By Patrick Watson*

The US Consumer Price Index is up 5% since May 2020, according to data released last week. This was the largest 12-month increase since 2008.

Some Wall Street denizens act like Weimar Germany-style hyperinflation is here. I think not. I’m old enough to remember when 3% to 5% inflation was normal. Even if CPI stays in that range, which I doubt, it would simply be a return to what everyone lived with in the 1990s. Somehow we survived.

Source: Wikimedia.

At the same time, even 3% inflation isn’t good. The Federal Reserve is supposed to deliver “price stability.” Thankfully, they’ve prevented hyperinflation. But even mild inflation, compounded over years, is the opposite of price stability.

And for many folks, inflation isn’t mild. Tried renting an apartment lately?

Whether inflation is a problem depends on your personal situation. It varies a lot, depending on your location and how you spend your money. It’s also easier to tolerate if your income rises at the same rate as your cost of living.

The inflation we’re seeing now comes mostly from the COVID-19 pandemic… but not necessarily in the ways you might expect.

Five culprits

CPI is an index, weighted to reflect the price change in a hypothetical basket of goods and services. It is also subject to significant statistical adjustments. It doesn’t reflect anyone’s reality, but it’s the measure we have.

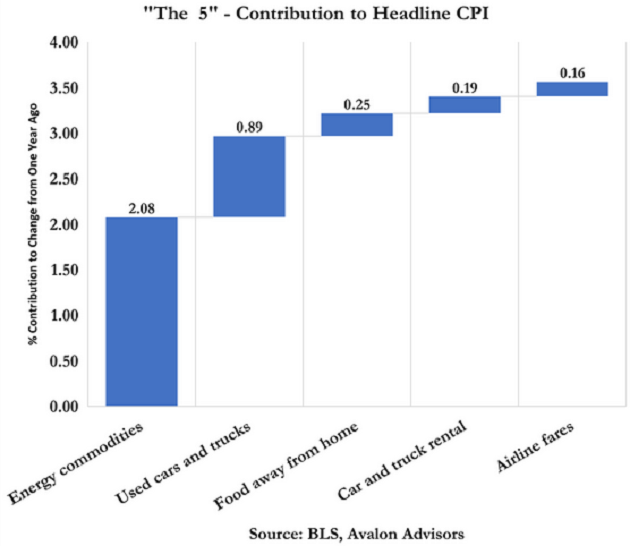

The yearly jump that has people so concerned was highly concentrated. Samuel Rines at Avalon Advisors calculates just five items accounted for 71% of the change in headline CPI.

The five leading culprits were:

- Energy commodities

- Used cars and trucks

- Food away from home

- Car and truck rental

- Airline fares

What do all these have in common?

For one thing, all their prices were severely depressed in May 2020, the beginning of the period in question. Many US businesses were closed, employees laid off, and fearful consumers staying home. Restaurants, if open at all, were doing only take-out service. Few people were buying airline tickets or renting cars.

Compare that to today. Vaccinated people are resuming their prior activities, business is booming in many segments, and economic optimism abounds.

Of course the prices that fell the most in that odd period have rebounded the most. That should surprise no one. But there’s more to this story.

Notice two of the categories are vehicle-related. That’s not coincidence.

- When the pandemic struck, car rental companies found themselves holding some very expensive, idle assets. They moved quickly to sell their fleets, pushing used car prices down.

- At the same time, car manufacturers lost orders from those large customers, and moved to reduce their own output. This reduced the supply of new cars for sale.

- Many Americans who used to rely on public transportation or ride-sharing services decided they would rather have their own cars. Government stimulus programs gave them some extra cash to spend, too.

All this happened while microchips—a major component in modern vehicles—were in short supply due to trade and national security disputes between the US and China. This further reduced new car supplies, encouraging consumers to look for used ones—and driving their prices higher.

As for car rentals… it’s simple supply and demand. They can’t rent cars they don’t have. They sold the used ones and haven’t been able to buy new replacements. So they’re charging more for the few vehicles available.

Now the question is whether those factors will persist. If so, we can expect used vehicle prices to keep rising, possibly boosting inflation further. Will they?

They might. Taiwan, the world’s primary microchip source, had been relatively spared from COVID damage. But now it’s experiencing a serious COVID outbreak, which seems to be centered on the foreign microchip workers who live in crowded dormitories. This is further restricting new vehicle supply, and many other goods, too.

But the other factors are probably fading. People who need a car to get to work have probably found one, or made other arrangements. Public transit at least seems safer.

Mobility data shows people are moving around almost as much as they were before the pandemic. That means fuel demand is probably about back to normal. Prices could rise for other reasons (we’re entering hurricane season, for instance) but energy prices should begin stabilizing. There’s little reason to expect another year like the last one.

Source: WIkimedia.

Hidden inflation

Inflation doesn’t always show in prices. For instance, I’ve noticed a trend where products aren’t available in the local store, but the same store will happily ship it for delivery next week.

That’s a kind of hidden price increase: Making you wait instead of taking your purchase home immediately. CPI doesn’t capture this unless the price rises, too.

Inflation is real, and it’s painful for many people. However, it’s not the kind of inflation that will continue boosting CPI. What we’re seeing now is a temporary consequence of the pandemic which, while not gone, is at least receding as more people get vaccinated.

Federal Reserve officials seem far more concerned about employment. Before they tighten policy, they want to see the millions of still-unemployed people get jobs again, and the millions who left the labor force get back in the game.

If that happens, it’s going to take a while. So expect the Fed to stay accommodative for a long time.

*Patrick Watson is senior economic analyst at Mauldin Economics. This article is from a regular Mauldin Economics series called Connecting the Dots. It first appeared here on June 15, and is used by interest.co.nz with permission.

23 Comments

"I’m old enough to remember when 3% to 5% inflation was normal. Even if CPI stays in that range, which I doubt, it would simply be a return to what everyone lived with in the 1990s. Somehow we survived."

We did survive, but the real price of goods and services was lower (i.e. wages increased at a similar rate) and the starting point the 3% was added to was significantly lower for most necessities.

and the starting point the 3% was added to was significantly lower for most necessities.

When talking about nominal inflation, 3% is 3%, and it doesn't matter what the starting point is.

Your comment about the real price being lower (due to wage increases at the time, or a lack of them over the last 10-20 years) is on the mark, though.

Don't underestimate the mental impact of a real $ price. Yes % are relative, but it is often the dollar price that drives behavior.

Look at the price "cap" of Petrol. Anything over $2.25 and behavior changes. A 3% increase now would see people make immediate changes. Whereas a 3% increase on fuel when it was $0.50/$0.88/$1.47/$1.88 would not have the same impact.

very informative article, thanks

The key difference now is the changed relativity between inflation and interest rates. With interest rates lower than inflation, holding savings is a flawed strategy.

KeithW

Yes, it creates a negative interest rate environment which fuels asset bubbles. The worst part is the CPI understates the true rate of inflation so your savings are getting eroded a lot faster that the govt is letting on.

keith,

I seldom disagree with you, but I do this time. I have been raising my cash holdings for some time now and the return on that cash is immaterial. I still have most of my capital in the market, but I want to be able to take advantage of any major correction as and when it happens. In addition, as I age I am increasingly risk averse.

If that doesn't convince you, Jamie Dimon of J P Morgan Chase is happy to be sitting on some US$500m of cash as he can't identify sufficiently good investment prospects. There are times when cash is king and i think we are approaching such a time. And if i am wrong? Well, I will only have lost the opportunity costs of not being fully invested.

agreed -- as much as it goes against the grain to have a significant amount of cash on call -- there are some strong arguments for it at the moment -- poor to insignificant returns elsewhere -- and such a high degree of uncertainty! It always makes sense to have some cash on hand -- but even more so in such an uncertain climate -- where its hard to see the upsides and the downsides are potentially huge -- liquidity and ability to move quickly feels a great option

Same here all cash again more downside risk than upside reward in my view best to be ready like last year and wait for some lverage to blowup.

Many new investors at moment want take much to shake the tree pnce the big end of town decide game is over.

Yes another cash holder here. No longer interested in speculative high risk investments. As long as the bank is still paying me and I'm not paying the bank to hold my money I don't care. Its pretty obvious there are going to be some big upsets out there within 2 years. You want to be in a position you can just sit back and watch it unfold without it wiping you out.

exactly!

The everything bubble is primed for an epic crash, there will be bargains!

As long as we define cash as physical cash. Bank-held digits seem moot, and I wonder if the Govt scheme will make it in time; 2023 seems a long way off?

Linklater

The problem with holding assets as cash is that the spending value of that cash declines each year.

I agree that it is very difficult to find assets worth investing in.

I have no easy solutions to that challenge in the current environment, but I am critical of the macro-economic policies that have aimed to push interest rates down and inflation rates up, and have helped create that environment.

I think as society we will pay the cost of that.

And some groups in society are going to pay a lot more than others.

KeithW

Those groups are paying right now…

I find it rather scary to look ahead at where we are heading as a nation.. I can see some big political divergence as the masses without cry foul and a strong leader takes advantage. Centre politics will be dead!

In that environment, we may need a party of the centre that can hold the balance of power.

Some of these issues pre-date Covid or are unrelated. For example there has been a shortage of some microchips, like graphics processing units (GPUs), for a couple of years thanks to the bitcoin mining boom. The aridification of the Western and mid-Western US that is driving up food prices has been going on for years.

Also inflation might be more sustained as employers accept that higher wages are required to attract and retain employees. Once wage rises are baked in there is no going back...

This article seem to ignore the fact that inflation is outstripping interest rates, wage inflation and that the inflation not captured in the CPI is far more rampant.

Seems to be a pretty limited piece of analysis that ignores the wider context.

...fuel demand is probably about back to normal. Prices could rise for other reasons (we’re entering hurricane season, for instance) but energy prices should begin stabilizing. There’s little reason to expect another year like the last one.

Little reason? Sounds like an energy head-in-the-sand comment.

I suspect severe weather events (e.g., Texas power grid down); geopolitical events (ME tensions/disruptions); technological failures (e.g., Suez canal blockage); reservoirs going dry (Auckland); and a host of other (what we've commonly referred to as) 'black swan' like events will only increase with time - disrupting supply and keeping energy prices high. And that's not to mention scarcity.

great perspective

At last a sensible article on inflation - reminding us that inflation is generally product / sector specific and temporary - unless of course a large proportion of workers have CPI-linked employment agreements.

Inflation is of course basically a redistribution of money - if someone is paying more, someone is getting more. If a country is comfortable with who is winning and who is losing then what's the problem? For example, if the price of restaurant food is going up because minimum wage has increased - I'm all good with that.

Speaking of inflation - I was lamenting today the house I looked at in Papamoa in 2014 that sold for under 280K. Now it's worth 785K on homes.co.nz. Right next to the beach and just down the road from a 1 billion dollar shopping development. sheesh!

Are you sure its a house and not a shed Pat ? I couldn't find anything down in Papamoa for under $1mil and that was a year ago now before the boom. Everything I looked at was pretty horrible to be honest and way over priced at the time and now they are going to be going for $1.3mil plus. Really glad I never bought anything down there now, the whole place is built on sand and is only a couple of meters above sea level.

I feel the same way. Papamoa seems to have an uncomfortable wealth divide too. I'm happy with the house purchase that I made way back then. It didnt do as well as Papamoa in percentage terms though.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.