Here's my Top 10 links from around the Internet at 10:00 am today in association with NZ Mint.

Bernard is back tomorrow with his version.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

1. 'Shadow banking system still a threat'

US Fed chairman Ben Bernanke said on Saturday (Friday Chicago time) that the shadow banking system still posed a threat to financial stability.

He pointed out funding markets might still not be able to cope with a major default.

In a wide-ranging speech explaining the Fed’s role in monitoring the health of the banking system, Bernanke also laid out how the central bank was looking at asset markets closely for signs of excessive risk taking. Reading this and given his public profile, it is amazing to me that he and his team have the time and resouces to do all the stuff he listed in the detail he revealed.

With respect to the triparty repo platform, progress has been made in reducing the amount of intraday credit extended by the clearing banks in the course of the daily settlement process, and, as additional enhancements are made, the extension of such credit should be largely eliminated by the end of 2014. However, important risks remain in the short-term wholesale funding markets.

One of the key risks is how the system would respond to the failure of a broker-dealer or other major borrower. The Dodd-Frank Act has provided important additional tools to deal with this vulnerability, notably the provisions that facilitate an orderly resolution of a broker-dealer or a broker-dealer holding company whose imminent failure poses a systemic risk.

But, as highlighted in the FSOC's most recent annual report, more work is needed to better prepare investors and other market participants to deal with the potential consequences of a default by a large participant in the repo market.

2. De-linking

The RBA recently cut its benchmark rate by 25 bps, but ANZ then announced a 27 bps cut. And Cameron Cline is out publicaly saying that out of cycle trading bank mortgage rate cuts in Austrlia are coming. This is an entirely different tune. We had gotten used to Aussie banks cutting less, not passing on RBA cuts in full. It seems the reasons are in the stats: as we note below (#7) risk spreads for NZ sovereign debt has narrowed sharply. Same for Aussie (although it is not as low as NZ).

Well, CDS spreads for Aussie investment grade debt (mainly bank debt) has narrowed even more that for our goverments. Low bond rates are being embellished by lower risk spreads. There is room now for bigger reductions. How long before we see that here? Home loan customers will like it, but TD 'investors' may start thinking something quite different. Here's what the AFR said:

National Australia Bank chief executive Cameron Clyne says he may cut mortgage rates out of step with the central bank as loan funding costs stabilise and competition intensifies in Australia’s $1.3 trillion home loan market.

Asked if NAB would move rates down out of cycle, Mr Clyne told Channel Nine’s Financial Review Sunday: “Oh absolutely, I think that’s a possibility”.

“I can’t predict when because it’s going to depend on funding conditions. But I think it’s important we continue to really talk about the fact that what drives bank funding costs is not the RBA.”

------------------------------------------------------------------------------------------------------------------------------------------

Keep it safe. Keep it in a New Zealand Mint safety deposit box. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

3. West losing influence

The WTO race that Tim Groser was in was won by a Brazilian, and there are expected to be long-term consequences. The WTO Doha round foundered on EU and US intransigence over agriculture, but now the BRICS may be making an end run around the West. Liam Halligan explains:

Having bought into the WTO’s multilateral system, many increasingly powerful emerging markets are furious at what they see - rightly, in many cases - as continued Western intransigence. There are now alarming signs such nations are going their own way, cutting bilateral trade deals between themselves that specifically exclude the West.

The bottom line is that, as Westerners, “we” have more to lose than “they” do. That’s because “they” are fast-growing, “they” have fiscal strength, “they” will soon account for the lion’s share of the global economy. Over the coming decade, such realities will become increasingly apparent.

Brazil is in an extremely strong position. Trade accounts for just 25pc of its economy, and it has practically the entire “non-Western” world in its corner. Western leaders should now bite the bullet and make whatever sector-specific sacrifices are needed to complete the Doha round. The reality is that, from our perspective, the terms can only get worse.

4. Today's raw market data ...

A quick new week update:

| as at 11:10am |

Today 9:00 am |

Friday |

Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.8302 | 0.8409 | 0.8578 | 0.7799 |

| NZ$1 = AU$ | 0.8290 | 0.8329 | 0.8160 | 0.7790 |

| TWI | 77.57 | 78.19 | 78.72 | 70.24 |

| Gold, US$/oz | 1,427 | 1,465 | 1,395 | 1,559 |

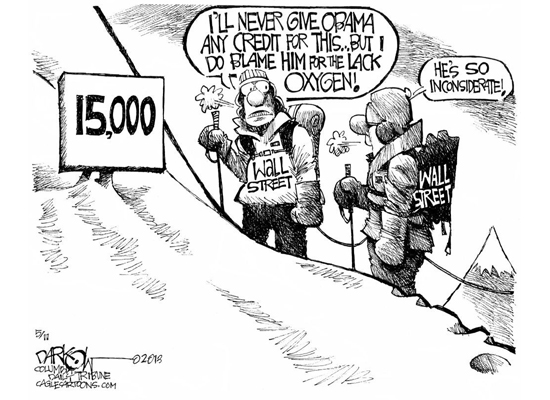

| Dow | 15,102 | 15,109 | 14,565 | 12,687 |

| Copper, US$/tonne | 7,391 | 7,311 | 7,121 | 7,980 |

| Volatility Index | 12.59 | 13.13 | 17.27 | 21.87 |

------------------------------------------------------------------------------------------------------------------------------------------

New Zealand Mint. Experts in gold & silver bullion, commemorative coins and jewellery. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

5. LVR of 30%

A stunning contrast between what the RBNZ is contemplating with their tightened up macro-prudential tools, and how the Chinese handle unwelcome investor demand for housing. Reporters in Beijing who mystery shopped for a loan on a 'second home' found they were required to put down a deposit of 70% ! And then pay interest 10% higher than the carded rate.

Loan conditions are much easier when you are buying a first or own home. The LVR can be as high as 93% (assuming I am reading the translated version of this story correctly).

6. A step too far

Some people think the Bundesbank is still unable to come to terms with its diminished role, hence the court challenge over the ECB's bond-buying program. Here is Melvyn Krauss' opinion:

Germans need to re-think whether Bundesbank President Jens Weidmann’s move to lodge a legal challenge against the European Central Bank’s bond-buying program was such a good idea. They don’t have a lot of time.

Germany’s constitutional court in Karlsruhe is scheduled to decide the case next month. If it says the ECB’s outright-monetary-transactions program is illegal, then markets will dump the euro, and bond markets in the euro area’s peripheral economies will swoon. The last thing Europe needs as it seeks to emerge from a recession is a return to last year’s unstable financial markets.

Chancellor Angela Merkel, no doubt, has a Plan B available for such an outcome, like going to parliament to amend the constitution, so the ECB program can resume. If she doesn’t, she should. Even so, the market volatility that would follow until the ECB was able to restore its bond-purchase guarantee would be devastating.

Most analysts believe the court will rule in favor of the ECB program, at least in a modified form. Even if that proves to be the case, however, the court hearings could easily develop a circus-like atmosphere that creates uncertainty and undermines confidence in the common currency. The hearings might also affect September’s federal elections in Germany, given that Merkel supported the ECB’s program from the outset.

And all this risk for what? So that the anti-euro lawyers and officials in top management at the Bundesbank can take their revenge on a currency union that they opposed from the very beginning.

Germany’s central bank clearly went too far this time.

------------------------------------------------------------------------------------------------------------------------------------------

Available now. Our brand new 1 oz Taku gold bullion coin. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

7. International judgement

New Zealand's sovereign credit default swap spreads have fallen to their lowest levels since the GFC. On Friday they were recorded at 38.59 bps. That's low compared to Australia which is still at about 40 bps. Switzerland is at 37, the USA at 32, Holland at 59. The UK is at 45. But we are still a long way from oil-rich Norway; their latest CDS spreads are just 18.74.

New Zealand's 'credit' may well improve from here soon if the Budget announcement on Thursday signal a return to surplus that observers deem credible and sustainable. At a time when credit is cheap, our government can borrow at the slimmest margins. The hoary old chestnut applies - if you can show you may not actually need it, bankers will fall over themselves to lend you money.

8. Creative agriculture

The climate news is 'frightening'. An observatory in Hawaii has reported that carbon dioxide has exceeded 400 ppm for the first time ever. Over eons it has oscilated between 180 and 280 ppm. 400 ppm is suddenly very high. Alarm is being reported everywhere.

But at the same time, the world is awash in agricultural output. This year and next it looks like both grains and animal production will be at all-time records. Price aren't rising; there is no shortage. In fact, widespread hunger is now so rare, when it appears in relatively small pockets, it is big news. Not only have we no tolerance for it any more, it is unusual - even in Africa. Living standards are rising. We can feed ourselves despite a gigantic world population. So much food is being produced, it is depressing prices. How come?

Maybe the two phenomia are related. Plants need two things to thrive. CO2 and water and we have them worldwide, even if their distribution is changing. We have also applied science to food production, raising productivity. Maybe the climate scrientists need to talk to the food scientists - we seem to be in the middle of massive adaption.

The US Department of Agriculture, in its first forecasts for 2013-14, showed what awaits the world supply and demand balance for grains and oilseeds.

And it certainly made better reading for crop consumers than sellers.

World stocks of soybeans are to jump to an all-time high, and global corn inventories reach their highest in 13 years.

In wheat, the global harvest will top 700m tonnes for the first time, with cotton managing its own superlatives too, seeing world inventories on course to end 2013-14 at a record 92.7m bales.

9. Job losses gains

The March HLFS Q1 data revealed that employment was up and unemployment down.

| Actual numbers, not seasonally adjusted | Mar-2013 | Dec-2012 | Mar-2012 |

| extra people employed | 34,700 | ( 3,000) | ( 6,100) |

| extra peope unemployed | ( 4,700) | ( 9,500) | 20,500 |

| extra people wanting more work | ( 4,800) | ( 3,400) | ( 2,400) |

| Participation rate | 68.2% | 67.5% | 69.0% |

| Unemployment rate | 6.5% | 6.8% | 7.1% |

These numbers did not bear out the concerns that job losses were growing. Having said that, it is right to note that many analysts have doubts about the HLFS survey. Those doubts are over the short term volatility rather than the longer term trends the survey reveals. Analysts thought the Dec-12 numbers were unexplainably low given other features of our economy. It is likely that the Q1 2013 data 'catches up' those concerns.

We are keeping a tally of reported job losses and we are asking readers for help keeping track of them. Let us know when you hear of some, even small ones.

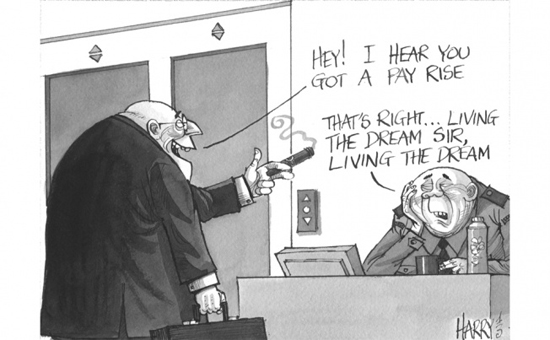

10. Today's quote

"Your net worth to the world is usually determined by what remains after your bad habits are subtracted from your good ones." - Benjamin Franklin

Dairy prices

Select chart tabs

37 Comments

#8 "first time ever" is technically first time ever recorded, or first time in human history. The last time the atmosphere got to these levels was about 3 million years ago, and was associated with oceans being much, much higher.

A lot of the grain commodities have been hit by large scale droughts at points over the past few years, so if for example you go back a decade in wheat production the amount produced in any one year jumps around the trned line a lot, as everyone has a good year or bad year. This means you can't read much into "this years increase on last years" figures.

It has been said by others, that there has never been a worldwide shortage of food, just a shortage of food where it is needed (while food in other places goes to waste). Losses in production in developing countries, consumption in developed countries. Conservatively estimated at about 30%, I haven't seen change over time data but it is the sort of area where small interventions in production losses in developed countries could have a strong influence on the tonage produced.

#9 The gains/ losses are sectorised though- up 12% construction, down 3% manufacturing/ warehousing/ transport. Sectorially it does not look like a great match to the areas in your own loses tally (which tends to favour major industries that get press coverage, and (it looks like) middle class jobs). I would construe this means many of the Labour force losses have been small scale, losing 1 or 2 employees from small groups so not making the news.

Last year unemploment numbers creted a quite a bit of controversy over what the immidiate future held for New Zealand. I feel today's numbers shine a bit if light on the matter, and that coupled with this brilliant weather we are experiencing, definitely point to a brighter future.

Good days are here!

Enjoy...

HGW

#8 Australian food science research shows CO2 forcing effect will be short-lived as most plants have limited/no tolerance for the higher temperature ranges that will come with the CO2.

HAving said that I am very curious about new land coming into grain production in Canada and Russia. Haven't heard anything about that yet.

"we seem to be in the middle of massive adaption".

Actually, we're in an all-hands-to-the-pumps, fossil-fuel-driven, aquifer-depleting, soil-depleting, bio-diversity destroying, blip.

The further you push the top of the gaussian, the more likely a Seneca event. Farming may well migrate away from the equator, but - as the Sumerians (and others) found - you can adapt until you can't.

David - any figures for the fossil calorie to food calorie ratio?

http://www.resilience.org/stories/2012-10-30/reducing-agriculture-s-high-energy-costs

I did a quick track back of where Pollan's figure comes from and it seems to have been 7-10 most of which is processing and shipping

https://www.nyu.edu/sustainability/pdf/Fossil%20Fuel%20and%20Energy%20U…

which in turn, pointed to what seems to be the (much more in-depth) document the calculations are based from

Thoughtful piece on the changing jobs and enployment landscape...ht Glenn Reynolds

Food prices at my local supermarkets are very depressing.

Have you looked into the quality of all that food production? From a nutritional perspective most of that food isn't worth eating.

#8 Took 30 seconds to fact-check your assertion that world hunger has been solved. You might be in a minority of one on this one. Although I suppose there is a universe where 230x the population of New Zealand is insignificant,

Update: in the time it takes you to read this trivial comment approximately 20 people will die of hunger.

Take a look at http://www.worldhunger.org/articles/Learn/world%20hunger%20facts%202002.htm

"No one really knows how many people are malnourished. The statistic most frequently cited is that of the United Nations Food and Agriculture Organization, which measures 'undernutrition'. The FAO did not publish an estimate in its most recent publication, 'The State of Food Insecurity in the World 2011' as it is undertaking a major revision of how it estimates food insecurity (FAO 2011 p. 10). The 2010 estimate, the most recent, says that 925 million people were undernourished in 2010 (FAO 2010). [,,,] the number of hungry people has increased since 1995-97. The increase has been due to three factors: 1) neglect of agriculture relevant to very poor people by governments and international agencies; 2) the current worldwide economic crisis, and 3) the significant increase of food prices in the last several years which has been devastating to those with only a few dollars a day to spend. 925 million people is 13.6 percent of the estimated world population of 6.8 billion. Nearly all of the undernourished are in developing countries. "

Someone has to spin the worth of extended farm prices underlying the outrageous increase in agricultural mortgage assets being created by US banks. I guess it's not much different here. Read article

A Federal Reserve panel of bankers warned policy makers in February that record stimulus was pushing financial institutions to take on more credit risk and creating a “bubble” in the price of U.S. farmland.

The panel also said in February that farmland valuations posed an asset-price bubble caused by unusually low interest rates, echoing concerns expressed by Kansas City Fed President Esther George.

“Agricultural land prices are veering further from what makes sense,” according to minutes of the council’s Feb. 8 gathering. “Members believe the run-up in agriculture land prices is a bubble resulting from persistently low interest rates.”

Data compiled by the regional Fed banks have documented a rapid run-up in farmland prices, particularly across the Midwest’s Corn Belt. The Kansas City Fed said irrigated cropland in its district rose 30 percent during 2012, while the Chicago Fed reported a 16 percent increase.

HAS ANYONE HEARD OF .... GLOBAL COOLING?

It turns out many people were wrong in thier predictions about Global warming and the end of the freemarket economy .

Those who predicted the end of the free market during the GFC..... well its been 5 years , and when I looked last , we still have free market capitalism , anf the US$ is getting stronger , and their unemployment is down , so they seem to be recovering

Those who rasied all this nonsense about global warming ... Pulkovo Observatory in St Petersburg, now predicts that we could be in for 200 plus years of global cooling. Cooling, folks, not warming

...and we could be in for everyone getting a pony...

I thought it wasn't free-market capitalism? Does that mean free-market capitalism caused the financial crisis after all? Who knew?

Oh, dear. You might want to read another translation from the Russian than the climate denial blogs are copy pasting around the place. The take home is that:

-journalists have recently been making unsubstantiated claims than the melting of arctic ice is going to reverse.

-the observatory is saying that even if the sun is entering a long term quiter period, the effect of this cooling will be nothing like past cooling periods because the strength of climate change means it can't get as cold as it used to.

-the melting of arctic ice is expected not to be reversed.

We can be sure that Boatman is well aware that his statement is a distortion of fact and the result of typically poor journalism. Despite that he chooses to repeat this obvious distortion (as if it is a matter of fact) without providing any possibility to find out where it comes from. We can be quite sure he is not actually interested in facts in this area, and I doubt he is interested in reading another translation either. What the Pulkovo Observatory actually said is not of any use here.

I think you have been trolled, I mean I cant believe anybody can be that stupid.

regards

Yes Boatman, I have heard about global cooling. It has been spoken of in some circles, although it has not been publicized as much as it's counterpart, global warming. I guess global warming has a stronger financial support due to the carbon credits and what not, and it is highly in vogue.

The reality is we simply don't know. We can't know, for we are like butterflies watching a tree grow; our life span is simply not long enough when compared to geological time.

One thing is certain though, life will prevail. Even if we don't think so...!

HGW

Looks like Al Gore's climate - 101 video has a few flaws.

http://wattsupwiththat.com/2011/09/28/video-analysis-and-scene-replicat…

Oh lookee there, another. Snap.

see my earlier comment below.

Sorry, but dispassionate science has a 'vested interest' filter.

PDK - what is your problem?

Chuckle - there we go again, spin 101, shoot the mesenger.

You could assume my problem is with those who fail to filter their vested interest. You could assume that I hold that view on behalf of future generations.

Logic says that if we weren't sure, the problem is is one of such inertia/momentum, that the only valid approach is to be proactive. Then, if it turned out it was a false alarm, all the oil, coal, gas would still be there to be used. In the long game, no loss whatever.

Which means that everyone urging denial/continuance, has either a vested interest in the short-game status-quo, is paid by same, or is perhaps belief-oriented to begin with. None of those are my problem - I suspect at least one is yours.

Nothing like tony watts flaws, mis-directions, lies and voodoo non-science.....

regards

It's really not a good idea to oppose measures taken to combat climate change on the basis that you don't believe in anthropogenic climate change. That position means either that you'll have to change your mind and start supporting the measures if new evidence comes forward that strengthens the case that it is happening - or that you take the position that you'll never believe in it, no matter what evidence is presented, which identifies you as closed-minded.

There's a good exploration in this article - which also makes some worthwhile points about how we pick and choose which consensus opinions we pray in aid - of the grounds for opposing measures taken in the name of climate change, showing that some are entirely coherent and sustainable - and others aren't.

http://offsettingbehaviour.blogspot.co.nz/search/label/global%20warming

MdM - I am not concerned with either my beliefs or other people's beliefs. A belief on the whole is not the truth.

In the early days I will admit that I once believed and swallowed the global warming theory.

There is plenty of sound scientific data which dispels the Gobal warming theory.

If we are to have a moral compass in life do we trust our beliefs or do we source the truth? The truth is always harder to find when so many people use their beliefs as their moral compass in life.

You wont find the truth if your not searching for it!

There's also plenty of sound scientific data which supports the proposition that human activity is causing climate change through an increase in the presence of greenhouse gases in the Earth's atmosphere.

We are faced therefore with decision making under uncertainty. In which case, a sensible approach is to consider which course of action is likely to lead to the worst outcome, if you adopt it and then your assumption about anthropogenic climate change turns out to be wrong.

That is an argument in favour of taking sensible, coherent measures to reduce greenhouse gas emissions. If it then turns out that climate change isn't real, what harm? Compared to the harm that is done if you don't do anything and then it turns out that climate change is real?

However, it is not a reason for slavishly agreeing to any old rubbish proposal, no matter how expensive, economically illiterate, administratively unworkable or technologically unrealistic, as long as it has the words "climate policy" attached to it. That simply gives climate science a bad name.

MdM - the trouble with sensible, coherant measures is that people view these differently. It depends on what risks people/bureaucrats decide to measure.

If we had sensible and coherant we would not have had people altering the data that went onto the hockey stick graph would we. Where there is one lie there will be more. Why would someone find it necessary to lie about the data that they were entering onto the hockey stick graph? Has Al Gore's experiment been replicated? If not why not? And should that not have been the first money any Government spent?

We have people dying of cold related winter houses in NZ because you cannot use certain heating sources. We have people who cannot afford to use other heating sources. We have leaky, damp, mold infested housing and it is assumed this is sensible and coherant for some people to be sick now because we might have Global warming? Those that die or become unwell now are the sacrificial lambs of an unproven Climate Change - hardly a sensible or coherant action.

How many people die from the cold each year around the world? Perhaps their death certiificates should read "Died from cold for global warming".

There is little if any "scientific" data that dispels AGW and masses of real scientific data that does.

There are lots of cranks, astro-turf employees and ppl with political axes to grind that provide shoddy claims that dont hold up when examined. If of course you can get the info/data they claim "proves" AGW is a lie in the first place.....

Im afraid if its sourcing the truth you want, you are failing miserably IMHO. I see nothing that could get you further from the truth in your posts.

regards

Steven - you are viewing only one side of the coin once again. Science cannot afford to have that limitation placed upon it. Can Al Gore's experiment be replicated? Was his experiment appropriate? Does Al Gore have a different axe to grind?

I suggest you put some time into more appropriate questioning rather than formulating personal attacks on people who don't share your beliefs.

I do not dispute the fact the temperature is rising, that is a simple fact of measure.

I do dispute the accuracy of the theory says humans as the primary cause.

I also dispute the assumption the climate system must have a high degree of 'sensitivity'.

I therefore call stupid the conclusion that a tax on farting cows will "save the planet".

Its not an April Fools joke either , and , whatsmore , according to the GLOBAL COOLING scientists , its much worse for the planet , than Global warming,

- Crops dont grow in so well in cooler temperatures

- Cows produce less milk ........ that us buggered

- Most people on earth live close to the equator, they live in grass huts that are not insulated properly , and they dont have enough blankets .

You got lost in translation Boatman. What the Russki was saying was that everyone is going to chill out and become like, really cool.

I have long assumed Boatman was a spinner, and probably Nat Party.

Notice where he/she/it chimed in - if you want to divert a conversation, that's what you do.

Spin 101. Too obvious, buddy. Only dinosaurs with a need to continue the smoke-and-mirrors Act, bother to do so at this late stage in the hollowscene period.

Oh come on, you are trying to tell me that the people reading this site are succeptable to National party rhetoric. Nobody would believe that, everybody here is fully enlightened, unblinkered and far too intelligent to fall for that kind of thing!

We should conclude that Boatman is Aaron Gilmore in drag and no longer has a party line to toe!

Chuckle. :)

Could be - he's out in the cold now.

He, he. I got my first thumb from Hevi Groswaite. He obviously agrees with my assessment above!

Now is it me .?....or is Steven Joyce doing just about everybody's job at once...? He , it appears is the go to face for the media on things Political....fascinatingly enough, that face encompasses the arrogance with which National delivers policy....a very up yours demeanor altogether.

The Question.....is Joyce being groomed for Key's exit once privatisation reaches an accepted level ...? we already know Billy Bob can't do it...!

Yeah I know sorry Bernard off topic, but worth a mention, as it appears Key can't take the heat once under fire......so he just shuffles Joyce out and says.... tell em to P off.

Lets face it who can JK delegate to? The likes of Brownlee seem typical of the National MPs....oh god is all I can say.

regards

I should note, the 400ppm figure for CO2 has been revised down to 399.89ppm. This is because the observatory is near the international date line and sometimes a few of the figures taken in one day in the observatory's time zone get classified into another "official day". If you are the sort of person to criticise climate scientists for adjusting data, then we truely have gone over 400pm and the scientists are conspiring to make the situation look less serious. Me, I like consistent measurement, even if it means the data grouping isn't the same as intially collected, as it means you can make reliable long term analysis.

In reality it has changed the siuation as being from "the most atmospheric CO2 for three million years" to "the most atmospheric CO2 for three million years"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.