By Bernard Hickey

Someone has to say this loudly in public and it may as well be me.

Bank profitability in New Zealand is too high and we have to do something about it. It's time regulators and customers hammered their banks into producing fairer returns that help the economy grow healthier. That means lower mortgage rates and higher term deposit rates.

Don't take my word for it that the banks are too profitable.

The Reserve Bank Governor Alan Bollard said as much recently in a very under-reported speech to the New Zealand Shareholder's Association in Tauranga.

"It seems unlikely that the rates of return in banking enjoyed over the past decade can be sustained in the future,"

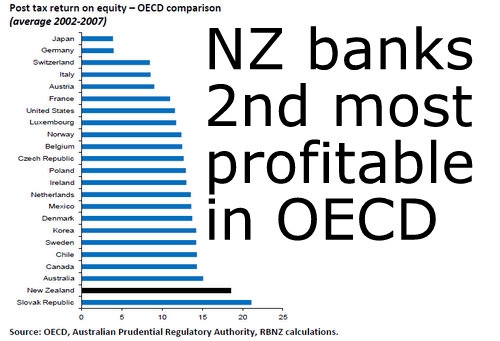

Bollard said in a 10 page speech packed full of detail showing how high bank profitability was and trying to explain why it was so high. After tax return on equity for the banks averaged around 18% from 2002 to 2007. See the full speech here.

This made them the second most profitable set of banks of a sample of 22 OECD countries conducted by the Reserve Bank. They were even more profitable than their parents in Australia, who third most profitable behind the Slovak Republic and New Zealand.

The last two weeks of profit reports from ANZ, ASB and Westpac underline just how profitable these banks are again, despite the weak growth in the economy and virtually no lending growth.

Banks have boosted their profits by quietly allowing their net interest profit margins to rise and they have seen their bad loan costs fall as the economy recovers. See more here from Gareth Vaughan on growing bank profitability and the need to haggle.

The latest bank leverage and return-on-capital data, by individual bank, is here »

Many may ask, how did the banks increase their net interest margins at the same time that mortgage rates were unchanged? Partly it has happened because banks pumped the effects of higher funding costs from the Lehman Bros crisis into their margins in 2008 and 2009 and haven't taken them back out as those wholesale market funding costs have fallen through late 2010 and early 2011. Floating mortgages are also more profitable for the banks and there has been a big shift to floating from fixed over the last year.

Close to 60% of all mortgages are now floating because they are nominally cheaper for borrowers, but more profitable for banks.

Back on July 1, 2005, the margin (what the bank pays to borrow versus what it charges to customers) on a floating home loan rate was 1.87% with the average bank floating rate at 8.90% versus the 90-day bank bill rate of 7.03%.

As of last Friday it was up almost 100 basis points to 2.85% with the average bank floating rate at 5.73% versus the 2.88% 90-day bank bill rate.

On July 1, 2005, when fixed mortgages were still all the rage, the average margin between the two-year swap rate and two-year fixed-term home loan rate was just 0.92% with the two-year swap rate 6.68% and the average bank two-year fixed rate 7.60%. As of last Friday it had more than trebled to 3.07% with the average two-year fixed rate at 6.41% versus the 3.34% swap rate.

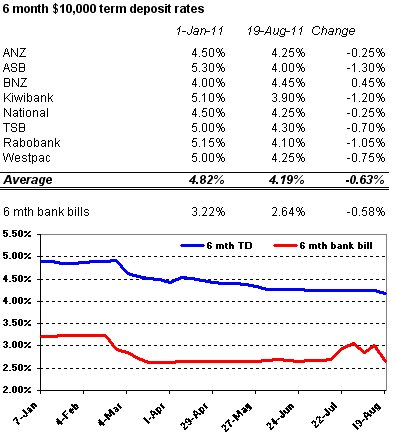

Also, term deposit rates have slowly fallen through the year as competition between the banks for such deposits has eased back.

The average bank one year term deposit rate has fallen 71 basis points this year. See more here on falling term deposit rates here from Gareth Vaughan.

All this meant the banks' net interest margins are rising. ASB reported this week its net interest margin rose 40 basis points to 2.08% this year.

Reserve Bank figures show the banks' combined net interest margin has risen to 2.23% by June from 1.87% in September 2009. New Zealand households need lower mortgage rates. The Reserve Bank can't cut the Official Cash Rate without fueling inflation.

It needs the banks to do that work by cutting mortgage rates. Savers need higher term deposit rates to help lift national savings.

It's time the banks played their part.

55 Comments

Good call BH, but as a Kiwibank customer with a variable mortgage, I'm not sure what I can do to help force rates lower. NZ needs more people to switch, and keep switching to the bank with the lowest rates...perhaps we need a government endorsed campaign like we are seeing in the electricity industry.

Interesting piece and of course profit is usually related to risk for stakeholders including retail creditors. In the US and Europe retail bank deposits are covered by government guarantee. In NZ and Australia they are not. Here living will legislation for banks is scheduled for early 2012 when creditors will take a haircut if a bank falters but a run on the bank is avoided along with taxpayer guarantees. Recent funding changes have also affected depositor risk. NZ banks can source covered bonds backed by ring fencing up to 10% of their assets. Any foreign currency denominated bonds carry exchange risk. When the Bank of Ireland faltered in 2010 headlines screamed its loan to deposit ratio was 160%! Its just one rough indicator but some of the big banks here seem to be around or above that %. Perhaps the credit rating agencies re-evaluation of NZ subsidiaries after downgrading their Aussie parents will shed more light on how high profits have been earned.

Three things:

1) "It's m' bad debt provsions guvnor', honest." Remember that one? Yeah right!

2) Banks are there to work for their shareholders. RBNZ is, supposedly, there to work for it's main stakeholder, NZ. It's just that the banks are better at their work than RBNZ is at theirs, simple.

3) What regulatory ratios would ameliorate the problem? (C'mon, they should be on the tip of your tongue.) Why haven't they been implemented given NZ would have benefitted in other ways, eg. better control of non-tradeables inflation, with less overvaluation influence on NZD and improvement in national savings rate? Who benefitted because said regulation was not implemented? (Sure as hell wasn't RBNZ's main stakeholder, was it.)

Cheers, Les.

PS - over to you Wolly.

Zigzactly right Les , banks have a duty to create a profit for their shareholders . One only has to tootle over to the ASX to purchase a slice of the action .

..... it's called the Capitalist System , Bernard . I'm disappointed that you disapprove of it . For a moment back there , I thought you'd joined us on the path of thrift & innovation , to walk on the Light Side .... But alas , back to the " friends of NZ Labour " you go .

In terms of competition maybe more of this kind of thing might help:

It was on Campbell Live last Friday night.

Hard to believe eh.

Cheers, Les.

Gummy,

I'm all for capitalism where we get competition and we don't have governments bailing out 'Too Big To Fail' institutions. This creates a moral hazard and a type of taxpayer-driven subsidy.

Consumers can do their bit.

The RBNZ could do some interesting things that could increase the potency of its monetary policy power without further damaging exporters. Forcing banks to match their funding with their lending (in NZ dollar terms) would reduce our foreign borrowing and increase term deposit rates.

It would allow the RBNZ to keep the OCR lower for longer.

What's not to love.

Unless you're a bank shareholder.

cheers

Bernard

Yes indeedy , Walter . The Gummy one is beavering through : " Lessons from the Art of Juggling " by Michael Gelb & Tony Buzan . .. Marvellous wee tome .

.. although I doubt that I'll be juggling Bernard anytime soon ... no offence big guy , but the hernia belt doesn't exist which could take that strain ...

There it is Roger, one particular ratio that should be tip of tongue:

"The RBNZ could do some interesting things that could increase the potency of its monetary policy power without further damaging exporters. Forcing banks to match their funding with their lending (in NZ dollar terms) would reduce our foreign borrowing and increase term deposit rates."

And it could be varyied beyond 1:1 if we really want to get serious about rebalancing the economy, wouldn't you say Rog?

"The world has once again cottoned on to the fact that the enormous overhang of debt it discovered back in 2008 has not been dealt with, but has instead been passed from households to banks to governments and, hence, back to households again... the upshot of those negative interest rates is to help erode away.....debt. It is appalling news for savers, of course. But this “financial repression”, in which a captive financial system accepts sub-par returns, was precisely what helped shrink ... war debt after 1945. ."

From the automaticearth

The Domino Effect of Europe Bank Woes

by John Carney - CNBC.comThere’s also the problem with hedge funds trying to hedge exposure to European banks. The short-selling ban on European banks makes hedging exposure more difficult. One response by some hedge funds will be to short U.S. banks as a proxy.

Ilargi: I'm sure you can agree that that is funny, no matter how tragic it is.

The tragedy that's unfolding is shed in an even clearer light when we expand the stats series to include the longer term, in this case 5 years.

In the past 5 years (dating back to August 25 2006, a date I took from Google Finance), these are the loss numbers for financials, as taken at noon, August 19 2011:

- Bank of America : - 86.68%

- Citigroup: -94.33%

- Morgan Stanley: -70.72%

- Keycorp: -83.46%

- Fifth Third Bancorp: -76.06%

- Barclays: - 76.85%

- RBS: -96.83%

- Société Générale: -83.57%

- BNP Paribas: 60.64%

- Crédit Agricole: -81.39%

- UBS: -75.27%

- Credit Suisse: -52.92%

- Deutsche Bank: -65.26%

The numbers are made even more poignant when we look at losses at the Dow and the S&P in the same time period.

- Dow Jones: -3.97%

- S&P 500: -12.81%

If this happens to house prices here then the banks are finished, have look at it sale price in 1989

http://www.redfin.com/CA/Vallejo/363-Catalina-Way-94589/home/2265725

Check a little further .. over the past 5 years the 4 banks have moved aggressively into the wealth management sector and now have influential "control" of 80% of the "funds management industry" through their investment platforms, financial advisory networks, insurance subsidiaries, and have that much power over the $1.4 trillion AU compulsory superannuation megalith.

To pick one bank at random , the ANZ , the 2009/10 annual report shows 411 692 shareholders . From 1 to 1000 shares , there are 211 496 shareholders . And from the 1001 to 5000 shares range , a further 163 252 folk . The first group holds a combined 87 million ordinary ANZ shares , and the latter group controls 364 million shares .

....... wow , there's fourth tenths of a million holders of ANZ ordinary shares . Gosh , alot of people stand to benefit if the bank makes a decent profit .

Speaking of which , in the last 5 years the ANZ has paid the following dividends : 126 cents ( 2009/10 ) , 102 , 136 , 136 again , and 125 cents in the 2005/06 year .

On the current price of $A 19.50 , the ANZ is paying a historic 6.46 % yield . Wow ! That's better than money in the bank .

... crikey , those 411 692 people who own ANZ stock have reason to feel very pleased with their investment .

Unless their entry to the stock was between Nov. 04 and Sept 08, or Aug 09 and now ( when the stock price was above the current $19.50). In which case their dividend has to be viewed in the light of an unrealised capital loss; especially so for those unlucky enough to pick Oct. 07 ( $31.47) as their jump in point! That's a paper loss of 38% ...so far. Or the fact that ANZ is still offering Aussies 6.25% for term deposits at the mom. with no capital risk :)

ANZ earnt $A 2.24 / share of profit in the 2006/07 year . Buying their stock at $ 31.47 in October 2007 gives an earning yield of only 7.1 % ( inverse of the PE ratio ) , and a dividend yield of just 4.3 % .

..... that was alot to pay for an Aussie bank . And so I didn't . Did you , St Nick ?

[ .. anyone fortuitous enough to buy ANZ stock at just $A 12.06 per share on January 19 , 2009 ... would be sitting on a hefty 62 % capital gain today ..... plus dividends ... Gummy can " cherry pick " too ! .. ]

The answer is simple, stop using the banks and contributing to their profits.

Don't have a mortgage and they can't make money from you. Don't have any deposits and they can't lend that money out 63X over to other suckers to get mortgages.

That is the choice you have.

If you have a mortgage and go into negative equity, you only have yourself to blame for participating in the fraudulent scheme.

And lets be clear on this, the system is fraudulent. Once that is drawn to your attention, then you become a criminal by participating.

I have said to you before Iain that your commentary on the money supply is excellent, although long winded. I have no doubt about the fraudulent nature of it all.

The big disappointment was to learn that you are in the thick of it yourself. You choose to participate fully by having a mortgage, it sounds like for some considerable time also.

As I say, by participating then you are guilty. How can your brand of politics be trusted?

So I am left in a situation where I wonder what exactly you stand for.

For me, now that I know I will take steps to slowly wean myself off. I don't have a mortgage or pay rates, I make/catch/grow my own food where possible. My money in the bank is limited, my bank transactions only what is absolutely necessary.

Very poor form , Iain , to accuse St Nick of deception . He is one of the good guys around here . Play the ball , not the man !

...... and for what it's worth , just to burst your latest conspiracy theory , the majority of those companies you list are in control of hundreds of millions ( $A ) of superannuation monies ........ and they invest it where , where do you think , hmmmm ?

Not wanting to deceive the astute types who frequent this forum , are we Iain ?... Nor to deceive ole Gummy as well ?

..... but that is not Bunnings Warehouse you have quoted and maligned , above . A small matter , Iain , but it is in fact a separate listed entity called Bunnings Warehouse Property Trust . They own the majority of the sites that the warehouses are on . They lease them to Bunnings Warehouse , who are themselves a division of the Wesfarmers Group , from Perth , WA .

There's a trillion bucks Iain , an ice cool trillion with a capital " T" , accumulated in the compulsory superannuation funds across Australia .

... is it a coincidence that the companies responsible for investing this money frequently turn up on the majority ownership lists of larger companies listed on the ASX & the NZX , ..

... or is Gummy trying to trick the good folks at interest.co.nz again ?

Which bank granted you a mortgage , Iain ? ..... I want to dip into their annual report to see if they have a dedicated Parksy Page for you , with a nice photo of you in the truck .... and a caption , oooooh , I don't know ...

... something like :---

" Loyal client Iain Parker , of New Zealand , merrily driving us to greater profits in 2011 and beyond " .

Drive " merrily " do you , Iain ? Remember Bill Murray to the Groundhog , " don't drive angry , OK ! "

795 561 : Holy shit , Batman .. that is the number of shareholders in the CBA , the Commonwealth Bank of Australia ... imagine if they all wanted a printed copy of the 241 page 2011 annual report ....... sheeeesh !

... 587 741 of those folk own between 1 and 1000 shares in the CBA . A total 196 677 335 ordinary shares , or 12.62 % of the grand total 1558.7 million shares .

So an average " small investor " has 335 CBA shares , $A 15 259 worth ( ASX : CBA , Friday close $A 45.96 ) . And they collected $A 3.20 in dividends ( 6.96 % yield on current share price ) , per share , or an average $A 1072 per small investor .

... the NZ proportion of CBA's $A 6835 million net profit was a mere 7 % , just $A 470 million ,( ASB ) .

Cowabunga ! .. there's a heaping big number of folk gaining a well deserved profit from this splendid firm .

If you were familiar with my posts I don't think you would make such an amateur allegation.

I would be interested in what you think the bank lending out $9 or ever $1 deposited is if not fraud.

Most people have no idea it is happening and I doubt they would consent if they knew. Even more so if they understood the implications.

You however have no excuse.

Scarfie old bean..it's not just 9 for one..the 9 moves to become deposits in other banks and each one creates 9 more..all part of parky's nightmare scarfie and it explains the gargantuan splurging madness the RBNZ failed so fabulously to control in the bubble....

You are living in a total F%$#$@ mess scarfie...it's called an economy...look who's in charge!

The banks make high profits because they can. I know, not funny. The issue is why is it they can make that much profit. I'm quite sure on this forum we have a pretty good idea by now.

"That means lower mortgage rates".. Seriously?! Only on mortgages less then 60% ltv yeh. Make that 50%.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.