Here's my Top 10 links from around the Internet at 10:00 am today. We now have a Monday-Wednesday-Friday schedule for Top 10.

Bernard will be back with his version this Wednesday. We will have a guest posting on Friday.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

See all previous Top 10s here.

1. A US federal deficit of 2.1% of GDP

What are they fighting about? The bi-partisan Congressional Budget Office says the US budget deficit will be only 2.1% of GDP, only US$378 billion in a US$17 trillion economy. The federal tax take will be US$3.4 trillion or less than 20% of GDP. By way of comparison, NZ's tax take is 31% of our GDP.

By the way, I am reading The Spirit Level at the moment and am yet to get to the part where I am impressed. Old or undated data, selectively presented. But really interesting all the same.

One of this things I noticed is there is lots of US state data on inequality - and a close reading shows that 'red states' - Republican (middle of the country) states - have the lowest levels of US inequality, whereas the liberal (Democrat) coasts are where the disparities are highest. Not something noted by the authors though.

If the current laws that govern federal taxes and spending do not change, the budget deficit will shrink this year to $642 billion, the Congressional Budget Office (CBO) estimates, the smallest shortfall since 2008.

Relative to the size of the economy, the deficit this year - at 4.0 percent of gross domestic product (GDP) - will be less than half as large as the shortfall in 2009, which was 10.1 percent of GDP.

Because revenues, under current law, are projected to rise more rapidly than spending in the next two years, deficits in CBO’s baseline projections continue to shrink, falling to 2.1 percent of GDP by 2015 (see Table 1 on page 8).

However, budget shortfalls are projected to increase later in the coming decade, reaching 3.5 percent of GDP in 2023, because of the pressures of an aging population, rising health care costs, an expansion of federal subsidies for health insurance, and growing interest payments on federal debt.

By comparison, the deficit averaged 3.1 percent of GDP over the past 40 years and 2.4 percent in the 40 years before fiscal year 2008, when the most recent recession began. During the next 10 years, both revenues and outlays are projected to be above their 40-year averages as a percentage of GDP (see Figure 1 on page 9).

2. Fund manager says, avoid Aussie banks

Matthew McLennan, who manages US$80 billion of assets in New York for First Eagle Investment Management, revealed to AFR Weekend he won’t invest in Australian banks because they are too risky and is concerned about the levels of private sector debt in Australia.

The ex Goldman Sachs Sydney banker is also worried about another financial bust.

The fund manager attacked “financial repression” by central banks which had cut real interest rates to record lows, and the policy known as “quantitative easing” whereby they print money to buy government debt, corporate bonds and shares, to bid up their prices above natural market levels and reduce the implied cost of capital.

“The problem with that mental model is that it assumes you are starting from a point of view of asset prices being below their equilibrium values and savings being excessive,” he said.

“So you are seeking to stimulate new investment, dissuade savings, and get asset prices back to their normal values. But if asset prices are already at reasonably elevated levels relative to long-term history, and savings are close to generational lows, it is not clear to me that repressing interest rates and engaging in quantitative easing is prudent policy.”

Mr McLennan said he thought an end game would arrive if people “start to realise that the quality of money has become impaired”.

“If we blow another bubble now that bursts, and the sovereign is forced to step in again with its higher level of starting debt, at a certain point the system has to become unsustainable,” he said.

“You either have to print more money or accept deflation. My fear is that the risk in the current global financial system is that you get one of these extreme corner solutions.”

3. In praise of debt ceilings

Despite the farcical process, a German professor argues that is is always better to slug it out now than to borrow endlessly without restriction and then suffer the end-of-the-line failure. More from Project Syndicate:

The wrangling about raising the US government’s borrowing limit – now thankfully over, at least for a few months – underscores the hazards posed by excessive state indebtedness. Governments nowadays are essentially running gigantic redistribution machines that steer funds from taxpayers to transfer recipients and other beneficiaries of public expenditure. The latter permanently ask for more, while the former zealously try to defend their purse.

In the end, the solution to this “redistribution battle” tends more often than not to be found in more government borrowing. For today’s democracies, the fact that those who will eventually have to pay the taxes to service the resulting debt cannot yet vote makes borrowing the most expedient way out of a messy political battle.

So, let us be grateful for strict debt ceilings, for they can help to nip disaster in the bud – even if bumping up against them can leave politicians slightly bruised.

4. Today's raw market data ...

A quick new-week update:

| as at 11:10am |

Today 9:00 am |

Friday |

Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.8501 | 0.8476 | 0.8365 | 0.8156 |

| NZ$1 = AU$ | 0.8775 | 0.8806 | 0.8904 | 0.7911 |

| TWI | 78.16 | 78.12 | 76.74 | 72.71 |

| Gold, US$/oz | 1,317 | 1,319 | 1,344 | 1,727 |

| Dow | 15,400 | 15,368 | 15,401 | 13,346 |

| Copper, US$/tonne | 7,242 | 7,172 | 7,181 | 7,984 |

| Volatility Index | 13.04 | 13.48 | 14.31 | 16.62 |

5. It's all about affordability

Some people are baffled by a new trend in the US of declining mobility. People are just not shifting to where there are high-paying jobs anymore, and that has plenty of heads scratching.

But it turns out the reason is essentially 'housing affordability'. The well-paid jobs may be there but the cost of housing and commuting makes a shift no easy decision. Sounds like New Zealand to me. In the end it comes down to local authorities adding a layer of rules (supported by local voters) that keep house prices high and neighbourhood character unchanged. Ultimate 'conservative' and usually promoted by left-green impulses.

The Washington Monthly has a very good assessment of the issue.

The underlying problem, however, isn’t the price of housing per se so much as its relationship to income. Since 2009, when the recession ended, the median price of a new house in the United States has risen 13 percent, even as median household income has fallen by about 4 percent. That doesn’t pose much of a problem for a migrating architect whose income is already well above the median, and who is likelier to have existing home equity that he can transfer to another state. But for construction workers, for example, it’s likely to be a big problem, and a reason why they can’t easily move to where the best-paying jobs are.

6. The cost of not making changes

In business, 'conservative' just doesn't work. The world is being changed by 'radical'. How fast you get left behind if you don't try substantial change is graphically illustrated by the Aussie dairy industry. They are now scrambling to remain relevant.

Believe it or not, there are remnants of the NZ dairy industry who still believe the Fonterra model was a wrong choice. I recall dairy advocates and Labour politicians visiting our offices vehement in their opposition to the Fonterra changes, opposing 'globalisation'. Where would NZ be today if we followed the Aussie approach? We wouldn't be setting any agendas, we would be taking scraps.

Mr Helou said Australian dairy production had declined while New Zealand’s had flourished.

"It’s a tale of two cities if you like."

He said a cooperative structure, like New Zealand dairy giant Fonterra, was the only way to compete globally.

"The old ways don’t work. The evidence is before us. We’ve declined amidst the most interesting, highest growth agri-sector business on the planet."

"Asia is at our doorstep and we are not really connecting there."

"This is the first major step to arresting the decline of our industry."

7. A bit player

New Zealand is a global player in the dairy trade. It is easy to jump to the conclusion that we rank the same way in dairy emissions. But it doesn't quite work out that way. Our dairy herd produces less than 0.5% of global dairy emissions, our beef herd 0.2%.

There is a big emission problem worldwide from cattle (beef and dairy) but New Zealand's contribution is almost non-existent. Our 10 million beef and cattle herds represent about 0.8% of the 1.3 billion on the planet. But the problem is enormous for India, Brazil and China who together have half, and the US , the EU and Argentina who together have about 20% of all cattle.

The world food industry may be in a sorry state, but I just don't buy into the extension that we are part of that. If there is 'waste' in the New Zealand food industry, it is more to do with high food regulatory standards than sloppiness or incompetence.

8. The Ministry of Truth

Another in our series: We Don't Know how Lucky We Are. Most of us now assume China is modernising and pushing ahead towards a more liberal state. But it is not true in the media. In their current crackdown against 'rumours' they are being particularly tough, and there are countless thousands of brave souls trying to expose the heavy handed suppression.

It is surprising (to me) how direct and specific the media instructions have become. You can follow the Chinese censor's directives on ChinaDigitalTimes, and their section MinistryOfTruth which chronicles these regular commands. (The bravery of the leakers should not be underestimated.) Here is a recent example:

State Council Information Office: Do not report the Yuyao Daily story “Yuyao Flood Spurs Mass Petitioning; Minority Behave in Extreme Manner.” Websites that have already posted the article are asked to immediately remove it. (October 16, 2013)

国新办:对于《余姚日报》发出的“余姚洪灾引发群体性上访 少数人员行为过激”一文不要报道,已经发表的网站请立即撤下稿件。

9. Losing it on air 'for the best possible reason'

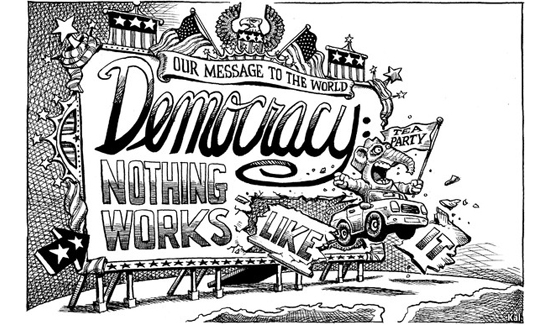

HT Christov. Passionate, yes. Honest, undoubtedly. But are we really ready for 'radical' yet?

Seems to me the political world has gone 'conservative' (as in, lets not change anything, lets go back to what used to work). In this country, that's what Labour aims for, its what National is governing for, its what our Councils are trying to do, and it's certainly core to the Greens - in their case, waaay back. ditto, NZ First. All 'conservative'.

What this news anchor is really calling for is 'radical', as in never been done before.

We like it when we see it, but we always vote 'conservative'. Why is that? We don't even give new ideas a chance. We certainly don't tolerate any flaws in our politicians even though we ourselves are full of flaws. As for even the smallest bump in the road for something new in public policy, whole generations feel 'scarred' if they have to make some sacrifice or perceive 'unfairness'.

Our problem as voters is that we want benefits without pain or cost.

The problem isn't the politicians we elect, it is us. We have to get to a point where we value taking a chance, making a few mistakes as we learn - and vote that way. (Just like #6.)

10. Today's quote

"It doesn’t matter if you’re black or white ... the only color that really matters is green." – Family Guy

25 Comments

#1 "US state data on inequality" dont the Republican states get bigger Federal handouts?

That might explian the "oddity".

regards

It is more to do with that the really rich people are mostly living in Democratic states. For instance see the column graph near the bottom of this page

http://www.fastcoexist.com/1678934/where-does-the-1-live

The states with large areas of black and dark green tend to be Democratic ones. This matches the findings that raising taxes causes no significant diiference in the residency of rich people.

It is more to do with that the really rich people are mostly living in Democratic states.

Am sure you are right. This does then suggest two or three other questions:

Why are these states Democratic and or why do very wealthy people live in Democratic states, that presumably find ways of taxing them a little more?

Is it that the inequality in peoples' back yard encourages the poorer people there to tax and spend a bit more? (I suspect this isn't the only or even prime reason).

Is it that something about a tax and spend economy (up to a point) produces a better overall infrastructure, and or pleasant city to live in? I suspect closer to the mark.

While nearly everyone resists the idea of extra taxes, most people with any heart presumably as they drive around in their flash cars, prefer not to observe kids with no shoes and struggling to find their next square meal; or to watch hard working but low paid people really struggling with basics.

So while the very wealthy may well choke on their tax bills, when they really think about what government services or benefits they would stop in order to save a bit of tax, it all gets a bit harder. So they grin and bear it happily enough. Up to a point.

#2 "“You either have to print more money or accept deflation. My fear is that the risk in the current global financial system is that you get one of these extreme corner solutions.”"

and there is a third?

um no...

regards

#7, and the per capita is? lies, damn lies and statistics to the fore.

regards

"The problem isn't the politicians we elect, it is us"

Indeed

regards

#7: dairy cow emissions. So... all you need to do is divide the world into chunks, each of which contribute only 0.5% of global emissions. eg provinces or regions of a country such as the US or India. None of these chunks is contributing a meaningful amount to emissions, so it is unreasonable for any of them to do anything to resolve it.

Voila! Global warming solved!

By the way, I am reading The Spirit Level at the moment and am yet to get to the part where I am impressed. Old or undated data, selectively presented. But really interesting all the same.

of course you are not impressed. A great many people are however. And many people have attacked vigourously. This is good. The book came out in 2008 so yes i guess the data has to be older than 2013 data. Most of the points against are well canvased. But yet the book still seems to hold up. rather well. Funny how people who dislike it really dislike it so much. It did start a change n thinking.

RE. today's quote : If you're Green , South Afican columnist Ivo Vegter may make you see red .... he's proposing that environmentalists such as Greenpeace and the anti-fracking lobby are grossly exagerrating the effects of mining and drilling on the planet ... he posits that the oceans easily cope with and recover from oil spills ....

... and he's had the temerity to write a book , " Extreme Environment " , to flesh out his arguments ...

As heard on Radio National this morning , Vegter with Kathryn Ryan ...

Really?

"Ivo Vegter is a free-market columnist"

So hardly surprising he's against the environment, he expects to spong off it for free....

oh and his qualifications on the subject are?

Peer reviewed papers?

copious?

Otherwise drivel up to your usual standard GBH.

regards

.... Vegter's point is that by holding the environmental extremists up to scrutiny , we're more likely to make better decisions ....

He's very much for the environment .... more so than you , 'cos he has an open mind.... he doesn't assume he knows it all , as you do ...

.... unlike you , he doesn't believe he's the sole suppositry of knowledge on the subject ..

regards

It's repository GBH...sole repository, now that's not the first time you've inserted that little slip up...!

And I must say "Vegter" is a great start for an eco friendly name, way better than Dino for sure.

I think Steven is just pointing out in his own cool way ( a bit more tact there Stevo, wouldn't go amiss) that the science of things generally now is putrid with bought outcomes desined to prolong the staus quo.........until they can no longer.....so that makes ol Stevo a real sceptic on people who may present a hopeful or soft approach to environmental change.

Happy day lads...I'd best get that picture up before she gets back.

So true , Count .... and howdy doodily doo to you , my friend ...

..as someone pointed out , even when folks attempt to bring some positive news to the environmental issues , it's never enough for the stevens & PDK's of our little world ...

Kind of like those gutsy chicks you see in a blackbird's nest : No matter how much they're fed , they keep screeching for more ....

... that sums up those two perennial septics , in my mind ..

Ciao !

#9 George Carlin was great at satirising the illusion of choice in anything that is important especially elections!

https://www.youtube.com/watch?v=bICwyV5ppLU

I'm a Green Party member but probably not for much longer because they have softened and diluted their core values so far for political expediency (the Values Party was advocating Steady State in the 70's), they now closely resemble that singular centralist party in the center with two factions, Labour and National. Liberal parties all of them, paying lip service to real change. Fact is they all like the way things are, the status quo. It's just one big political game for Wellington insiders - the politicians, the bureaucracy, the media. Key, Cunliffe, Norman, Garner, Espiner etc all in the same circus tent.

Meanwhile the "owners" as Carlin calls them burrow away in the background making money and pulling the strings. Same everywhere. Two liberal centrist factions of the "business as usual" party. The reason there is mass political disillusionment wordwide is that you can change the government but in reality everything stays pretty much the same. And those that can be bothered voting accept it because they are scared of real change and the unknown. Even if year by year their real standard of living is being whittled away they are socialised and indoctrinated by the school system and the MSM to fear anything "radical" until it is too late and desperation is widespread. It takes a war or depression to forment real widespread political dissent

It would be great to see a kiwi academic get up and critique like Cornel West but they all seem to be institutionalised and afraid.

https://www.youtube.com/watch?v=CoWiV6Q8qME

https://www.youtube.com/watch?v=t85OB6w7Eiw

A German 3-D printer manufacturer Voxeljet AG has listed 6.5 million ADR's at $US 13 , and seen it's depository receipts soar 102 % in the first day's trading , climbing to $US 26.20 ...

... other 3-D companies to IPO in the US have also rocketed in price , over the past year ...

No mention was made of sclerotic old electricity producers .... but one suspects few of them led to a mighty river of profits for their investors ... no meridian line will lead you to riches in the way that a good tech stock can ...

of course the losses also bear true.....no one can make you broke as fast...remember Wang? Digital? Bio-fuel from algae? oh can you name BIG flops when you try...

Just like the "fantastic" multi-tool so heavily flogged last year...over-hyped, over-priced and poor performing except in niches...where, yes it excels.

3D printers...well I wonder......consumables eating out your pocketbook....just like the old ink-jets.

just think tulips....

regards

... so , I take it that your morbid fear of loss has kept you out of owning any Google stock.... or Apple .... or Xero ?

of course the losses also bear true.....no one can make you broke as fast...remember Wang? Digital? Bio-fuel from algae? oh can you name BIG flops when you try...

Just like the "fantastic" multi-tool so heavily flogged last year...over-hyped, over-priced and poor performing except in niches...where, yes it excels.

3D printers...well I wonder......consumables eating out your pocketbook....just like the old ink-jets.

just think tulips....

regards

Sclerotic (that has to be the word of the day, kudos GBH) will be coming under severe price pressure.

A must read for anyone thinking of weighing their portfolio too heavily in these dinosaurs:

#9

"Behind the ostensible government sits enthroned an invisible government owing no allegiance and acknowledging no responsibility to the people. To destroy this invisible government, to befoul the unholy alliance between corrupt business and corrupt politics is the first task of the statesmanship of the day." - Theodore Roosevelt in 1906.

Did he fail?

His popular legacy is Teddy Bears so you would have to say yes. How many Americans know he was a Republican President who was anti corporate, pro regulation, conservationist and a historian? History is very inconvenient sometimes.

FDR had to be talked into the New Deal and that invisible government tried to organise a coup against him

#7 As a licensed food manufacturer I am more than happy to stick it to food regulators but not in this case. Regulation only contributes indirectly to waste in NZ; most of our domestic waste is just supply chain issues and consumer stupidity.

E.g very few people know the difference between "use by" and "best before" dating. My adult children will throw milk out on the stroke of midnight of the "best before" date instead of just checking to see whether its still OK.

Global food waste has two components: optimal land/resource use and supply chain efficiency. If we are wasteful it is because of the former not the latter. As I said recently, from a global food security perspective we grow the wrong stuff to feed the world. But then we are not in the "feed the world" game so who cares?

Indeed, "feed the world" isnt possible, finite planet, infinite demand. When the world is starving because it cant pay the cost of food and its transport do we really want to pauper ourselves giving it away at close to cost? What does that gain NZ? we throw more and more fertilizers on our soil, productionalise more and more of our landscape and water resources to our long term detriment. What does it gain the world? maybe another generation of yet more over-population?

Sooner or later we are going to learn we cant feed the present 7billion let alone 9billion....experience is it seems the only teacher in this case.

regards

#6 With respect David Chaston, there is nothing new about cooperative structures contributing to the success of specific industry, specifically agriculture. The NZ dairy industry was built on a cooperative structure, and theoretically the various dairy cooperatives that exisited prior to Fonterra should have been able to work together to compete on a global stage as it is a core cooperative value. But perhaps that doesn't suit neo liberal economic ideology. Can you point out the benefits of such ideology, and how it is living up to what it is purported to represent?

I dont follow your arguement in #6 regarding Fonterra. What changes are you referring to. Was interest.co in existence in 1998-2001 when Fonterra was formed?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.