By Roger J Kerr

Long-term (10-year) swap interest rates have increased 0.30% from 5.05% to 5.35% since the dip in yields caused by the Christchurch and Japanese earthquakes.

Higher inflation expectations globally/locally and higher bond issuance in New Zealand are behind the increase in long-term interest rates.

I expect the US 10-year Treasury Bonds to continue to increase in yield over coming months to at least 4.00% (currently 3.58%).

The US bond market is still trying to work out who is going to be the big buyer of bonds once the Federal Reserve cease their US$80 billion per month purchases under QE2 in June.

If there is no-one to take their place the market yield will have to go higher to attract those buyers in.

To what extent our 10-year bond and swap interest rates follow the US Treasury Bond yield higher is always a moot point.

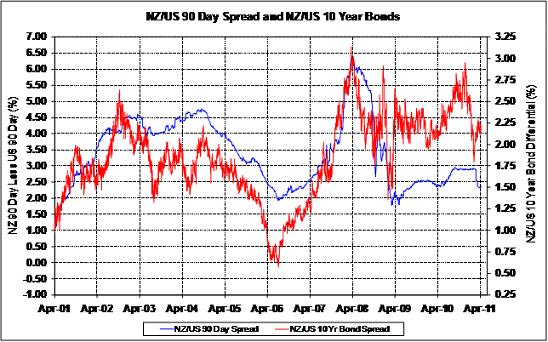

The margin between US and NZ 10-year bond yields has always been highly correlated to the gap in the respective 90-day interest rates (see chart below)

The 90-day gap would suggest that the US: NZ bond spread should be closer to 1.50% instead of the current 2.20%.

NZ bonds are trading at a higher spread than normal due to our high bond issuance programme and the possibility of a NZ sovereign credit rating downgrade. The 90-day gap will not go any lower than the current 2.50% and will increase as our NZ monetary policy is tightened earlier than the US in late 2011/early 2012.

It all adds up to the US: NZ bond spread staying above 2.00% and most probably closer to 2.25%. The end run of this analysis is that when US 10-year Treasury Bond yields are above 4.00%, our bond and swap rates will be well above 6.00%.

These will be attractive entry points for fixed interest investors and very unattractive for corporate borrowers against a likely 90-day average rate of 5.00% over coming years.

Corporate borrowers need to look forward at what they will be required to fix (for interest rate risk management policy compliance) over the next 12 months and enter pre-emptive hedging strategies now in the three, four and five year terms.

The yield curve is steep and, on the surface, against such hedging, however the market rates will be considerably higher in nine and 12 months time.

--------------------

* Roger J Kerr runs Asia Pacific Risk Management. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

No chart with that title exists.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.