get away from pseudo Tsars. Now we have Putins's Palace

All of these are designed to put people into long-term debt and short-term penury, in order to validate already inflated house prices. The implicit message is: “Don’t worry we’ll keep prices up, so you can eventually sell on to a greater fool and trouser the capital gain.”

The problem is that the greater fool is your children and their children. (BINGO!!!!)

But we (Boomers) know that ..trouble is we don't give a fig!

The Irish solution is the obvious one....and it will never (willingly) happen.

A quick calculation on an average NZ household income of $107,731 (from Stats NZ, noting an average rather than a median). That's a monthly after tax income of $6,377 (including 3% Kiwisaver). There's problems with this though, in that there could be multiple contributing incomes on lower tax rates and a median will be lower than an average. But anyway:

6377 x 0.3 = 1913

1913 x 12 = 22,956

22956 x (100/5) = $459,120

That's the fair price. The current average NZ house value is $839,000 based on the latest QV figures.

I think a lot of house pricing is really a bet on government. If they pull the RMA and remove the constraints on developing land house prices would drop like a stone. It's the expectation that Government will not remove the impediments to development that drives prices. In that respect the most dangerous thing for the current government would be to botch its chance because that will drive proces rapidly higher.

Removing the RMA will cause land prices to rise as you will be able to put more house on the same amount of land. In the short term this means the price of houses with land will go up. Over the longer term as these single house plots get bought up and converted into multi unit dwellings prices per dwelling may drop because each dwelling requires less land.

No land prices would not go up because you could buy fringe greenfields land closer to its next best use-value which is its rural land price. There would be a truly open market where landbanking monopolistic landbanking could not happen.

As the price for all land is set on the value of this fringe land, then this would slowly work its way into the CBD prices.

In jurisdictions that do not have restrictive RMA type land policies, then house median multiple is approx. 3x income.

Don't hold out for the RMA reform to work. They'll tinker with things but the fundamentals will be the same.

Yes, they are not removing the RMA, they are just recreating a three-headed monster.

The Govt. is confused in thinking if they do the wrong thing quicker, or do more of the wrong thing, then that will make it right.

I would be happy for them to just one good thing, at a time.

Unfortunately that's my read as well, it's likely to get a lot more difficult to get consent for housing which will drive house prices higher very rapidly. I suspect government are aware of this which is why they've kept so quiet on setting goals.

I don't think there will be any fundamental changes, but I think there will be significant process changes. Which will help, but won't magically solve the housing problem.

In terms of housing, most of it's just blah blah, especially around 'Spatial Planning', one of the Minister's and bureaucracy's favourite buzzwords...

I listened to McWilliams proposal on a podcast. The state built houses would not be for sale on the general market. He envisaged a two-system housing market - with the second state-intervening market having the goal that housing costs are 30% of income.

But that would involve the Govt. putting its own landholding is at those lower revalued prices.

They can easily do that, by removing supply restrictions for all.

Yes that is the Houston splatter sprawl option with a truly humongous amount of motorways everywhere. Alternatively the government could buy land prior to a more limited amount of transport and trunk infrastructure provision and prior to rezoning and do what McWilliams suggests or do what the Austrians do (which is better because it is a tried and tested model plus social housing is mixed with general market housing - so the whole housing continuum benefits from the lower land prices and good access to infrastructure provision).

Houston now has one of the highest suburban infill rates in the States, all at 3x median multiple, because they have the infill space to do it, plus the fringe vent to stop any inner-city monopolistic behaviour.

Yes I agree that is how it works in Houston. But there are other affordable housing models.

Houston outsources acreage, as does every city. Just ask where your breakfast came from, or your petrol, car, house-fittings......

The problem is that too many have crowded finite acreage, which means most commentators (here and generally) are wrong. And we made it worse by temporarily harvesting historical acreage (fossil energy). I wouldn't live in Houston, or Auckland, or anything over about 30,000 people, from here on; they're all just going to be more and more unworkable.

At this point I think any consideration for livability and aesthetic improvements or greening in New Zealand cities will have to take a back seat. The shortage of housing is now so acute that we just need to construct places for families to live and we need them yesterday.

It's a terrible situation and deplorable that we have let it get this bad before acting.

So given all that, what you are saying less population in smaller Groups, which I agree with.

The question then becomes, whatever group you are in, what $ price would like like to pay?

To pay for more than you need to, is not the best use of your financial resources, especially when the savings could be better used to pay for more sustainable systems.

There's also lots of downsides to the Houston approach, such as building lots of Greenfield housing on flood prone land.... and ultra car-dependency

Houston is no more flood-prone than Christchurch, both build on ex swampland, but Christchurch and NZ for that matter are also earthquake-prone.

Houston is not so much car dependant but car-friendly.

Also, the travel costs for a CBD worker and apartment owner in NY and Houston are the same, but the apartment in Houston is less than half the cost of the NY one

Whatever the downsides, the 3x median multiple more than makes up for it.

Even if I agreed with those points, it doesn't get around the fact that Auckland's rural hinterland has totally different characteristics to Houston's.

Getting rid of the RUB in Auckland would make minimal difference to house prices, and yet could lead to some very ad hoc outcomes.

Nothing is stopping Canterbury getting rid of it's RUB equivalent. That's something for the Canterbury community to consider.

Auckland's hinterland is more like Austin's whose median multiple is approx. only 4x income.

And provided the supply was sufficient the flow on impact on private rents would reset the private market thereby forcing the innovation in private construction to reduce costs (and that includes land development)....however we know that the goal is to not decrease house prices so any public housing programme is carefully scaled so as not to have a detrimental effect of real estate valuations.

And again we return to the underlying cause of both the bubble and inaction.....debt (credit) levels.

I think the transition to affordability is doable with the social housing build model - something like what the Austrians do - because it will affect rents for the low end of the housing continuum first and the impact on median or higher house prices much later.

The Houston model would affect the top end of the housing continuum first. Crashing the market. Which of course cannot be allowed.

What, if any, longer term impacts has Hurricane Harvey had on Houston housing?

https://www.bloomberg.com/news/features/2017-08-31/a-hard-rain-and-a-hard-lesson-for-houston?cmpid=BBD083117_BIZ&utm_medium=email&utm_source=newsletter&utm_term=170831&utm_campaign=bloombergdaily

I haven't heard. But given how the climate is changing - the flooding risk of splatter sprawl could be a hugely expensive problem for Houston.

"Rents are the income that accrues to the property owner and should determine the value of the asset".

Hmmm. What if the cost of building (or re-building) the house is higher than the price determined by affordability? I suspect that is the case in NZ - particularly when infrastructure costs are factored in.

We build smaller or cheaper houses (there is no market pressure to find any efficiencies at the moment) but there is a lot of fat from everyone involved in the building process to come out first.

Green field land price, construction materials, building costs and so on have been taking "their cut" of rising prices. Decreasing home prices will be a massive rework of a large section of our economy which a small part of why no government is brave enough to start it.

(My third hand anecdotal story here is someone negotiating their build costs down by 90k by going though the itemised quote and pricing parts himself.)

We had three quotes on some building work on our house just over three years ago - prices came in around $30k on average. Sought quotes again last week - prices around $50k on average (including from one company that had obviously forgotten quoting last time!)

We need to crank up the house building factories. Perhaps even import prefab houses/components from international suppliers.

Like Railways did in the 1920's.

"The prefabricated houses were constructed at the Frankton Railway House Factory in Hamilton, mainly using timber from the railway-owned indigenous forests, and freighted to sites across the country, primarily in the North Island due to the costs of shipping. Whole suburbs were built at Frankton and Moera, with smaller settlements along the railways' main trunk and secondary lines.

It was the first time in New Zealand for an employer to provide permanent accommodation on a large scale for its workforce. The Railways Department become one of New Zealand's largest property developers and landlords.

During the short period of the scheme's operations (1923 to 1929), over 1591 houses were constructed to provide low-cost housing to railway workers and their families. The programme was so successful that the cost of a five-room house at the time fell from £831 to £635."

The genesis of Kiwibuild was from David Shearer, and a key part of the idea was that the government would build and run prefabrication plants.

They would then be able to build good homes more quickly and affordably.

I have no idea why this can't be done other than for ideological reasons.

*Shoulder Shrug*

In NZ I strongly suspect that the cost of building is being jacked up so that the normal market response of increasing supply does not work. As a result the market is on an ever increasing trajectory. Nice racket if you can get it. I can remember about 6 years ago a house building company advertising new house builds at or under $1000 per square meter. Today you would be very lucky to find anything under $2000.m2. Have costs really this much in that period?

The government stands by and does nothing to address these supply and competition issues. Ardern stands on the side lines, refusing to get involved, pouring petrol on the bonfire and cheering it on.

It's actually the opposite.

What this sudden boom has caused, plus the increased import costs due to Covid logistics being disrupted is a mismatch between labour, materials and time.

These are genuine cost increases for builders, and I know of building companies who are busier than ever, selling their houses for more but making less.

Plus any savings by the building companies normally results within one build cycle for that saving to be captured by the system most restrictive part, ie the land has gone up far more.

It's a negative-sum game, with higher prices, smaller houses, and poorer quality.

Explain then the explosion of tradies driving Ford explorers and the like if they are doing so poorly?

Having said that the actual house builders are at the bleeding edge of the market and competition should keep them reasonably honest. The problems are at the top of the material supply chain where there is little or no competition. The Fletchers and the like.

Yes the artificial boom has caused a labour shortage, so the tradies/subbies are charging more. I'm talking about the guy who is in the middle of all this between the subbies and the client.

And of course, we know they don't really 'own' those vehicles yet.

Regarding #3 the vaccine isn't perfect but some offer more protection than others (e.g. the BioNTech/Pfizer vaccine has been extremely effective against new mutations.) Also Oxford University is working on a vaccine mark two.

Vaccination numbers should be viewed now as our primary measure of progress in fighting the virus. Without a rapid vaccination program our hard work could easily be undone.

McWilliams gets a bit ahead of himself at the end of his article by assuming the state can make a profit. I think the infrastructure costs could be a lot larger than he calculates. Also it would be a mistake to build for the median income person. KiwiBuild tried that and there was insufficient demand to generate the build numbers the scheme needs. It would be better to build for low to medium income earners like Austria does. That is a proven model. But it is interesting that economists around the English speaking world are thinking along these lines, because in so many countries the housing model is broken.

I also think building sufficient social housing on scale would be the most impactful. The problem with Kiwibuild was that it lacked the scale to actually drive down prices - I think they should have been acquiring land from landbankers at a realistic price, build the infrastructure on that land at scale and we might have seen reasonable priced properties. Buying existing land ready for development and trying to build an affordable house was a fools game. It meant the government had already been "scalped" by the landbankers who have taken the unearned capital gains from the council built infrastructure.

A very good point Miguel - "the government had already been "scalped" by the landbankers who have taken the unearned capital gains from the council built infrastructure."

The KiwiBuild initiative of Buying off the Plans was a disaster.

Yes, this was so obvious to everyone except them.

But they also put land they owned in at its full value. I have asked politicians why they do this and didn't get a satisfactory answer although I suspect it has to do with devaluing their own assets if they allow this to happen, and this affects their own 'world' position re-credit ratings, Govt debt %, etc.

The Govt. being the latest landowner also has the largest vested interest to protect.

I have heard politicians say they might have paid too much for some Kainga Ora land when they purchased it from other government agencies - they said the other government departments were capturing the future value for themselves.

P.S buying off the plans was driven by MBIE officials.

"Trouble is it means house prices need to fall"

I see no trouble at all with this. Whoever took the risk buying too high should know they are likely to lose equity and find themselves into negative equity. If these are investors the more reason to deal with risks in a sensible manner and not make the rest responsible for their failures.

Prices MUST fall, the opposite will doom generations into unsustainable debt and cripple even more NZ productivity.

Of all the comments until now, B21 you come closest. There is no doubt that house prices MUST fall. The problem is landlords expect their returns on their business decisions to be covered by the taxpayer. This is in effect socialising the risk while privatising the profits. I believe the banks, directly or indirectly through the RBNZ are lobbying the Government too, to ensure nothing is done to make the housing market retreat. Remember in 2019 the RBNZ told the country they had stress tested the banks, which included a retreat of house prices by up to 50%, and found them secure. Now they tell us that such a retreat could cause them to collapse. So again we have private business's looking to the Government and the taxpayer to cover their risks from their shonky business practices, while they walk away with humongous profits. The problem is, do we have a political party anywhere capable of addressing this pressure to the benefit of all Kiwis, not just the money? And the RBNZ's theoretical 50% housing price retreat? should be more like 80%! I suggest normal house prices should be no more that 3 - 6 x the median wage, a point many have made here before.

Oh, by the way 30% of the median wage in rent should be an absolute maximum, and it should be of the take home pay, in other words after tax!

Great comment murray86.

Love point 2. Let's get there.

Buying land and developing it company CDL records another nice profit for year just ended even though there was much turmoil in the world.

Putin's Palace beats Trump's Mar a Lago any day. Lovely RE. Can I migrate to it ?

I have money on the markets and making surprising great money. -- I am the opposite of active.

It's too good to be true and thus I am nervous. Nervous not excited.

5) The biggest bribe in the history of bribing and US$850 toilet brushes.

Oligarchy in Russia – Alexei Navalny's Telling Mistake

‘I’m the beneficiary,’ Russian billionaire Rotenberg says about large Black Sea property dubbed ‘Putin’s palace’

Building dubbed ‘Putin’s Palace’ by Navalny is an empty shell, say Russian journalists in video from Black Sea building site

There are, of course, the anti-vaxxers to factor in

Natural selection should take care of a few of those...

I went to check on the progress of a development I bought into recently. It was a Sunday but you'd have thought it was mid-week with the number of people working on-site. Saw what looked like a big boss man carrying a black bag paying one of the workers in cash. I tried to talk to him but English is clearly not his first language and he literally walked away from me. I wasn't expecting that . Just makes me wonder if we're overpaying for poor quality at the end of the day. :-(

We are being rorted left, right and centre by people from cultures where it is basically endemic, coming here to take advantage of our good naturedness and sense of fair play, except it isn't going both ways, in many instances. Wait till we discover the shonky building practices that have been going on that will end up making leaky homes look like a bad paint job.

I truly hope that we have the right people doing the right thing in construction. It just seems too easy right now to make a quick $$$ in the name of new builds.

There'll be people doing the right thing, plenty not as well

#2. How cool. My argument exactly and he cites Germany's rent control policies.

Really, this government has nowhere to hide.

#rentcontrolnow.

Rent control in the form of a build-to-rent housing cost target where the target is tied to incomes is a good idea. But it needs to be matched with a commitment to build as many public houses are needed so there is no waiting list. This is what the Irish economist is suggesting and what many Germanic/European countries do. Rent control without the build commitment - like New York did - causes as many social ills as it tries to solve.

Yeah agree.

And I have cited the disastrous results of rent control in Sweden.

so there is no waiting list.

That issue is resolved by implementing a universal rent control policy, i.e., all rented properties are rent controlled based on a standard formula, with a single variable to take into account location specific data - data which is already captured by tenancy.govt.nz (actual rent prices) and StatsNZ (median household incomes).

Gareth, like the few comments above - the fearless investors just being hyped in action by the silent greed sponsors that is the BANKS. Plain and simple. Which means? if both political party have less will due to voters pressure, their addressing policy scheme must start from the Central Banks, then flow into more prudent measure of retailer banks. Right now their lobbying is as good as the rest of addiction industries; gambling, alcohol, nicotine etc. - the current approach citing as a wild west, self regulatory... pretentious level. Keep binge On NZ.

With ref to the Irish rent example (assumes 30% income for rent, 5% return for landlord etc) - how come rental returns for housing at the lower decile end of the housing scale deliver the highest returns in NZ - e.g Fordlands Rotorua? Cos our beloved NZ Govt funds landlords with rental subsidies and accommodation supplements all without sanity checking the rent demanded and with complete disregard for whether the property even meets basic rental standards. The political/economic doctrine of "market rents" (can't recall which side intro'd that) remarkably coincides with the start of house price rises at the lower end and its filtering up effect - yes I know immigration is also a huge driver but lets not blame investors greed when the State is saying "just tell me how much you want, here it is".

Exactly. The subsidy needs to end and the only way to bring that about is #rentcontrolnow.

* On one side of the tectonic divide are the house fetishests. They believe they can't lose, ever. The earthquake hasn't happened yet, therefore it never will.

* On the other side of the divide are the economic fundamentalists. They believe the pressure builds with each passing day, and a Big One is inevitable, because something has to give.

I guess we'll just have to wait and see.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.