By Bernard Hickey

I want to detail 10 reasons why I think house prices have another 10% to fall, but first a bit of background.

Back in March 2008 before the Global Financial Crisis hit and before finance companies collapsed en masse, I predicted house prices would fall 30% from their late 2007 peaks.

I got a lot of stick for saying such an outrageous thing. Our Home Loan Affordability analysis showed then that prices were unaffordable for most and I was worried about the stability of the global financial system, although not the New Zealand system. I thought New Zealand house prices had been pumped up with NZ$100 billion of foreign debt over the past 5 years and would subside once the cheap foreign credit dried up.

Then most of the property finance companies collapsed through May, June and July of 2008. Lehman Brothers and AIG collapsed in September 2008 and global credit markets froze through until early 2009. All hell appeared to be breaking loose and there was genuine fear for the future of the financial system.

In early October Australasia's banks were granted government guarantees and between July 2008 and April 2009 the Reserve Bank of New Zealand cut the Official Cash Rate from 8.25% to 2.5%, helping to bring the 2 year mortgage rate down from over 9% to under 6%. This stabilised the economy and the housing market, where prices had fallen as much as 11% by early 2009.

So in early 2009 I revised my view on house prices to a fall from the late 2007 peak of 15%, rather than the 30% I forecast a year earlier. House prices bounced through mid 2009 thanks to the drop in interest rates and the decision by many investors to abandon low interest rates in banks, a collapsing finance company sector and a discredited stock market to put yet more leveraged cash into rental property.

Also, it appeared, New Zealand's economy had dodged a bullet because of our stable banking system and our close connections to the strong-growing Australian and Chinese economies.

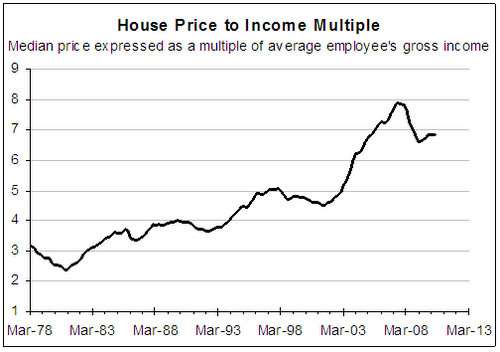

But the fundamental problems had not gone away. Housing was still vastly overvalued compared to incomes, households were carrying too much debt, and the cheap foreign credit had dried up.

And now those fundamentals are coming home to roost.

In the last six to eight weeks the sheer weight of these problems has ground down growth in the economy and the housing market to a virtual standstill.

Reports on the housing market from Quotable Value, REINZ , Barfoot and Thompson nd First National indicate the winter of 2010 has been awful for the housing market. Buyers have gone into their shells and those that haven't are demanding price reductions. Those that still want to borrow are reporting the banks are being cautious about Loan to Value ratios and the types of property being bought, in particular apartments, townhouses and sections.

Two events locally and one internationally seem to have been the catalysts for this slowdown. The May 20 Budget was initially welcomed by property investors as being a weaker crackdown on property tax breaks than they had feared, but it was still a crackdown of sorts. Also, the Reserve Bank's widely expected decision to start putting up the Official Cash Rate from June 10 appears to have shocked those who thought interest rates would stay low for a long time. The European Financial Crisis in May to June was the final nail in the coffin.

So now prices are falling again.

Here's why I think they have another 10% to fall, taking the fall from the late 2007 peak to 15%. QV figures show prices are now down 4.7% from the late 2007 peak.

1. The cheap foreign credit has dried up

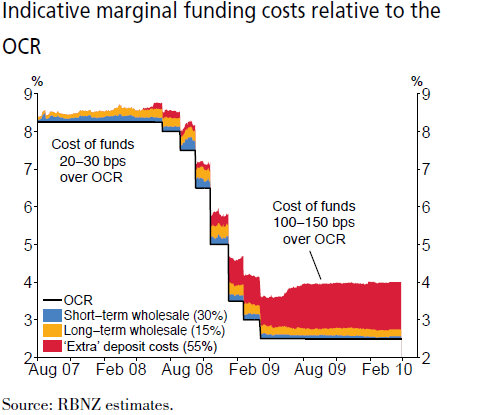

Before the Global Financial Crisis banks could borrow as much as they wanted for around 15 basis points above the prevailing wholesale interest rates. That cost rose above 200 basis points early in 2009 before subsiding to around 120 basis points earlier this year. The European Financial Crisis boosted that cost to back over 150 basis points and now it's clear that the cost is never going back to the 'normal' levels of 2002-2007 when New Zealand's banks borrowed almost NZ$100 billion on these 'hot' money markets and passed it on to home buyers at a sharp margin.

This chart shows how much those margins have risen the crisis. Interest rates are likely to remain around 1 percentage points higher than they would otherwise have been.

This makes it harder for the banks to offer fixed mortgage rates that are significantly cheaper than floating rates and keeps the margin between mortgage rates and the OCR relatively high.

2. Home loans remain unaffordable for most in the bigger cities

The Roost Home Loan Affordability reports that we prepare show that it still takes 61.8% of a single median income earner's after tax pay to afford an 80% mortgage on a median priced property in New Zealand.

The Roost Home Loan Affordability reports that we prepare show that it still takes 61.8% of a single median income earner's after tax pay to afford an 80% mortgage on a median priced property in New Zealand.

In Auckland Wellington, Hamilton, Tauranga, Queenstown, Nelson and Christchurch that portion of after tax income is between 65-75%.

New Zealand's house price to gross income multiples are still well above historic norms and those of other countries such as Britain and America, albeit not Australia.

Those with two incomes in provincial cities such as Wanganui, Palmerston North, Invercargill, Whangarei and New Plymouth can still afford to buy a house, while first home buyers with two incomes can also afford a cheaper property in these markets.

Rodney Dickens makes the point in his piece about the property outlook here.

3. New Zealanders are migrating to Australia again.

The exodus of New Zealanders to Australia through 2008 was a major reason for the decline in house prices through mid to late 2008.

During 2009 the exodus slowed as the Australian economy slowed, but it has restarted again in recent months as Australian wages are now growing at a rate of 5.5% while New Zealand wages are growing around 1.5%.

Australia's unemployment rate has fallen to 5.1% versus New Zealand's on 6.8%. The likely reduction in non-New Zealand immigration to Australia after the upcoming Australian election will intensify the pressure for New Zealanders to migrate to Australia. The wage gap between Australia's average weekly earnings and New Zealand average weekly earnings has blown out to NZ$643 from NZ$565 in the last two years.

That translates into an annual gross wage gap of NZ$33,400, up from NZ$23,000 two years ago. New Zealand wages are now on average worth 60% of the Australian equivalent, down from 66% two years earlier.

At current wage growth and exchange rates, New Zealand wages will be half those in Australia within 7 years. By then annual wages will be NZ$65,000 higher in Australia than New Zealand.

Earnings differential with Australia

Select chart tabs

4. The property tax changes are hurting more than expected

The tax changes in the 2010 Budget were less than some had expected or hoped or feared, depending on your exposure to property. But they are having a real impact on demand for residential investment property, particularly by those already heavily geared.

It is forcing many to ask whether than can afford to take the risk of going negatively geared when they may not be able to claim so much of the losses back against their regular incomes.

The IRD is also cracking down around the fringes of the property trading, LAQC and family trust areas. The recent Penny vs Hooper Penny and Hooper vs IRD case has sent a chill through the sector, although the IRD win has been appealed to the High Court.

Independent economist Rodney Dickens believes the property tax changes are having as big an impact on property demand as a 100-150 basis point increase in the OCR. See more here.

5. The developed world is deleveraging from property bubbles

The forces of deleveraging globally cannot be underestimated. The scale of the debt now embedded into developed economies in Britain, Europe and America is enormous.

Consumers, in particular, but also governments, will spend at least 20 to 30 years either repaying or restructuring debt to reduce their debt loads.

This chart here shows the scale of the debt in the US economy, the world's biggest. To reduce leverage levels to anything near normal will take decades of slower growth, less consumption, more savings and higher interest rates. Debt is now much higher than it ever was before the 1929 Depression.

New Zealand's banks depend on these international funding markets and will be affected in one way or another by this huge sinking lid of deleveraging.

6. NZ households have hit debt saturation point

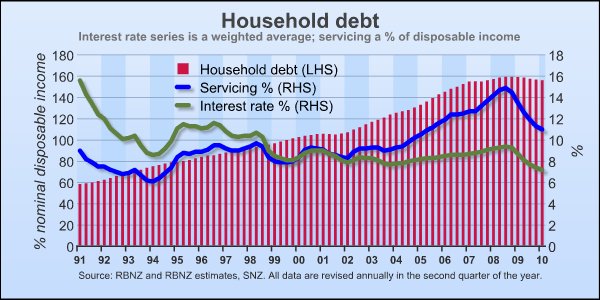

New Zealand's household debt to disposable income hit a peak of 159% in the fourth quarter of 2008, right at the time of the Global Financial Crisis. Since then it has been trending down as New Zealanders chose either not to take on any more debt or chose to repay debt.

Reserve Bank figures show many New Zealanders either left their mortgage repayments at relatively high levels, even though interest rates had fallen, or 'downsized' their houses and repaid debt.

This chart below shows how leverage is reducing. It has a long way to get back to 'normal' levels of around 100%, which is widely seen as the sustainable maximum for any government or household.

To get back to around 100%, New Zealand's household sector would have to repay around NZ$45 billion of debt over the next five to seven years.

House prices will not rise without the impetus of extra debt.

7. Our debt is relatively high compared to many others

This chart below shows that New Zealand's household debt to disposable income ratio is actually higher than some of the countries such as Britain, America, Spain and Italy, who are seen as heavily indebted and in danger of being ostracised by lenders.

New Zealand is lucky in that government or sovereign debt is much lower than in those countries, but it's the reason why our government can't afford to 'pump' up the economy with deficit spending.

That will restrain the ability of our government to restart economic growth with heavy government spending.

The risk is that foreign lenders will work out how indebted we are and increase our interest rates.

8. Rents are not increasing in most places

Data from the Department of Building and Housing up until the end of June shows the median rent across New Zealand has been flat since December 2008 at NZ$300/week.

However, they have risen in Auckland in recent months, particularly for larger houses rather than apartments. See our interactive charts here.

However, rental growth remains signficantly below inflation and has stubbornly remained less than growth in house prices.

Landlords looking to increase rents more than wage growth have consistently failed to impose such increases.

Increasing costs and the potential removal of tax breaks will dampen demand from residential property investors, given rental growth will not be enough to compensate for higher costs and the removal of tax breaks.

That sends a new chill across the market.

9. Banks face even more funding pressure

The pressure from the big banks to pass on increased funding costs and to restrict their lending growth will become more rather than less intense in the coming two to three years. This will keep the pressure up on interest rates and ensure banks remain cautious.

European and US banks have to replace over US$2 trillion worth of funding in the coming 18 months, raising the likely cost of such funding on international markets.

The Reserve Bank's Core Funding Ratio (CFR) is expected to increase from 65% to 75% over the next two years, forcing the banks to raise more funds from the expensive long term and local funding markets rather than the cheaper 'hot' short term money markets.

The likely imposition, albeit slowly, of tougher rules for capital and leverage by the Basel Committee for international capital rules will also keep credit growth contained in coming years.

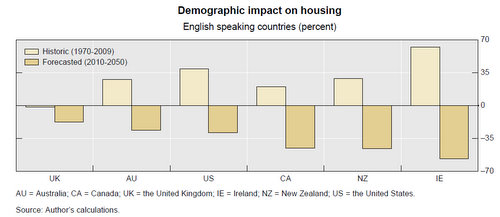

10. The baby boomers will start selling down their houses and rental properties to free up cash

Fresh research published over the weekend by the Bank for International Settlements estimates real New Zealand house prices could fall more than 35% over the next 40 years as a growing population of elderly are forced to sell assets to a smaller population of younger people to fund their retirement and health care costs.

9 Comments

I'm talking about the national median, but I don't necessarility think Auckland will be better off.

You could argue it has further to fall and will be hit most by the net migration outflow to Australia.

cheers

Bernard

Story above mentions my 30% prediction in March 2008 and how I revised that to a 15% fall in early 2009. I'm sticking with that 15% figure. The 10% fall figure takes into account we've already fallen 5%, which means 10% more to go.

cheers

Bernard

Hang in there Nicholas

Beavering away right now on Top 10

cheers

Bernard

Robert M

You're quite right. I'll correct and update.

cheers

Bernard

Oh Bernard...

I should have saved all those comments of mine over the last few years pointing out what a idiot you are, but alas, you are not just an idiot anymore, you are a good businessman driving your web traffic to new heights. For you it is your niche way of generating lots of money and respect from the brain dead.

Although I will not go full slaughter after you this time around, as I believe you already understand my position on this matter. So although you have developed good smarts about what headlines sell news, advertising space and increases traffic, I hope in the back of your mind you remember some people will believe you and chances you are doing them over, further losing any footing or hope of that rung on the property ladder, only to find out you are in the business of getting your melon as much coverage as the networks can handle.

In a way you are as bad talking it down as those talking it up. Residential property is a necessity, way more important than if people put 91 or 95 octane in their tanks, or if the kids get the fancy yogurt in their lunchboxes - end of story...

Don't bet the farm on Olly or Bernard, do your own homework people. (remember though location, location, location....)

Oh, and I particularily remember how you describe yourself as contrarian - kind of sums it up.

not in a slum town = location advantage

not next to the local gangster pad = location advantage

not in a decile 1 school zone = location advantage

I would suggest if you think about it location can be about where NOT to be rather than just where the best street in New Zealand is. If you need to choose a property choose one around you needs not your wants, and take into consideration external neighbourhood forces that are out of your control as you will have no control over those things, and consider what the future may bring i.e. having a place close to your babysitting friend may not be so good if it is a half days trek to a decent primary school once the kids reach school age.

I'd rather be in a sh-one-tty caravan on a section in a decent neighbour and feel relatively safe, than have the best place in gangstertown for all my neighbours ready to burgle the house moments after i leave driveway.

And that is where speculators learnt a lesson about demographics... you can too...

But house prices are now down 5% on where they were three years ago...

Getting a bit beyond a mere breather now

cheers

Bernard

Anonymous,

Many thanks for your comments, including this one:

"My guess is you are neither, but made the attempt and failed."

I don't guess at your motivations. In fact, I try not to guess at anything.

You are wrong.

My wife and I own the house we live in and have a mortgage worth less than 30% of the house's value. We've actually done well out of the property boom both here and in Sydney.

We have never tried to be a property investor and have no desire to do so.

I prefer to invest the savings I have and whatever skills I have in building a business (interest.co.nz) that employs people and produces something of value (I hope).

My overall aim is to build a business around providing useful news, information and debate about economic, financial and investing issues for New Zealanders. That way, I might have a chance (in a tiny, tiny way) of helping the New Zealand econony producing higher paying jobs for my two daughters so they can stay here and bring up their children here.

A nation built on property investment won't do that.

cheers

Bernard

Fair enough. Too true. But this one with Brian Gaynor on the stock market did get 66 comments ;)

http://www.interest.co.nz/news/gaynor-pins-future-hope-sharemarket-gene…

cheers

Bernard

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.