By Kirdan Lees

Before Graeme Wheeler starts his new job as Governor of the Reserve Bank, he must sign a new Policy Targets Agreement (PTA) that sets the goalposts for monetary policy. This is an opportunity to introduce macro-prudential tools to help ease the exchange rate impact of inflation targeting.

Unease about high exchange rate undermines inflation targeting regime

Unease about the impact of inflation targeting on the economy has persisted since the early 1990s. One particular concern is that New Zealand’s exchange rate is regularly overvalued. While the RBNZ manages inflation, it inadvertently strangles the tradable sector by lifting the currency higher.

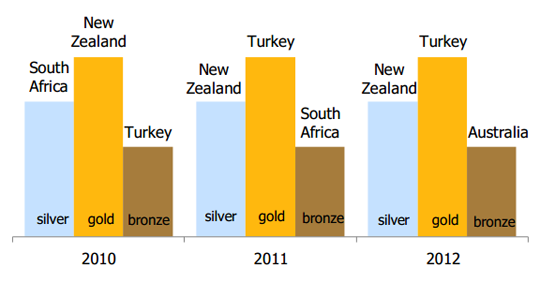

And not just a bit higher. In 2007 the kiwi topped the list of overvalued currencies according to Morgan Stanley. And two US economists, Cline and Williamson have produced a league table of overvalued currencies since 2009 across thirty-four other countries. Over the past three years, the kiwi has consistently been overvalued, placing in the top three each year.

Figure 1: The 'kiwi' consistently wins medals for being overvalued

It is too easy to reject exchange rate concerns as the self-interests of the export sector. The high exchange rate is a symptom of broader imbalances both domestically and internationally. The nation’s savings rate has not been high enough to fund domestic investment. This has culminated in a poor net international investment position from years of not paying our way.

Frustration about the high exchange rate has led to repeated calls to do something about the exchange rate. The RBNZ has dabbled with direct intervention but, unsurprisingly, with little impact. Successive governments have muddied the waters by expanding the objectives of monetary policy, including targeting unnecessary exchange rate instability.

The current inflation targeting framework was left wanting in the boom phase

The current PTA contains too many targets for only one policy lever. Interest rates on their own cannot simultaneously take aim at inflation and reduce pressure on the exchange rate. Additional policy tools are needed to address more than one target.

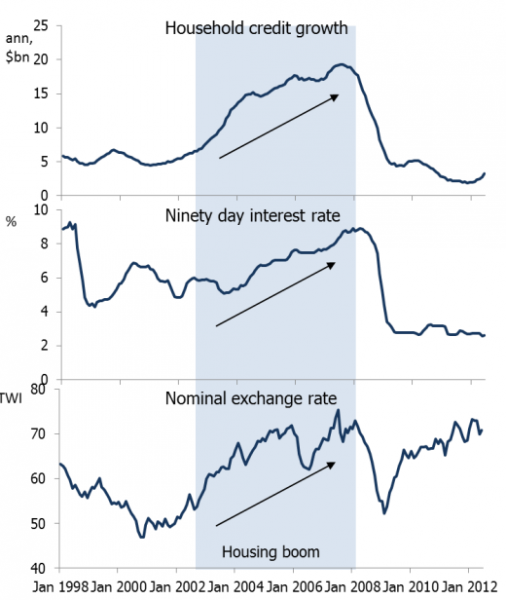

New Zealand’s housing boom in the mid-2000s demonstrates interest rates alone can’t achieve multiple goals. Raising short term interest rates was ineffective in arresting household credit growth since the appreciating currency limited the Reserve Bank’s appetite for increasing rates. Additional tools were required to meet the Reserve Bank’s objectives.

Figure 2: Interest rates alone could not dampen credit growth during the housing market boom

Macro-prudential tools can soften the inflation targeting-exchange rate link

Right now, the Reserve Bank is exploring a range of tools for macro-prudential purposes. Some tools will be more efficient than others at strengthening the financial system without simply raising the cost of capital. The costs and benefits of these tools will need to be evaluated – macro-prudential tools are not a silver bullet.

But macro-prudential tools could be used to weaken the current link between inflation-targeting and the exchange rate, by dampening credit cycles through a variety of measures rather than just interest rate settings.

These macro-prudential tools include:

• quantity measures that constrain bank lending by putting limits on, for example, mortgage loan-to-value or debt-to-income ratios

• forcing banks to maintain counter cyclical capital buffers that put away cash and core assets in good times for the bad times

• asking banks to adopt less pro-cyclical accounting standards.

The most effective macro-prudential tool for actively managing the economic cycle is likely to be moving the Core Funding Ratio. The Core Funding Ratio makes banks fund credit growth from stable long term funding sources, not the short term international markets that seized up during the GFC. This increases the resilience of banks to funding squeezes during financial crises.

Raising the Core Funding Ratio increases the banks’ costs of funding lending to households and firms. Banks pass on these costs, increasing business and mortgage lending rates, generating more bang for buck for a given Official Cash Rate. This means the Reserve Bank can leave the Official Cash Rate and consequently wholesale rates lower, reducing the attractiveness to international investors of parking funds in New Zealand, relieving pressure on the exchange rate.

Not easy but necessary

Policy choices are never easy but macro-prudential tools expand the range of possibilities for the Reserve Bank. Had varying the Core Funding Ratio been available to the Reserve Bank during the housing boom it would have been used to reduce the credit growth that fuelled the housing boom without pressuring the exchange rate higher by increasing interest rates.

But when the exchange rate is high due to fundamental factors there is no role for macro-prudential tools. This means using frameworks like Cline and Williamson’s or the Reserve Bank’s work (see McDonald 2012) to help determine when real factors drive the exchange rate higher. Right now the exchange rate is high for both fundamental reasons (New Zealand’s economy is outperforming advanced economies like the US) and non-fundamental reasons (governments buying New Zealand dollars to sit in foreign reserves rather than investing in the real economy).

Using macro-prudential tools has costs. These include:

• limiting the role banks play in channelling funds from savers to investors

• making a call on the “fair value” for the exchange rate. Getting it wrong means foregoing the benefit of a high kiwi distributing benefits of commodity booms better than farmers’ incomes alone via cheaper machinery, cheaper petrol and cheaper flat screen televisions

• calibrating macro-prudential tools appropriately. Careful assessment is needed for the Reserve Bank to learn these tools just as inflation targeting was learned in the 1990s.

If the PTA continues to include a requirement to stop “unnecessary fluctuations in the exchange rate” then the Governor should be provided with a credible mechanism to help make that happen. Otherwise it would be difficult to hold the Reserve Bank accountable for outcomes. Macro-prudential tools provide a mechanism that can limit non-fundamental exchange rate movements.

There is currently a risk that some future government will succumb to the clamour to ‘do something’ about the high exchange rate, and ends up doing something silly. The introduction of macro-prudential tools gives an opportunity to soften the link between the interest and exchange rates by being able to target financial asset bubbles directly. Introducing macro-prudential tools as an additional instrument in the PTA improves the credibility of inflation targeting.

References

Cline, William R. and John Williamson (2010, 2011, 2012), “Estimates of Fundamental Equilibrium Exchange Rates”, May, Policy Briefs Series, Peterson Institute for International Economics.

McDonald, Chris (2012), “Kiwi drivers: the New Zealand dollar experience”, Reserve Bank of New Zealand Analytical Note 2012/02, May.

* Kirdan Lees is Senior Economist and Head of Public Good Research at NZIER.

32 Comments

This is probably the most important economic policy the government needs to address. If they want to know how to make it happen, they can give me a call :-)

You'll get my vote raf.

raf, if you knew, you would have executed the trade and saved a lot of hot air being expelled by the inexperienced.

Stephen, I don't have the firepower I used to have!

Nonsense. The stronger the NZD, the better.

On what do you bias your opinion, pray tell.

Alex must be importing plasma tv's...

And hate tourists too gelorus....only an importer of Chinese crapola want's that overweight flightless bird gaining anymore weight....

Geesus Alex13 ...I've seen some bad taste comment ,but that's a shocker.

As I posted before,-

The majority of ordinary people benefit from the high NZ dollar when living here or when traveling overseas. A fall in NZD exchange rate would cause a significant rise to both cost of living and inflation. The only people who might benefit from such an exercise are owners of export companies – and even that is not guaranteed (I won’t go into analyzing the reasons for success or failure of export businesses in NZ as this is too big of a subject – suffice it to say that the said reasons have very little to do with the currency exchange rate).

The majority of ordinary people benefit from the high NZ dollar when living here or when traveling overseas.

And overseas Economies are the ones benifiting from the travelling your lauding Alex. duh.!

(I won’t go into analyzing the reasons for success or failure of export businesses in NZ as this is too big of a subject – suffice it to say that the said reasons have very little to do with the currency exchange rate).

Alex that statement is beyond naive it is just offensive and wrong , (as in ) incorrect, not right,bollocks. You won't go into it because, you don't knbow what the frig your talking about sunshine.

Mate, your brainwashed emotional tirade is so representative of the quality of comments often found on this site. Nothing in it warrants a serious response.

YES , YES , YES , Like the mercantalist Chinese do with their currency , it should be targetted at a specific level, nothing too drastic .

This all sounds very sensible. Hopefully the government will in fact take the opportunity to make the change to the PTA. They presumably would have to stare down the banks, who, if I understand the measures above, would make smaller but almost guaranteed profits from more traditional banking.

A good measure it seems to me of whether the exchange rate is fairly valued, is whether the current account is in balance- or even say 1-2% in surplus, given we have 40 years of deficits to catch up on. The IMF suggest balance would need something like a 20% devaluation.

Although frankly, I think the talk of ringing the changes is suspiciously linked to the RBA's recent posturing on the matter....maybe even a directive.

Indeed, Christov, it would have been nice if we could have come to the correct conclusion on our own, but certainly if the Aussies move, we surely have no choice.

Is there a flaw in the argument that high interest rates leads to a high exchange rate? Surely the high exchange rate is due to money flowing into NZD. This will happen when our borrowing increases. Surely the high interest rate is due to increased borrowing too.

Stop the borrowing and the exchange rate will fall (careful what we wish for, I guess).

This article inplies that both the write and the governor actually have some idea about what they are doing, but they don't have a bloody clue!

Any interest require growth, any growth requires resources. Constant growth results in an exponential requirement for resources on a planet that is finite. So changing the targeting methods won't help, it is a wasted argument.

Funny.

Kirdan Lees is Senior Economist and Head of Public Good Research at NZIER

Tommorow's encore will be an article by the Head of Public Bad Research at NZIER

We are getting exactly what we need, a strong currency. Would a weak currency stop councils racking up debt like Kaipara? Would it really help my vineyard drowning in costs, or the %8 rate increase on my sheep and cattle block? Would it stop supermarkets gouging ?

a strong $ is going to force these institutions to change and Im happy to sit it out while they suffer.

I am told that a lot of foreign govt and govt associated institutions now hold Australian bonds, once a country is on their buy list it stays there .

Diversification of foreign bank reserves will continue to be the driver .The keybeing the desire to get away from the three ugly sisters. To add to the mix , new issue will be significantly lower over the next 12 months .

>>>>>>

Calvin Bear

Posted Today, 05:55 AM

As a snapshot image, yes, one might employ the analogy of trees growing and then being cut down by the purchasers and users of debt.The problem though is not just the one that Bill Clinton just pointed out - namely, the possibility that some politicians can't stick to the basic rules of arithmetic - but also, that in actuality we are dealing with a 'moving image;' that is, the trees are moving around and not simply 'growing.'

I do not agree at all that we are anywhere near unsustainably large absolute amounts of debt or fiat money issued - in spite of all the fearful talk and big signs clicking the numbers over in red.

The only thing that society needs to work out is how to encourage the 'movements of growing trees' towards where useful activities are (which can also help to grow more trees), and steer the mobile trees away from people who just burn the trees for no worthwhile purpose at all. Modern cartel banks are 'burning trees' for no good reason and taking a commission for doing so. Trees = money/debt = burning trees.

Bill Clinton spoke earlier today of the long term debt situation becoming a serious problem if it is not properly addressed. What this means is that we should be concerned if we are growing trees in order just to burn them, rather than use them.

If you look at the Wikepedia definition of 'money' it says in one section that 'money is any commodity which...' No; money is not a commodity at all - it is a token representing value.

Burning trees for no real purpose has no value. And that is what is going on with large swathes of money/'trees.' Because of the licence cartel banks have been granted as 'primary dealers' of money, they invent new and ever more useless ways to burn the money in order to get more of it and take ever greater commissions along the way.

The mortgage market situation is one very substantial example of this. An individual property is a fixed asset that requires maintenance and cannot be (guaranteed to be) turned over within a standard accounting term of one year - therefore it is not genuinely 'financial capital' ever on its own. A group of properties might partly be financial capital when their turnover is averaged out.

1. Real estate prices are all wildly overpriced in a moral and ethical fiat money economy - which is what we do not have and cannot hope to have for some time now.

2. There is no climate of deterrence away from frivolous 'tree burning,' and incentive attracting 'trees' to positive beneficial activities and uses.

Taxation is minimally attracted to real estate compared with say, manufacturing and food and services and other high velocity economic activities - THAT IS WHY CURRENT DEBT IS DIFFICULT TO CONTAIN.

The only reason money is not flowing to less anaemic economic activities, and encouraging domestic spending and much higher consumption levels (of value), is not because there is a lot of debt out on issue - but because the cartel banks have invited themselves to a 'no risk' situation of projecting real estate as their main, or even sole and only basis of credit supply to the domestic economy. Money is thus being locked up, lock into, pooling around in turgid swamps of unproductive activity. At heart, even credit cards are based around 'the wealth effect' and people's equity value of houses.

If it were really true that investment banks could sustain themselves on a zero percent bond yield, then all would be well and we could not suspect a moral hazard at play. But they are taking taxpayer value from the 'trees they get given to burn gratutitously...' They are not taking 'zero per cent.' They are taking enough for multi-million dollar bonuses to directors and enough to play a significant and unelected hand in politics at the highest levels and in the media extensively.

Why is it true that 16 trillion is unmanagable? Because there is inadequate tax revenue. But that is only because of anaemic circulation, and that is directly because of cartel bank credit allocation policy.

Is inflation - that is CONSUMER AND MANUFACTURER price inflation - the fatal flaw or problem with higher velocity sector credit allocation? Not at all. It was when data and information and lack of transparency were issues but now with technology we know EXACTLY where anti-competitive cost imposts and unproductive inflationary pools are and we can know it immediately in happens and take monetary and fiscal policy actions against such effects.

But... ...as one famous Russian intelligence official whose name I for the moment forget, once said - we are dealing with people who, even faced with the facts, cannot alter their opinions.

Debt is NOT a problem. A lot of debt is not a problem. But governments are required to pull special interests back from imaginary fairy stories about currency credibility that serve to deliberately confuse credibility with credit-ability. One is about value - and the other is only about the official name of an official token. Ben Bernanke and his mates want you to believe the official name of the official token used to hold and to transfer value... ...is the swift code of a primary dealer account ONLY. But the credit-ability of the US is not 'ZERO PER CENT' except in Bill Clinton's 'rouse up the faithful's' mind. And he himself said outright to be prepared for economic growth and eventually higher interest rates. And that is certain to happen. Certain.

Money is NOT what Bernanke is pushing that it is, and NOT what Rush Limbaugh says it is and its credibility has nothing to do with the austerity of the citizenry and the tax minimisation programs of the Republicans. It is ONLY legal tender. That is all. In fact it is whatever Congress and the President and the Supreme Court say ought to be good for legal tender - and nothing to do with the interest rate has any connection with that at all except at the margins of trade. People will still use rubles if they want to buy Barguzinskaya. Or gold. And they will still use US Dollars at 100 % monetary inflation if they need to bribe a US Republican Congressman who wants to be paid in US Dollars to push for a vote on the re-introduction of slavery for a news headline on Fox.

The ability to trade is the absolute thing. And THAT is the thing the Republicans ought to be concentrating on. Not, 'oh things COST more because of social programs and therefore no one wants to buy our things and therefore it is all because of debt.' Quality things always cost a little more. Rubbish things built by illiterate sickly people are not going to sell either way whether debt paid for them to be built or austerity programs did.

The idea that national currency issuance debt puts an impost on costs and on the future generations is the biggest load of rubbish anyone ever spouted but it is the thing driving all of modern politics.

Real balance of trade value going in the wrong direction puts an impost on real costs and that is all about whether capital has really been investing in the right things; which it has not. And that is because government policy has not required it to actually invest for actual profit but to work up fantasy crises and exploit sophisticated lobby-ists to justify gratuitous helicopter drops of vast bulk cash that goes to 'the money markets.' Whatever in the hell that is meant to be today.

That fact that no one seems to know what large scale and longer term manufacturing capital investments could drive real employment growth is testiment to the success that cartel banks have achieved being lazy-minded and fat beyond belief and clever in using propaganda.

Factories that are fully-robotic/fully JIT and function from fluid designs that each and every individual consumer could plug personally and directly in from their iPad, while sitting anywhere in the world with branded company design consultants, and turn out vehicles that cost anywhere in a huge range from five hundred dollars to five million dollars - would captivate the whole world and drive employment beyond any medium term future requirement. Not only is this entirely possible, but all the materials and supply chains and complete levels of costs option inputs are already obtainable in this way. The same with food - anything you want/from anywhere you want it - and the same with clothing and everything that we use in our lives. Everything.

The future of employment, is, as President Clinton just now said completely different to the economy of the past and that economy is never coming back.

Concern about debt is rubbish.

Calvin J. Bear http://forums.wallstreetexaminer.com/topic/1045901-why-do-keynesians-th…

Yes but the thing here is A.J. your sitting it out in the States, I would guess repatriating funds back to N.Z. and copping the advantage that comes with our high exchange rate,

Now I wanted or needed, to pay down debt here at a faster clip...i think I'd be right where you are....that is provided you are recieving an American increment, your postings lead me to believe that is the case.

Don't misunderstand me on this A.J. I have a great deal of respect for your input on many things here, but this is one where I just sniff a little bias with good reason.

A.J. your sitting it out in the States, I would guess repatriating funds back to N.Z. and copping the advantage that comes with our high exchange rate,

C'mon Christov - he would be commiting suicide. No US income on the funds - smart money says AUD to USD interest income transfer for living purposes. The rest is just speculation in terms of buying NZD forward against AUD - one loses carry points every day.

But maybe worth a punt to take advantage of a return to speculative farm price sales way above QV values.

Who said deflation was a problem? - banks' recent profits and highly leveraged lending actions prove otherwise and if not they are about to collapse at our expense - cos Aussie won't bale them out. Either way we need higher short term rates to invert curve to stop this type of speculative property investment nonsense - NZD crash would follow immediately.

Point well made...point taken Stephen H.

Quite what the angle is I don't ...Know....but safe to say from following A..J. posts the move was one to mittigate losses or erosions in value to N.Z. investment on the ground.

Hi Christov, I have a vested interest yes its great living overseas witha strong kiwi or actually for me a strong Aussie. I also want NZ to sort itself out andf move to a business friendly environment. Cut this sort of crap out which is an atempt to keep our land prices high

http://www.stuff.co.nz/business/farming/7631604/NZX-plans-trading-tools…

AS for the currency I think its going to stay high for longer, this from a mate who knows more than me.

Diversification of foreign bank reserves will continue to be the driver .The key

being the desire to get away from the three ugly sisters . I used to work with central banks and once a country is on their buy list it stays there . The swiss are the big buyers ( as they need a home for the euros that are flooding in from their 1.20 floor

plus our asian and brazilian friends .

Yep Cheers A.J. n thanks for the heads up on the higher for longer, I prolly never figured that not to be the case, but ah live in hope and all that Bla....

Damn it I just might have to join you out there, cause I certainly don't look like I can beat em.

Christov, Im heading to the Uk for Christmas, an expensive time to fly, cost me $500 each way could have done it for $400 rest of the year. Going to NZ $1000 each way, Hmm, wonder where the tourists went?

As for the Aussie

I am told that 64 foreign govt and govt associated institutions now hold australian bonds

Keep an Eye out for the RBA's posturing on that A.J.....it's gone from happyville to a matter of concern for them.

But as you say , good bonds are hard to find , so it would take a powerfull disuassion from the Governor to make any of those institutions rethink their strategy.

Stay well.

Mist42nz, Christov and Steven - may I suggest going to the link at the bottom of Andrewj's post and read the responses - Hypertiger has provided a good response to all the other bloggers on the site.

Cheers Notaneco...will do.

Andrewj - many thanks for sharing the article, well worth the read. I also followed the link you provided to the wall street examiner and read the comments and replies etc again well worth the read.

I know most people won't understand these most basic of economic principles i this article and Bill Clinton is correct in his statement that Politicians can't stick to the basic rules of arithmetic.

I have always said there is productive and non-productive debt, the first provides a real return while the second one tends to burn the benefit of the first. Most economists don't get it and view the whole economy as offering a benefit (including the public service) but fail to see that it is actually burning the trees as Calvin J. Bear puts it.

People do not even understand what a real return is anymore and have implied that because the Capital Gain value of land and buildings has increased that they are getting a real return. They then add that property has consistenltly gone up in value year after year then believe that yes this is real return because it has consistency. These same people then conveniently forget about the amount of money in debt servicing and other costs they have to put into this house on an annual basis. This just tells me we have many uneducated financially illiterate people running around. At least property investors have their eye on the ball and see housing as a stock which have costs associated.

All housing, is a necessary social cost (along with health, education etc) that most of the time isn't productive. The debts and costs create high levels of money burning and then the productive sector becomes constrained because of the affects.

You might also like the latest Bill Gross edition to banks' position in society.

It’s that the price of money (be it in the form of a real interest rate, a quality risk spread, or both) is too low. Our entire finance-based monetary system – led by banks but typified by insurance companies, investment management firms and hedge funds as well – is based on an acceptable level of carry and the expectation of earning it. When credit is priced such that carry is no longer as profitable at a customary amount of leverage/risk, then the system will stall, list, or perhaps even tip over." Indeed, according to Gross central banks have now clearly sown the seeds of the entire financial system's own destruction. That he is right we have no doubt. The only question: how soon until he is proven right.

Steven H - may I suggest that you read the article Andrewj posted again.

While Gross talks about the banks money-lending and margins etc, so does the article that Andrewj posted. The problem lies with where the money (loaned by the banks) finally ended up and that is in unproductive investments (of which by the way shouldn't be called an investment as they do not provide an annual return back into the system on an annualised basis).

Both writers recognise the problems within the system and both recognise that the system could topple over.

The consumers borrowed the money and chose to spend it unproductively in not producing a valuable tradeable supply.

I was always taught look after the productive side of your business first and then you can afford the consumables as your income allows. Nowadays people spend on the consumables first and then wonder why we have a mess.

Thanks I have and have been reading this blog (Bear Chat) and the views of the protagonists long before it found a home at Wall Street Examiner. It started life with a few more than the current suspects at Prudent Bear - I have been signed up for ten years or more.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.