Here's my Top 10 links from around the Internet at 10:00 am today.

Bernard is back tomorrow with his version.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

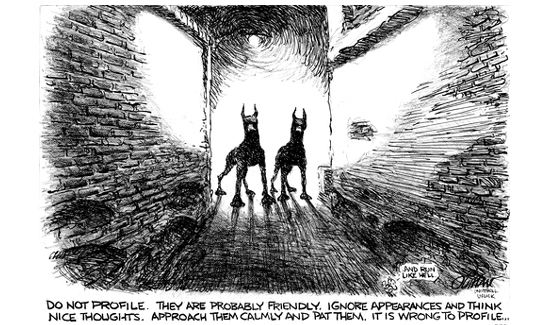

1. Five basic principles

What is it about housing policy that leads to people forgetting basic economic principles? asks Dr. Seamus Hogan a senior economics lecturer at the University of Canterbury.

He's not very complimentary of recent Labour Party policy announcements, nor of fellow economist Susan Guthrie (who works with Gareth Morgan).

He says it is hard to see predictions of future population growth in Auckland coupled with land-supply restrictions and feel confident that current prices aren't just capitalising high future costs of housing.

Here are his five principles:

1. The price of housing depends on the supply of available houses and the number of people wanting to live in houses coupled with their willingness to pay for housing. The price of houses depends on the price of housing today and the expected price in the future. Policies that affect who owns houses and the incentive to purchase existing houses as an investment are sideshows unless they change the underlying stock or the underlying demand for housing.

2. Speculation works by buying assets when their price is expected to rise and selling when the price is expected to fall, thus reducing price volatility. Speculative investment that increases volatility in house prices is investment that loses money. If such speculation were coming from overseas, it would be a source of income to New Zealand.

3. Speculation that leads to an increase in house prices and makes money, is only profitable because underlying factors are operating to push prices up even further in the future. Any policy that claims to be able to reduce house-price inflation by restricting speculative investment, is a policy that is an open admission of having no solution to the long-term problem.

4. Policy can reduce the demand for housing or for houses by imposing taxes, but that can only lead to a reduction in the before-tax price not to the after-tax price and hence is not a route to making housing more affordable.

5. More specifically, there is a tax advantages to owner-occupied housing over renting. But to the extent that has any effect, it leads to too much investment in creating houses and hence to lower house prices than would otherwise be the case. There may be arguments for eliminating the tax preference, but affordability is not one of them.

2. The problem that could sink Asia

When the US Congress returns to work after its summer holiday, one of the big items to be addressed will be its debt-ceiling limit - again. Asian countries hold almost US$7 trillion in US Treasuries. But as a former (and smart) US Treasury Secretary once observed: "It’s our currency, but it’s your problem." The potential for mis-steps are large, and one of those could ruin a lot of plans. William Pesek reviews the problem.

The more Asia adds to its holdings of U.S. debt, the harder they become to unload. If traders got even the slightest whiff that China was selling large blocks of its $1.3 trillion in dollar holdings, markets would quake. The same goes for Japan’s $1.1 trillion stockpile. So central banks just keep adding to them. Pyramid scheme, anyone?

Never before has the world seen a greater misallocation of vast resources. Loading up on dollars helps Asia’s exporters by holding down local currencies, but it causes economic control problems. When central banks buy dollars, they need to sell local currency, increasing its availability and boosting the money supply and inflation. So they sell bonds to mop up excess money. It’s an imprecise science made even more complicated by the Federal Reserve’s quantitative-easing policies.

3. Assassin arrives

The Aussie election campaign - already a too-long and tawdry affair - is just about to get even dirtier. Their election will be on September 7. Rupert Murdoch is sending his mercenaries in. He is fighting to kill their broadband rollout, their NBN initiative. If he 'wins' his dirty war, chances are New Zealand will have a significant ultra-fast fibre infrastructure advantage. Although that will be very good for us, you hate to see it come about that way. More from Paul Sheehan at smh.com.au:

(Until Feb 2013, News Corp owned a controlling interest in Sky TV here, but has since sold that stake. Our UFB initiative is a threat to SkyTV's business model too.)

The arrival of Col Allan in Australia is making a lot of people uneasy.

Allan is a man widely known inside News Corporation as Col Pot, a play on the name of a Cambodian genocidal dictator.

He is News Corp's most feared flamethrower in a company of flamethrowers and he has been sent to Australia by Rupert Murdoch himself. The purpose of his mission has become clear in recent days. One person who should rightly be disconcerted by Allan's sudden secondment to Australia is the head of News Corporation Australia, Kim Williams. Several other executives should also be leery, but they are not Allan's primary target.

His primary target is Kevin Rudd.

4. Today's raw market data ...

A quick new-week update:

| as at 11:10am |

Today 9:00 am |

Friday |

Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.7700 | 0.7900 | 0.7716 | 0.8183 |

| NZ$1 = AU$ | 0.8637 | 0.8839 | 0.8517 | 0.7746 |

| TWI | 73.11 | 75.19 | 74.08 | 73.49 |

| Gold, US$/oz | 1,309 | 1,315 | 1,213 | 1,610 |

| Dow | 15,663 | 15,646 | 15,235 | 13,110 |

| Copper, US$/tonne | 7,019 | 6,999 | 6,765 | 7,400 |

| Volatility Index | 11.98 | 12.99 | 14.78 | 15.95 |

5. It's not what they say, its what they do

If you were 'saved' in a time of crisis, and subsequently went on to make A$92 billion, would you quibble about a A$0.5 billion annual fee? Would you try and pass it on to your customers and call it unfair? The Aussie govt. has a budget problem. It now needs help. It is turning to those it helped in the past. What should the big banks do? What will they do? How they react will tell us a lot about them. Heres a SMH report:

The levy, announced as part of a mini-budget on Friday, is forecast to raise about $500 million a year, to be put in a fund to pay depositors in any future bank collapses.

Banks argue the impost is unnecessary and will be passed on to customers through lower deposit rates.

Mr Bowen conceded the cost might be passed on to savers, but also said lenders could choose to absorb the levy after the sector's run of bumper earnings, which were supported by the government's move to guarantee deposits in 2008.

''I want big and strong and profitable banks, but the big four banks have had profits in excess of $92 billion collectively over the past four years,'' Mr Bowen said. ''One or more of them could make a decision to absorb that cost.''

Mr Bowen argued the banks' recent success had been helped by the government's move to guarantee bank deposits free of charge during the global financial crisis.

''With all seriousness and respect to the banks … this government stepped in during the global financial crisis and made an important step to guarantee bank deposits. More than one person has pointed out it was absolutely vital to the survival and prosperity of our banks,'' he said.

Under the policy, a levy of 0.05 per cent will be placed on all deposits below $250,000 that are guaranteed by the government from 2016. This rate is equivalent to 5¢ for every $100. It comes after the government stepped in to guarantee bank deposits up to $1 million at the peak of the global financial crisis in 2008. The upper limit of the guarantee has since been cut to $250,000.

6. How not to pick a central banker

Israel has had a highly respected central bank governor for a long time, Stanley Fischer. But he has announced his retirement. However he must be fuming at the nonsense unfolding over how his replacement is being selected, making the job into an international laughing-stock. BusinessWeek has the sad story:

Karnit Flug, the acting governor, would have been a natural candidate for the post. But she resigned after Netanyahu picked Leiderman over her.

“Netanyahu and [Finance Minister Yair] Lapid should go to the home of Dr. Karnit Flug to apologize and beg her to take on the job,” Labor party leader Shelly Yachimovich said, according to Haaretz. ”A bunch of bad and bizarre decisions that Netanyahu and Lapid took just so as not to appoint a woman more suited for the position is starting to look like one big farce.”

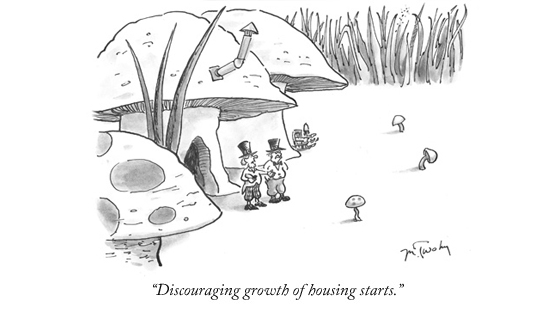

7. No price pressure yet

We have been collecting detailed grocery prices for a 28 item 'healthy food' shopping list for more than two years now. The details of that list is here. The results of this weekly survey is now charted and online in this new graph series. It will be updated weekly.

Grocery price monitor

Select chart tabs

8. Selling out

This is where you get to when you can't kick the can any further. Endless, unrepayable debt built up during years of voting for free-wheeling 'social' spending politicians in Spain has left everyone, voters and rulers alike, helpless to see any sense in anything anymore. This from Spiegel Online:

Although Madrid residents shake their heads over such tonterías, they no longer resist the foolish things their administration does. After five years of growing unemployment and an economic recession, Spaniards are demoralized. With debts of €7.4 billion, the capital is the most highly indebted city in the country.

Mayor Ana Botella - the wife of conservative former Prime Minister José María Aznar, also with the PP - would like to bring the Summer Olympics to Madrid in 2020, following the city's third attempt to capture the games. Her predecessors have already invested more than €6 billion in the effort, and she needs at least another €2.5 billion. That might explain why, in recent months, Botella has begun to sell off public buildings and properties - even if she hasn't managed to raise very much money so far. A Chinese bank snatched up a magnificent building near the Prado Museum at a price discount of almost a third.

The fire sale also included 26 works by Spain's best-known contemporary artists, which were part of the city hall's inventory. Botella justified the sale, saying the works had "only decorative value."

Madrilenians feel resigned and, if they are scoffing at anything, it is another bizarre idea: Popular Party politicians want to build Eurovegas, a giant entertainment complex, on a 750-hectare (1,850-acre) site in the southwestern part of the city. Under the plan, skyscrapers would shoot up from the wheat fields in the coming years, to house casinos, hotels and convention centers. Backers claim the project, which would become one of the biggest construction sites in Europe, also has the potential to create up to 10,000 jobs, chicken soup for the soul in a country with 27 percent unemployment, and with 682,000 people out of work in the Madrid region alone.

9. Peak oil

The Economist is declaring we have reached peak oil - not a peak in supply, but a peak in demand. Big call.

They say the future is for falling demand for oil while supply keeps rising. And that means prices will fall. They say this future is upon us, even with the growth on China and India. They explain:

We believe that they are wrong, and that oil is close to a peak. This is not the “peak oil” widely discussed several years ago, when several theorists, who have since gone strangely quiet, reckoned that supply would flatten and then fall. We believe that demand, not supply, could decline. In the rich world oil demand has already peaked: it has fallen since 2005. Even allowing for all those new drivers in Beijing and Delhi, two revolutions in technology will dampen the world’s thirst for the black stuff.

The first revolution was led by a Texan who has just died. George Mitchell championed “fracking” as a way to release huge supplies of “unconventional” gas from shale beds. This, along with vast new discoveries of conventional gas, has recently helped increase the world’s reserves from 50 to 200 years. In America, where thanks to Mr Mitchell shale gas already billows from the ground, liquefied or compressed gas is finding its way into the tanks of lorries, buses and local-delivery vehicles. Gas could also replace oil in ships, power stations, petrochemical plants and domestic and industrial heating systems, and thus displace a few million barrels of oil a day by 2020.

The other great change is in automotive technology. Rapid advances in engine and vehicle design also threaten oil’s dominance. Foremost is the efficiency of the internal-combustion engine itself. Petrol and diesel engines are becoming ever more frugal. The materials used to make cars are getting lighter and stronger. The growing popularity of electric and hybrid cars, as well as vehicles powered by natural gas or hydrogen fuel cells, will also have an effect on demand for oil. Analysts at Citi, a bank, calculate that if the fuel-efficiency of cars and trucks improves by an average of 2.5% a year it will be enough to constrain oil demand; they predict that a peak of less than 92m b/d will come in the next few years. Ricardo, a big automotive engineer, has come to a similar conclusion.

10. Today's quote

"You can lose lots of money chasing women, but you will never lose women by chasing money." - Chris Rock

30 Comments

Agree that Judges should hear cases where they have an expertise - it is mad ex environment lawyers hearing criminal cases. Need to play to people's strenght!

# 8 - Last Para - sounds like Queenstown's proposed 750 seat convention centre. Last decade it was stadiums, this decade convention centres!

First Para sounds like Auckland - NZ Herald item reports Auckland super city debt ballooning out into multiple billions in the next decade.

#9...la la land that one.

regards

Ah yes, The Economist.

That paragon of oil price forecasting.

Back in 1999 they said the world was 'drowning in oil' and that the oil price would stay low for on and and on and on.

http://www.economist.com/node/21519208

They could not have been more wrong.

But lets continue to act as though they know what they are talking about shall we?

I find it astonishing that individuals, publications and information sources that got a range of things so spectacularly wrong in the first decade of this century are once again being trotted out as some how authoritative.

Andyh - chuckle. One suspects Chaston does it to stir traffic.

But the interesting development to me, has to be the Saudi push to Solar

http://www.arabnews.com/news/446879

109 billion - and that's just the first round. Obviously, they're in a position to know where it's going. You don't do that if you are going to truck on forever. Why would you bother, and especially, why would you bother if the (it ends ineptly, doesn't it?) article was correct?

The problem now is to continue confidence, in those who need to be convinced. Uphill task, by the reading of that article. Where's the actual vehicle counts, where's the real growth data, where's the efficiencies factor?

Newsflash - Intercepted phone records show Saudi's corner market by buying global panel productioin for next 10 years to power kingdom.

I think Saudi actually uses quite a bit of electrical power to desalinate, just that oil is "cheap"

I wonder where solar desalinaters as a technloogy is at might make more sense.

regards

I think I saw a comment that Saudi also wanted its own nuclear plants

http://www.world-nuclear.org/info/Country-Profiles/Countries-O-S/Saudi-…

regards

I dont think ppl care actually, they read the headlines, "all's well, petrol could even get cheaper" and move on.

regards

"....But lets continue to act as though they know what they are talking about shall we?

I find it astonishing that individuals, publications and information sources that got a range of things so spectacularly wrong in the first decade of this century are once again being trotted out as some how authoritative....."

Too True andy I mean im glad we didnt buy into all that global warming crap....oh wait a minute.....bugger...

as for oil.countries like Ausralia are flat out trying to set up and extract their massive shale oil reserves before world oversupply kicks in and the price/demand plummets.

Just maybe because AGW is best science, unlike the deniers who do "best" politics.

Shale oil, Im sorry but if the price is about to collapse, why try and get it out? where is the business model?

Oh and OZ has some big shale gas reserves, there isnt much proof that getting shale oil out is ever going to happen in quantity and then the environmental damage is hefty, and then can we pay the $ price to get it....probably not.

regards

Reads number nine. Heads to the cupboard to grab some popcorn. Sits back with a smile on his face.

#3 The plan for ultrafast broadband by the Coalition in Australia is approximately equivalent to New Zealands ultrafast broadband plan (a bit better in some ways, worse in others). So it wouls be better to say we will not be at a disadvantage if Murdoch kills the current Aussie plan, but we we be approximately the same as Australia.

Going by Ookla we are already speeding ahead of Oz

I have broadband at 20 mbps which suits my needs.

The NBN offers Fibre to the Home (FTTH) at 100 mbps

The Coalition offers Fibre to the Node (FTTN) with copper to the Home at 20 mbps

Users who want the full 100 mbps will have to pay for Fibre connection from the Street Corner Node to the Home. FTTN will meet most users needs who want internet connection for standard requirements. If they want streaming TV and movies etc they will have to pay the extra to complete the journey of FTTN-to-FTTH

Lucky you - I have Speedtest.net tested 11.44 Mbps - location, Eastern Bays Wellington.

For FTTN thats about right.

Look here to see if FTTH is in your area by Jun 2016

Thks:

Unfortunately:

- UFB deployment dates for your area are still being developed

Yeah....but think competition and not monopoly. So its not the "improved performance" that interests me but the greatly reduced costs indicated. Right now Im into $240+ a month, prices indicated to me suggest that will drop to $130 a month.

regards

Its the competition and reduced costs potential. Vodafone BB currently costs me $200~$250 a month, UFB costs are $130 for 200~250GB (which would do me) or 1~1.5TB for $200 a month I pay now. Based on my current consumption I'd save over $1k a year. So if someone wants me to pay $500 up front, yeah sure it will pay for itself in 6months...

regards

1 Housing price - disappointing claptrap, typical of a narrow-minded & purist economist

The housing price depends only on supply & demand. Yeah right! It also depends on the availality of credit. Since the Reserve Bank has been keeping price at historical stimulatory lows, the housing market is responding to the artificially cheap money. Of course the bank is to scared to up the rate & push the economy into recession, & the housing market is an unintended beneficiary of this.

"Overseas money is a source of income to NZ". Maybe to property-rich baby boomers, but not to struggling younger Kiwis, who are kept on the sidelines.

"Speculation is only profitable because of underlying economic factors". Yeah right - speculation is encouraged by a tax system that allows generous write-offs against other income, then doesn't tax the gains.

At the end of the day, allowing the buy-up of houses in NZ to feed a desire for safe investments outside China isn't necessarily good for NZ. & bigger yet, creating an ever-growing overseas debt to feed our addiction to over-priced housing is destructive to the NZ economy long-term.

At long last an economist that understands the key to the housing market. If there are more houses than needed then the price will drop and "speculators" and others will not vector price increases into thier investment or housing decisions. Well done Dr Hogan!

If it were as simple as just "making more houses" and section prices remained static as house prices went up I would agree.

What actually happens is as soon as property speculators push up house prices, land speculators respond by asking more for sections. As a result building a home doesn't become the obvious response to fix the imbalance, even when house prices rise only a select few that are prepared to pay more for a new house ever build.

Of course if the council freed up land supply so that sections remained affordable in the face of rising house prices then your argument makes sense. We all know it won't happen though so it's an academic argument at best, in the meantime the issues has to be addressed by other means.

1. The price of housing depends on the supply of available houses and the number of people wanting to live in houses coupled with their willingness to pay for housing. The price of houses depends on the price of housing today and the expected price in the future. Policies that affect who owns houses and the incentive to purchase existing houses as an investment are sideshows unless they change the underlying stock or the underlying demand for housing.

...........

Couldn't the future price of housing be related to a persons world view. We are told authoratively that Auckland's population will grow by one million in the next 20 years; that there is an inexhaustable supply of millionaires that NZ is hot. At least in the short term demand will outpace supply.

As for supply it is hard to imagine the scale of building needed or (if built) it would be Auckland (but far away)... that sort of scale is probably beyond most peoples experience.

Do people really believe in an immigration department eye of needle?

3. Speculation that leads to an increase in house prices and makes money, is only profitable because underlying factors are operating to push prices up even further in the future. Any policy that claims to be able to reduce house-price inflation by restricting speculative investment, is a policy that is an open admission of having no solution to the long-term problem.

.......

Qouting a commenter on Public Address:

My understanding was that, since around 2009 there had been a divergence between the value of New Zealand housing stock and New Zealand housing debt (which is to say the increase in the price of housing cannot be explained by New Zealand residents borrowing, so money appears to be entering the system from somewhere else). This divergence seems to be on the increase recently (suggesting even more money entering the housing system from elsewhere). ?

4. Policy can reduce the demand for housing or for houses by imposing taxes, but that can only lead to a reduction in the before-tax price not to the after-tax price and hence is not a route to making housing more affordable.

5. More specifically, there is a tax advantages to owner-occupied housing over renting. But to the extent that has any effect, it leads to too much investment in creating houses and hence to lower house prices than would otherwise be the case. There may be arguments for eliminating the tax preference, but affordability is not one of them.

............

Could somebody explain that?

I found this letter from Martin Williams: Secretary Resource Management Law Assn

In terms of that latter issue, those that bemoan the scale of financial and development contributions aimed at ensuring the burden of servicing new development through infrastructure (transportation, water supply, drainage and the like) does not fall on the ratepayer generally, might well be in for a shock at the scale of such contributions calculated on an anything approaching a user pays basis, and as necessary to service development on otherwise undoubtedly cheaper rural land (outside the MUL).

Put more simply, would housing become any more affordable (in net or overall terms) following any “immediate release” of land for residential development outside the MUL in Auckland? Perhaps to the immediate parties concerned, but what about the broader distribution of costs and benefits that would result?

--

With Auckland having defined a boundary, edge or bottom line (however one may wish to describe it) (the MUL now adopted in the Auckland Plan), and as instructed by Parliament during a period of rapidly increasing land and house prices, it would seem that for a range of reasons (including as indentified in the Productivity Commission report), the market has not provided the affordable housing people need. This raises the question of course, is the problem with the planning, or what has been happening in the market place, including in the lead up to the GFC, and with the global banking sector clearly at least a significant part of the issue?

It seems most unlikely to me that our planners and policy makers, transportation and infrastructure engineers, and local body politicians have all got it so wrong in the past 15 or more years that the “conventional wisdom” underpinning a containment approach is in fact fundamentally flawed, just as it would be to suggest the market should now be left to determine the location and distribution of future urban development in the result.

http://www.rmla.org.nz/obiter/view/id/25

Foreign Investment Case study

--------------------------

Samoa's prime minister says he has kept secret a visit by a large Chinese business delegation demanding 160 year leases over big swathes of land and the right to bring in 30,000 people.

"I kept this from the media because I know that once the media hears about this, then they are full of smart people who will go and waste time asking stupid questions to stupid companies like this," Prime Minister Tuilaepa Sa'ilele says.

But as is typical of a nation of just 170,000 people, the secret activity of the "Beijing Zhao Yi Li Investment Management Co Ltd" soon got out - and sparked outrage.

Talamua website said their 10 strong delegation was heading to Savai'i after presenting the government with a list of 17 demands.

Among them they wanted land for hotels and villages on 160 year leases, land from the government for an airport, port, hospital, school and nursery and the right to keep anybody from using them other than the Chinese.

They would have an exclusive casino license and the right to bring in 30,000 workers with the same status as Samoans.

One of the odder conditions was that all road signs in Samoa in future be in Chinese, English and Samoan.

Earlier this year another Chinese group were given the right by the government to build a 500-room hotel on 202 hectares south of Apia, along with a casino and a golf course. The company's CEO returned to China however and was arrested.

In the latest case Tuilaepa is cryptic about what he knows, telling a press conference he had kept the latest company visit quiet, saying it was a "fantasy."

..................

if it were true some economists would rationalise it as good for everyone?!

http://www.stuff.co.nz/world/south-pacific/8772928/Samoa-in-uproar-over-strange-Chinese-company

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.