Here's something I thought I'd try. It's a bit like Bernard's Top Ten, but instead a weekly round up of the economic posts on various NZ blog sites.

I've currently got three categories - from the left, from the right, and economics blogs. Any feedback is greatly appreciated, especially on what other blogs Interest.co readers go to, and what you would like to see and read here in these posts.

From the left

Russel Norman from the Greens writes on Frogblog about 'state dispute mechanisms' involved in US free trade agreements. The US has said joining the Trans-Pacific Partnership is its priority over any bilateral deals at the moment, although questions are being raised about powers awarded to firms, and their ability to sue governments (ie ours) in international tribunals. The subject is also discussed by Lori Wallach in a double shot interview with Bernard Hickey here.

Key said the idea that investors would sue governments using investor state disputes mechanisms was “far-fetched”. This shows tremendous ignorance of the facts of NAFTA and apparent ignorance that Labour put these clauses into the NZ China FTA – chapter 11.2.

Then, I think it was Al from Scoop, persisted questioning him by pointing out that investor state disputes provisions were in NAFTA but that the Australians had blocked such clauses in the AUSFTA. And asked whether Key would block these clauses from entering the Trans Pacific Partnership deal.

Journalist: Is it that sort of thing being sought? Is it being negotiated?

PM: Not as far as I’m aware.

Journalist: And it’s being ruled out in that sense? The Australians apparently have ruled it out.

PM: I imagine we would too and I think it’s pretty farfetched.

So Key almost ruled out investor state dispute clauses in the TPP. This must have sent shivers up the spines of the MFAT officials and Tim Groser who both understand these issues well.

2. Key wanted to emulate the Irish. Possibly not any more

In separate posts on The Standard, Marty G and Lprent pull Prime Minister John Key up on comments he made in 2007 on economic lessons New Zealand could learn from Ireland .

Here’s the ‘Key Notes’ from October 2007, where Key says we should adopt Ireland’s economic reforms:

I’m always struck by the similarities between New Zealand and Ireland. We are the same size in terms of population, and we are both green, hilly, and have strong agricultural economies.

There are differences too. Ireland is also more prosperous than New Zealand. That hasn’t always been the case. Just fifteen years ago, the Irish and New Zealand economies were on a par. We were both poor performers compared to other developed countries.

Nothing much has changed in New Zealand. But Ireland has gone from being one of the poorest countries in Europe to being one of the wealthiest. It’s done this by adopting policies that encourage business growth, improve the skills of its young people, and entice Irish people all over the world to return home to live and work.

The lesson from Ireland is that countries can turn themselves around if they are determined enough. It’s a lesson New Zealand would do well to learn.

From Key’s speech to the NZ Institute of Foreign Affairs on emulating the “Celtic Tiger”:

Thirty years ago, Ireland was a total basket case. Today, it has all of the trappings of a considerable economic success story, including the capacity to attract and retain smart, educated, enterprising people.

three key policy initiatives which were critical to this success:

- They got the tax rates down to really competitive levels.

- They got infrastructure, especially communications infrastructure, up to an impressive standard, and

- They made sure the educational institutions were turning out graduates of the high standard demanded by the sectors that were seen as their areas of competitive advantage.

But the most important point is this: all these initiatives were deliberately targeted at leveraging off their most important strategic asset their location on the edge of the European Union.

Leave aside some of the EU subsidies that someone will mention if I do not the secret to Ireland’s success was location, location, location

And that, surely, must be the key to New Zealand’s economic success in the years ahead.

3. 'S&P say National is failing'

Rounding up the left blogs is Labour finance spokesman David Cunliffe with two posts (part 1, part 2) on Red Alert on the move by Standard and Poor's this week to put NZ's sovereign credit rating on negative outlook, indicating a 30% chance of a downgrade in the next few years.

In other words: New Zealand does not save enough, it has too much private debt, and that debt was used to fund the wrong things (property speculation not real business investment). New Zealand’s exports are under-diversified and New Zealand will continue structural bleeding on our external accounts after the immediate recession.

The logical repsonse to these problems should be;

- strong action to close the savings deficit (if possible by building good household saving behaviour)

- diversify and increase exports (presumably moving beyond a narrow range of bulk commodities)

- managing the fiscal position to encourage sustainable growth, employment and healthy tax revenues without blowing the fiscal deficit.

- ensuring monetary policy supports the direction of reform rather than acting against it.

It obviously should NOT include:

- borrowing more for tax cuts to upper income earners that neither create powerful stimulus nor correct the underlying imbalances

- reinforcing exisitng bulk commodity exports while reducing investment in innovation and R&D to divesify and add value to the export base

- cutting back Kiwisaver; cancelling prefunding for the NZ Super Fund; and taking two years to set up a Savings Working Group (and even then proscribing a range of strong policy options)

- pretending monetary settings are ideal when exporters face extreme currency volatility

Bill English and John Key declared S&P lifting their previous negative outlook as a” verdict’ on Budget 2009.

They should be straight-up enough to accept that S&P has now reversed its verdict.

Mr Key manages to contradict himself three ways in two paragraphs:

“Nothing has changed from our point of view, in fact if anything, our position looks stronger from our point of view (really?)…

We accept that we’ve had to take the earthquake on our balance sheet, accept tax revenues have been a bit weaker this year than we had anticipated…(corporate was 22.4% below 2010 forecasts, gst 15.8% below!)”

So… nothing has changed, we are stronger, but we are weaker. Classic. He must have been eyeballing three different journos and guessing they wanted three different answers, so why not try to please all of them at once?

The coup de grace is his attempt to pass it all off as Ireland’s fault. True, the Irish are in a bit of a bog, but lets assume S & P can tell the difference between the land of the long white cloud and the emerald isle.

From the right

4. Here's one of John Ansell's latest ads. Ansell's been up in Roger Douglas' office recently helping the old fella out.

5. Not much from the right this week in terms of economic policy posts, but seeing as Norman and Cunliffe are included above, here is a video from Finance Minister Bill English on his website, explaining the S&P move.

My initial thoughts are:

- I like the idea of a more flexible system where one can look at the likely life-time welfare cost of a beneficiary, which may mean spending more money early on to help them transition off welfare.

- Work testing for those with some capacity to work, is very important

- Childcare assistance should be targeted more at lower income families so you gain more financially from re-entering the workforce

- I like the idea of a transition allowance for those going from benefits to working

- I support some benefits being time-limited as this sets clear expectations. However some sort of emergency relief benefit would have to remain available with some flexibility.

If you have a view on what options are most preferable, then have your say. There is an online response form here. You can also e-mail submissions to welfareworkinggroup@vuw.ac.nz.

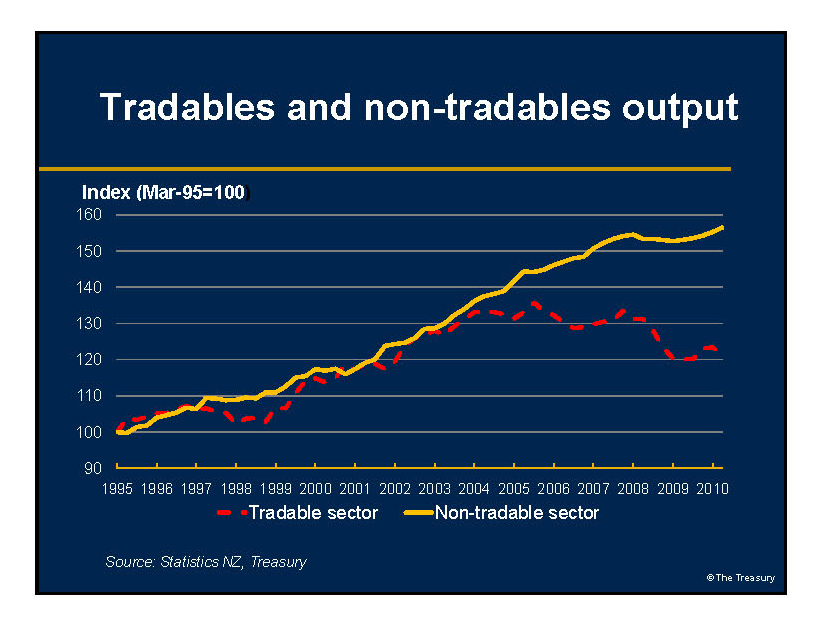

Business Roundtable Roger Kerr has his own website, this morning pointing to the Treasury chart on the tradable vs non-tradable parts of the economy. He's not happy, and wants govt spending cut.

Reining in government spending is the single most important action the government can take to improve international competitiveness and export sector profitability and growth.

As John Whitehead warned, we are not as yet seeing the significant rebalancing needed in the economy – the shift of resources to tradables.

8. 'Peak oil? Don't worry, supply and demand will save us'

Roger Kerr also has a go at the peak oil debate. He thinks the laws of supply and demand will save us, given governments don't get suckered in by "fake" peak oil premises.

Danish environmentalist Bjorn Lomborg suggested in his 2003 Sir Ronald Trotter Lecture for the Business Roundtable that oil and substitutes like shale oil could cover current energy consumption levels for 5000 years.

He also noted that “Sheik Yamani, founder of the Organisation of Petroleum Exporting Countries (OPEC), has often pointed out that the oil age will come to an end but not for a lack of oil, just as the stone age came to an end but not for a lack of stones. Humans search constantly for better alternatives.”

Provided markets are allowed to adjust to supply and demand trends, and are not distorted by government interventions based on false ‘peak oil’ premises, there is every likelihood of an eventual smooth transition to other energy sources.

Economics blogs.

Not wanting to place them in the left-right argument, there are a couple of good economics blogs out there, namely TVHE and Offsetting Behaviour.

9. Matt Nolan at TVHE has some questions as to why everyone loves the chart above from Treasury

A key set of points for me is that:

- Our terms of trade has structurally increased

- Changes to policy throughout Asia have lead to massive productivity growth among our neighbours – something we as importers benefit from

- There was a tax bias towards housing, and potentially other investment vehicles, through the tax system following the introduction of the top tax rate – a matter that has been largely dealt with.

All three of these issue will have pushed up our real exchange rate, and if we assume the third one has now been dealt with, there is no policy recommendation required here.

Now my question to people is simply this three parter:

- Does this graph show an issue,

- If so, what is it?

- And if so, are their any changes that could improve matters?

22 Comments

Nice job Alex. Particularly enjoyed the Ansell graphic (We're on our way to Antarctica not Australia) and that great chart from Treasury showing the tradeable sector still dead in the water.

Who says we're rebalancing the economy? No sign of progress yet.

cheers

Bernard

PS Friday's Top 10 out shortly

The tradebale is in recession....hardly justifyable looking at it at the moment and saying its re-balancing....

My point is tradables appear cyclic....non-tradables are not....so yes we have to contain non-tradable, however to simply look at this present point in time and say non-tradables is the problem is not justified IMHO.

Look at the private debt, that is probably hog tying the recovery....I can but assume it was taken on badly.....unwise privtae "investment" that has not paid off...again complaining the the not-tradeables are too high when there is a case to answer for mis-management knee capping the tradables isnt fair.

Anyway, deck chair anyone?

regards

Tell them what?

He doesn't say anything!!!!!!!!!!!!!!!!!!

you didn't read this did you, PB?:

http://scienceblogs.com/casaubonsbook/2010/11/how_not_to_write_an_essay…

Take time to read it over the weekend, and the article it disseminates. Take lots of time. Over both.

Then compare the critiqued article to the Kerr diatribe - Kerr's effort doesn't come up to its knees, and as she points out, the taller one is horseshit.

She - rightly - questions the difference between 'disingenuous' and 'lying'.

so do I.

So should you.

http://gregor.us/currency/gold-energy-and-the-problem-of-capital-storage/

These same questions have long been asked in the world of energy extraction as well. Why did global oil production advance so quickly into late 2003 as price was rising towards the high thirties, only to peak out for the past 6 years as price skyrocketed? Well, we can safely assume that oil production in the West, governed mostly by for-profit enterprise, was doing everything possible to lift production. In short, they couldn’t. But in contrast to BP, Shell, Exxon, Total, Chevron, and Conoco, what about the NOCs–the National Oil Companies? Is it possible they were inclined to apply some form of scarcity rent, holding back production slightly? Echoing statements made at least twice last decade, King Abdullah of Saudi Arabia repeated himself this Summer when he remarked about future Saudi oil production: “I told them that I have ordered a halt to all oil explorations so part of this wealth is left for our sons and successors God willing.” |see: Global Crude Oil Supply 2002-2010 in kbpd (this is updated with the latest data through July 2010)

The supply/demand model is broke for oil now.

It's not in the interest of the NOC's to play that silly game.

Kerr knows jack about energy.

If the banks had not been rescued the carnage in the bond market would have seen the collapse of the global financial system....no inter-bank transfers, we wouldnt have been unable to get money out....the system would have frozen.

Do I agree with bailing them out? no I do not the point is things should never have been allowed to get this bad....

regards

steven, do you actually think the powers-that-be in the global financial system would have allowed it to totally collapse? Hardly. Faced with the threat that unless they managed to unstick it (i.e. credit flows) - governments the world over would move legislatively to take back their own economic sovereignty - they (the private credit powers-that-be) would have found a way.

The prudent would have survived and the imprudent would have been purged - in both the finance and corporate sectors.

As it is each crisis becomes only more violent.

Not so much collapse as freeze, at least initially.....would they have allowed it to, no I dont believe anyone sane would.......

I think you attach too much ability and clout to the private credit powers that be....I odnt subscribe to the notion that private interest manages the system, to me it merely extracts rent at every opportunity...ie it certianly has a tactical capability but not a strategic one.

Prudent etc, I dont agree I think the fallout would have been totally indiscriminate. The problem is that of scale....

regards

Alek, interesting idea, look forward to reading this.

Tips: you missed this significant post: http://pc.blogspot.com/2010/11/as-good-as-gold-or-as-bad-as-paper.html

And follow this blog: http://uoaecongroup.wordpress.com/

Excellent work , Alex !....... Makes a nice change of pace from Bernard's manically depressive daily " Top 10 @ 10 ."

I look forward to next week's round up of stories .

[ It seems that they learned you real good on that journalist course you done....... . Brilliant ! ]

#7) Annoyed that people who ought to know better can't plot graphs starting the y-axis from zero to avoid distortion. Unless that is your goal. http://nzmaths.co.nz/resource/data-distortion

Iain : A tip as to why your text hyperlinks aren't working .......... " They " have found you .......... The international cartel of investment bankers are onto you ! They will track you down , grind your face into the mud , and bellow , " Oi ! Parksy , where's our dosh ? ............. We loaned yer plenty for the house , now pay it back ............ With interest ! "

Bankers are mean sods ............. Fancy wanting an interest payment , 'cos they took the risk of giving a mortgage to such a splendid fellow , as your good self .

Hi all,

Here's Herald Bus editor Liam Dann on the Irish situation

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10690358

The Economist reports that at its peak, about a fifth of Irish workers were in the property sector.

When the banking world went pear-shaped in 2008, the Irish state followed the rest of the world and guaranteed bank deposits.

But ironically - given the country had opened itself to much foreign investment - the banks remained locally owned. Without the security of foreign parents to fall back on, they began to sink in a mire of property debt. The call on the Government coffers became too great.

And

New Zealand has managed to avoid Ireland's fate but it has been more through good luck than good management.

Our banks are Australian and were never close to collapse and our economy remains underpinned by commodity exports which continue to fetch high prices, thanks to the boom in China.

While a reliance on exporting milk powder, meat and logs might not close the wage gap with Australia, in times like this, when every other sector of the global economy is faltering, it can safeguard the standards of living we're used to.

Right I'm off to play cricket. Beautiful day in Wellington. (my words, not Liam's)

Roll on the latest round of Wikileaks documents! Keep the bastards honest!

It's amazing how many people I meet who have been conned into believing that lifting the veil of secrecy from government plots and schemes is a bad thing.

Government should fear the people, not vice versa.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.