Today's Top 10 is a guest post from Eric Crampton, who is a senior lecturer in economics at the University of Canterbury. Next month he becomes head of research at the New Zealand Initiative. He blogs at the ever-popular Offsetting Behaviour.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

And if you're interested in contributing the occasional Top 10 yourself, contact gareth.vaughan@interest.co.nz.

See all previous Top 10s here.

Blogging has been light at Offsetting Behaviour as I’ve been preparing to move to Wellington to serve as Head of Research with the New Zealand Initiative. And so my browser has been accumulating many tabs - things about which I’ve wished to blog, but for which I hadn’t the time. Today’s Top 10 brings some closure to these long-cherished tabs, as well as a few other bits I thought needed wider viewing.

1. Piketty and Housing

The past week has brought a fairly substantial critique of Piketty’s work on inequality from MIT’s Matthew Rognlie.

Rognlie demonstrates that part of Piketty’s divergence from mainstream macroeconomic models stems from differences between net and gross capital growth, and that increases in the value of housing constitute almost all of the growth in net capital’s share of income.

Justin Wolfers draws on work by Bonnet et al providing graphical demonstration:

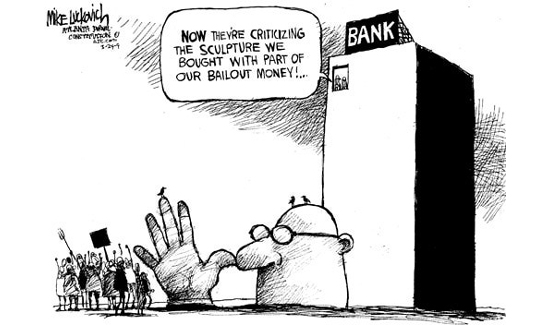

Ryan Avent comments at The Economist’s Free Exchange blog, noting that the run-up in housing prices is hardly inconsistent with Piketty’s broader thesis that the rich have been able to use the political system to steal from the poor. In this case, they’ve used zoning regulations to inflate the value of their main housing asset, at the expense of those then unable to afford a house. Avent writes:

“I have written quite a lot about housing supply restrictions and the macroeconomy, and here is the general argument that I make. Over the last few decades technological changes have greatly increased the return to locating in large cities filled with skilled people. Being in such places makes workers more productive and raises the income they are able to earn. But skilled cities have not allowed housing supply to expand to meet rising demand. Housing has therefore been rationed by price, pushing less productive workers toward cities where housing supply growth is higher and housing cost growth is lower. As a result, fewer people live in the most productive places, and quite a lot of the gain from employment in productive places is captured by landowners earning rents thanks to artificial housing scarcity. This may mean lower overall productivity, more income inequality, and more income flowing to capital rather than labour.

How do I reconcile that story with the mechanics in "Capital"? I think the place to begin is to note that this is not just a supply-side question; there are lots of places in the world where it is difficult to build but where prices remain low because no one wants to live there. So we need to recognise that part of what is going on is a rising contribution to production from scarce land in big, rich metropolitan areas. The contribution is entirely due to the crowds of people sitting on top of the land (rather than any natural productivity) but that doesn't matter. The scarcity of productive land is a natural, inevitable thing, because if people are going to crowd together they can only do it in a few places at once (for now, at least, though technology may eventually solve that problem).

What would happen if we got rid of all restrictions on the construction of new housing? We should see lots of new investment in places where the gap between housing costs and construction costs is largest: in central London, New York, San Francisco, and so on. Housing cost growth in those cities would slow relative to income growth, real wage growth would soar, and many more people would move in. Over time, prices would converge toward construction costs. More people would be working at higher wages and productivity levels, which suggests that inequality in labour income should fall and the labour share should rise.

Restrictive zoning laws exacerbate inequality. Would that Kiwi campaigners against income inequality came to recognize the important role played by both anti-density and anti-sprawl regulations in fairly directly helping the rich at the expense of the poor.

2. Can we avoid all the catastrophes?

The best argument for strong investments in avoiding global warming’s worst effects is an insurance argument: even if the really really bad scenarios have less than even odds of obtaining, we all buy fire insurance for our homes even though it’s not particularly likely that any one of us will be unlucky enough to have a house burn down.

Matt Nolan ably tackled the Greens’ carbon tax plan a fortnight ago here at Interest.co.nz, suggesting that we might not be doing ourselves a favour by going it alone on a carbon tax.

I agree with Matt: if we could get everybody signing on for a carbon tax, we should sign on too.

But where it’s really unlikely that we would really sway that many other countries by example, Kiwi abatement alone just doesn’t get us very far.

If New Zealand were to sink to the bottom of the sea in a massive earthquake tomorrow, with our carbon (by assumption) there forever sequestered, would we delay global warming a century from now by more than a couple of days? A week? If that’s about what total abatement could achieve, what are we really buying in imposing a carbon tax on ourselves without global cooperation?

I’m not saying we should do nothing: rather, if we should be thinking of ourselves as going it alone, we should be buying some lottery tickets. If you owe the mob a hundred grand and only have $10k in the bank, putting in overtime at minimum wage won’t really cut it, even if working harder would be the best solution in normal times.

Instead, a trip out to the casino might not be the worst thing to do. If they’ll bust your kneecaps whether you’re $100k short or only $90k short, some chance of turning that $10k into $100k is pretty valuable. Hello, Sky City.

And so I wrote a few years ago that, unless we were part of an enforced global agreement where we all implement either a real carbon trading scheme or a carbon tax, we should instead be taking a few punts at projects that could have much higher returns.

Investments in pastoral systems using genetic enhancement could yield pretty substantial improvements: better nitrogen fixing means fewer emissions in fertiliser production, better clovers and grasses produce less methane in the digestive tract, and better digestive tracts reduce emissions as well. Commit to that anything we find is released internationally under a form of Creative Commons licence allowing for free sharing, with attribution. There’s a reasonable chance it won’t amount to anything, but a non-trivial chance that it could yield globally consequential reductions.

But Tyler Cowen sounds a somewhat more cautionary note: how many catastrophes can we really avert? And what if resources put into averting one particular catastrophe leave us then less able to handle other, worse ones, that we don’t yet know about? Cowen writes:

“There is a new Martin and Pindyck paper on this topic, “Averting Catastrophes: The Strange Economics of Scylla and Charybdis”:

“How should we evaluate public policies or projects to avert or reduce the likelihood of a catastrophic event? Examples might include a greenhouse gas abatement policy to avert a climate change catastrophe, investments in vaccine technologies that would help respond to a “mega-virus,” or the construction of levees to avert major flooding. A policy to avert a particular catastrophe considered in isolation might be evaluated in a cost-benefit framework. But because society faces multiple potential catastrophes, simple cost-benefit analysis breaks down: Even if the benefit of averting each one exceeds the cost, we should not avert all of them. We explore the policy interdependence of catastrophic events, and show that considering these events in isolation can lead to policies that are far from optimal. We develop a rule for determining which events should be averted and which should not.”

“The ungated version is here, I do not at the moment see the link to the gated NBER version I printed out and read. The main point is simply that the shadow price of all these small anti-catastrophe investments goes up, the more of them we do, and thus we cannot do them all, even if every single investment appears to make sense on its own terms.

I think of this paper as providing a framework for assessing the debates between modern Progressives and pessimistic old school conservatives (not exactly the main debate we are seeing today by the way). The Progressive states “here is a potential or real catastrophe, let us fix it.” The pessimistic conservative says in response “there are far greater and less visible catastrophic dangers. We need to address those instead.” The pessimistic conservative usually is ignored, and so at the relevant margin it appears the Progressive is correct. Maybe in a sense the Progressive really is correct. But in another, more systemic sense the Progressive is walking a dangerous path. Society is losing the resources it may need to avert the more catastrophic catastrophes.”

3. We Don’t Know How Lucky We Are In New Zealand, episode 57

George Mason University’s Mercatus Center documents the barriers facing the American home-brewer wishing to go commercial. They write:

“Build a better mousetrap,” the old saying goes, “and the world will beat a path to your door.” Brew a better beer, however, and regulators will tie your door shut with red tape. Startups in the craft brewing industry face formidable barriers to entry in the form of federal, state, and local regulations. These barriers limit competition and innovation, reducing consumer welfare.

While customers and new entrants are harmed, these regulations can be a privilege to incumbent firms and industries. There are various political and historical reasons for the persistence of these rules, despite the fact that they lack economic justification. Policymakers interested in economic development should eliminate regulations to help firms overcome confusing and unnecessary barriers to entry and to level the playing field between established firms and their newer, smaller rivals.

4. Just so

We’ve had no end of fun introducing our kids to Rudyard Kipling’s “Just So” stories, which explain how the animals came to be just as they are. They’re fun, but they have a deeper importance: the same data can be explained by multiple hypotheses.

One should always check whether the data that confirms one’s hypothesis also rules out competing hypotheses.

And so we come to Zach Weinersmith’s excellent Just-So story explaining the aerodynamic qualities of infants. The hypothesis is both internally consistent and consistent with the available data. I’m not sure it’s convincing, but it is fun.

5. Donal Curtin at EconomicsNZ says that the good times are rolling

Here’s the projected output gap for New Zealand and Australia. Capacity constraints may prove binding. If you think that voters mostly vote based on expected economic performance, and if you think that this hasn’t already been incorporated into trading prices, go buy some PM.National.

6. Last Saturday, I attended NORML’s annual meeting in Wellington, as I was in town house-hunting anyway. I sat two chairs away from Max Abbott, a member of the Ministerial Forum on Alcohol Advertising and Sponsorship, to whose committee I’d be presenting two days later. I suspect we agree more on marijuana than we do on alcohol.

I’d previously reckoned that legalising marijuana, imposing an excise tax set to keep retail prices to consumers about where they are now, and otherwise regulating it similarly to alcohol, would yield excise revenues somewhere between $100 and $300 million (subsequently revised downwards a bit), with additional fiscal gains coming from reductions in policing and justice system costs.

The real benefits would accrue to those no longer burdened with a criminal record for an activity that is harmless to others. Transform, a drug reform activist group, has produced a new report on the Portuguese experience with drug decriminalisation. Drug use and harms have both declined since decriminalisation.

It’s sad that only the Internet Party here is willing to talk about it. I still blame the folks on the left who made fun of Don Brash for mooting decriminalisation. If the right expects only mockery for realism on drug reform, we’re not going to get anywhere.

7. Speaking of Wellington house-hunting, here’s something incredibly useful if you, like me, are absolutely terrified of earthquakes. Koordinates has overlaid Wellington’s combined quake hazard risk map onto Google Maps. Put in any address and get the combined all-source risk. Severity runs from 2 (low-moderate) to 5 (terrifying). I don’t think anywhere gets a 1.

8. Labour has proposed re-funding the adult and continuing education programmes cut by National.

Whether or not the proposal has merit, the case for it should not be based on the old PriceWaterhouse Coopers report on the social benefits of Adult and Continuing Education. In a report commissioned by the Adult and Continuing Education association, PWC argued that ACE provided substantial crime reduction and associated benefits. The numbers really didn’t add up.

9. The think-piece of the day:

The University of Victoria at Wellington’s excellent political scientist Xavier Marquez discusses the tedium of authoritarianism. What’s a dictator to do when the state media can’t jazz up their official tedious speeches?

At any rate, it seems to me that the moral of these stories, so to speak, is that ideological persuasion is a sort of by-product of particular discourses, not something that can be produced intentionally and at will. In the Spanish case, ideological persuasion faltered in the face of terrible economic conditions during the 40s; as one Falangista wrote in a confidential report in late 1939, “frente a todo esto, no caben propagandas” (“in the face of [these conditions], no propaganda can work”). Similarly, Nazi propaganda was less effective the less contact it had with the existing beliefs of the German population and their real conditions of life. But in both cases the attempt to directly persuade a population by tightly restricting the variety of points of views presented failed to produce maximal commitment; wherever persuasion occurred, it was less due to the content of the rhetoric of both regimes and their monopoly over public space than as a by-product of the conditions under which propaganda was received. I suppose this is good news: the tedium of genuine authoritarianism prevents such regimes from truly shaping people’s characters.

10. Finally, did you ever wonder how economics came to be called the Dismal Science?

It isn’t because we’re all such boring lecturers, nor is it because Malthus thought we were all going to run out of food and die if we couldn’t stop breeding.

Nope, it’s because Thomas Carlyle reckoned us economists to be horrible people for denying blacks the benefits of being slaves to white people.

In the Carlyle-Mill debates of the 1800s, Carlyle excoriated John Stuart Mill and the political economists for arguing against slavery; in Carlyle’s view, the lash was the only way that blacks could become fully human. And so he contrasted the dismal science of economics with the gay sciences of poetry, where the latter recognised the purported benefits of flogging.

If you want the full story, David Levy’s excellent book, “How the Dismal Science Got Its Name”, is now available as a free PDF download from the University of Michigan Press.

13 Comments

#7 For wellington think Sun, Sun, Sun, without all day sun you will freeze in Winter.

Also look at how often and when a house is sold, if its every 2 or 3 years and every spring thats because the situation is awful (exposed to southerly and no Sun, walk away.

regards

#7 Actually I think its more like 99.1% v 99.5% rather than 1 v 5. If its the data I recall seeing when working for the Earthqauke Engineer(s) who compiled it the difference in risk isnt very big.

Though,

a) dont buy build on steep land, you'll slide into the valley, or houses above you will slide onto you.

b) avoid low land, tsunami risk.

c) Try and keep away from known faults, lots of houses are on the main fault, ouch.

d) Did I mention Sun?

;]

regards

#2 = #7 I agree on lack of a strategic view when lookng at risks and teh dangers of looking at them in isolation. There is also a blindfolded view, ie ignoring peak oil while looking at AGW. Now whatever we do for Peak oil in terms of going green and using (far) less also helps with AGW.

On top of that I think "do nothing because no one else is" is a very poor moral stance. Let alone a failure of leadership (failing to lead).

I also agree that the top few % somehow think they are immune to the outcome of their actions. "Let them eat cake" seems to be the outlook and just doesnt work. As a few ppl have said lamposts and rope are common.

http://kunstler.com/clusterfuck-nation/piketty-dikitty-rikitty/

"Rather, its more likely that they’ll be strung up on lampposts or dragged over three miles of pavement behind their own limousines. After all, the second leading delusion in our culture these days, after the wish for a something-for-nothing magic energy rescue remedy, is the idea that we can politically organize our way out of the epochal predicament of civilization that we face. Piketty just feeds that secondary delusion."

regards

Are we approaching Peak Steven?

Next month he becomes head of research at the New Zealand Initiative (Business Round Table).

...

I'm not surprised. On The Panel he recommended population increase as a way of increasing productivity ("I would look at"). Interesting that:

[Quote]

*/

At that time, [1990's] it was considered that skills-focused inward migration could: improve growth

by bringing in better quality human capital and addressing skills shortages; improve

international connections and boost trade; help mitigate the effects of population ageing;

and have beneficial effects on fiscal balance. As well as “replacing” departing

New Zealanders and providing particular help with staffing public services (for example,

medical professionals), it was believed that migration flows could be managed so as to

avoid possible detrimental effects (such as congestion or poorer economic prospects) for

existing New Zealanders.

Since then, New Zealand has had substantial gross and net immigration, which has been

relatively skill-focused by international standards. However, New Zealand’s economic

performance has not been transformed. Growth in GDP per capita has been relatively

lacklustre, with no progress in closing income gaps with the rest of the advanced world,

and productivity performance has been poor. It may be that initial expectations about the

potential positive net benefits of immigration were too high.

Based on a large body of new research evidence and practical experience, the consensus

among policymakers now is that other factors are more important for per capita growth and productivity than migration and population growth. CGE modelling exercises for

Australia and New Zealand have been influential in reshaping expectations.

*/

http://www.treasury.govt.nz/publications/research-policy/wp/2014/14-10

Migration and Macroeconomic

Performance in New Zealand:

Theory and Evidence

Julie Fry

New Zealand Treasury Working Paper 14/10

Julie Fry - NZ Treasury - 2014 [quote] it was believed that migration flows could be MANAGED so as to avoid possible detrimental effects (such as congestion or poorer economic prospects) for existing New Zealanders [endquote]

Have a look at Statistics NZ analysis for 2013

There were 40,000 incoming migrants

Of the 40,000

only 8,000 arrived under the skilled migrant category

Whereas 20,000 arrived under the family re-union category

Of the 8,000 skilled migrants the 3 largest groups were IT support, retail managers, and restaurant employees

Not one inbound migrant was an agricultural or farming or dairying applicant

Yep, they are all here in Auckland property speculating, praying to Mecca or working in service industry jobs keeping wages supressed.

If you think the new Pay Wave technology on your Visa card is safe to use think again - watch this:

https://youtube.googleapis.com/v/lLAFhTjsQHw%2526sns=em

wow

I have seen the same story on these insecure cards done by NZ telly.

Scanner in the satchel. Walk past people with the card in the pocket.

Maybe stand next to them in a lift.

And Zzzzzzzziiiiiiiiippppp.

It's done.

... sorry about the smell , guys ... I've just pooped me Gummy nappies !

I purchased protective shields on eBay.com from Australia:

RFID PASSPORT x 2 AND CREDIT CARD x 4 BLOCKING SLEEVE ID PROTECTION ANTI SCAN

They work and cost $22 delivered (just checked and they're $18.35 delivered tonight).

I realised it was a problem when the Countdown checkout picked up a cc in my wallet instead of the one I had out to use, so went looking for a Faraday cage solution.

Evderyone in the family is scrambling to see if they got a Pay Wave logo on their cards after I showed them this video, lol.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.